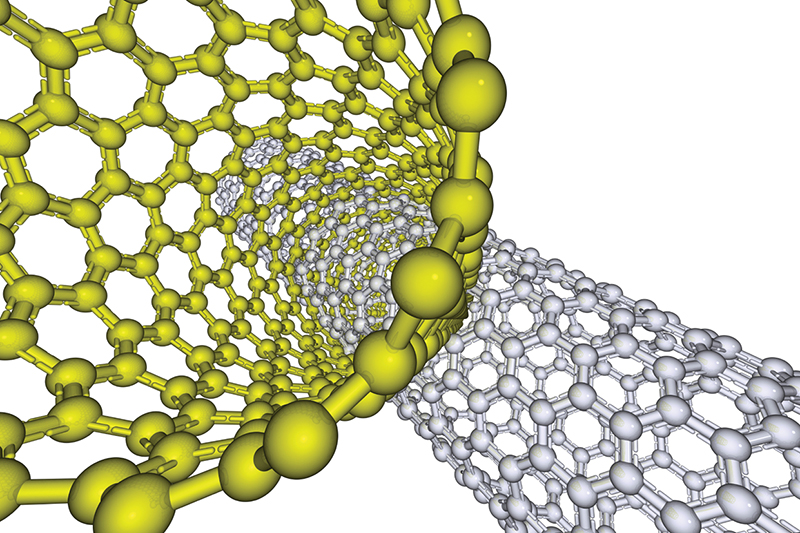

What are We?

Formally launched in Europe and the United States in October 2010, INSCX™ (the Integrated Nano-Science & Commodity Exchange) is a commodity exchange established to physically trade accredited, compliant and validated nanomaterials and nano-enabled products, as well as traditional commodities (grains, metals, minerals and products).

INSCX™ (http://inscx.com) is based in the United Kingdom and has satellite operations in the United States and Asia. The exchange electronic trading platform can be accessed at:

http://www.comdaq.net/comdaqnet.asp?calledsite=INSCX

The exchange is designed for commercial users (trade suppliers and buyers of physical materials and commodities) where actual trade is placed for execution by member brokers (non-commercial users) through a specialist order routing system based on the model of the NYSE in the United States. The exchange is the focal point of the emerging world trade in nanomaterials, a trade that will be crucial to continuing world prosperity in the 21st century. The opening of INSCX™ means that, for the first time, nanomaterials will be traded in the same way as other goods where purchasers are assured of quality and competitive prices while suppliers are provided with surety of demand and the financial tools and trade flexibilities needed to respond.

What is listed for trade?

INSCX™ is not exclusive to just trade in nanomaterials however, as a variety of physical materials and commodities are also listed for trade. This follows in line with the stated objectives of the exchange, being to promote a greater industrial dependence on nanomaterials based on integration with the existing economy. Integration will by definition provide capital allocation models with the ability to change to embed the emerging suite of more functional raw materials. Just as important will be the fostering of greater collaborations between existing commerce and nanobusiness from where demand for NMs is now clearly evident.

Exchange contracts for physical delivery are listed for the following categories of materials:

[ms-protect-content id=”9932″](SHE) Accredited NanoMaterials, (Interim) Accredited NanoMaterials, Advanced Materials, Polymers (Base & Nano-enabled), Industrial Chemicals, Commodities (Nano-enabled), Commodities (Minerals/Metals), Commodities (Agricultural), Commodities (Softs), Energy Products (Bitumen, Base Oil, Carbon Black Feedstock etc).

Nanomaterials, nano-enabled and advanced materials are referred to as Thematic Class Materials (TCMs) while more traditional materials and source materials (grains, metals, oils, gasses etc.) will be classed under the common headings of Hard and Soft Commodities.

Why are We Here?

INSCX™ places nanomaterials on a par with existing established materials and commodities through provision of cost-effective tools to enable organic growth. These materials also have had to overcome familiar obstacles including capital limitations, lack of generally agreed material specifications, volume uncertainties and limited availability of development capital. INSCX™ simply follows the historical support legacy of commodity exchanges established in the 19th century for metals, grains and oils by providing the nanomaterials industry with the tools necessary to increase the tradability of this broad suite of innovative materials.

The origins of such commodity exchanges were commercial not financial. They were first formed by metals foundries and grain farmers seeking more efficient trade processes capable of meeting increased societal demand for metals and foodstuffs. These commercial, as opposed to financial origins, remain with us today and underline the distinct difference between a commodity exchange and a financial market exchange.

Trade Efficiency

The basic purpose of a commodity exchange is to enable greater trade efficiency and to remove uncertainty from the process of supply and purchase of physical materials. INSCX lists for trade more “traditional” materials (Chemicals, Polymers, Minerals etc) not only as a means to create synergies between these markets and emerging NMs, essential to entice greater reliance on NMs at any rate, but also to overcome inefficiencies evident in many of these traditional sectors.

Concerns

Concerns are being expressed by many participants themselves across several of the more “traditional” non-exchange listed markets. These concerns focus on issues regarding price transparency, assurance of quality, lack of forward allocation capability as an offsetting tool to overcome excessive price volatility and bureaucracy undermining certainty of payment versus delivery. Efficiency and trade certainty has broken down across many material sectors (Chemicals, Polymers, Minerals etc) driven by a sea-change in demand for base inputs from emerging nations.

Price differentials across the supplier base in many of the more traditional non-exchange trades have become unmanageable. Suppliers often find themselves receiving less than fair value as a plethora of non-accountable agents overload end sale prices to commercial buyers while buyers themselves are finding difficulty achieving fair price and the ability to forecast future price trends. Often even when a trade is agreed the cumbersome process of securing payment using the LOI and L/C process causes a trade to cancel compounding frustrations for both supplier and buyer particularly when a track record has not been established.

While some effort has been made to overcome this through developing on-line micro-exchanges and “Open Source” trade portals, these have been shown not to work as they act to breach confidences essential to the trade process and lack an imposed discipline to ensure trade performance and price transparency.

Confidentiality

Any supplier in competition with rival suppliers simply will not use a trade mechanism which exposes their activities to the scrutiny of rivals. Buyers very often cannot afford to rely on a single supplier to achieve best price or be assured a web forum provides an accurate reflection, as many prices are not “live”.

Market Discipline

In addition a lack of assurance on inspection and market discipline merely compounds the inefficiency of the micro or “Open-Source” trade portal. Who polices the market to ensure fair play for customers on an “Open-Source” web portal? Can any of these systems guarantee the price is the best available price for a supplier or a buyer or ensure efficiency in transport, storage or inspection?

Contrast

In contrast the formal commodity exchange process has gone from strength to strength, the MCX exchange in India proving the point. These formal commodity exchanges transact trillions in trade across exchange listed materials daily providing instant price discovery and guarantees essential in the trade process. The commodity exchange is driven by approved suppliers using brokers who are professionally qualified to get business done in the best interests of the customer.

INSCX differs from these larger exchanges in only one respect.

INSCX is not an investment or financial commodity exchange and is not saddled with the raft of legislation designed to appease the interests of capital committed to investment commodities such as steel, copper, crude oil and so forth.

Rather INSCX matches these investment exchanges in terms of trade integrity standards of course, but unlike the financial commodity exchange INSCX can move quickly to list an infinite number of material specifications where trade can be structured to the highest of commercial standards and more importantly for suppliers and users, commence quickly.

The fact that is lost on many participants in non-exchange traded materials is that the commodity exchange system simply works. In contrast many non-exchange traded materials sectors have witnessed a near breakdown in market cohesion and fluidity reducing pricing and forecasting ability to a minimum.

The effective commercial usefulness of any raw material is determined by ensuring these cohesions.

Nanomaterials (NMs)

Supporting suppliers and promoting growth

INSCX™ provides supplier access to trade finance, Advance Project Finance (a system where the exchange guarantees a capital investor the supply of an inspected nanomaterial for future delivery, financing a supplier/s from start to finish). The exchange will help industrial-scale uptake of nanomaterials, whilst enabling suppliers and users to obtain nanomaterial SHE standard via accreditation to initial and ongoing inspection audits devised by AssuredNano®. The overall objective is to enable both commerce and society to benefit from nanomaterials, supplying and purchasing to agreed standards in trade, whilst ensuring observance of quality standards, agreed material specifications and regulatory transparency.

Buyer assurances

Purchasers of nanomaterials will benefit from agreed material specifications, price transparency and guaranteed supply. They will also be insured against unforeseen commercial and/or political difficulty causing disruption to supply.

A buyer seeking to use the exchange to purchase a material places a bid (the price at which they wish to purchase) on a given material for placing on the exchange via the Trade Order Routing System (TORS). TORS is operated by the exchange specialist dealers, NCM/Stekram and enables a supplier or buyer to list a sale or purchase price anonymously. What this means is that only the sale or buy price and quantity is shown to the market, not the identity of the actual trade supplier or trade buyer.

The specialist will act in the best interest of a buyer or seller securing the best available price within limit levels agreed with the customer.

When a purchase occurs the trade is reported by the exchange specialist listing price, material and quantity only. The purpose is to help market participants see a true reflection of supply/demand balance or in other words enable price discovery, essential to any business planning.

On trading a buyer has 48 hours within which to commit funds to cover the purchase. These are held under escrow against the ETDR (Exchange Traded Depositary Receipt) meaning they can only ever be

used to cover the purchase of the particular trade.

On proof of funds the supplier/s are instructed to deliver the quantity they have agreed to supply by a given date and also forward a material sample of the consignment/s to be supplied to the inspection agent appointed by the exchange.

These sample/s are characterised to prove exact quality in line with the purchase specification. On passing inspection (which also involves a quantity count) the goods are shipped and at this stage the exchange makes good the purchase cost to the supplier/s concerned.

The buyer in the first instance will have committed funds held under escrow in the exchange clearing system to cover the purchase. In the event a supplied material does not pass independent inspection these funds are returned to the buyer plus interest and the trade declared decayed.

Inspection failure

The inspection of materials often leads to a situation where supplied materials fail inspection even in the case of established commodities.

A supplier failing inspection is not penalized by the failure becoming public knowledge thus affecting the reputation and standing of their business. Rather this “failing” is disclosed only as a decay or trade failure to the buyer with the identity of the supplier concerned withheld. However, this disclosure of “decay” only occurs assuming the exchange and inspection agent are unable to help the supplier correct the deficiency.

Inspection is about guaranteeing the quality of materials supplied, and not a process established to punish suppliers when quality of supply materials can be affected by any number of unforeseen factors. Inspection is the assurance that whatever is supplied is of a proven quality.

Quality assurance is the most basic of requirements for any buyer of a material, good or product. Why should nanomaterials be treated any different?

The most important strategic relationship any emerging nanomaterials supplier should cultivate is with INSCX exchange and their nominated broker who is the nanomaterials supplier’s sales force and materials planning advisor.

Inspection Standards

Inspection standards and methods are established by the competent inspection agent in collaboration with the exchange and the processing capability of approved suppliers to the listed specification. The exchange employs the best available techniques to proven independent inspection sources; i.e. professional inspection agents who hold no material interest in expressing favour over one supply source or the other or are engaged directly or indirectly in seeking to compete as material suppliers.

While in more traditional materials inspection standards are long established, the characterisation of NMs remains a new task.

INSCX itself commits resources to fund continuing R&D into the field supporting the ability to have at hand the best and most recent available technique.

Why Get Involved?

There are many reasons why nanomaterials suppliers and purchasers should get involved with INSCX™. These include:

1. Trading Standards – INSCX™ offers the ability to provide potential buyers of nanomaterials with the very same standards they demand of existing materials, namely price transparency, quality/supply assurance, commercial insurance and trade flexibility, including the ability to procure materials on a cash forward basis.

2. Health & Safety Standards – INSCX™ exchange offers nanomaterials suppliers and downstream users of nanomaterials the ability to use the exchange process to become Nanomaterials (SHE) accredited without undue finance. Through agreements with the scheme’s global provider, AssuredNano® www.assurednano.eu participation with INSCX™, any supplier or downstream user of nanomaterials may graduate toward full SHE accreditation without having to commit initial capital.

3. Regulation: INSCX™ exchange is a process to deliver self-regulation within nanomaterials providing regulatory bodies with a working template on which to base potential legislation. Participation means in effect the creation of an industry voice to communicate with official bodies.

4. Market Development: INSCX™ will provide a true assessment of the economic value of nanomaterials, enabling the global investment community to value nanomaterials as a collective industry based on factual evidence of trade flows.

How to Get Involved

INSCX™ is open to any supplier and/or downstream user of nanomaterials, source/advanced materials, nano-enabled and more traditional commodities domiciled anywhere across the globe. The procedure to get involved is simple.

First register with INSCX™ exchange. Registration provides access to other exchange services and of course retail access to view the live electronic trade platform for placing formal trade instructions. Registration can be completed online using the link or in nominee through a member firm broker or broker-dealer.

The online link is below:

http://www.comdaq.net/comdaqnet.asp?calledsite=INSCX

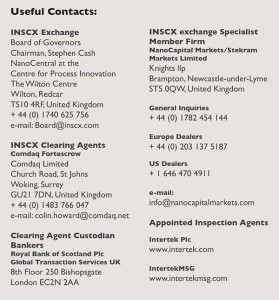

Contact:

T: + 44 1782 454 144

E: info@inscx.com

Exchange representatives can be reached at the above contact points and are on-hand to guide you through the process exchange.

Second open a Commercial Trade Account with an approved member firm of the exchange. Your nominated broker is there to advise you about how to use the exchange to procure and/or supply materials. Annual registration costs to supply and/or source materials from the exchange are fixed at UK GBP £550 per annum renewed annually for £250 thereafter.

Costs

There are no hidden costs associated with using INSCX exchange as these are stated up front and kept in line with industry standards. For any trade executed using the exchange a broker conducting the trade is permitted to charge a commission at levels fixed by the rules and regulations of INSCX exchange.

Trade costs (clearing, contract lot turn, broker commissions, insurance, inspection and accreditation) on INSCX are competitive with those levied by the world’s major commodity markets and made known to users in advance of agreeing to any trade.

For more information, please visit:

http://inscx.com

http://nanocapitalmarkets.com

Issued by:

INSCX exchange

Integrated Nano-Science & Commodity Exchange Limited, United Kingdom

[/ms-protect-content]