By Magne Angelshaug and Tina Saebi

Without argue, digitalisation has changed many aspects of our everyday lives. With these changes come different challenges and one of the most challenged industries is banking – particularly retail banking. Magne Angelshaug and Tina Saebi discuss how retail banking, through open innovation, could possibly cope with the difficulties brought by their “burning platform”.

“Banking is necessary, banks are not” (Bill Gates, 1994)

Something major is happening in the realm of banking. While retail banks have grown accustomed to dealing with competition from other banks, financial deregulations and economic downturns, something is different this time around. With rapid digitalisation, changes in consumer behaviour, and emerging financial technology (Fintech) – players such as Affirm and Square, the battle is being fought on grounds of new and disruptive business models. Nowhere is this more visible than in the area of retail banking.1 The prediction from Bill Gates is arguably starting to ring true. Most retail banks are not equipped to respond to these new threats and many will struggle to survive the next decade. One major hurdle lies in the lack of innovative capability necessary to uproot and reinvent old business models. Building this kind of capability requires a focused and long-term commitment in what is a new area for many banks. But, even if the commitment is there, attempting to build such capability solely in-house can be costly and slow, if at all feasible. Hence in this article, we first briefly describe the “burning platform” of retail banking and argue how adopting open innovation practices can help banks invigorate their business models and thereby regain their competitive edge.

Fuel for the Flame

What is “fuelling” the change in retail banking? Figure 1 illustrates the main change drivers along the banking value chain.

Figure 1: Drivers of change impacting the value chain

Changing Customer Demands. The millennial customer, which is the emerging customer base in the retail banking industry, demands simpler and more seamless services. This customer segment is associated with statements such as “understand me”, “make it simple or just fix it for me”. Digitalisation and online activity has impacted virtually all parts of their everyday life and therefore, banking services must also be digital and easily accessible. The widespread use of smart phones is rapidly making mobile banking the digital channel of choice, not just for the millennials, but across age-groups. A study from 2015 showed that one in four consumers in Western Europe uses mobile banking in some form.2 In Norway for example, mobile banking has by far surpassed all other forms of direct bank distribution. But, for full-service banking, all forms of direct distribution are under threat. Customer behaviour is inevitably converging towards cherry-picking the best services for the relevant context. They will choose banking services that are optimised for and available in the situation where the need arises (like when buying a new car or planning a holiday), as opposed to the current situation, where banks still expect customers to seek them out to choose from a standardised set of bundled services.

Currently, banks are not in the position to offer customised services for all contexts where the need for banking services arises. In the era of digital shifts, the context will be controlled by a myriad of local and global (non-bank) players. For example, Facebook and Snapchat offer digital payment services optimised for their own platforms. Arguably, this is just the beginning. Social media, together with other platforms such as Google and Apple, are well positioned to take the next steps as context-based distributors of many more banking services.

Emerging Technologies. New technologies in banking are eroding industry barriers and giving rise to new business models. These opportunities are strongly exploited by new Fintech players worldwide. Incumbent retail banks are, in contrast, slow in their adaptation. For example, with cloud-based “off the shelf” core banking solutions, suppliers such as Mambu lay the ground work for this change. And as distribution is already going digital, new providers can easily reach their target audiences. Other technology trends include robo-advice for low-cost savings and investment services, and big data for advanced customer-data analytics. US based Betterment and Simple are niche players building on these types of technologies. Much more is on the horizon. Some emerging technologies that will soon get to prove their commercial worth in banking include developments in Artificial intelligence (AI) and Machine learning (ML), and the blurring of boundaries between the physical world and software through the Internet of Things (IoT).

The solutions for customer identification will be critical enablers in the future of digital banking, as customers will be able to get a frictionless identification experience

New Regulations In many parts of the world, new regulation will have a profound effect on competition in banking. New regulations are increasing consumer protection and opening up parts of the industry to increased transparency and competition, which raises serious questions about the long-term viability and sustainability of the banks’ current business models. To make matters worse, the incumbents’ organisation and talent are most often focused solely on securing compliance in face of the new regulations, while new opportunities that may follow as a consequence of regulation remain unexplored. Key developments in the European regulative area include the European Payment Services Directive (PSD2) and Markets in Financial Instruments Directive (MIFID2): both having significant impact on competition and business models in the industry. In addition, regulation targeting the area of knowing your customer (KYC) has been an important driver for development in electronic identification (eID). The solutions for customer identification will be critical enablers in the future of digital banking, as customers will be able to get a frictionless identification experience in their transactions and interactions with service providers anytime, anywhere and on any device.

These are just a few change drivers that are perhaps the most visible as of today. Add to these possible future trends, and we gain a picture of a challenging business landscape where incumbents must be able and willing to change on a much more fundamental level in order to stay relevant. But what is it that makes this so difficult for most banks out there? Some of the answers are to be found within their business models.

The Trap of the Traditional Business Model

A business model defines how a company creates, delivers and captures value.3 Most retail banks are based on variations of a universal or full service banking model where they design and distribute their own services. We find that some characteristics of the retail banking model are particularly relevant to understand why some retail banks find it difficult to change.

Value to Customers. The business model of traditional retail banks is geared towards core services supporting customers’ everyday finances. Services offered include transactional accounts, payment cards (debit and credit), personal loans, mortgages, and long- and short-term savings. Demand for the core services has historically been predictable in most markets and banks have, to a large degree, converged to offering industry-standard services. Standardisation has provided banks and customers the security of a well-known and stable set of services. The flip side of the coin is a bias towards serving existing customer needs when faced with new forms of competition. The convergence by the traditional banks on types of services offered means the available differentiators in attracting and retaining customers are severely limited.

Organisational Structure and Governance. Organisational structure and governance in retail banking industry are mainly characterised by a strong functional orientation, which ensures cost effective delivery of services and compliance within functions. Considering the asset- and compliance-intensive nature of the traditional banking model, combined with difficulties in achieving further revenue growth in many saturated markets, such an orientation is a natural development. Structures of this kind are well suited for their purpose, but may also significantly restrict an organisation’s ability to identify and react to external change. The potential downside is further amplified by resources and talent-development being prioritised along the same functional lines, with the consequence that innovative minds will migrate to opportunities elsewhere. A prerequisite for today’s setup then is a market situation of general predictability in demand and competition: something we have already shown to no longer be the case.

Lack of Flexibility. The retail banking model has been slow to change, particularly when it comes to drivers outside the realm of regulation and fundamental shifts in economy. By and large, retail banks have adopted technological advancements on their own terms and often as an “add-on” to their existing business models. Neither these advancements nor historical changes among customer demands have given any significant rise to heterogeneity in competition. It is challenging for an incumbent to take the step of building new business models, not to mention the difficulties associated with phasing out the existing model. The difficulties spring from many sources, but internal aspects such as cognitive bias towards the existing model and organisational challenges associated with structure and control are significant.4 Will the traditional models be flexible enough to handle new and more powerful drivers of change? History makes it difficult to give them the benefit of doubt.

How should a traditional bank go about finding the way forward and breaking free from the existing biases? In the next section we focus on open innovation as the critical element in building the capability for reinventing the business model.

The Step Towards Open Innovation

So how can banks beat the new competition from Fintechs and other non-bank players? We suggest the old adage of “if you can’t beat them, join them”. With rising R&D costs, talent migration and shortening of product life cycles, banks can no longer rely on the traditional model of “closed innovation” where innovation and R&D processes are protected tightly in-house. On the contrary, there will be an increasing dependency on accessing external sources of knowledge and collaborating with external partners to innovate effectively.5 In fact, most retail banks are already receiving assistance from outside their organisational boundaries. However, these practices do not often go beyond mere outsourcing and in-sourcing of activities. Thus, we propose more fundamental “open” approaches to collaboration in the innovation process.

Types of Open Innovation Practices. Open innovation includes various practices such as engaging in crowd sourcing, innovation contests, joint ventures and R&D alliances. The common denominator is that practices facilitate both purposive inflows and outflows of knowledge. Thus, open innovation practices can encompass both inbound and outbound dimensions of innovation processes. Outbound open innovation refers to innovation activities to leverage existing capabilities outside the boundaries of the company, whereas inbound open innovation relates to the internal use of external knowledge.

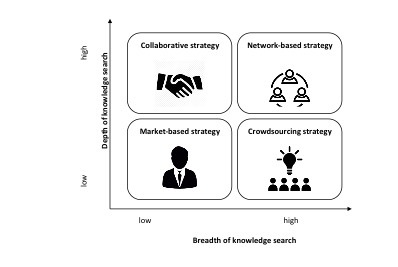

The open innovation design of a company may vary in both “breadth” and “depth” of knowledge search. This is illustrated in figure 2. Breadth signifies the diversity of a company’s external sources, often defined as the number of different types of external parties involved. Depth signifies the level of intensity with which the company deals with external sources, defined by how deeply the firm integrates external parties into the innovation processes.6

Figure 2: Types of Open Innovation Practices7

In a market-based strategy the knowledge input to the innovation process is acquired through the market. The strategy is likely to be pursued by a company in order to reduce development time and time to market. It is characterised by low diversity in and low integration of external sources, such as R&D outsourcing and the acquisition of start-ups. For example, in 2014 BBVA acquired the startup Simple, which is still operating as a separate unit, or Westpack bank of New Zealand collaborating with US based Moven to achieve short time to market with new solutions.

In a crowdsourcing strategy the knowledge input to the innovation process is sourced from a larger number of actors. Crowdsourcing is the act of outsourcing a task to a “crowd” rather than a designated agent as in the case of the market-based strategy. Types of this practice include hackathon contests and engaging with user communities. The international hackathon program of BNP Paribas is an example of crowdsourcing innovative ideas.

In a collaborative strategy a company enters into collaborative agreements with a few selected knowledge-intensive partners, such as startups, corporate partnerships or universities. This kind of deep integration of external actors ensures easy transfer of tacit knowledge across organisational boundaries. An area where one can observe this form of collaborative practice is in the emerging blockchain technology. For example, financial institutions partnering with the innovation firm R3 led to a consortium that designs and delivers distributed ledgers based on emerging technologies.

In a network-based strategy, the company is embedded in an ecosystem of tightly interconnected companies, communities and individuals. A relevant example from banking is Citi Ventures (of the Citi group) that has placed itself as the hub in an innovation ecosystem. Their ecosystem includes startups, corporations, thought leaders, accelerators and universities.

As we see from these examples, even powerful companies such as Citi and BNP Paribas are using broad-spanning open innovation practices. They are tapping into the great innovative potential that can be released when organisations join forces. There should be nothing to stop other banks following suit. When considering the burning platform of retail banking, and the biases that make change difficult for incumbents, we argue that open innovation provides a viable way to innovate incumbents’ business models.

The Way Forward

The ability to effectively stay ahead of competition can only be fully attained through a significant level of knowledge sharing and cooperation involving different organisations and perspectives, for example, between traditional banks and Fintech startups. All four types of open innovation practices have the potential to spur business model innovation. In order for this potential to be realised, a significant degree of flexibility for change should be embedded in the organisation. This work is not done overnight, and must be initiated as the bank’s business model is prepared for the new innovation practice. So how can a retail bank take its first steps towards an open business model? There is no established blueprint process that will guide a bank through this transition, but, recent studies shed light on a number of critical factors.

First, the tricky part is to find the right open innovation strategy that fits the bank’s innovation needs and, second, to design the business model accordingly. To take the first step and choose the “right” open innovation strategy, executives must decide:

1. Whether the bank can readily acquire the technology/knowledge or whether it needs to co-develop it with external partner(s), and

2. Whether the bank can rely on a single source of external knowledge or needs to rely on the “wisdom of the crowds”

Second, the bank has to find the right partners, which can range from customers (see crowdsourcing), to other retail banks but also Fintechs and other non-bank players. Especially the latter category will give incumbents a fresh perspective into the new and emerging business models.

Third, to successfully implement the open innovation initiative, the firm needs to install (1) the search processes to identify external knowledge sources, (2) incentives for external sources to contribute knowledge input, (3) incentives for own employees to interact with external parties, and (4) sufficient absorptive capacity to integrate external knowledge input.

The intensity of the “burning platform” in retail banking will of course be felt differently in different markets. In some areas the journey will take some time, but at some point in the near future all banks will face significant disruption. The old way of doing retail banking will be outdated and new business models will be taking its place. The goal of an open innovation initiative will be to secure a place in the driving seat when it happens.

About the Authors

Magne Angelshaug is a Research Fellow at the Norwegian School of Economics (NHH) and the Center for Service Innovation (CSI). He has a professional background in Consulting and Senior Management in the Norwegian financial industry. His research focuses on business model innovation in digital services through open innovation practices.

Magne Angelshaug is a Research Fellow at the Norwegian School of Economics (NHH) and the Center for Service Innovation (CSI). He has a professional background in Consulting and Senior Management in the Norwegian financial industry. His research focuses on business model innovation in digital services through open innovation practices.

Tina Saebi is Associate Professor in International Strategy at the Norwegian School of Economics (NHH) and Research Director for the theme Business Model Innovation at the Center for Service Innovation (CSI). Her research focuses on business model design for entrepreneurs as well as the drivers, barriers and facilitators of business model innovation in established, international companies.

Tina Saebi is Associate Professor in International Strategy at the Norwegian School of Economics (NHH) and Research Director for the theme Business Model Innovation at the Center for Service Innovation (CSI). Her research focuses on business model design for entrepreneurs as well as the drivers, barriers and facilitators of business model innovation in established, international companies.

References

1. This area encompasses the provision of banking and financial products to individual consumers and to some degree small businesses.

2. L’Hostis, A. & Wannemacher, P. (2015) The State Of Mobile Banking. Forrester. Accessed at https://www.forrester.com/report/The+State+Of+Mobile+Banking+2015/-/E-RES116777

3. Amit, R. C. Zott. (2012). Creating value through business model innovation. Sloan Management Review, 53 (3), 41 – 49; Foss, N.J., Saebi, T.2015. Business Models and Business Model Innovation: Bringing Organization into the Field. In: Foss, N.J & T. Saebi, eds. Business Model Innovation: The Organisational Dimension. Oxford: Oxford University Press.

4. Foss, N.J & T. Saebi (2016) The Bumpy Road to Business Model Innovation. The European Business Review. Accessed at https://www.europeanbusinessreview.com/the-bumpy-road-to-business-model-innovation-overcoming-cognitive-and-organisational-barriers/

5. Chesbrough, H. (2003). Open Innovation: The New Imperative for Creating and Profiting from Technology. Harvard Business School Press.

6. Laursen, K., & Salter, A. J. (2006) Open for innovation: The role of openness in explaining innovative performance among UK manufacturing firms. Strategic Management Journal 27(2), 131–150.

7. Saebi, T., Foss, N.J. (2015). Business models for open innovation: matching heterogenous open innovation strategies with business model dimensions. European Management Journal, 33, 201-213.