By Daniel Trabucchi and Tommaso Buganza

Established companies face persistent challenges of inefficient transactions, shifting customer needs, innovation bottlenecks, underused data, and strategic data gaps. Daniel Trabucchi and Tommaso Buganza of the Politecnico di Milano reveal how platform models address these problems and present a methodology to design, ignite, and grow scalable ecosystems.

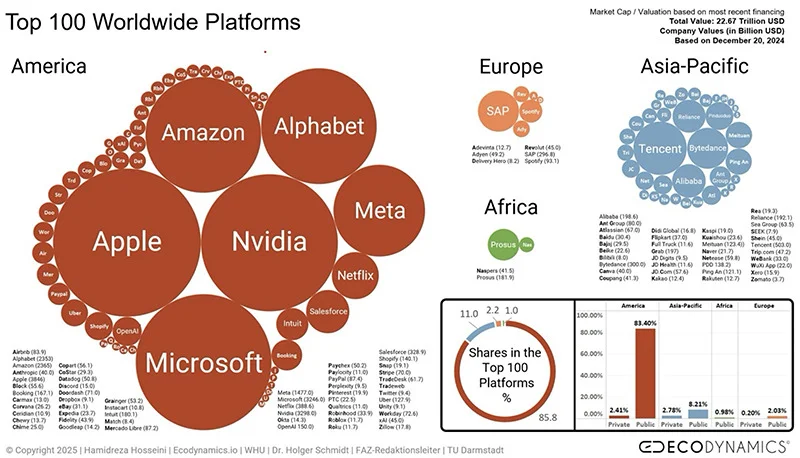

The platform economy is no longer an emerging trend—it is an established reality. Yet its geography tells a story of striking imbalance. According to the latest Top 100 Worldwide Platforms ranking, based on market capitalisation, 85.8 per cent of their total value is concentrated in the Americas, 11 per cent in Asia-Pacific, while Europe accounts for a modest 2.2 per cent and Africa just 1 per cent1. This disparity begs an obvious question: has Europe already lost the platform battle?

Not entirely. Significant examples prove that Europe can still matter in the global platform landscape. Siemens with Siemens Xcelerator, AXA with its AXA Digital Commercial Platform, and Eni with Open-es are three distinct initiatives united by the same logic: leveraging platform models to tackle complex challenges and create new value2.

We believe there is still hope. Like a phoenix rising from its own roots, European companies can build on what they already have—brand, customers, relationships, data, and know-how—to innovate and grow.

In our previous article for The European Business Review3, we introduced the concept of Platform Thinking, showing how even traditional firms can adopt it. With our new book, The Digital Phoenix Effect2, we explore this dynamic in depth, revealing how legacy companies can reinvent themselves—not by burning everything down, but by using their legacy as the foundation for a new way of creating value.

The Study: Decoding the Digital Phoenix Effect

The Digital Phoenix Effect is grounded in a multi-year research effort on the S&P 500, examining how established firms have approached platform strategies in recent years. Our analysis covered over 800 initiatives, identifying 140 cases that met the essential conditions to be classified as platforms: the presence of at least two distinct groups of customers and the existence of cross-side network externalities2.

These two features, which we discussed in our previous The European Business Review article3, are what distinguish platform models from traditional linear value chains. In a linear model, value is created and delivered through a sequence of activities—from supplier to producer to customer—without the interdependent dynamics of multi-sided interactions. In a platform, value emerges from enabling these interactions, and network effects power its growth; the more participants on one side, the more valuable it becomes for the other side, and vice versa4,5,6.

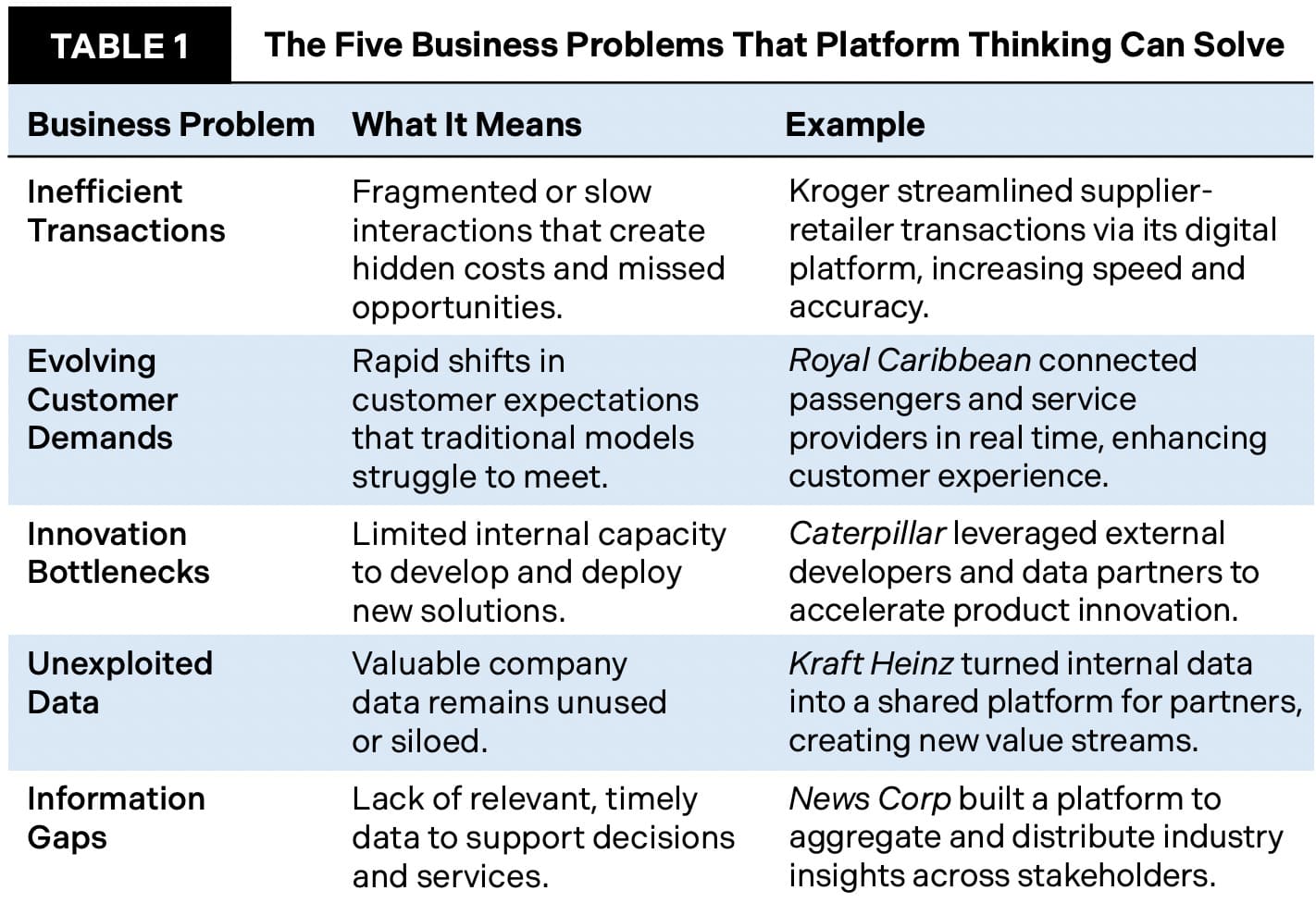

From the 140 platforms identified, a pattern emerged. Regardless of industry, we found that platforms were not built for their own sake—they were designed to solve pressing business problems that linear models could no longer address effectively. We distilled these into five recurring “business problems” that platforms are particularly suited to tackle2:

- Missing or Inefficient Transactions – cases where opportunities for exchange exist but are hindered by friction or lack of connection.

- Evolving Customer Demands – situations where customer expectations shift faster than traditional offerings can adapt.

- Innovation Bottlenecks – contexts where internal innovation capacity is insufficient to keep pace

with market needs. - Underutilised Data – scenarios where valuable data exists but is not leveraged for new value creation.

- Lack of Data for Strategic Insights – situations where key decisions are made with incomplete or inaccessible data.

These categories provide a practical lens for managers. Instead of asking, “Should we build a platform?”, the more relevant question becomes, “Which problem are we trying to solve, and can a platform mechanism address it better than a linear one?” The next section explores each problem through a concrete case.

The Five Problems Platforms Can Solve

1. Kroger – Supplier Hub for Missing or Inefficient Transactions

Some transactions, while possible and desirable, remain slow, fragmented, or absent. Inefficiencies may arise from organisational silos, non-integrated IT systems, or centralised decision-making that slows the flow of information. These frictions can occur externally—between customers and suppliers, partners and affiliates—or internally—between departments and teams.

Kroger, one of the largest U.S. supermarket chains, faced this challenge in procurement. With thousands of suppliers and hundreds of internal buyers operating across categories and locations, transactions between these two existing groups were frequent but often costly and inefficient.

Moving beyond the traditional “supplier as vendor” mindset, the platform positioned suppliers as active participants in a shared ecosystem.

In 2018, Kroger launched Supplier Hub, a platform designed to streamline these interactions. Moving beyond the traditional “supplier as vendor” mindset, the platform positioned suppliers as active participants in a shared ecosystem. It provided self-service tools, tutorials, dedicated support, and simplified compliance processes.

By enabling more direct, transparent, and efficient exchanges, Kroger unlocked previously hidden value. As more suppliers engaged, the platform generated richer data and greater variety for buyers; as buyers became more active, suppliers gained visibility and efficiency.

This illustrates the power of Platform Thinking: reimagining existing relationships and assets to transform inefficiency into a scalable, self-reinforcing advantage.

2. Royal Caribbean – Royal Caribbean Hotels for Evolving Customer Demands

Royal Caribbean is renowned for world-class onboard experiences, yet many guests face a recurring gap: pre- and post-cruise lodging near ports. Managing this need through external portals is fragmented and can undermine the perceived quality of the entire journey. Rather than buying hotels or locking into a handful of bilateral deals, Royal Caribbean launched Royal Caribbean Hotels, a transactional platform that connects two distinct groups: passengers seeking convenient stays and hotels eager to reach a pre-qualified, high-value audience.

On the platform, hotels are not mere suppliers—they are customers. The more properties participate, the more choice and flexibility travellers enjoy; the more travelers book through the platform, the greater the visibility and occupancy upside for hotels. These cross-side network effects strengthen with every interaction, without diverting the company from its core: delivering great cruises.

By leveraging brand trust, customer relationships, and an existing loyal base, Royal Caribbean extended its ecosystem to solve a fast-evolving customer need, improving end-to-end experience while keeping capital intensity low. The platform turns a service gap into a growth vector—and does so by orchestrating partners rather than owning every asset.

3. Caterpillar – Cat Digital Marketplace for Innovation Bottlenecks

As customers demanded smarter, more integrated solutions, building every digital tool in-house became untenable for Caterpillar: slow cycles, rising costs, and a narrow funnel of ideas. To break the bottleneck, Caterpillar created Cat Digital Marketplace, opening APIs and infrastructure so external developers can build software that augments its machines—fleet management, predictive maintenance, and more.

Developers are platform customers, motivated by access to Caterpillar’s global installed base. More developers mean more solutions for equipment owners; more adoption attracts more developers—a virtuous loop that scales innovation without bloating internal teams.

Crucially, the marketplace enhances (not replaces) Caterpillar’s core. The machines remain the anchor; the ecosystem makes them more valuable, configurable, and future-proof. By activating dormant assets—brand, trust, and a massive installed base—Caterpillar shifted from “doing all the innovation” to enabling it, accelerating time-to-solution while preserving focus on what it does best.

4. Kraft Heinz – Kraft-O-Matic for Unlocking Underused Data

Kraft Heinz, a household name in the food industry, has long enjoyed the trust of millions of consumers and a portfolio of iconic brands. Yet, much of its vast trove of sales, marketing, and feedback data remained locked in silos, underutilised and mostly archival. Recognising the opportunity to transform these dormant assets into real-time strategic insights, the company partnered with Google Cloud to create Kraft-O-Matic, an AI-powered platform designed to aggregate, analyse, and distribute data across the organisation.

In this ecosystem, consumers remain end customers but also act—often unknowingly—as data suppliers through their interactions with the products. Internal R&D and marketing teams become customers of the platform’s insights, leveraging them to shape new products, campaigns, and adaptations with far greater precision.

By reframing data as a multi-use asset, Kraft Heinz shifted from static reporting to a continuous, generative flow of value. Cross-side network effects ensure that the more data consumers feed into the system, the more effective internal decision-making becomes—creating a self-reinforcing cycle of innovation. The result is not just technological upgrade, but a redefinition of relationships, roles, and flows within the company’s value creation system.

5. News Corp – Vertical Video Platform for Strategic Data Gaps

In the fast-evolving media landscape, News Corp faced a critical challenge: acquiring the granular, real-time behavioural data that advertisers demanded, while competing with mobile-first giants like TikTok and YouTube. Traditional audience metrics and market research were too slow, too costly, and too generic to sustain competitiveness.

The solution came in 2022 with the launch of the Vertical Video Platform—a mobile-first, interactive content service designed to attract new audiences and, crucially, to turn engagement into a natural source of data generation. Integrated with Intent Connect, News Corp’s proprietary analytics engine, the platform enables hyper-personalised targeting for advertisers based on in-app behaviours, preferences, and interactions.

Here, users become both customers of an engaging media experience and providers of valuable data; advertisers gain precise targeting capabilities, which in turn makes the platform more attractive for users. This virtuous loop is a hallmark of Platform Thinking: value is exchanged continuously, with each side making the other more valuable.

By leveraging brand trust, existing advertiser relationships, and its established user base, News Corp didn’t just close a data gap—it built an entirely new, sustainable source of competitive advantage.

From the Platform Revolution to the Phoenix Effect, making platform a concrete tool for legacy firms

All five cases presented—Kroger, Royal Caribbean, Caterpillar, Kraft Heinz, and News Corp—are drawn from the U.S. market. This is no coincidence. Given the global scale and maturity of the “platform revolution,” our research focused on the S&P 500, where platforms have long been integral to business models.

Yet the opening examples—Siemens Xcelerator, AXA Digital Commercial Platform, Open-es—show that European firms can play, and win, in this arena. The first part of The Digital Phoenix Effect is dedicated to these and other European success stories, such as Telepass and XOM Materials, demonstrating that geography need not dictate destiny2.

The book closes with a practical build-track: the Platform Thinking Journey, a strategic design process structured into four phases—Framing, Design, Ignition, and Growth—and articulated through seven recurring cycles of questions, each supported by clear alternatives, tools, and milestones. The aim is not a linear recipe but a recursive cadence that managers can actually run.

- Framing clarifies where and why to apply Platform Thinking (new service, core activity, or support activity; problem to solve or idle asset to unlock).

- Design translates intent into architecture

and business model choices across sides and value flows. - Ignition makes the go-to-market concrete, selecting onboarding strategies and sequencing sides with a roadmap, learnt from a decade of research in start-up-based platforms.

- Growth scales through extension and exploitation strategies, based on the success

of digital platforms.

This methodology was developed and stress-tested within the Platform Thinking HUB at Politecnico di Milano, a multi-year design science effort that engaged more than 50 managers annually and iterated the journey from a card-based toolkit into a four-phase model—now also supported by a GenAI co-thinker to sustain decisions between workshops. Recent partners include Eni, Leonardo, Prysmian, GS1 Italy, Angelini Industries, and Sisal (over 20 partners in the first three editions).

The “platform revolution” may no longer be an ongoing revolution—it’s the current operating system of competition. The new game is different: established firms can win by building on what they already have—relationships, data, physical assets, and know-how—using platform mechanisms to turn constraints into catalysts. Like a digital phoenix, they don’t burn everything down; they rise by recombining legacy assets into new value-creation logics. That is the opportunity in front of Europe—and any legacy company ready to play it.