The lot size measures a quantity or increment of a specific asset or product suitable for buying and selling in the financial sector. Different types of items are frequently offered in a variety of lot sizes. Spot FX has traditionally been traded in lots of 100, 1,000, 10,000, or 100,000 units.

In contrast, non-standard lot sizes have just become available to forex traders. Today, we will guide you about different sizes of the lot and much more. Keep reading this article till the end.

What Is a Lot Size in Trading?

Lot size in the stock market refers to the number of shares purchased in a single transaction. The lot size is the overall number of contracts in a single derivative security.

There are different lot sizes available in the stock market. Standard lots, mini lots, and micro-lots are common lot sizes available. It is important to understand that the lot size directly impacts and indicates the risk you are taking.

Trading with Micro Lot

In a forex trade, a micro lot represents 1,000 units of the base currency. Moreover, this base currency is the first currency that one purchased or sold. Trading in micro-lots allows retail traders to trade in small increments.

A micro lot is the smallest unit of currency that a forex trader can trade. It is utilized by novice traders who want to start trading but want to limit their risk. While nano lots are relatively uncommon, some forex brokers offer them 100 units of the base currency.

When investors wish to stay away from trading mini or standard lots, they use micro-lots. Ten micro-lots are equal to one mini lot (10,000 units), and ten mini lots are equal to one standard lot.

Trading with Mini Lot

A mini lot is a forex market lot size that is one-tenth of a standard lot of 100,000 units. When trading a mini lot, one pip of a currency pair predicated in US dollars equals $1.00, whereas a standard lot equals $10.00. Mini lots are the most common lot sizes in mini forex accounts.

When you’re beginning out, it’s risky to use the smallest lot sizes possible to reduce the capital at risk. The issue is that when significant amounts of capital are at risk, traders tend to act differently.

When first starting, it’s best to gradually increase the amount of capital at risk instead of jumping from a nano lot size to a standard lot size. Similarly, after creating a successful strategic plan, algorithmic traders should ensure no changes in slippage or other expenses as they scale up their lot sizes.

Trading with Standard Lot

A standard lot is the same as 100,000 units of the base currency in forex trading. It is among the most common lot sizes. A standard lot offers 100,000 unique units. If you’re trading in USD, that’s a $100,000 trade. Similarly, this position size implies that the trader’s account value will fluctuate by $10 for every pip move.

For someone with $3,000 in their account, a 20-pip move can result in a 10% change in the final balance. Therefore, most retail traders with small accounts do not prefer to work with standard lots. The majority of forex traders trade mini lots or micro-lots.

How To Calculate Maximum Lot Size for Trading?

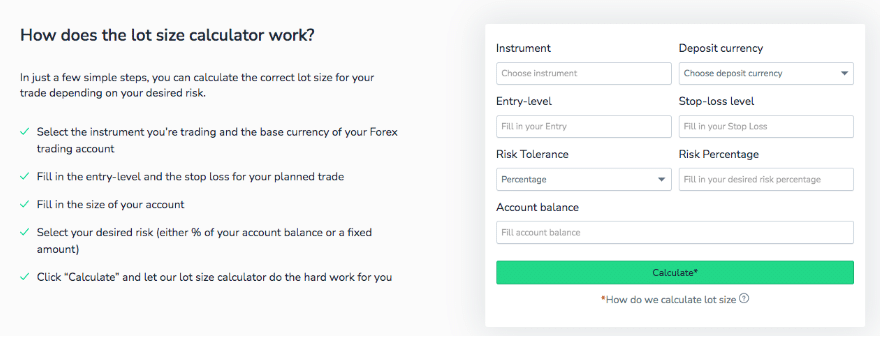

This forex lot size calculator by Switch Markets considers the pip amount (stop-loss), the percentage at risk, and the margin to find the maximum lot size. It can assist you in precisely calculating how it will impact your forex trading account equity following a series of losing transactions and, eventually, recouping from previously losing transactions. If the pair is in USD, the equation looks like this:

Lot Size = ((Margin * Percentage) ÷ Pip Amount) ÷ 100k

Does Lot Size Matter in Trading?

Selecting the perfect lot size with a tool like a risk management calculator or something similar with the desired output can suggest the best lot size based on your current trading account resources, whether you’re practicing trading or trading live. It can also help you learn how much you want to risk.

The size of your trading lot directly impacts how much a business move impacts your accounts. You will encounter different lot sizes during your trading career, and they can be explained using a useful comparison borrowed from one of the most respected trading books.

Conclusion

The lot size measures a quantity or increment of a specific asset or product suitable for buying and selling in the financial sector. Different types of items are frequently offered in a variety of lot sizes. For example, mini lot, micro-lot, and standard lot, but most traders use a mini lot or micro lot in trading. Lot Size Calculators are available for calculating the maximum that helps you accurately calculate the maximum lot size for trading.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)