By Patrick Dailey and Joel Koblentz

As the impulse of industry players to stay ahead of the competition skyrockets, how will you drive superior performance towards greater value creation? In this article, the authors highlight the significance of having an agile board in an organisation and elaborate on the critical role of the Chairman in navigating the company through board agility towards a strategic direction.

Shareholders are poorly served by boards that provide “wait and see” oversight. The directors serving these passive boards increasingly find themselves in the cross hairs of activists, proxy advisory firms and major investors. They provide little “lift” to the shareholders they serve and the corporations they oversee.

Directors continue to face tumultuous corporate and personal change – 70% of the top 20 companies in the F1000 disappeared during the 2003-2013 decade. Only 35% turnover of top 20 companies disappeared in the 1973-1983 decade. Consequently, directors are stepping away from their legacy instincts for policy approval and compliance to become increasingly conscious of their catalytic role in identifying and capturing value more quickly than rivals.

Agility is the capability that board leadership is pursuing as a foundation for governance fitness and value creation.

An agile board’s role is increasingly one of anticipation and building capability for the future. Directors are being refreshed or re-invented to ensure they are more alert, innovative, better informed, and talented in rapidly pivoting company direction and resources. Agile boards must be more capable of changing the rules of the game ahead of their competitors and bring “first mover” advantages to their companies and shareholders.

[ms-protect-content id=”9932″]Critical Role of the Chairman

Chairs of agile boards bring different skill sets to their roles – these leaders must see, influence and lead transformation initiatives by astute, often powerful, independent directors and self-reliant management teams in order to move the business toward value creation/realisation before rivals “catch the scent”. These chairmen are more than colleagues to other directors – they often are active “spiritual leaders”.

Building Blocks of an Agile Board

Agility has two facets: one is dynamism. This enables a board to be alert to critical change events and able to pivot their company’s strategic thinking and resource allocation with innovative thinking, marketplace awareness and confident decision-making.

The other facet is stability. It provides board leadership with clear and steadfast foundational values and beliefs, which must not be tinkered with or changed – its roots and core values.

The key building blocks for an agile board are described below. They reflect the balance between dynamism and stability. Boards cannot pursue business dynamism without relying upon the structure and controls resulting from adherence to core values and organisational stability.

Often times, the agile board must be willing to address alternative paths toward value creation and adjust the expectations of the operating executive team while challenging the ingrained culture of “how we do things”, a basic inhibitor of change.

1. The Chair Must Institute and Anchor a Durable Governance Coalition

Some boards are a collection of wise and thoughtful directors who earnestly come together periodically to pursue shareholders’ best interests. But, their role and their gait may be that of a “wait and see” board. These collections or alliances rarely have the “juice” to mobilise sustainable transformation. On the other hand, coalitions tend to form around sound leadership who offers a compelling agenda for the future to other ready and opportunistic directors. The coalition comprehends that well-managed change is a key role of theirs and essential for value creation. Coalitions are at the centre of an agile board and are essential when directors choose to pursue transformational change.

A board coalition gains its footing when a critical mass of directors or investors allows the chair to engage the board in frank discussion about the facts and conditions of the business. These discussions can range from a focus on competitive threats, activist interests, customer defections, margin shrinkage, share decline, flat YoY growth, or unsatisfactory earnings – sober discussion about the signs of an “out of gas” strategy, disappointing operational execution and/or managerial ineffectiveness. An agile chair uses credibility, influence and personal trust to drive other directors out of their comfort zone and toward the conclusion that business as usual is untenable; that exploration and vetting of risk alternatives is necessary… and their collective duty as shareholder fiduciaries.

The behaviour and instincts of an agile chair define the difference between a “board manager” who strives to minimise risk, maintain current operating structure and processes, and protect the enterprise versus a “board leader” who raises the “right” issues, strives to revitalise strategy, redirect resources, and drives the business forward with a prudent sense of urgency.

The coalition must form around the board leader – the chairman. The chair must adroitly lead the coalition toward value creation not simply preside over a collection of wise and thoughtful directors.

2. The Chair Must Demand Directors are Independently Well-Informed and Analytically Prepared. They Do their “Homework”

An agile board must be inclusive and staffed by well-informed directors.

Management provides directors with briefs and education regarding the future of the sector and the company’s strategic strengths and options. This information is typically deep and well-articulated. Yet, an agile board simply requires more educational immersion from each director.

Independent fact gathering through site visits, industry educational opportunities, and experts the board may bring in for board retreats and pre-strategy planning sessions tends to equip directors with deep and broad perspective on the sector and the company’s positioning. Independent study supplements the information provided by management. This independent “homework” reduces asymmetrical understanding of the business environment that will always exist between the board and its management team.

Agile directors should gather information from traditional and non-traditional channels to supplement management’s education and broaden their independent perspective. With this “homework”, directors avoid becoming content deep but narrowly focussed with too little breadth to be truly strategic. Independent perspective equips agile directors to bring more than historical knowledge and experience to strategic discussion. Independent “homework” brings an intensified level of director engagement and insight about the future that can be shared and deliberated with executive leaders.

The individual wisdom of any director has a “half-life”. To continue to be discerning and astute, the wisdom of every director must be refreshed. It is the responsibility of every director to sustain his/her relevance and value with continuing education, not just tap into his/her wisdom reservoir.

3. Directors Deliberate with a Dispassionate View of the Business

Agile boards continuously challenge themselves in the same manner that activists’ investors analyse and pursue their targets. Board directors increasingly recognise that they must effectively govern the change agenda, enhance value or be replaced.

The biggest hurdle for independent directors is to view the company from the “outside in” – just the perspective an activist takes. Traditional board oversight must give way to activists’ tactics for value creation and disruption. More and more, agile directors must think like activist investors and advance value creation ideas and tactics at the board and executive management level.

The most successful boards challenge themselves as they openly engaged in an ongoing and continual rigorous value discovery process. They honestly address “sacred cows” as if there are none. They act decisively and recognise that their company is constantly under a threat of being disrupted and seek strategic and investment pivots to assure that their company has the best chance of successfully repositioning to unlock currently hidden and potential future value.

Simply, it takes director courage to perform the valuation assessments (often times by engaging outside aid) to make tough unemotional decisions about the future of each business in their company’s portfolio including perceived “untouchables.” This means truly gathering “quality” and pertinent information to evaluate thoroughly the current situation while being fully prepared to “gore the oxen” of identified valuation traps…checking, rechecking and reviewing annually strategic options for every business operation, one by one, to determine capital allocation strategy and expected business unit return. And, no business operation or corporate function is off limits.

To govern effectively today, directors must begin a continual program of delving into vexing business questions as if they are outsiders analytically viewing and evaluating each element of the company they govern. These inquiries and questions are tough and direct as they strike at the heart of whether a company, and the sum of its parts, is properly valued and worthy of continuing investment…funding and time.

If a business unit, no matter what its traditional positioning and history, isn’t performing, it is the board’s duty to ascertain the rationale of why shareholders should continue to invest in it. Urgency prevails over “wait and see” board governance.

4. Directors Must Be Accountable to One Another for Decisions Leading to Value Creation

It is undisputable that directors are accountable to shareholders for the prudent management of the shareholders’ business interests. Academics, union leaders and special interest groups have worked to enlarge the scope of director accountability to stakeholders.

This building block is more personal. It addresses directors’ expectations for the behaviour of fellow directors that ultimately impacts a board’s fiduciary responsibility to shareholders. When a director displays valuable knowledge about the business and shares the knowledge in a serious and constructive manner, every other director is kept on their toes and trust increases in the quality of board process and deliberation. Ultimately, board effectiveness depends less on policy, structure and bylaws and more so on the behavioural dynamics of the board. Collegiality must be balanced with penetrating questioning and serious debate. The “loudest” nor longest tenured director should not win debates and dominate decisions.

Agile boards are characterised by fellow directors who challenge, question, probe test, influence, explore and intensely debate the future-focussed issues of the enterprise. Support and dissent coexist when directors feel accountable to one another for the best decisions they can make collectively.

Agile boards use director scorecards and evaluations to sharpen individual contribution, remove obstacles to group process, and may ultimately serve to strengthen the board via director refreshment [replacement].

Shared accountability puts the spotlight on each director’s competency, their reliability to one another and perception of common goals. Accountable boards are better able to move quickly and with unity.

5. “First Mover” Temperament is Expected and Cultivated Among Directors

It is said “Good generals make their luck by shaping the odds in their favour”. Agile boards shape the odds in their favour.

A “first mover” temperament does not represent a board that jumps into change mode any time a threat or opportunity comes on to its radar. It does mean board leadership and the board coalition has developed an opportunistic predisposition.

Readiness is key to board agility. It is a necessary element for an agile board’s instincts to detect forces of change emerging in the marketplace – change that might present opportunity as well as signaling threats and disruption. It is necessary element in making decisions – “no go” decisions as well as “go” decisions.

Readiness fosters a first mover temperament that can translate into first mover advantages, which include technology leadership, pricing advantage derived from superior marketplace or competitor information, and pre-emptive acquisition of strategic assets. Certainly, an astute board works to deliver increased shareholder value and sustainability from its first mover actions.

The agile board uses its first mover temperament as a competitive advantage to pursue value…in contrast to simply operating as a collection of directors who are proud to serve.

A strong chairman plays a necessary role within an agile board to steer the board and management team down the path toward high probability endeavors and away from the folly of change for change stake. Agile boards effectively shape the odds in their favour.

6. Core Values Have a Perceptible Impact on Policy Making and Judgment

Every board and every operating organisation has a unique culture that reflects its underlying values, beliefs, attitudes and behaviours. Some of these cultures exist by design, others by default. Successful boards don’t leave the company’s culture to chance. They identify and define core values that are aligned with the vision of the business and plainly signal priorities and choices the board is prepared to make. Application of core values through the policies a board adopts, by behavioural example of directors, and/or by the accountabilities a board delivers will communicate to management and the entire organisation “how we do things around here.” This is the way “tone at the top” makes a perceptible impact on an organisation and is a vital element for creating and sustaining an agile board – which often incorporates a more passionate style than “wait and see” boards.

Agile boards invest in team education and decision-making processes which are anchored by enduring core values.

Role of the Governance Committee in Building Board Agility

The governance committee plays the primary role in building and sustaining an agile board through governance policy, chair leadership and through the recruitment, selection, development, evaluation and refreshment of directors.

The committee chair works with the board chair to define a unique blueprint for the company’s agile board that best fits the needs of the company and its shareholders. Certainly, we would advocate for the building blocks we have offered but no single blueprint exists for reproducing another company’s agile board. And, the definition and practices of an agile board will change as board leadership and market dynamics change. Special team training and education may benefit a governance committee chair and raise the odds for a successful transformation.

There are few structural matters critical for shaping an agile board. Perhaps the creation of an advisory board of business or subject matter experts who are tasked to keep the statutory board members well informed.

Most board processes are likely in place for defining the roles and responsibilities for directors, tools for director selection and evaluation. As mentioned earlier, the key to successful creation of an agile board is more behavioural in nature. It’s valuable for the governance committee to articulate those behaviours and values to other directors and the management team. We have found that attention to defining “everyday” board vs. management roles and responsibilities is effective in launching and managing an agile board lest the board over reaches its responsibilities toward co-management of the business or micro management of senior management.

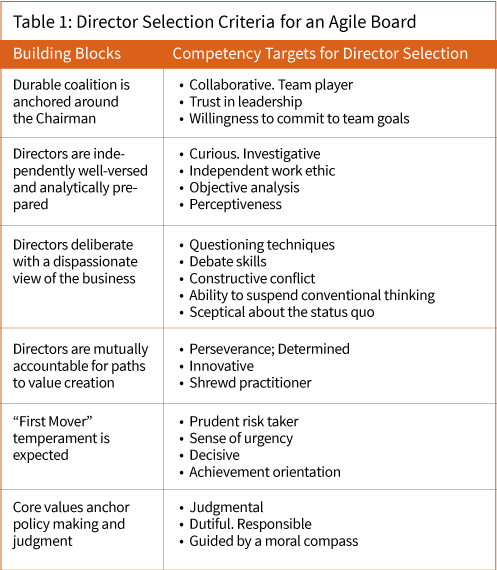

Most of the governance committee’s work is focussed on governance process and its people – the director profile the board needs to attract, candidate competencies, early assimilation and then periodic feedback about director performance and contribution to the business. The table on the next page presents the agile board building blocks matched up against behavioural competencies, which we have found to be predictive of a positive contribution by directors serving on so-called agile boards.

The maintenance requirements for an agile board are more demanding than with a “wait and see” board. The governance functions of director selection as we have developed above, director evaluation, committee leadership and board education are organised by an astute and active governance committee. There is increasingly use of external expertise to support statutory board insight, compliance and strategic activity.

An Agile Board Might Not Be Right for You

Certainly, there is variation in the level of intensity that exists across the range of agile boards. But we observe, that agile boards tend to require more from their directors – deeper knowledge of the business and marketplace, stronger engagement with fellow directors and senior management to keep the coalition vigorous, and constant alertness. These boards rarely feel like part time “gigs”.

Not all boards will wish to become an agile coalition. With any change or transformation situation, the risks are higher and the visibility brighter. Board leadership may not have the passion or the “juice” to build an agile board. Director coming and goings may not engender readiness or capability for building a more engaged, agile board. Activists may have better ideas and a more persuasive game plan with your major shareholders. The business may disappoint.

However when agility catches hold of a board, it can deliver feelings of fulfilment, shared accomplishment, and most likely shareholder delight.

If you are a strong leader with passion for winning, to stay professionally relevant, bring keen business insight coupled with being a loyal team player who can collaborate and follow, an agile board will value your contribution.

[/ms-protect-content]About the Authors

Patrick Dailey, Ph.D. is an industrial and organisational psychologist. He co-founded BoardQuest, a board governance and C-Suite management consultancy addressing talent, team dynamics and organisational performance matters. He has been a Chief Administrative Officer and senior human resources executive for Herbalife, Hewlett-Packard and PepisCo. Patrick can be reached at 310.400.9992/www.boardquest.com

Patrick Dailey, Ph.D. is an industrial and organisational psychologist. He co-founded BoardQuest, a board governance and C-Suite management consultancy addressing talent, team dynamics and organisational performance matters. He has been a Chief Administrative Officer and senior human resources executive for Herbalife, Hewlett-Packard and PepisCo. Patrick can be reached at 310.400.9992/www.boardquest.com

Joel M. Koblentz is the Senior Partner of The Koblentz Group. He is nationally recognised for resolving clients’ most sensitive, critical and confidential leadership and governance challenges. He advises publicly traded companies and private equity concerns, globally. Currently, Mr. Koblentz is the Chair of Emory University’s Center for Ethics and on the Board of Directors of the Chick-fil-A Bowl Foundation. He can be reached at jkoblentz@koblentzgroup.com.

Joel M. Koblentz is the Senior Partner of The Koblentz Group. He is nationally recognised for resolving clients’ most sensitive, critical and confidential leadership and governance challenges. He advises publicly traded companies and private equity concerns, globally. Currently, Mr. Koblentz is the Chair of Emory University’s Center for Ethics and on the Board of Directors of the Chick-fil-A Bowl Foundation. He can be reached at jkoblentz@koblentzgroup.com.