The board room is going through an extraordinary time of transition. More is being demanded of boards than ever before, and the activities of boards are under greater scrutiny.

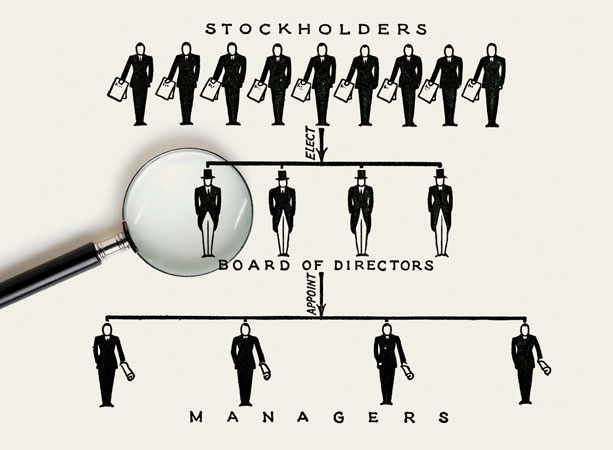

Corporate boards no longer operate in a secretive world behind closed doors, beyond the watchful eyes of the public and media. Investors, stakeholders, regulatory bodies, and governments are demanding more transparency and accountability. This increased scrutiny is the result of a greater public understanding of the role boards can and should play. There is growing awareness by investors, employees, and customers of the consequences of boards and board members not asking hard questions, not adding real value to the organization, and not protecting its future health and wealth.

Many question what boards do and if they have the skill, vision, and determination, and indeed any power, to affect the real change necessary in steering organizations and improving their business practices. The answer is that the best boards do. Most organizations have boards, be they in the public or private sector, a FTSE 100 company or an NGO, a university or a utility, and these boards have the power to influence the direction of business, to ensure that organizations are doing what is necessary to operate at its best, and to take real action if the organization is not performing well.

Boards will be judged in the future on their ability to “future proof” their organization, ensuring that their organization has longevity and fortitude and the ability to withstand the vagaries of the marketplace, serving not only those invested in the company today, but the investors and all of the stakeholders of tomorrow. They’ll also be viewed for how well they fulfil and balance their “grounding and stargazing” responsibilities, ensuring the company is addressing its day to day and tactical requirements, while at the same time building a strong organization for the future. Boards will be assessed on whether they simply chase short term gain or build strong organizations for the long term, and whether the people around the table of the board room complement each other well for the tasks at hand.

The best organizations of all sizes, in the for-profit and not-for profit sectors alike, have boards with independent chairs who can help mitigate conflicts of interest and ensure that the board acts as an effective oversight body. These boards are composed of truly active, engaged, independent, and interested directors who strive to have the best possible understanding of the business the organization is in, and the one it wants to be in. These boards are diverse in the true sense of the word, not only when it comes to gender but also in terms of professional expertise, sector background, color, age, international perspective, and more, representing the stakeholders of the business and the environment in which it operates.

Beyond that, the best organizations encourage a climate in which actually having the best people on board can bear fruit. These board rooms are environments in which independent board members are comfortable, and indeed required, to ask hard questions, challenge the status quo, and step up to assist in areas where they can. In such an environment boards are able to discuss a whole range of agenda items that are essential for their organization’s short- and long-term success. The role of the board here is to help the organization put the relevant items on its agenda and prioritize without losing sight of the bigger picture of the local and global ecosystem in which they operate.

In times of crises like the one we are currently experiencing, effective boards help their organization to emerge strengthened and to recognize and seize opportunities for critical innovation and investment into a future of sustainable growth that benefits all stakeholders of the organization.

Greater public and shareholder scrutiny will demand more engagement on the part of board members who, in turn, should actively promote transparency and accountability as a means to ensure that organizations can truly serve their stakeholders’ and the public interest.

Grounding and Stargazing

The role of modern corporate boards is the juxtaposition of “grounding and stargazing.”

Grounding is about making sure the company fulfils all its legal requirements, manages risks properly and does business in a responsible way. It is about all the vital things we associate with board oversight tasks in corporate governance, compliance and corporate risk.

But with that comes an equally and perhaps even more important role: grounding needs to be complemented by stargazing. This is where a board demonstrates its mettle in making sure their organization is ready and able to expand its horizons, strive to achieve more and stretch itself to become the robust and resilient business that is capable of responding effectively to the unknowns in its future. Stargazing should be a big component of the strategic work a board does.

Both grounding and stargazing require asking questions, looking beyond the obvious and the comfortable, and actively engaging with the organization.

The emphasis in recent years seems to be on the tick-boxing of risk management. In speaking with fellow board members from around the world and across a wide variety of sectors, I’ve found that concern for risk exposure coupled with a desire not to appear too meddlesome and the time commitments required to do the job properly means they sometimes leave too little time for discussions of strategy.

This is a real loss for organizations of all sizes, as part of the purpose of having independent directors with a broad range of skills is to draw on the knowledge and understanding around the table and the broader perspectives they bring to help propel the organization to new heights.

Grounding is a big part of the vital role of directors – ensuring that companies are managing their risk, fulfilling their requirements, “playing by the rules” and being good corporate citizens. But even when fulfilling that role, strategy needs to play a part. In every audit committee and compensation committee, there must be room for considering what the company can do to push itself that much further to achieve more, and better, things for all its stakeholders.

Most importantly, getting the balance right between the two functions of grounding and stargazing helps to ensure the company is doing what it needs to future proof itself. It requires board members who can think outside the box, and who also know when to get back in the box.

Today’s Agendas

The boardroom agenda is going through a reformation. To ensure we are helping organizations future proof themselves, what are some essential things boards and board members need to think about, no matter size, location or sector of the organization? Five areas need an update in the way we as board members think about them: infrastructure, technology, internationalization, communication and balancing continuity and change.

Infrastructure

Boards must embrace the political, economic and social reality of the way the world is operating today and tomorrow. One of the areas that needs a real rethink is building organizations that can operate effectively in a low-carbon economy. The main issues here are about energy consumption and integrating clean tech and sustainability. They apply to all facets of the business: from facilities to building stock and rolling stock; from changing work patterns and practices to the ways in which companies engage with their stakeholders and the local communities where they are based. It touches everything an organization does, how it behaves and how it invests. It means board members need to be asking the questions about how these decisions will impact business five and 10 years down the road. Most importantly, it isn’t about green washing or perception; it is fundamentally about how the organization does business.

Technology

At the heart of many issues on the modern board agenda is technological innovation. Technology, thus, is not a standalone issue, but an integral part of how effectively and successfully a company can be run. It is not an end in itself, but an instrument that can only prove its worth if it serves a concrete purpose. Coupled with that is the speed at which new technology comes into play and the level of disruption it creates in the process of integrating it into the daily running of a company. For all the importance of disruptive innovation, if ‘old industries’ and the tech sector communicate effectively, understanding each other’s needs and coming to grips with the significant benefits that today’s technology offers, innovation can be enormously helpful in future proofing companies.

For this potential to be fulfilled, boards must make sure their organization is flexible enough to recognize important technological developments and incorporate them into existing business models.

Internationalization

Regardless of a company’s main business or where it is located, its success will ultimately depend on grasping the internationalized environment in which it operates. The world today is politically, socially, and economically inter-connected.

This offers opportunities and poses risks at the same time. Board directors need to be able to think outside the walls of their own corporate boardroom. They need to speak their own language as well as the language of the markets where they want to be; for while the world gets smaller and in some respects more similar, local cultural difference remains and understanding it gives companies a distinct edge.

Corporate boards need to set an example and help implement an agenda that is focused on attracting the best people from anywhere and put them in a place where they work most productively for the success of the company as a whole.

Communication

No corporate board will be able to implement its modern agenda without effective and dynamic communication, both with its stakeholders (customers, staff, investors, etc.) and within the boardroom.

Within the boardroom, this is about asking the necessary questions and being open to hear the answers, however uncomfortable they might be. Outside the boardroom communication is about the image and strategy of the company; it is about the methods used to communicate this message, and increasingly so.

A board that sends out a message of a forward-looking, socially and economically responsible, and politically aware strategy and does it by old and new forms of communication also sends a message about the right balance between continuity and change, about the unity of word and deed, demonstrating in action to which it rhetorically commits.

Balancing Continuity and Change

Embracing new ideas and ways of thinking does not mean completely disregarding the old. Boards will only succeed in their task of future proofing their organizations if they see the connections between the old and new.

This requires casting a critical eye on the old, innovating where fruitful, and integrating new technologies and items on the corporate social responsibility agenda into the tried and tested business practices of corporate governance, risk assessment and finance.

Corporate directors need to understand the purpose, strengths and limitations of existing practices and be willing and able to take steps to address them. The modern board agenda does not disregard ‘old issues,’ it is not driven by short-lived ‘flavors of the month’ or temptations of every disruptive technology or idea that comes into the room, but is rather guided by the needs and vision of the business. This need for balance requires boardrooms to have a mix of people to ensure a comprehensive and complementary diversity of approach, background and skills.

Stargazing is most effective if it is done from a strong foundation where the nuts and bolts of the company work, and where they are grounded in a solid foundation. This is nowhere more obvious then when it comes to a company’s financial stability and sustainability. Past, present and future are a continuum when companies seek opportunities for investment and expansion, when they carefully assess risks connected with either, and as they determine the right level of (not only monetary) compensation for their directors and staff.

About the author

Lucy P. Marcus is a board chair and non-executive director who is challenging conventional wisdom inside and outside the board room. She has emerged as the voice setting the agenda on future proofing boardrooms and companies around the world, and was recently recognised with the Thinkers 50 “Future Thinker” Award. The CEO of Marcus Venture Consulting, she is also Professor of Leadership & Governance at IE Business School, focusing on corporate governance, ethics and leadership, and she writes a column for Reuters on the intersection of boards and leadership. (She can be found on twitter at @lucymarcus)