By Leo Rocha and Jason Kofman

Picture running a marathon as if it were a sprint. Initially, your speed puts you ahead, but as the race progresses, your energy wanes, and those who maintain a consistent pace steadily overtake you. This scenario mirrors the challenge many companies face with their sales incentive models. By focusing solely on short-term gains, they risk burning out sales opportunities and jeopardizing long-term success. Just as marathon runners need a strategy for endurance, companies must design incentive plans that balance immediate achievements with sustainable growth. This challenge was made painfully obvious by some highly visible corporate failings at the senior executive level.

Collapses at Lehman Brothers and Bear Stearns helped ignite the 2008 financial crisis. Part of what led to these firms’ failures was excessive risk taking by the executive teams. It has been accepted that this risk taking was fuelled in part by the structure of the executives’ compensation plans. Senior leaders at Lehman and Bear pocketed more than $1 billion in equity-based short-term compensation in the years 2000-2007 and still had significant exposure to their firms when they unwound in 20081. The resulting firestorm of publicity around these executives’ earnings helped fuel passage of the Dodd Frank Reform Act of 2008 which mandates disclosure of the relationship between executive compensation and the company’s financial performance. This, in turn, has led most companies to structure executive pay with a significant focus on medium and long-term performance.

But it’s not only senior executives who have had misaligned incentive compensation. In the years 2002 to 2015 Wells Fargo sales staff had incentives to generate short-term results at the expense of longer-term shareholder value. Driven by the incentive structures of the senior management team, sales staff were given high sales goals with lucrative pay packs to achieve those goals, while at the same time the bank lacked the control framework to guard against undesirable sales practices. As a result, sales staff engaged in notorious practices such as opening over 1 million unwanted customer accounts and applying for over 500,000 unrequested credit cards. In 2016 the bank was fined $185 million due to these aggressive sales tactics. The bank ultimately fired over 5,300 staff, lost its CEO (twice), and restructured its board of directors and compensation structure due to the scandal.2

The Wells Fargo case is an extreme example of a sales incentive program designed to maximize short-term results that had the unintended consequence of driving behaviors that destroyed longer-term stakeholder value. It highlights the point that most sales compensation plans focus on current-year performance. This aligns sales rep focus with the short-term goals of the firm. However, is this short sighted? Could this unintentionally lead to the next Wells Fargo?

Most publicly traded firms compensate executive leaders with a mix of incentives, with much ‘at-risk’ compensation tied to long-term objectives. A recent assessment by AJ Gallagher found that long-term incentives accounted for 74% of average CEO compensation in 2022.3 This represents a significant shift in compensation standards since the onset of Dodd Frank, when executives’ at-risk compensation was typically tied to short-term performance. Much has been written about the danger of tying significant executive pay to short-term metrics such as EPS, as it pushes executives to focus on moves to boost short-term performance while putting potential longer-term performance at risk.4

In most businesses sales professionals also have a material amount of their compensation ‘at risk.’ Typically sales reps earn north of 50% of their total pay from commissions, with upside potential to earn many multiples of their base salary. This is quite different from roles with compensation tied to bonus plans, which tend to have a variable component making up 10-25% of total pay and without significant upside for peak performance.5

With a commission plan solely focused on current year results, sales professionals have a material incentive to maximize current-year performance as it can lead to exceptional earning opportunities. This incentive could lead sales staff to make decisions that are not aligned with their firm’s long-term value, a similar moral hazard to that faced by senior executives in past years. As sales professionals have the ability to focus on selling opportunities that can pay off in the current year or longer term, why not apply a similar compensation approach to them?

Best practice incentive compensation design is to tie pay to performance, where staff can observe a direct linkage from a comp plan metric such as booked sales to individual earnings. For a company whose revenues are based on the stability of repeat business and long-term customer relationships, current-year sales form the foundation for future performance. Thus, most firms use current-year sales as the foundation for sales compensation plans. But if sales booked in the current year do not renew in the future shareholder value is compromised. It is not sufficient to focus sales compensation plans on current-year sales only, there should also be some responsibility for the sustainability of those sales to generate future sales. A separate aspect of best practice is to have a variety of metrics tuned to different sales timelines. Some metrics take time to reveal, and these are best linked to longer-term resolution. We found three examples of firms employing this philosophy using a variety of metrics and tools.

Firm 1 – A leading technology firm addresses this concept by adding sales incentives focused on long-term stability and value creation to a standard current-year base plan. This approach maintains the firm’s focus on short-term performance and enables sales professionals to outperform financially if they drive business that is long-term in nature. There are two main downsides to this approach. It can be expensive to implement, as the base plan focused on current year objectives is ‘at budget’ with the long-term-focused sales earning incremental commission. The other downside is that the plan does not penalize or discourage sales reps from engaging in short-termism.

Firm 2 – Another technology firm takes this a step further by dedicating a portion of a sales professional’s quota to multi-year contracts. For example, if a seller is assigned a $1 million new business quota, $300,000 must qualify as multi-year contracts. This gives the seller two quotas to pursue and holds them accountable for generating business that will provide a level of stability to the firm. The approach also re-defines the definition of success, which under a traditional plan would focus solely on maximizing top-line growth. Under this program success focuses on responsible top-line growth. The downside of this approach is that it can be challenging to implement without flexible incentive compensation management systems.

Firm 3 – The two previous examples focused on maximizing commission opportunities for sales professionals – – all carrots. Our final example is from a FMCG firm that focuses on maximizing portfolio value by using a mix of carrots and sticks. This firm’s plan assigns specific growth expectations on different product lines. In the FMCG market product-line stability is a key component of earnings stability. It is important that new products serve to grow the firm’s overall market presence and do not cannibalize existing market share. Therefore, the Key Accounts sales teams have an overall sales goal but with the condition that new products are not allowed to outsell existing ones. If a team successfully places a new product but the core product line does not reach a minimum growth level the sales team is penalized. While this may appear short sighted – – why discourage the adoption of new products? – – the firm recognizes that its long-term success is predicated on stable growth in its core product line.

All three of these examples show different ways that firms attempt to mix long-term strategic growth with current-year objectives. All compensation plans include tradeoffs, some overt and some hidden. While Firm #1 trades commission budget against potential long-term stability, it has the benefit of not ‘rocking the boat’ with a perceived penalty on the sales team. Firm #2 focuses on a desired mix of contractual commitments, trading off the need for stable revenue against the risk of seller attrition. Finally, Firm #3’s focus on long-term stability trades off the risk of potentially blunting new product adoption. These strategies also have different data and systems requirements. Firm #1’s approach is the simplest as the long-term sales incentives are built on top of the core commission plan. Firm #2’s approach requires an ability to track multiple quotas for each sales professional against different contract characteristics. Finally, Firm #3’s approach requires significant historical data to set appropriate product-level thresholds and an incentive system that can track performance at the product group level.6

To address the need for more sustainable and strategic incentive practices, a comprehensive framework designed to guide organizations in assessing and refining their sales compensation models can be a very useful tool. While understanding the benefits of innovating compensation approaches is important, a framework enables the firm to evaluate the applicability of different strategies. The following ‘Incentive Mix Matrix’ example can help ensure that incentive structures not only drive immediate sales achievements but also align with long-term organizational goals, advancing a culture of lasting success and value creation.

Incentive Mix Matrix Example – Subscription Sales7

|

Incentive Compensation Plan Metric Examples |

Linked Sales Motion |

Impact Period (Short, Medium or Long Term) |

Aligned with Firm’s Long-Term Value? |

|

Core Commissions |

Current year contract |

Short |

Only if recurring |

|

Cross Selling Credit |

New product sold to existing customer |

Medium |

Very likely if recurring |

|

Multi-Year Sales Credit |

New multi-year, non cancelable contract |

Long |

Yes |

|

Retention credit |

Current contract renewal |

Medium |

Very likely if recurring |

|

Service credit |

Services component linked to product sale |

Short |

No, not recurring |

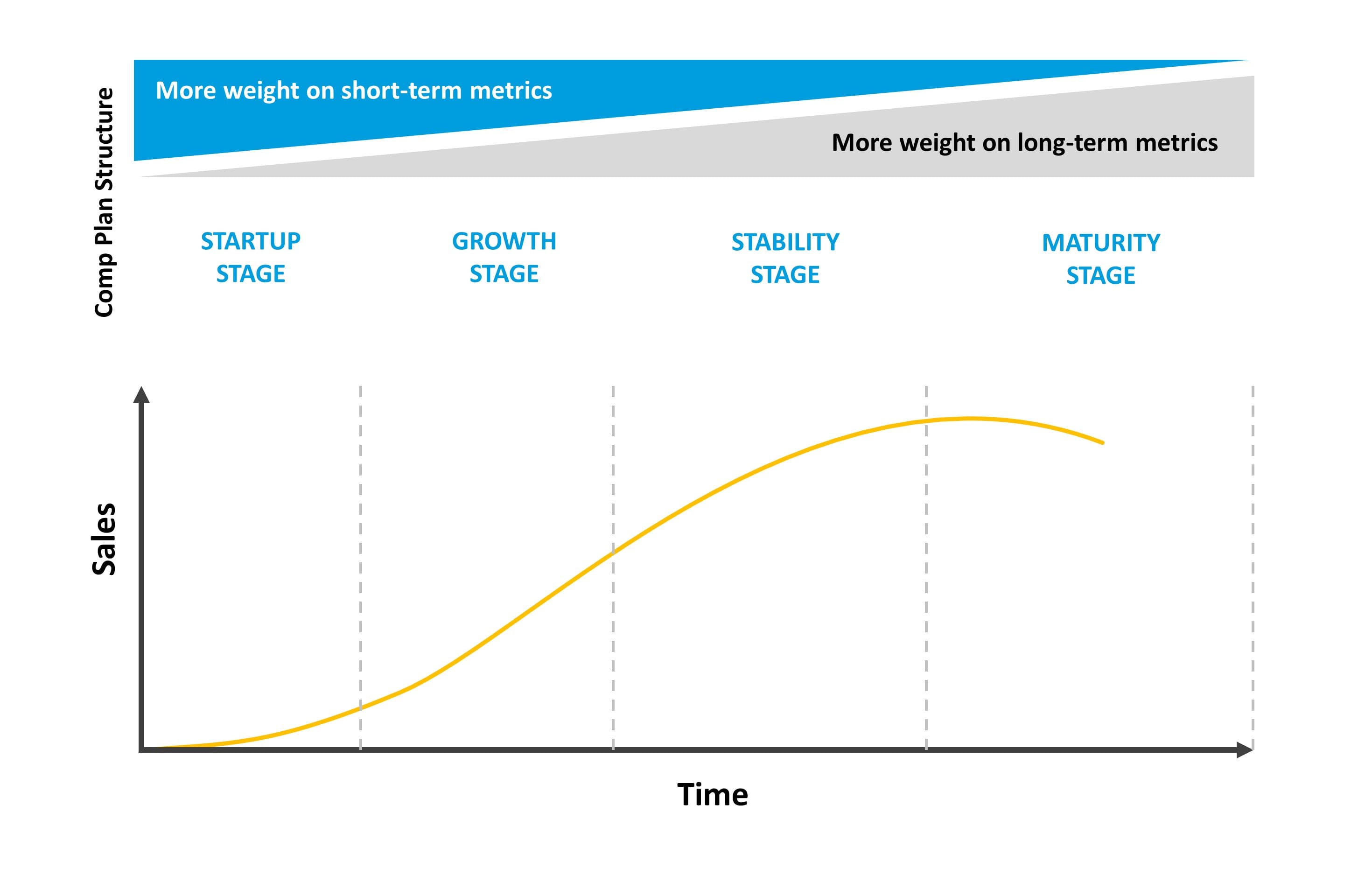

Once the appropriate metrics are determined the next key decision is how to weigh them in the commission plan. We can look to the state of the firm’s evolution for guidance here. Firms in the early stage of development are highly focused on cash flow and establishing market presence, thus their primary need is for current year sales. At the other end of the spectrum, a mature firm in an established market is focused on efficiency and sustained growth. The focus here is on repeatable sales, and given the focus on efficiency, to discourage new sales with a low probability of recurring. Overlaying this metric mix on a standard business lifecycle chart shows how firms should consider their compensation strategy as the firm evolves.

As a next step, firms need to determine how a desired incentive strategy can be put into production and used effectively. Therefore, a second framework is required focused on implementation. The best strategy must be able to survive the environment if it is to flourish and reorient behavior.

Key Implementation Concepts:

- Does the plan and metric mix align with the firm’s priorities based on its market position?

- Does the sales organization have sales roles focused on delivering against these priorities (e.g., does the customer success team allow for focus on retention, does the prospecting team allow for focus on new customer acquisition?)

- Does the firm have the data, tools and analytics to execute the changes?

- Does the firm’s sales culture allow for a realignment from current-year focus to one more nuanced?

- Is the plan compliant with relevant laws and regulations?

- What is the feedback loop to assess reps’ understanding of the plan and if the plan meets its objectives?

To win in the long run, companies must redesign their sales incentive plans to balance immediate performance with sustainable growth. Just as marathon runners need a well-paced strategy, sales teams require incentive structures that encourage enduring success without neglecting short-term achievements. By incorporating a mix of short, medium, and long-term goals into sales compensation plans, firms can cultivate a culture that values both immediate results and long-term stability. This approach not only aligns sales professionals’ incentives with the company’s overarching objectives but also ensures that every stride taken today paves the way for future success. To truly win the marathon of business, sales teams must be equipped with incentives that drive enduring growth and lasting success.

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)