By John Mullins

Are you looking for a venture capitalist to finance or grow your startup but you’re struggling in doing so? Surprisingly, perhaps, the vast majority of fast-growing companies get the funds they need from a much more hospitable and agreeable source – their customers. John Mullins shares five effective ways to do it.

A long-accepted notion in entrepreneurial circles is that the way to start and grow a thriving business is to come up with a great “idea”, write a great business plan, raise capital from angels or VCs, flawlessly execute the plan, and (Voila!) get rich! But it hardly ever happens this way, and the vast majority of successful businesses don’t ever raise venture capital. In fact, the majority of small businesses – after all, start-ups are always small businesses, for at least some time – simply remain small businesses, despite their ambitions to grow.

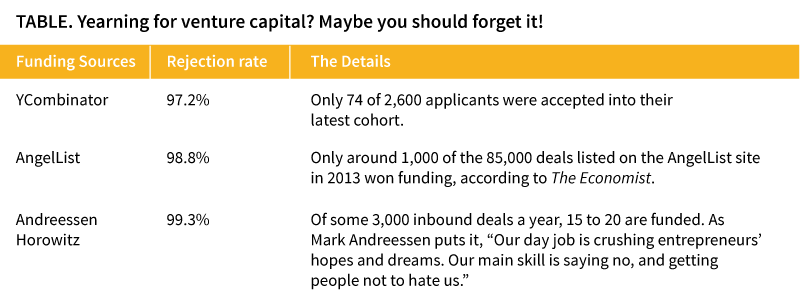

Despite the daunting barriers, most entrepreneurs still want to grow, for lots of good reasons: more profit to take home, more opportunities for their employees, greater give-back to their communities, and more. So how might they find the cash they need, without going hat-in-hand to reluctant bankers or pandering to VCs?

The Customer-Funded Business: A Better Way to Grow

It’s long been the case that the most sure-footed source of funding for companies that grow is their customers’ cash. That’s right: they use the revenue they get from what they sell to their customers, collected as early as possible, to cover the amounts they owe to their employees and their suppliers, paid as late as possible, to provide the necessary fuel for survival and growth.

Rocket science? No. It’s living on one’s float, really. But with VCs having hogged the entrepreneurial limelight for the past couple of generations, customer funding as source of cash for growth has been understudied and largely overlooked. You’ll scarcely find mention of it in business school classrooms or in textbooks on entrepreneurial finance.

This is sad, really, as some of the 20th century’s best-known entrepreneurs – Michael Dell, Bill Gates, and Banana Republic’s Mel and Patricia Ziegler, to name just a few – have done just that. The bright side of the story is this: there are five novel customer funding approaches that scrappy and innovative 21st century entrepreneurs have ingeniously adapted from their predecessors like Dell, Gates, and the Zieglers. Here’s how they do it:

[ms-protect-content id=”9932″]• Matchmaker models: By bringing together buyers and sellers, but not owning what is bought and sold, matchmakers build great companies with virtually no startup capital. For Airbnb, the initial investment in 2007 was for a couple of air mattresses on the founders’ San Francisco apartment floor. By narrowly focusing on conventions that were too big for a city’s hotel inventory, Brian Chesky and Joe Gebbia built their business one step at a time until they got noticed at the Democratic National Convention in Denver in 2008. VC funding followed, and the rest is history: 600,000 properties for rent in 192 countries!

• Pay-in-advance models (a la Michael Dell and the Zieglers): Bangalore’s Vinay Gupta built Via into the “Intel Inside” of the Indian travel industry. How? By asking India’s mom-and-pop travel agents for a rolling $5,000 deposit in advance in return for real-time ticketing capability and better commissions than the airlines were giving them. Signing up 200 agents in the first few months gave Gupta $1 million in cash – his customers’ cash – with which to start and grow his business! It was much like Michael Dell’s approach, which required his customers to pay for their custom-built PCs in advance, but with a 21st century twist! Similarly, the Zieglers charged $1 a copy for their initial Banana Republic mail-order catalogs, and convinced their key suppliers to give them 30 to 90 day terms.

• Subscription models: Krishnan Ganesh started TutorVista with three Indian teachers and a VoIP Internet connection reaching American teens who needed help with their homework. He quickly learned that $100 per month for “all you can learn” – paid monthly in advance – was just what the teens’ parents wanted. When renewal rates after the trial subscriptions quickly materialised at north of 50%, growing the business was simply a matter of adding more fuel. VC funds provided it, and Ganesh sold the business to Pearson in six short years for more than $200 million.

• Scarcity models: Jean-Jacques Granjon and his partners created the flash-sales phenomenon by doing something simple for Parisian designer apparel makers who needed to move unwanted inventory. By collecting immediate credit card payment from “members” who responded to the limited 3-day online sales and limited quantity available at discounted prices, and paying his vendors long after the goods had been ordered and shipped, Granjon didn’t need any additional capital to sell their unwanted styles online and to grow what became France’s 5th most popular fashion brand.

• Service-to-product models (a la Bill Gates): Claus Moseholm and Jimmy Maymann of GoViral, a Danish company created in 2003 to harness the then-emerging power of the internet to deliver advertisers’ video content in viral fashion, funded their company’s startup and growth with the proceeds of one successful viral video campaign after another. In 2011, after having turned their service business (creating and hosting viral video campaigns) into a product platform that stood on its own, GoViral was sold for $97 million, having never taken a single krone or euro of investment capital. Gates and his buddy Paul Allen, who got started by writing operating system software for most of the early PC makers – a services business – deftly made the transition to a product business when they started selling Windows, Word, Excel and the rest in shrink-wrapped boxes.

Does Venture Capital Have its Place?

The five customer-funded models are not for every company, of course. If you want to build a dam and a hydroelectric power plant on some fast-moving water, you’ll probably need capital up front, and lots of it. The same goes for other capital-intensive businesses, including many kinds of manufacturing. But I find the five models apply much more widely than might appear at a first glance – in both services and product businesses, and in both B2B and B2C settings.

If yours is a business for which customer-funded models do have applicability, once your business has won the traction you were dreaming of, then you may well decide that funding from an angel or a VC is just what you need to take your business to the next level. Indeed, as Kleiner Perkins partner Randy Komisar notes, “Even if you plan on eventually scaling with venture capital, customer funding can be a smart path to experiment and prove your business in advance.”

The best news is this. If you raise money at a somewhat later stage of your entrepreneurial journey, once your business is firing on all cylinders with proven customer traction in hand, you’ll be in the driver’s seat, and the queue of investors outside your door will have to compete for your deal!

Why Not VC?

On the other hand, there are numerous reasons why entrepreneurs might not even want to take VC: one, it’s a distraction, as raising capital is a full-time job; two, the stake they’ll probably have to give away in return for the capital they raise; three, the “advice and support” they probably will get from their VC, whether they need it or want it (not to mention whether it is sound); and more. For these and other reasons, for many businesses, raising capital is off the radar; for some of them, appropriately so.

Is Customer Funding a Better Way To Go – and Grow?

Perhaps the most important benefit of funding your company with your customer’s cash is freedom. According to Hussein Kanji, founding partner of Hoxton Ventures, “I wish more entrepreneurs understood the significance and freedom that cash generation can bring to young, fledging businesses. It puts an entrepreneur in the driver’s seat.”

A second benefit is the good things that can happen by directing your primary attention to customers, rather than to investors. In the words of The Darden School’s Saras Sarasvathy, “Treat your first customers as your partners – they are your earliest investors and your best salespeople.” Putting your customers at the forefront of your thinking can only pay dividends.

Third, and thinking pragmatically, with the cost of building many kinds of businesses – including software and Internet businesses that are on so many entrepreneurial agendas today – lower today than ever, you may not need very much cash to cover your modest costs. Your customers’ cash from one or more of the five customer-funded models may suffice for quite some time, maybe forever.

The Way Forward

If you’re an aspiring entrepreneur lacking the startup capital you need or trying to get your cash-starved venture into take-off mode, or an angel investor, mentor, or business accelerator or incubator professional who supports high-potential entrepreneurial ventures, a customer-funded approach may offer the most sure-footed path to starting, financing, or growing your business or one you support. In the words of Shanghai’s entrepreneur and angel investor Bernard Auyang, “The customer is not just king, he can be your VC too!”

[/ms-protect-content]

About the Author

John Mullins is a three-time entrepreneur and an Associate Professor of Management Practice at London Business School. His latest book is The Customer-Funded Business: Start, Finance, or Grow Your Company with Your Customers’ Cash.

John Mullins is a three-time entrepreneur and an Associate Professor of Management Practice at London Business School. His latest book is The Customer-Funded Business: Start, Finance, or Grow Your Company with Your Customers’ Cash.