By Klaus Heine and Vanessa Brunner

Most brand managers today see room for improvement in their repurchase rates, particularly as Generation Z tends to exhibit lower brand loyalty amidst intensifying competition. As it is more difficult to acquire new customers than to retain existing ones, loyalty programmes stand out as a promising tool. This article outlines a seven-step decision process to create loyalty programmes that are effective because they align with consumer psychology and the brand’s overall purpose.

According to a McKinsey study (2020), members of loyalty programmes are 30 percent more likely to spend more on the brand after subscribing. Even more, Ourself, a beauty brand recognised for its tech-centric products, attributes 40 percent of its sales to its rewards programme (Morris 2023). Research shows that loyalty programmes are also a crucial step in enhancing the share-of-wallet (Leenheer et al., 2007). Many brand managers have yet to fully realise the great potential of loyalty programmes, given the significant number of brands that resort to unoriginal, standard loyalty approaches like basic point-collection systems for discounts, which may not engage consumers effectively.

The cosmetics industry represents a vital area for studying loyalty programme usage, as it remains ahead of many other industries in digital marketing innovation. While smaller companies can greatly benefit from well-designed loyalty programmes, they face the challenge of competing with established programmes from major players like Sephora, as consumers often hesitate to engage with multiple loyalty schemes. This article aims to persuade brand managers of the critical role loyalty programmes play in accelerating business growth and provides advice on effective implementation. While the focus is on luxury beauty, the findings are applicable across various consumer markets.

Comparative Analysis of Loyalty Programmes

We conducted a comparative analysis of loyalty programmes in the high-end beauty segment. To create a representative sample, we gathered all brands available on the websites of the three most prestigious retail stores in the Western world: La Samaritaine Paris, Bergdorf Goodman New York, and Harrods London. Our objectives were to gain insights into the usage rates and designs of loyalty programmes.

Our findings revealed that the high-end beauty segment is driven by 247 entry-prestige to ultra-luxury beauty brands.

Our findings revealed that the high-end beauty segment is driven by 247 entry-prestige to ultra-luxury beauty brands. Among these, a quarter of the brands are owned by major parent companies, while roughly 16 percent belong to parent companies that own four or fewer brands. Another 58% of them are independent brands.

- Usage Rate of Loyalty Programmes: From all 247 brands that were covered, only about a quarter (60 brands) have put a loyalty programme in place. However, an additional two-thirds of the brands (63%) employ other loyalty-building initiatives, such as inviting customers to subscribe to newsletters or create customer accounts. Only 13% (31 brands) do not offer any loyalty-building initiatives at all.

- Naming of Loyalty Programmes: The biggest part of loyalty programme names (66%) includes words like ”rewards” or ”loyalty program”. While this approach ensures that customers easily understand the programme’s purpose, it often sounds commercial and overly focused on marketing, which can contradict efforts to foster a sense of ”community”.

A valuable branding technique involves the use of brand puns, which utilise creative wordplay with the brand name to generate a distinctive name for the loyalty programme. For instance, NARS makeup named its loyalty programme ”NARSissist Rewards”, RéVive skincare uses ”RéVive RéWards”, and La Mer uses ”Waves de La Mer”. Brand puns help make the name more memorable and relatable to consumers while conveying the brand identity, making the loyalty programme stand out from the competition.

Even more promising is the use of community-driven names. Approximately a third of loyalty programmes (17 brands) incorporate terms such as ”club”, ”society”, ”circle”, or ”insiders” into their names. For example, Valentino Beauty offers the ”Valentino Beauty Dreams Club”. Our analysis revealed some innovation in rarity marketing, with four brands labelling their programmes as ”VIP” or ”VIC” rewards programmes, like Armani Beauty’s ”VIP Beauty Programme”. Such names leverage the rarity principle, implying the opportunity to join an exclusive association not open to everyone.

Instead of emphasising exclusivity, Furtuna Skin calls its programme ”La Famiglia” (Italian for ”The family”), reflecting their slogan ”family is everything”. Community-driven names tap into the passion principle, suggesting that consumers are deterred by overly commercialised marketing and are instead drawn to brands that genuinely enjoy and believe in what they do. Drawing from social identity theory, loyalty programme memberships offer customers a sense of social identity aligned with their desired self-concept, becoming a source of pride and self-esteem.

Seven Key Decisions in Loyalty Programme Design

The next step was to gain a general understanding of the loyalty programme designs. Most programmes, specifically 45 out of 60 (75%), employ a straightforward design that aligns with how customers expect and know loyalty programmes. They typically offer either status tiers or loyalty points that customers can either climb to achieve a higher status or redeem for rewards as a way to incentivise brand loyalty. These insights underscore that customers tend to favour a simple design that is easy to understand and works well – which is one of the key success factors for loyalty programmes.

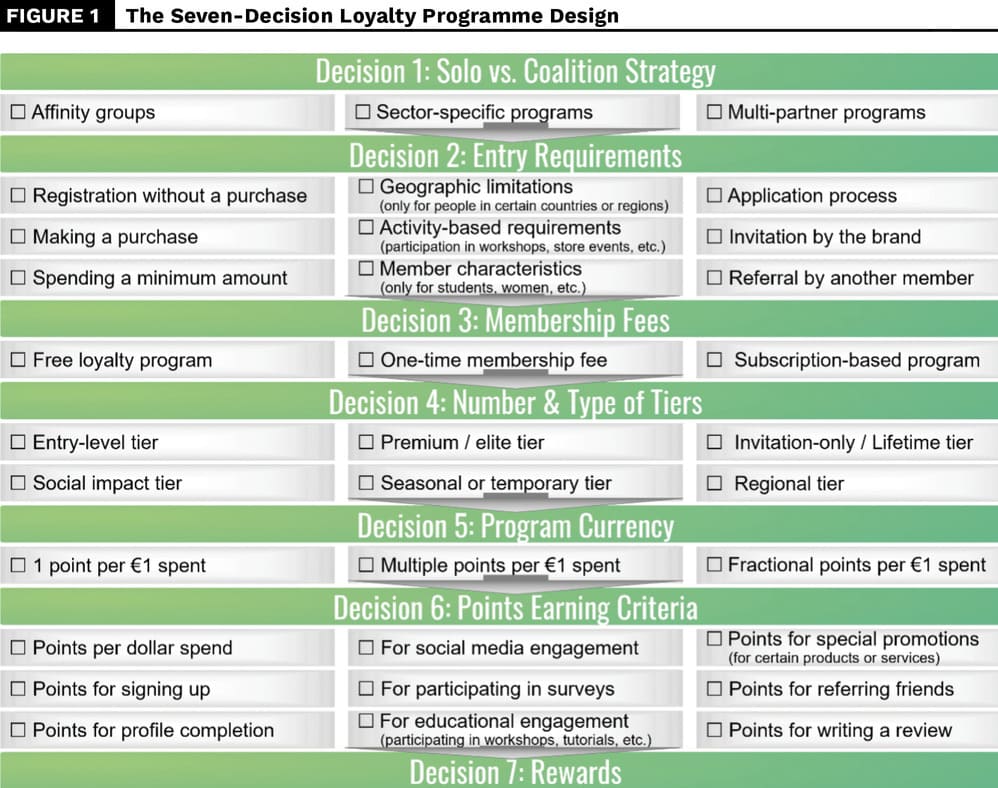

To develop a basic loyalty programme design, it is recommended to follow a seven-decision process, which is illustrated in Figure 1 and also outlines the main options available to brands at each stage.

Decision 1

Involves choosing between a solo or coalition strategy

Will the programme be operated independently or in partnership with other brands? Most luxury beauty brands prefer to operate an independent loyalty programme to preserve their distinct identity. The primary challenge of coalition programmes is the risk that consumers might develop loyalty to the programme itself rather than to individual brands. As a result, all the beauty brands we analysed have chosen to run independent programmes. However, the potential of the coalition strategy remains largely untapped. The significant advantage lies in cross-promotion opportunities. Instead of competing individually, coalition partners can actively promote each other and leverage their respective customer bases for the benefit of the entire coalition. To avoid collaborating with direct competitors, there are (1.) affinity groups, which unite like-minded entrepreneurs sharing a common interest or affiliation, (2.) sector-specific programmes, such as those in travel or hospitality, and (3.) multi-partner programmes spanning different industries.

Decision 2

Entry Requirements

What are the requirements for joining the loyalty programme? Some brands such as Sephora have minimal entry requirements. Consumers can simply sign up for free without the need to make any purchases and gain instant access to the Beauty Insider Community, including its beauty classes. Sephora’s advantage lies in collecting detailed contact information from potential future clients. On the other end of the spectrum, the highest level of entry requirements may be an invitation-only membership to a hidden community that the general customer is not even aware of.

Decision 3

Membership Fees

Does the loyalty programme require a membership fee? A recently emerging trend is the development of paid loyalty programmes. According to a McKinsey survey on loyalty programmes, members of paid loyalty programmes are 60 percent more likely to increase their spending on the brand after subscribing. Furthermore, they drive higher purchase frequency, basket size, and brand affinity compared to free loyalty programmes. The landscape of paid loyalty programmes today is small but rapidly expanding. Among the brands we analysed, only the fragrance brand Bond No. 9 offers a paid loyalty programme. Convincing people to invest $950 annually for entry-level membership ensures a dedicated customer base committed to regular purchases. Besides generating a new revenue stream, it enables the funding of unique, bespoke, high-value rewards, cultivating an exclusive community and an air of distinction among its members. Paid loyalty programmes are particularly well-suited for competing in highly fragmented markets, such as luxury beauty.

Decision 4

Number and Type of Tiers

How many and what types of tiers does the programme offer? Standard loyalty programmes are typically divided into tiers, with members advancing through these tiers based on their spending. Approximately 35% of brands use no tiers, 8% employ a four-tier approach, and only the makeup brand Charlotte Tilbury adopts a six-tier system. The majority of brands (57%, or 34 brands) prefer a three-tiered approach, which seems to be the most suitable and proven choice. This aligns with research indicating that a three-tier structure is the most favoured hierarchical structure (Nunes & Dréze, 2009).

Approximately 35% of brands use no tiers, 8% employ a four-tier approach.

Drawing from the Pareto Principle, tiered structures allow companies to reward the 20% of customers responsible for 80% of their profits. The top tier must be relatively small because the fewer people are granted elite status, the more superior these people will feel. Adding a subordinate elite tier enhances the status among consumers in the top tier because being ranked above other elites feels better than being above the masses. However, the research did not find evidence that adding a third elite tier would significantly enhance the perceived status of the top tier.

Tiered programmes feed people’s desire for status. An interesting strategy is to show members what percentage of the total members are in each tier. This can make elite members feel more special and trigger the competitive desire to reach the next higher tier. How much do consumers need to spend to become a member of the top tier? The highest limit, at €5000, is set by Charlotte Tilbury (with 6 tiers) and Joanna Czech (with 4 tiers). Nevertheless, the industry average for the highest tier threshold is around €1500.

Decision 5

Programme Currency

How many points should a member receive per euro spent? The standard option is ”1 point per €1 spent”. The big advantage of this option is its simplicity and ease of understanding. In categories with relatively low prices, the promising option of ”multiple points per €1 spent” often translates to ‘‘10 points for each € spent”. This approach makes the accumulation of points appear faster and more rewarding for consumers, thereby having a greater perceived value. Conversely, in high-value categories, an appropriate option is ”fractional points per €1 spent”, such as 0.5 points per € spent.

Decision 6

Points Earning Criteria

How can members earn points? In the beauty industry, loyalty currencies are a common framework. Approximately 75 percent of loyalty programmes (44 brands) employ loyalty currencies, with points being the most frequent form (also called miles, stars, pearls, etc.). Typically, companies inform customers of the number of points needed to redeem certain rewards, which may include a specific product or a selection of products from which they can choose. The problem is that this prevents any surprise moments – which are a standard tactic in the luxury industry and a key driver of customer delight.

In contrast, some brands opt not to have a loyalty currency, choosing instead to keep the details of their rewards secret. This lack of visible benefits might initially deter consumers from signing up for any programme, but such ”secret” rewards offer unique advantages. Customers are pleasantly surprised with (personalised) gifts, reflecting a gift scheme based on the purchase price. This strategy employs the norm of reciprocity, suggesting that people are inclined to return favours. Unlike typical rewards that are perceived as part of the transaction, surprise gifts create a stronger emotional bond and a sense of obligation for further purchases.

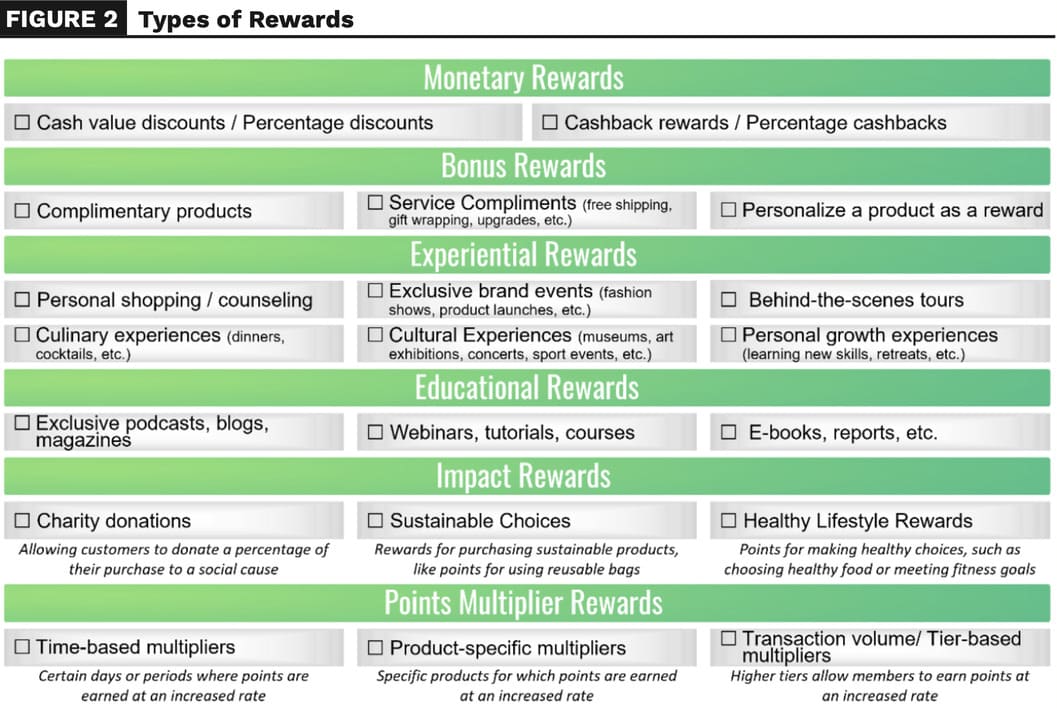

Non-Monetary Rewards Lead the Way

Loyalty point programmes allow customers to accumulate points, which can be redeemed for various rewards. The nature of these rewards is critical, as it significantly influences subscription rates and active engagement with the loyalty programme. Figure 2 presents an overview of the types of rewards that brands can offer their members.

Traditional rewards often include various discounts. Research indicates that consumers perceive non-monetary rewards as ”gaining something extra”, whereas monetary rewards are seen as ”losing less than usual”. In essence, non-monetary rewards are framed as gains, and monetary rewards as reduced losses. This framing suggests that non-monetary rewards are generally viewed more favourably and tend to be more effective (Shelper et al. 2023). Therefore, it is advisable to shift from offering discounts to providing free goods or additional product quantities. McKinsey research indicates that such hard-value benefits are particularly effective in convincing consumers to sign up for loyalty programmes, while experiential and status benefits are increasingly important for retaining subscribers.

Key Success Factors in Building Loyalty Programmes

- Award Points for Non-Purchase Activities: There is a trend that people want to use points in new ways and earn points in new ways (Shelper et al. 2023). For example, ‘‘My Lancôme Rewards’’ offers additional points for activities like signing up for text messages or newsletters, writing reviews, referring friends, and completing a virtual service such as makeovers, skin consultations, beauty tutorials or interactive quizzes. Other common activities include event participation, profile completion (which aids in collecting consumer data), and social media engagement like tagging the brand or using specific hashtags. Awarding points for non-purchase activities makes the loyalty programme more dynamic and interactive, which in turn significantly boosts active participant engagement. Furthermore, it can direct participant motivation towards new product offerings and foster a sense of community, particularly as non-purchase points can encourage sustainable or healthy choices, aligning participants with the brand’s overall purpose.

- Create Sunk and Switching Costs: A crucial success factor is designing loyalty programmes in a way that encourages regular purchases while deterring members from leaving. Prospect theory suggests a guiding principle: People exhibit loss aversion, meaning that losses loom larger than gains. Members should feel that leaving the programme would result in significant loss, particularly in terms of status. Common in frequent flyer and hotel loyalty schemes, this approach generates switching costs for members who have attained elite tiers, particularly in the form of status and convenience benefits that would be lost. Glow Recipe adapted this concept for the beauty segment: The points earned per unit spent increase with each tier – from just 1 point per unit in the first tier to 3 points in the top tier. This is particularly effective when consumers realise the substantial time and money required to attain similar benefits should they rejoin the programme. Groups are harder to leave when consumers have invested significant financial, cultural, and social capital. Such sunk costs can be established through one-time membership fees and, more effectively, through social benefits. Glow Recipe ensures that participants feel part of a community, fostering a sense of belonging and possibly status among peers. Leaving the programme would mean losing these social benefits.

- Gamify Programme Features: When evaluating a programme design, consider whether it enhances (1) repeat purchases, (2) upselling and cross-selling opportunities, (3) active member participation, and (4) alignment with the brand’s values and purpose. The latter two criteria are crucial for evolving a loyalty program into a community. Gamification is a key driver of active participation, yet currently underutilised, with only five (8.4%) out of 60 programmes employing it. NARS, for example, opts for subtle passive gamification elements like game-inspired avatars and a progress tracker, which keeps customers engaged in earning and checking points, adding fun to the programme. Chanel’s ‘‘La Collection’’ card game is a role model for interactive gamification elements, originally designed for video games. Purchases and different tasks unlock new cards and rewards, creating a sense of anticipation and surprise.

- Provide a Sense of Purpose: Two powerful techniques to increase emotional commitment are often underestimated. Firstly, giving consumers an excuse or justification for consumption can motivate those on the fence to make a purchase, especially when linked to value-based rewards. For instance, Louis Vuitton launched a campaign highlighting their commitment to donate a portion of purchase revenues to the Red Cross. In the Mugler Circle loyalty programme, participants can ‘‘engage with the planet’’ and earn 450 points by refilling their perfume bottles instead of buying new ones. Secondly, people are most motivated when contributing to something larger than themselves that they believe in. Brands have the opportunity to achieve dual goals: striving for a higher purpose beyond making money while convincing consumers that their purchases are contributing to a good cause. Research shows that resistance to leaving a programme is maximised when participants identify with the values and imagery of a brand (Shelper et al. 2023). Without such emotional commitment, consumers are more likely to switch to competitors when a better product is available.

About the Authors

Klaus Heine is a marketing professor at Emlyon Business School and has collaborated with numerous luxury houses in both Europe and Asia. He helps entrepreneurs find out what they want their brands to stand for – to build high-end brands with a higher purpose.

Klaus Heine is a marketing professor at Emlyon Business School and has collaborated with numerous luxury houses in both Europe and Asia. He helps entrepreneurs find out what they want their brands to stand for – to build high-end brands with a higher purpose.

Holding an MSc in Luxury Management and Marketing, Vanessa Brunner specialises in enhancing brand-customer relationships in the luxury sector. Her experience and insights from her thesis on loyalty in luxury beauty equip her to guide luxury brands towards customer-centric strategies, fostering devoted brand advocates.

Holding an MSc in Luxury Management and Marketing, Vanessa Brunner specialises in enhancing brand-customer relationships in the luxury sector. Her experience and insights from her thesis on loyalty in luxury beauty equip her to guide luxury brands towards customer-centric strategies, fostering devoted brand advocates.

References

-

Leenheer, J., van Heerde, H. J., Bijmolt, T. H. A. & Smids, A. (2007). Do Loyalty Programs Really Enhance Behavioral Loyalty? International Journal of Research in Marketing: 42(1): 31-47.

-

McKinsey (2020). Coping with the Big Switch: How Paid Loyalty Programs Can Help Bring Consumers Back to Your Brand, https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/coping-with-the-big-switch-how-paid-loyalty-programs-can-help-bring-consumers-back-to-your-brand.

-

Morris, M. (2023). Building a Rewards Programme That Keeps Fickle Customers Coming Back, January 8, https://www.businessoffashion.com/articles/direct-to-consumer/rewardsprogramme-to-keep-fickle-customers-coming-back/.

-

Nunes, J. C. & Dréze, X. (2009). Feeling Superior: The Impact of Loyalty Program Structure on Consumers’ Perceptions of Status. Journal of Consumer Research, 35 (6), 890-905.

-

Shelper, P., Lyons, S., Savransky, M., & Harrison, S. (2020). Loyalty Programs: The Complete Guide, Loyalty & Reward Co Pty Ltd: London.