By Elizabeth Stephens and J. Mark Munoz

New rules of the game

The COVID-19 pandemic and the Russian invasion of Ukraine have accelerated the drivers of geopolitical change, entrenching the bipolar confrontation between the US and China, the reconfiguration of international supply chains, and the declining commitment to international law. An increased focus on sustainability and climate change, rising inequality within and across nations, and the dominance of big tech are rapidly shifting the global balance of power.

A McKinsey (2022) report indicated that geopolitical instability poses a threat to both domestic and global growth. An Edelman (2022) Trust Barometer Report indicated that 59 per cent of executives believe that responding to geopolitical issues is a top priority in business.

For multinational corporations, the impact a single event or policy shift can exert on their operations is magnified through a complex web of interrelated dependencies. The physical locations of premises, multi-faceted supply chains, geographically mobile workforces and cyber-connectivity have led to greater risk exposure emanating from the cross-border transfer of goods and currency exchange.

As the geopolitical landscape changes, so must the way in which risk leaders protect their businesses. A thorough understanding of the interlinked geopolitical risk drivers and their impacts provides a strong foundation for prevention and protection against them and is essential in order to maintain a competitive advantage.

Revising the corporate play book

With a changed operational environment, companies need to conduct business utilising new methodologies. The four ways organisations can manage elevated geopolitical risk are: abstain, play, insure, or mitigate.

Abstain. Companies can decide not to participate in cross-border business. That is a strategic choice depending on the nature of a firm’s business, its aspirations, and the degree of domestic and international competition. However, it is practically difficult to be isolated from the external environment. Autarky is painful. North Korea is a current example, and is hardly an economic tiger. Even relatively closed economies cannot avoid external problems. Coronavirus exemplifies the capacity for cross-border contagion. The same is true with climate change, technology, and regulation.

Play. Companies can decide to bear all the risk and take any potential loss in the pursuit of profit. Many oil majors take this approach because the scale of their global investments is so great that the cost of insuring is greater than the odds of a sizeable incident impacting more than a small fraction of their portfolio. Again, this depends on the nature of the business and the strategic appetite for unmitigated risk. Profits may be huge one year, but collapse subsequently if external exposures turn bad. Shareholders may like the former but not the latter.

Insure. Companies can pay for insurance, be it specific political risk insurance or a guarantee from either an export credit agency or a supplier. Obviously, these carry a significant cost, particularly for higher-risk territories, so the decision is a commercial trade-off. Less risk, but less return.

Mitigate. Companies can explore ways to minimise risk. There are various means to do this, depending on the product, the wider market, the term, and the quantum.

For a bank, the choice of product and its term is key. Market risk is the shortest-term product, applicable to, say, exchange rate or interest rate trading, though more complex products have longer tenors and can stray into risky territory. Bonds are also perceived as being a less risky form of cross-border investment.

Trade credit is the next-shortest-term product and is at the least risky end of the scale. Some deals can be 3-5 years in tenor, though most tend to be 364 days or less. Typically, the fact that the credit is secured on the goods being traded limits the risk. Failure to pay for a consignment means the next one is unlikely to be forthcoming. Risk-averse lenders may only deal in strategically important trade, such as food or key industrial inputs essential to an economy’s performance, on the basis that these are most likely to be fully repaid.

Project finance may be seen as more risky due to its longer tenor, but the ability to structure the terms of the loan and potentially to secure it against a revenue stream massively reduces the risk. This is the riskiest product on tenor grounds, along with any other lending over five years. For instance, lending to develop a copper mine could be structured to link repayments to the future income stream. But what if the commodity price plummets? Or production fails for some technical reason? Or technology changes? Or the mine floods? Or is expropriated? Or its operating licence term changes?

Beyond the choice of product, options such as government guarantee or insurance exist to mitigate the risk of default – or structuring a line to secure repayment against future income streams. But these are costly and detract from the profitability of the deal. In addition, there is a risk that a proportion – sizeable or otherwise – of the deal might not be repaid, again impacting the lender’s profit – and balance sheet.

A broader financial perspective is necessary. For example, when a lender operates in a specific country, key issues to be considered within its agreed risk appetite would be both ability (economic) and willingness (political) to repay a loan – or bond, or trade credit line, or project investment.

In essence, companies need to reevaluate and refine their approaches and enhance their business intelligence in order to improve the chances of operational success.

Hurdling a higher bar

A major conundrum is that data input to traditional models is, by definition, backward-looking, but risk rating has to be forward-looking. Thus, an important question arises: how can this dichotomy be reconciled, given that the future is not necessarily like the past?

There are multiple factors that need to be carefully weighed up by corporations. Here are just a few examples:

Pandemic. There are lessons that can be learned from history. Coronavirus was a new development, but the 2003 SARS outbreak carried similarities that can be extrapolated, especially as the origin was similar geographically.

Cybersecurity. A new threat such as cybersecurity has limited past comparators. Arguably, IPR theft has some parallels, but that tends to be company-specific and sector-specific, which contains its impact. By contrast, cyber-threats are potentially economy-wide, the attack on Colonial Pipeline being a case in point. In these circumstances, the quality of corporate governance is crucial. Is the firm regulated? If it is, is the regulator credible and effective? If the answers are yes, it can be assumed that the regulated entities have a robust business model. Very few businesses could fully insulate themselves from a sophisticated cyberattack. Most companies would rely on the public infrastructure protections, in the case of the UK stemming from Government Communications Headquarters (GCHQ).

Climate change. Environmental shifts are another evolving risk factor. Ten years ago, only obviously vulnerable countries such as Bangladesh or the Maldives (flooding risk from rising sea levels) would have been identified. Now, climate change is a global threat impacting even developed economies such as Australia (fires) or parts of the UK (floods and fires). As a contrast, the cases of Australia and Brazil, which also suffered from forest fires, show that political risk and infrastructure matter. Australia’s fires were too extensive even for its relatively advanced prevention systems, although political choices by the current administration did limit the preventive actions that could have limited the spread of the flames. Brazil, by contrast, made a deliberate political decision to cultivate the rainforest with scant regard for the climatic consequences of destroying valuable rainforest that absorbed damaging carbons. Traditional political risk drivers should have differentiated between the two in this example.

Supply chain. One crucial development that does complicate geopolitical risk assessment is supply chains. Truly global supply chains developed after the Cold War and have evolved into worldwide interconnected supply-and-demand networks with profound interdependencies, comprising vastly complex operations and with greater exposure to the vulnerabilities of every country and manufacturer in the process.

Multipolarity. The transition to a multipolar world has heightened competition and mistrust between political leaders. The increasing use of economic weapons such as tariffs and sanctions for geopolitical leverage impacts the viability of business operations in countries around the world. The withdrawal of many Western companies from Russia and the relocation of financial institutions from Hong Kong to Singapore are two such examples.

Given the diversity and depth of these issues, a heightened level of intelligence, focus, and operational engagement is necessary.

Winning the geopolitical game

In today’s environment, three strategic imperatives provide the foundation for corporate geopolitical success.

Paradigm shift. There is a need to embrace lateral thinking in order to find proxy measures. Companies should know the history of a country and the world. The traditional inputs remain relevant to current geopolitical risk assessment, but they are no longer sufficient. Increasingly more survey evidence is developing, and that typically offers a more forward-looking perspective. Speed of data release and quality of economic data are also improving, making ratings more timely and realistic – as long as the potential for logic override exists. For instance, some countries routinely exaggerate or understate key data, China being an example of the former. It routinely releases its GDP data immediately at the end of an assessment period, and sometimes even before. The UK typically takes some weeks, with many revisions following that can massively change the immediate assessment once the full facts become available. Hence the importance of the data-quality criterion in the model inputs.

Unconventional business models. Flexibility matters in model-building, and greater model power and accuracy do mean that ratings are becoming more reflective of the real risk. Moreover, as the timeliness and spread of news information improve with technology, the degree of accuracy also improves.

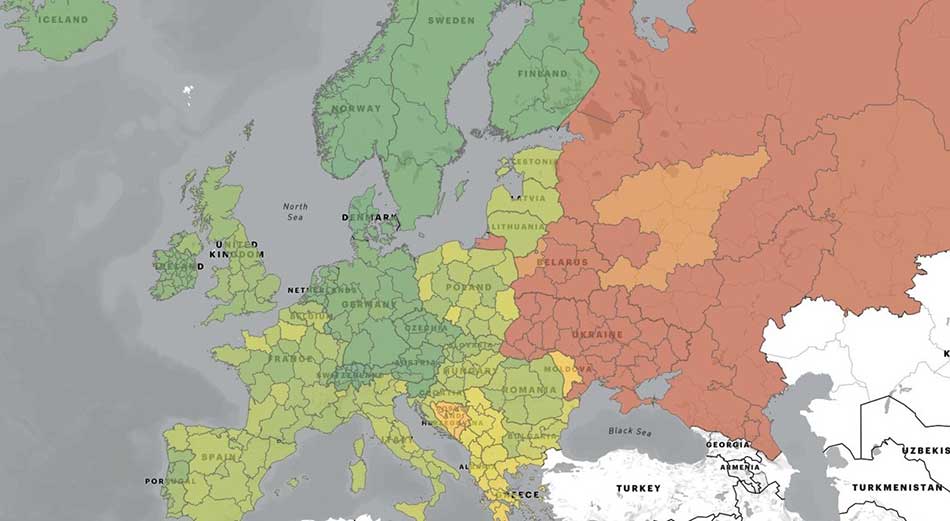

Exceptional intelligence. Geopolitical risk data analytics is a subset of quantitative risk assessment. It is needed because the speed and complexity of geopolitical change is increasing and traditional political risk analysis is unable to keep up. It differs from traditional political risk models, because it uses a new generation of political data sets, which creates a higher spatial and temporal resolution of geopolitical risk data. The enhanced granularity in geopolitical risk assessment offered by data analytics creates new insights and perspectives on geopolitical risk that enable new risk mitigation strategies to be developed.

The world has evolved significantly in recent years, stemming from key geopolitical events. The rules of business have changed and the geopolitical playing field has been transformed. Complexity is at an unprecedented level. As a result, companies need to rethink their operations and elevate their game in order to find new strategic victories.

This article was originally published on 6 November 2022.

About the Authors

Dr Elizabeth Stephens is an investment and country risk advisor and managing director of Geopolitical Risk Advisory, a tech company that uses AI and data analytics to map geopolitical instability. She is a regular conference speaker and visiting lecturer at London and Henley Business Schools.

Dr Elizabeth Stephens is an investment and country risk advisor and managing director of Geopolitical Risk Advisory, a tech company that uses AI and data analytics to map geopolitical instability. She is a regular conference speaker and visiting lecturer at London and Henley Business Schools.

Dr J. Mark Munoz is a Full Professor of Management at Millikin University, a former visiting fellow at Harvard University and editor of the books Handbook on the Geopolitics of Business, Advances in Geoeconomics, and Global Business Intelligence.

Dr J. Mark Munoz is a Full Professor of Management at Millikin University, a former visiting fellow at Harvard University and editor of the books Handbook on the Geopolitics of Business, Advances in Geoeconomics, and Global Business Intelligence.

References

- Edelman (2022). “2022 Edelman Trust Barometer Report”. Accessed 8 Aug 2022. Available at: https://www.edelman.com/trust/2022-trust-barometer/special-report-geopolitical-business

- McKinsey (2022). “Economic conditions outlook, June 2022”. Accessed 8 Aug 2022. Available at: https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/economic-conditions-outlook-2022