By Séverine Mastikian, Maros Mraz and Vikas Dubey

As Europe pursues climate change targets and digital sovereignty, its rail network risks falling behind. Legacy systems, slow moving pilots, and talent shortages are stalling progress. But there is hope. Future Railway Mobile Communications System pilots are showing promise in the drive to lead in the 5G-enabled transport era.

With the EU targeting climate neutrality by 2050, the rail industry stands at a pivotal point in its history. Ambitious EU goals to triple high-speed rail traffic and double freight volumes present a rare opportunity to reposition rail as the backbone of sustainable mobility. But realising that vision will take more than new infrastructure. It calls for reinventing how Europe’s railways communicate, operate, and innovate.

At the core of this transformation is the Future Railway Mobile Communication System (FRMCS), a 5G-based standard replacing the Global System for Mobile Communications—Railway (GSM-R) (figure 1). Developed by the International Union of Railways, it offers faster, more reliable communication to support the European Rail Traffic Management System (ERTMS) and advanced train control (European Train Control System, ETCS level 2+). Unlike standard 5G, FRMCS is designed for mission-critical railway operations, ensuring secure, interoperable communication, while standard 5G can support passenger services, asset monitoring, and station connectivity. FRMCS is the keystone for a digitally connected rail ecosystem, one designed to deliver safer, smarter, more seamless journeys while advancing the EU’s climate goals under its Sustainable and Smart Mobility Strategy.

Figure 1: How GSM-R and 5G-FRMCS stack up against today’s needs.

The stakes: Safety, sustainability, and market share

The case for 5G-FRMCS goes far beyond compliance or modernisation. It’s a strategic race for relevance. As aviation and automotive options become greener, rail must compete not only on sustainability, but also on performance, reliability, and passenger experience. 5G-FRMCS enables that leap. It unlocks capabilities that modernise many layers of rail operations, from real-time diagnostics and predictive maintenance to automated train control and seamless cross-border communication.

As aviation and automotive options become greener, rail must compete not only on sustainability, but also on performance, reliability, and passenger experience.

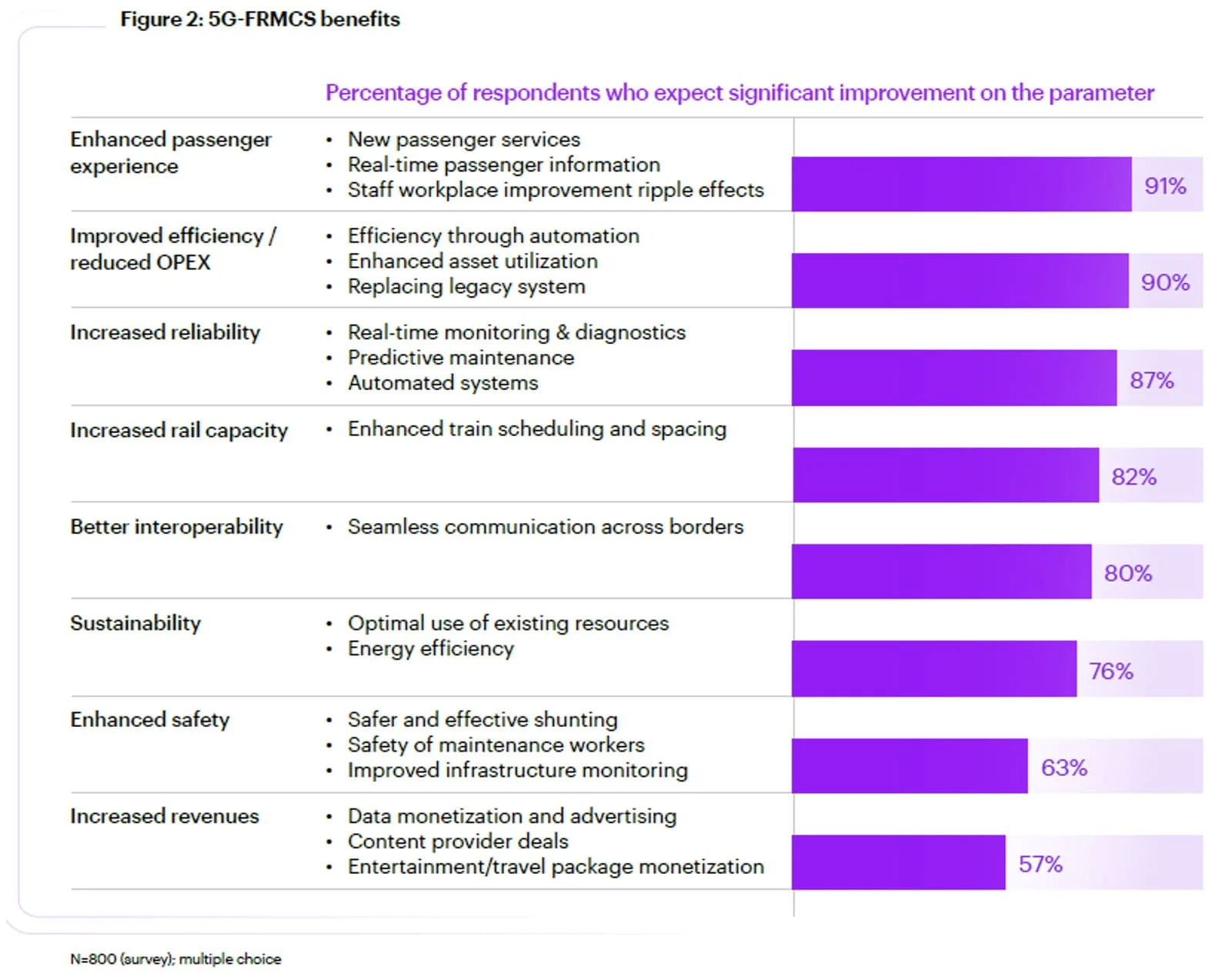

In fact, 91 per cent of the 800 rail industry executives surveyed cited improved passenger experience as a top expected benefit of 5G-FRMCS (see figure 2). They also highlighted expected benefits such as lower operating costs (87 per cent), increased reliability (82 per cent), better interoperability (80 per cent), and enhanced safety (76 per cent), while more than half (57 per cent) anticipate benefits in revenue growth. In other words, 5G-FRMCS offers value across the board, from traveler satisfaction to network efficiency.

Figure 2: Rail leaders expect 5G-FRMCS to deliver widespread gains, from passenger experience to safety.

Crucially, FRMCS is also a climate imperative. With GSM-R nearing obsolescence, its maintenance is becoming increasingly expensive and resource-intensive. Retiring legacy systems and transitioning to 5G-FRMCS is necessary to cut lifecycle emissions, increase energy efficiency, and help meet the EU’s target of a 90 per cent reduction in transport emissions by 2050.

Yet, despite the overwhelming consensus on its importance, the shift to FRMCS remains sluggish. New research from Accenture (based on a survey of 800 executives across Europe’s rail ecosystem and interviews with senior stakeholders) found that just 24 per cent of respondents feel ready to make the transition. Most projects remain in pilot or early planning stages.

The roadblocks: Complexity and inertia

If the benefits are clear, why the holdup? Multiple, overlapping challenges form a web of resistance. Technologically, FRMCS is still maturing, with limited off-the-shelf solutions. Financially, the return on investment remains hard to quantify; just 17 per cent of executives feel confident estimating implementation costs. Two in three executives cite a lack of international agreement on technical solutions as a major obstacle, while 40 per cent of rail operators admit they are waiting for others to make the first move.

One chief technology officer summed it up: “The practical dimension is still not fully understood. The deployment itself will be a huge challenge.”

Funding uncertainty also weighs on operators. While many have historically depended on EU support, the future is less assured. In fact, 40 per cent of the executives that Accenture surveyed believe that the government will fully fund 5G-FRMCS implementation, and 59 per cent admit they are delaying investments in anticipation of that funding.

The takeaway is clear. Organisationally, fragmented stakeholder interests across operators, infrastructure managers, equipment vendors, and regulators make coordinated action difficult. Yet, no one player can lead this urgently needed push for change at scale.

Proof points from early movers

To break the deadlock, the industry needs evidence and momentum. Fortunately, use cases from around the world are already showing what’s possible.

In China, for instance, Guangzhou Railway has deployed a 5G-powered shunting yard that increased capacity from 8,000 to 10,000 trains per day while reducing staffing needs by 30 per cent. They also introduced AI-assisted suspension inspections that now take two minutes instead of two hours.

FRMCS is designed to deliver safer, smarter, more seamless journeys while advancing the EU’s climate goals.

In Europe, Deutsche Bahn is integrating FRMCS infrastructure into the Hamburg-Berlin corridor renovation, with passive infrastructure made available to telecom providers such as Deutsche Telekom and Vodafone. Switzerland’s SBB has piloted installations along key routes. In the UK, the Connected Heartland Railways project is testing public-private models that extend network benefits to surrounding communities.

These examples show that 5G-FRMCS is no longer theoretical. It’s being deployed, delivering results and creating momentum , especially when paired with broader infrastructure upgrades.

A playbook for moving forward

So how can rail leaders turn intention into action? Accenture’s research identifies five strategic imperatives:

- Build compelling use cases: Look to global exemplars, not just for mission-critical functions. Passenger-facing and operational innovations like high-speed Wi-Fi and real-time journey information strengthen the business case for funders and boards.

- Take a strategic approach to migration: Develop rigorous test strategies that ensure reliability, security, and operational continuity. Partner with mobile network operators (MNOs) and technology providers to access skilled talent and accelerate technical readiness.

- Rethink the operating model: Move from hardware-centric to software-centric architecture. Replace rigid procurement with agile frameworks like innovation partnerships and competitive dialogues. Ensure coordination across operations, IT, and infrastructure to unlock the full potential of data-driven rail operations.

- Upskill for a 5G-enabled future: Only 28 per cent of operators are prioritising workforce transformation. Success will depend on the right training and making teams fluent in network slicing, cybersecurity, AI, and 5G systems integration.

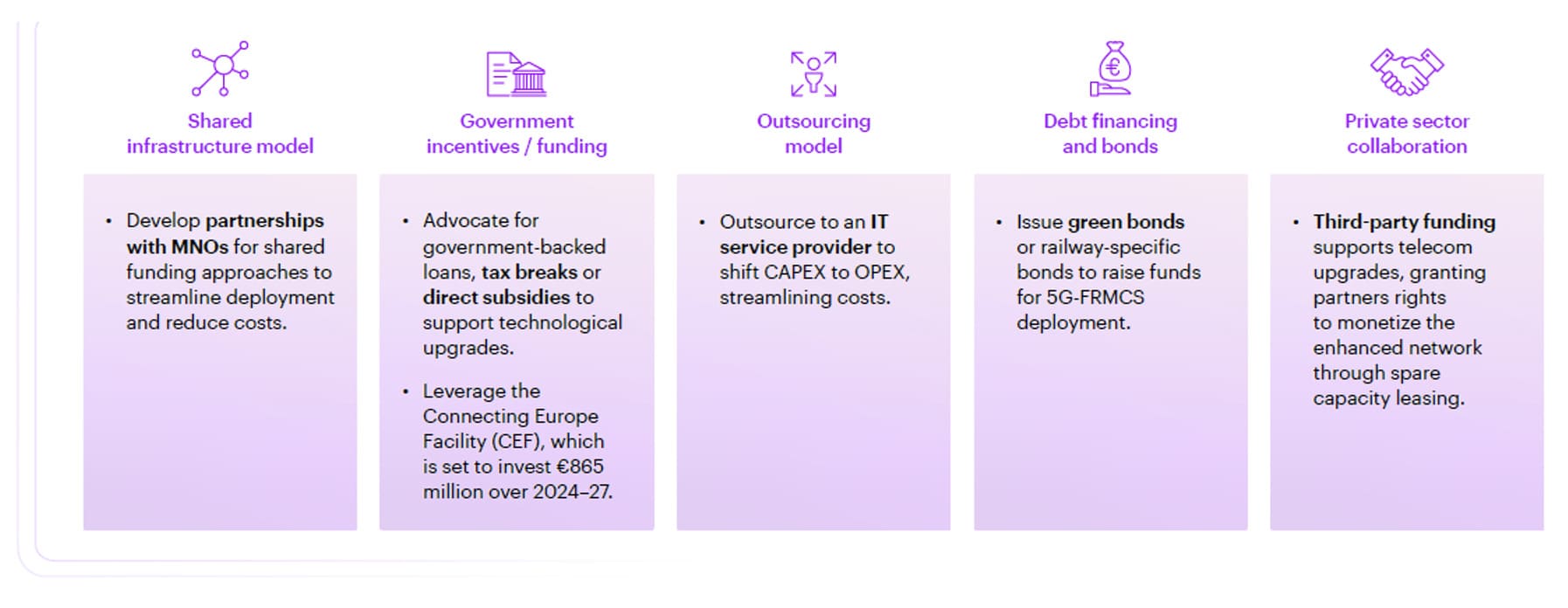

- Pursue creative funding models: Just 24 per cent of operators are actively exploring non-traditional funding approaches like green bonds and public-private partnerships, which can help close the investment gap (see figure 3).

Figure 3: Leading operators are adopting innovative funding models to close the investment gap.

Practice should shape policy

Regulation remains a significant variable in the FRMCS equation. The EU’s MORANE 2 project is expected to finalise technical specifications by 2026, but waiting for the paperwork to catch up could cost Europe its lead. As with other frontier technologies, practice must inform policy, not the other way around.

Finland’s Digi Rail initiative offers a useful model. By piloting FRMCS on mobile network-operated infrastructure, it is not only reducing capital intensity but also generating real-world data to shape regulatory frameworks. This early-mover approach is helping Finland test what works, and influence EU-wide guidance in the process.

This test-and-learn approach should be the norm. Industry stakeholders, including rail operators, infrastructure managers, and MNOs, should engage proactively with regulators, sharing pilot results and proposing practical, scalable rules. Europe doesn’t need lockstep conformity; it needs interoperability, safety, and momentum.

The broader stakes are impossible to ignore. FRMCS sits at the intersection of climate ambition, digital sovereignty, and industrial strategy. It offers Europe a rare opportunity to lead not just in transport, but in infrastructure innovation. But that window is closing.

As one executive puts it: “We know we have to move. The question is, do we wait for perfect conditions, or do we help create them?”

The playbook is here. What remains is action – confident, coordinated, and urgent.

About the Authors

Séverine Mastikian, EMEA Transport & Logistics Lead at Accenture.

Séverine Mastikian, EMEA Transport & Logistics Lead at Accenture.

Maros Mraz, Industry X, Transport & Logistics Lead for Austria, Switzerland and Germany at Accenture.

Maros Mraz, Industry X, Transport & Logistics Lead for Austria, Switzerland and Germany at Accenture.

Vikas Dubey

Vikas Dubey