By Jens Laue, Matthew Robinson, Monique de Ritter and Michela Coppola

As Europe recalibrates its sustainability regulations, it may seem natural for businesses to ease efforts in collecting and integrating sustainability information. Yet the real opportunity is to move ahead — strengthening data, talent, and technology so that sustainability information becomes a driver of innovation, resilience, and long-term competitiveness.

“Opportunity is missed by most people because it is dressed in overalls and looks like work.”

Thomas Edison’s words resonate stronger than ever today as businesses face growing uncertainty around the future of sustainability regulation in Europe. Yet within the complexity lies opportunity for those willing to engage with regulation as a catalyst rather than as a constraint.

Over the past five years, the EU has set a global benchmark with the EU Taxonomy, the Corporate Sustainability Reporting Directive (CSRD), and the proposed Corporate Sustainability Due Diligence Directive (CSDDD). The direction was clear: mandate detailed sustainability data disclosure to drive transparency, improve risk-management, and steer businesses towards sustainable, resilient models.

But even as rules shift, one signal remains clear: sustainability is becoming a long-term driver of performance and innovation.

Now, with economic headwinds and growing competitiveness concerns, reducing regulatory and administrative burdens is a key priority for governments, industry lobbies, and lawmakers. In this context, the European Commission proposed the Omnibus Simplification Package, which, if adopted in its current form, would significantly reduce the scope and depth of sustainability disclosure and due diligence requirements.

These moves have sparked debate. Is the EU recalibrating or retreating from its Green Deal ambitions? Is this no longer the EU’s “man on the moon moment”? Amid the uncertainty, the challenge for companies is to decide how to treat sustainability data in this shifting context.

The risk lies not in regulatory fluctuations, but in treating the collection of sustainability information as a compliance task rather than a strategic capability. Businesses may be tempted to pause or scale back efforts to collect high-quality sustainability data. But even as rules shift, one signal remains clear: sustainability is becoming a long-term driver of performance and innovation. Those who invest with foresight instead of pausing can gain a competitive advantage.

Accenture’s research shows that three strategic actions can turn sustainability regulation into a business advantage: building intelligent data infrastructure, embedding ESG metrics into core decision-making, and empowering teams to act on sustainability intelligence. Companies that take these steps are best placed to lead, regardless of how the regulatory landscape shifts.

Regulation as a driver of innovation

Leading businesses already recognize that if they embrace sustainability regulation in spirit, not just letter, it can become a source of strategic advantage.

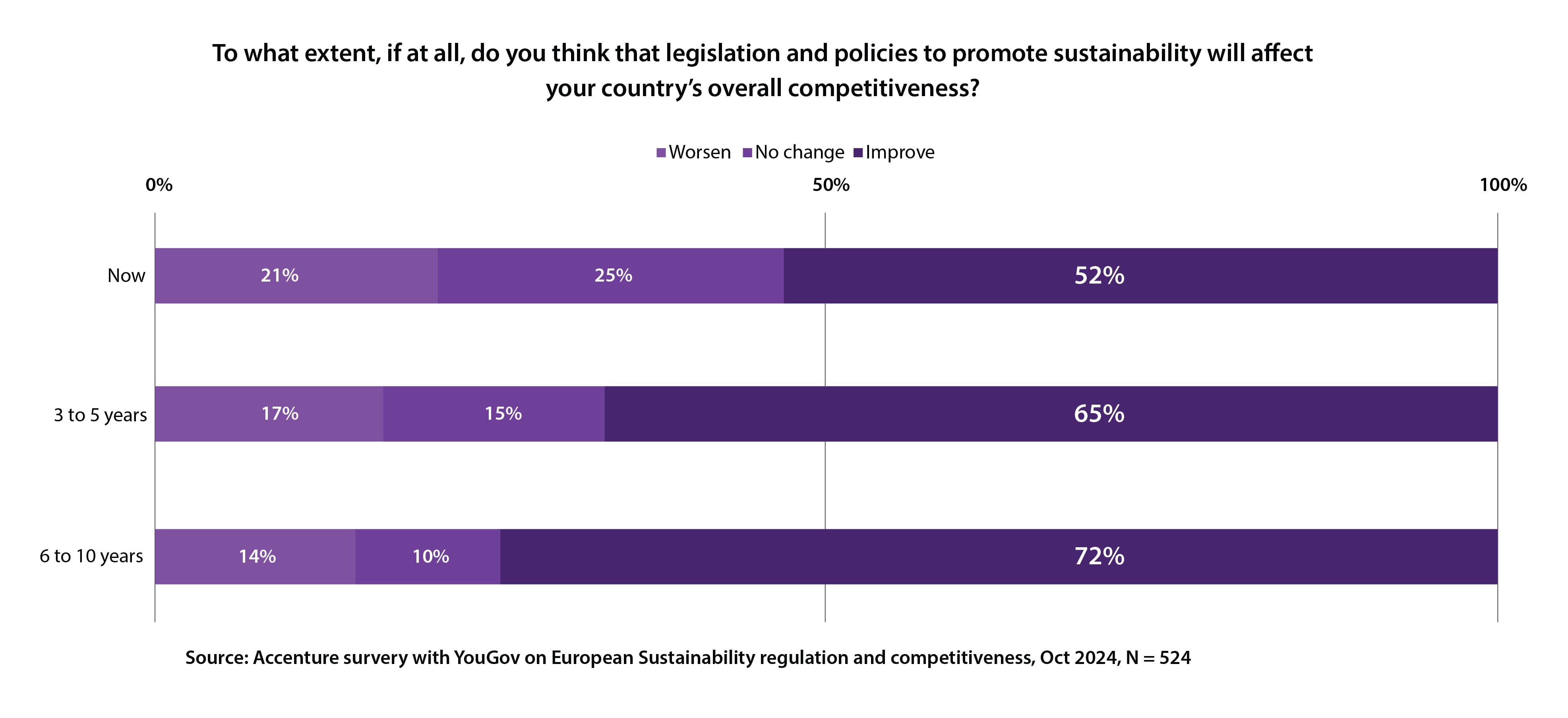

A recent Accenture survey across five major European economies reveals a growing recognition of this mindset. Over half of business leaders already see sustainability regulation as a driver of competitiveness now. The figure rises to 65 percent in the medium term and 72 percent in the long term, evidence that more companies see the broader intent of regulation as a tool for national advantage (see figure 1).

Figure 1: Business leaders view sustainability regulation as a competitiveness driver

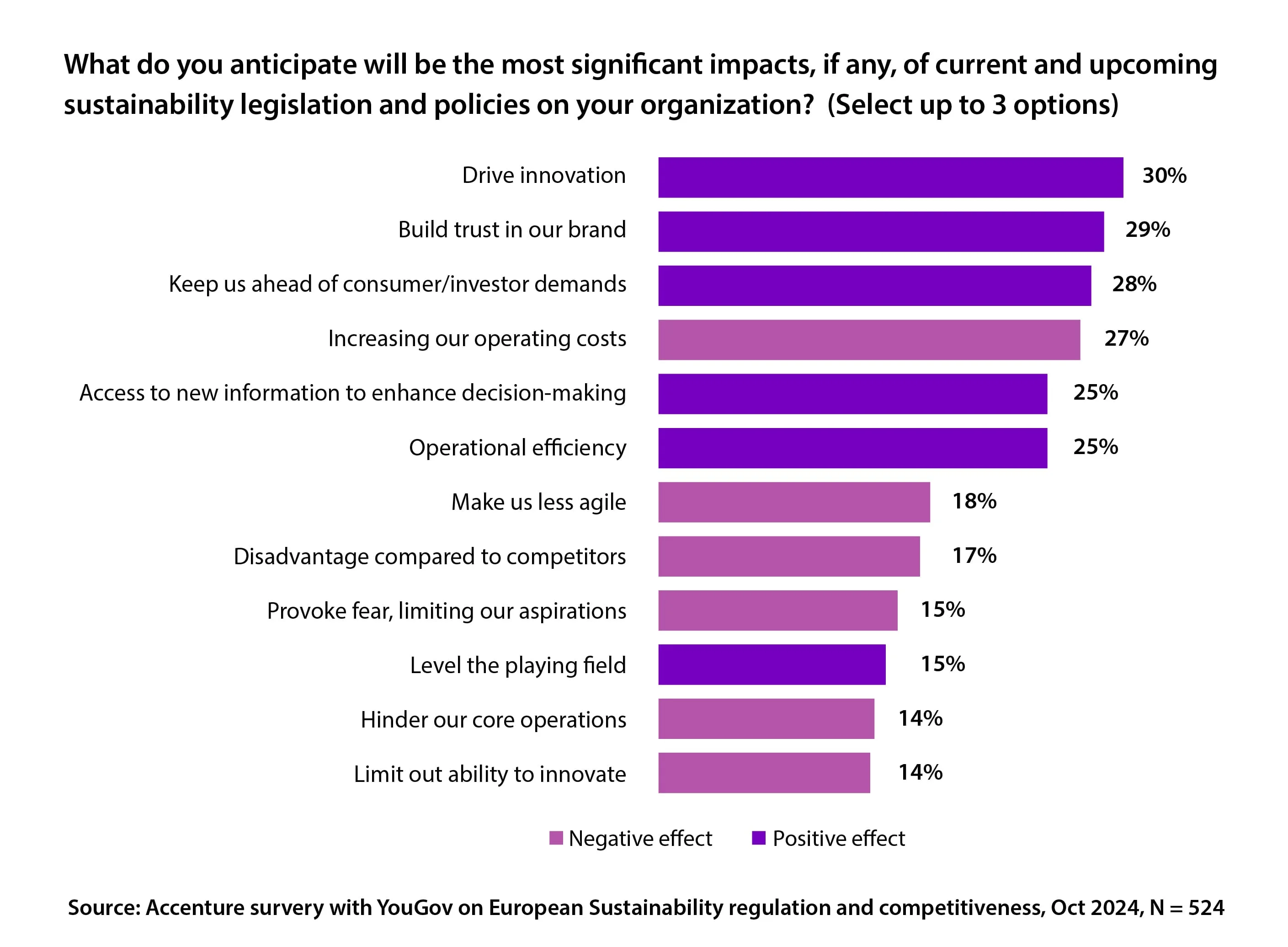

This perspective, however, goes beyond the aggregated, national level. Many leaders also recognize tangible benefits for their own organizations. Over half (54 percent) anticipate overall positive outcomes from current and upcoming sustainability legislation. And while rising operating costs are a concern, the top three expected outcomes are all positive: driving innovation, building brand trust, and staying ahead of investor and consumer demands (see figure 2).

Figure 2: Top anticipated outcomes of EU sustainability legislation

By treating sustainability data not as a reporting chore but as raw material for better decisions, companies can unlock powerful value. Financial and non-financial performance should not be managed in isolation, nor should investment decisions be made in silos, as there is a strong correlation between traditional business decisions and sustainability impacts, and vice versa. Currently, fewer than 30 percent of large European firms integrate non-financial, ESG data into their decision-making processes but that’s changing. Nearly 60 percent expect to do so within three years, indicating that building a “sustainability intelligence” capability is becoming a strategic differentiator.

Turning sustainability data into a business driver: Three strategic actions

Forward-thinking companies are already taking strategic actions to harness sustainability intelligence. Their approach offers clear lessons for others, centered on three actions that deliver both immediate impact and long-term benefit:

1. Build robust, data-driven sustainability infrastructure to turn compliance into insight

For many companies, the challenge is not just a lack of information; it’s also the lack of infrastructure to make sense of it. New regulations are accelerating the demand for high-quality, granular, and auditable non-financial data. Yet most firms treat reporting as a siloed, manual exercise, narrowly focused on compliance. Organizations taking this reactive stance have limited strategic visibility and run the risk of falling behind more data-fluent competitors.

Leading organizations, on the other hand, are:

- Adopting cloud-based solutions to streamline data management and enable real-time updates

- Leveraging AI and machine learning to automate data classification, validation reporting, and analysis

- Integrating sustainability metrics into enterprise resource planning (ERP) systems to enhance reporting accuracy, enable decision making, and generate efficiency.

These technologies are becoming core to how companies track, analyze, and act on sustainability signals.

Ørsted, for example, uses SparkCognition’s AI-powered Renewable Suite to integrate financial, operational, and third-party data—including weather forecasts—onto a single platform. This cloud-based system enhances data quality, enables self-serve models for actionable insights, accelerates fault detection, and fosters collaboration across the enterprise.

UPS spent years developing ORION, an AI-powered logistics engine that optimizes delivery routes in real time. The system not only cuts emissions, it also boosts operational efficiency, turning sustainability into a bottom-line driver.

A robust, connected data ecosystem can transform regulatory effort into an operational edge. By providing real-time insights, it can shift businesses from box-ticking to agile innovation, value creation, and industry leadership.

2. Embed non-financial intelligence into core decision-making

Building infrastructure is just the start; the real edge comes from using sustainability intelligence to guide strategy, operations, and capital allocation. Few organizations are there yet. Forward-looking companies go beyond compliance, treating non-financial data as a lens for risk, opportunity, and long-term value, embedding ESG insights into core decision-making to anticipate change, seize advantage, and drive sustainable growth. To move from intent to impact, they focus on:

- Developing integrated dashboards where leadership can access both financial and non-financial KPIs

- Using AI-powered analytics to forecast risks and opportunities related to ESG performance

- Aligning sustainability goals with investment and innovation strategies to attract responsible investors and future-proof the business

By embedding ESG metrics into enterprise dashboards and decision architectures, companies gain clearer insight into supply chain resilience, product lifecycles, climate risk, and stakeholder expectations.

Building infrastructure is just the start; the real edge comes from using sustainability intelligence to guide strategy, operations, and capital allocation.

For instance, BlackRock’s Aladdin Climate translates climate science and policy scenarios into climate-adjusted valuations, risk metrics, and financial models, equipping investors to anticipate how environmental risk will reshape valuations across portfolios.

This strategic integration treats sustainability intelligence as a strategic asset and drives better risk-adjusted returns, sharper innovation, and stronger stakeholder alignment.

3. Empower teams to act on sustainability insights

Data and dashboards mean little unless they drive action. Leading companies pair tools with talent and culture, embedding ESG intelligence into operations, adapting models, and bringing together the right skillset to use sustainability intelligence in real time, at scale. Measures include:

- Upskilling employees in ESG analytics and data-driven decision-making

- Embedding sustainability expertise across departments, ensuring that non-financial performance is part of business planning and operations.

- Encouraging cross-functional collaboration between sustainability, finance, and innovation teams.

The answer is not to create isolated ESG teams, but embed sustainability literacy across functions and empower decision-makers—whether in finance, procurement or product development—to act with confidence and speed. This requires new capabilities, new incentives and, often, new governance models that align sustainability goals with operational execution.

Companies that equip teams with the right data, skills, and authority are creating cultures of continuous innovation, where sustainability is not just an objective, but a mindset.

Sustainability intelligence as a competitive advantage

Europe’s regulatory landscape may be shifting, but the direction is clear for businesses: sustainability is a defining force in how value is created, measured, and delivered. It remains a powerful driver of long-term competitiveness and innovation.

The European Competitiveness Compass and amendments put forward in the Omnibus Proposal underscore the need for a balanced approach, but simplification need not undermine the long-term benefits of sustainability initiatives. Organizations that invest in data capabilities, integrate non-financial metrics into decision-making, and build a sustainability-focused workforce will be better equipped to thrive in a rapidly evolving global economy.

The companies that invest with intention will be the leaders. They are building the infrastructure to turn compliance into insight. They are embedding sustainability intelligence into strategic decisions. And they are empowering teams to act on that intelligence, transforming sustainability from a reporting exercise into a source of resilience, efficiency, and growth.

In a time of uncertainty, the biggest risk is inertia. Competitive advantage will flow not to those who wait for regulatory clarity, but to those who use this moment to future-proof their business.

Sustainability is no longer a cost to manage. It is a capability to master.

About the Authors

Jens Laue is a Managing Director and Accenture’s global lead for Sustainability Measurement, Analytics, and Performance services.

Monique de Ritter is the Sustainability Measurement, Analytics, and Performance research specialist within Accenture Research.

Michela Coppola is the global CFO and Enterprise Value research lead within Accenture Research.