Looking to secure a small business loan? Fortunately, for early-stage UK businesses, government-backed schemes often provide the most accessible starting point, especially when trading history remains limited.

In this guide, we’ll walk you through the essential steps to successfully apply for a loan, from defining your needs to choosing the right lender and submitting your application.

TL;DR

This guide outlines the 5 key steps to securing a small business loan: define your loan needs, prepare your business and personal profiles, choose the right loan type, compare lenders, and submit your application.

Focus on having a clear purpose for the loan, organizing necessary documents, and choosing the best terms.

Very new UK businesses often begin with Start Up Loans, while approval speed depends heavily on document quality and eligibility rather than lender size.

What is a Business Loan?

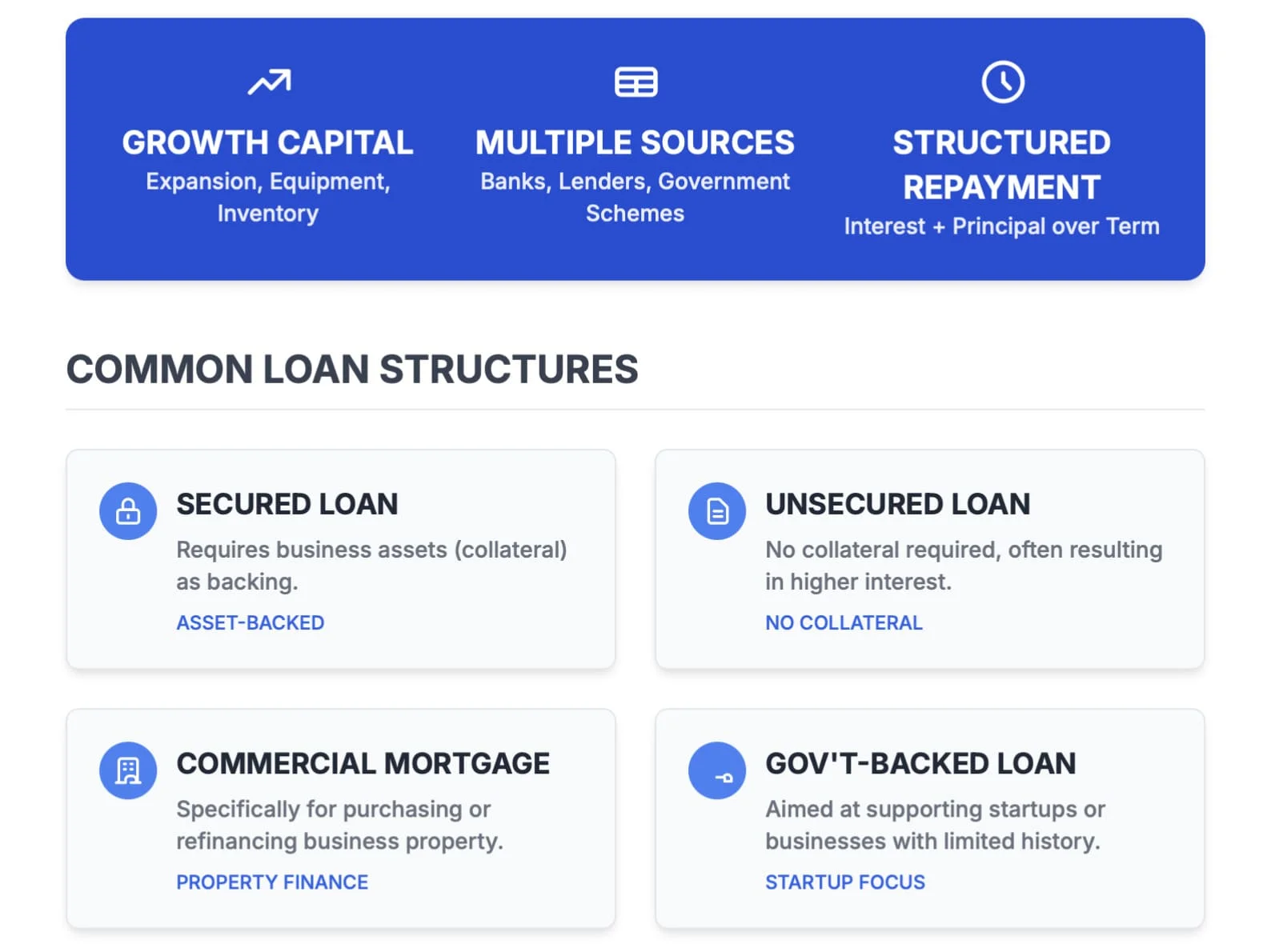

A business loan is a financial product provided to business owners to support various needs, such as expanding operations, purchasing equipment, or managing cash flow. These loans can be obtained from banks, alternative lenders, or government schemes and are typically repaid with interest over a set term.

Many UK small business loans now operate under public support frameworks overseen through the British Business Bank, which widens access for startups and smaller firms

Common types of business loans are:

- Secured loans: Backed by business assets like property or equipment.

- Unsecured loans: Do not require collateral, usually with higher interest rates.

- Commercial mortgages: Loans specifically for purchasing or refinancing business property.

- Government-backed loans: Aimed at supporting startups or businesses with limited financial history. These commonly range from £500 to £25,000 for startups, carry fixed interest, and run over 1 to 5 years

For businesses seeking flexible loan options, KIS Finance offers a range of solutions, including unsecured loans and commercial mortgages, to help secure the necessary funding for growth and development.

How to Get a Small Business Loan?

The process of getting a small business loan involves several key steps that can greatly impact your chances of approval. Follow these 5 simple steps to ensure a smooth and successful loan application:

Step 1: Define Your Need

Before applying for a business loan, clearly define how much you need and what the funds will be used for.

Lenders want to see a specific purpose for the loan and how it will contribute to your business growth or cost savings. A well-defined need increases the likelihood of approval. Keep in mind that lenders also factor urgency into pricing, with faster access funding usually carrying higher overall cost.

Common purposes for business loans are:

- Purchasing new equipment or inventory

- Expanding operations or premises

- Hiring additional staff

- Funding marketing campaigns

- Managing cash flow or working capital

Tip: Be specific about the amount and how it aligns with your business goals to present a solid case to potential lenders.

Step 2: Get Your Business and Personal Profile “Loan Ready”

Lenders evaluate both your business and personal financial health. A strong application requires you to gather key documents and ensure your business’s financial records are up-to-date.

Essential documents are:

- Business plan: A clear plan outlining goals and strategies.

- Cash-flow forecast: Estimates of income and expenses.

- Bank statements: Recent statements showing financial activity.

- Profit and loss statement: A summary of your business’s revenue and expenses.

- Personal identification: Proof of identity and address for the business owner.

Keep in mind that lenders also check your credit score and business credit score to assess risk. Preparing these documents in advance will streamline the application process and increase your chances of success.

Many UK schemes also expect a personal survival budget showing how living costs remain covered during early trading

Step 3: Choose the Right Type of Loan

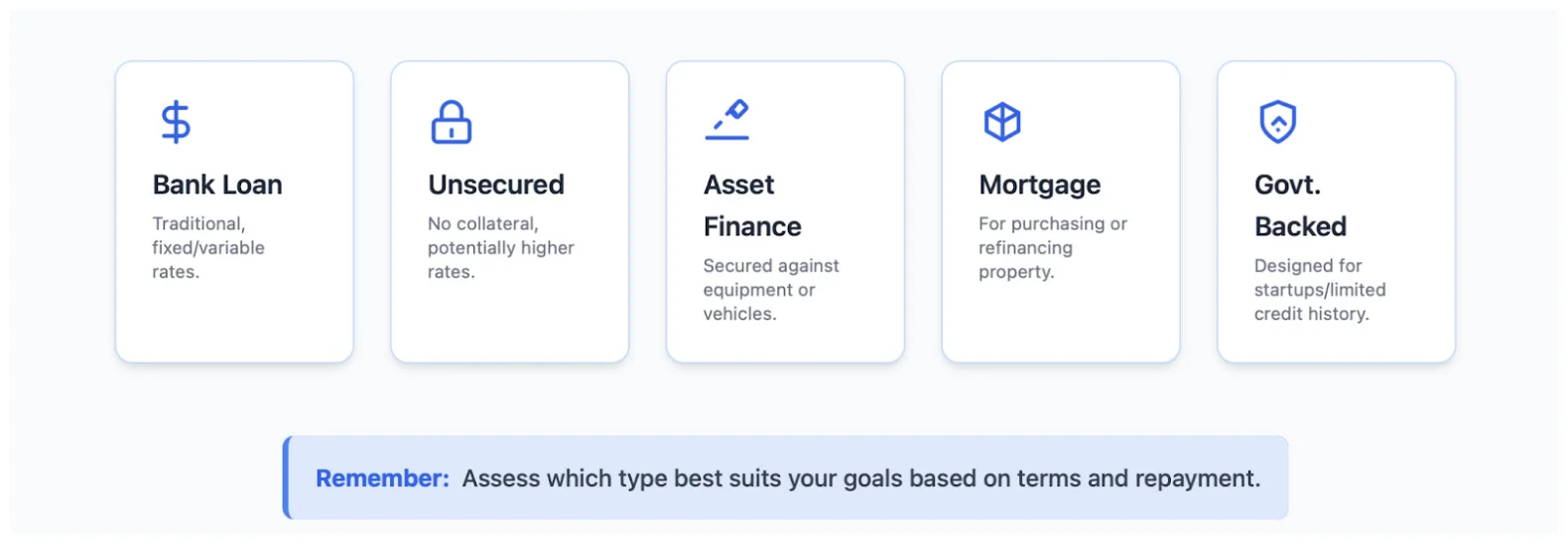

Selecting the right loan depends on your business’s needs and financial situation. There are several types of loans to consider:

- Bank loans: Traditional loans with fixed or variable interest rates.

- Unsecured business loans: Do not require collateral but may have higher interest rates.

- Asset finance: A loan secured against business assets such as equipment or vehicles.

- Commercial mortgages: Used to purchase or refinance property for your business.

- Government-backed loans: Specifically designed for startups or businesses with a limited credit history.

Businesses trading under 2 years usually face narrower product choice than established firms, which affects pricing and approval thresholds

Remember: Each loan type has its terms, interest rates, and repayment schedules, so it’s important to assess which one best suits your goals.

Step 4: Shop Around and Check Eligibility

Before applying, it’s important to compare lenders to find the best loan for your business. Different lenders offer varying terms, interest rates, and fees. Use eligibility check tools (soft searches) to get an idea of your chances without impacting your credit score.

Most UK lenders apply baseline eligibility checks covering age, right to work status, business use of funds, and affordability. Government-supported options often require evidence that suitable private finance was unavailable.

When comparing loans, consider:

- Loan amount and term: Ensure the loan size and repayment period meet your business needs.

- Interest rates: Look at the annual percentage rate (APR) and fixed vs. variable interest options.

- Fees: Be aware of application, arrangement, and early repayment fees.

- Repayment terms: Check the flexibility of repayments, including any early repayment fees or opportunities.

Important to note: Make sure the lender is authorized by the Financial Services Register and meets your lender’s eligibility criteria to avoid scams and ensure a legitimate borrowing process.

Step 5: Apply and Respond Quickly

Once you’ve chosen a lender, complete the application accurately. The application process typically involves submitting your business plan, financial documents, and personal information. Lenders may also conduct a credit check to assess your creditworthiness.

Applications under government-backed schemes commonly complete within 2 to 6 weeks depending on preparation level and response speed.

Key steps in your application:

- Ensure consistency: Double-check that figures in your application match your supporting documents.

- Submit your application: Apply online, in person, or by post, depending on the lender.

- Be responsive: Respond promptly to any follow-up questions from the lender, including requests for additional documentation.

For government schemes like Start Up Loans, lenders will assess your business plan and cash-flow forecast before approval. If successful, you may be assigned a mentor or advisor to help guide your business growth.

Common Mistakes to Avoid When Applying for a Business Loan

Applying for a business loan can be straightforward, but several mistakes can delay or even derail your chances of approval. Avoiding these pitfalls will help you present a stronger application.

Common mistakes are:

- Lack of a clear business plan: Without a solid plan, lenders may question how you will use the loan to grow your business.

- Underestimating loan costs: Not accounting for interest rates, fees, and repayment terms can lead to financial strain later.

- Overestimating repayment ability: Make sure you have a realistic view of your cash flow and can afford the monthly repayments.

- Not shopping around: Failing to compare loan options and lenders may result in higher rates or unfavorable terms.

Incomplete cash-flow forecasts or unrealistic personal affordability assumptions frequently trigger rejections under current lending criteria.

Tip: Before applying, create a detailed financial projection, including expected loan usage and repayment schedule. This will not only help you avoid overestimating your repayment ability but also demonstrate to lenders that you have a clear, realistic plan for managing the loan.

Summary

Securing a small business loan requires preparation and research. Follow the steps outlined to increase your chances of success.

Start by defining your needs clearly, then ensure your financial documents are organized and up-to-date. Choose the right type of loan based on your business goals and compare lenders to find the best terms. Finally, submit your application accurately and respond quickly to any follow-up questions.

Key takeaways for applying:

- Define your loan amount and purpose.

- Get your business and personal profiles ready.

- Choose the right loan type for your needs.

- Compare lenders and check eligibility.

- Apply quickly and stay responsive.

FAQs

1. What are the requirements to get a small business loan?

To secure a small business loan, you must meet lender criteria, which typically include a strong credit score, a solid business plan, proof of cash flow, and relevant financial documents like tax returns and balance sheets. Lenders may also assess your business history, existing debt, and industry stability.

2. How do I know which type of loan is right for my business?

Choose a loan type based on your business needs. For example, use unsecured loans for flexibility without collateral, asset financing for purchasing equipment, or a commercial mortgage for property-related needs. Government-backed options may be best for startups with limited credit history.

3. How long does it take to get approved for a small business loan?

The approval process varies depending on the lender. Traditional bank loans may take several weeks, while alternative lenders or online platforms can provide approval in as little as 24-48 hours. The speed depends on the complexity of your application and the lender’s procedures. Government-backed loans usually sit toward the longer end of that range due to assessment stages.

4. What are the costs involved in getting a small business loan?

The cost of a business loan includes the interest rate, fees, and potential early repayment charges. Some loans also have arrangement fees or monthly servicing costs. Always check the annual percentage rate (APR) for a complete view of the loan’s total cost.

5. How can I improve my chances of getting a business loan?

Improve your chances by maintaining a strong business credit score, presenting a detailed business plan, and showing solid financial management. Prepare all necessary documents, such as cash flow forecasts and tax returns, and ensure your loan purpose aligns with lender expectations.

6. What’s the difference between secured and unsecured business loans?

Secured loans require collateral, such as property or equipment, reducing the lender’s risk. They typically offer lower interest rates. Unsecured loans don’t require collateral but come with higher interest rates, as lenders take on more risk.

7. Can I get a business loan with bad credit?

It’s more challenging to get a loan with poor credit, but some options exist. Alternative lenders or government-backed loans may be more flexible. However, you may face higher interest rates and stricter terms. Public schemes may remain accessible, although terms often tighten and loan sizes reduce.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.