Recent British Business Bank survey statistics show that over half of all UK-based business emissions are attributed to the SME sector. Despite COP26’s push for a global net-zero by 2050, post-pandemic studies have found that only 3% of small businesses plan to measure their carbon footprint in the next five years.

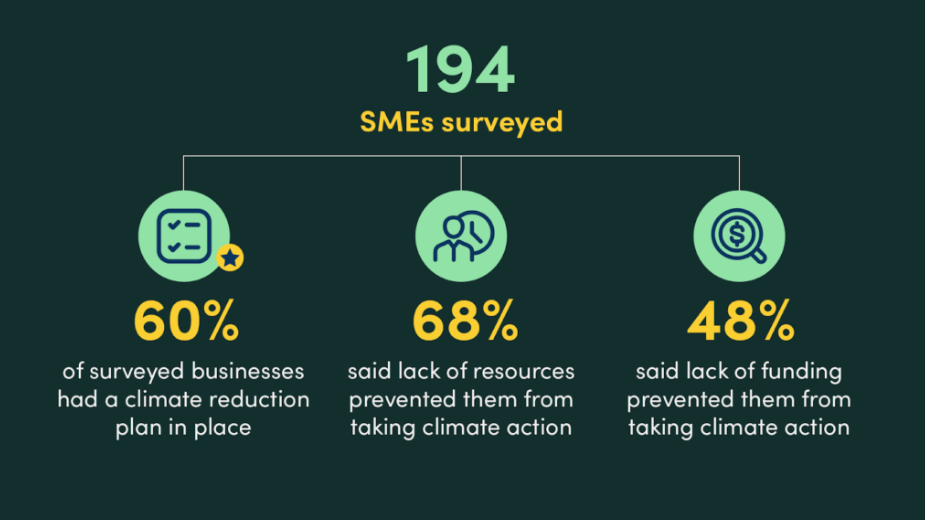

In an SME Climate Hub survey, 48% of SMEs attributed their reluctance to take climate action to their lack of business funding.

As large-scale lenders pull back from small business investment, SME leaders must work harder than ever to secure funding in a competitive landscape. One catalytic factor driving a new era of funding is sustainability. Small business leaders must consider their socioeconomic and environmental impacts in 2022 and take steps to mitigate their risks if they are to be considered for capital investment.

This brings us to the birth of the ‘Green Credit Score.’ Raising a capital profit in a fierce SME playing field has become all but possible in the wake of inflation. However, credit risk consultancy firm, 4Most, has lobbied to introduce a new credit rating system that generates an SME credit score based on business sustainability.

Small business leaders could receive quicker access to capital investment at a cheaper rate to increase funding efforts for SMEs that strive to reduce their current carbon impact.

Read on as we jump into what the future could hold for ‘green financing’ and discuss this environmental initiative’s impacts on SME funding challenges.

A Green Future For Business Funding

In June 2022, 4Most, a popular credit risk consultancy firm, gained government backing to develop a new green credit scoring system that rewards carbon-conscious SMEs with a cheaper financing plan.

Partnering with the cleantech advisory company, Meckon, and global fintech investor, Swishfund, the environmentally charged initiative hopes to improve small business sustainability and encourage SME owners to go green in return for a capital return.

Head of climate change and client partner, Ivelina Nilsson, has described the project as ‘environmentally revolutionary.’ “This project will build a virtuous circle of measuring carbon footprints, providing risk-based funding and boosting climate action,” she claims. “To develop the Green Credit Score, we plan to gather data from potential borrowers to estimate the various aspects of climate change risk they are exposed to.”

Available to all UK-based lending institutions, a new green credit scoring system will educate SMEs about their current environmental impacts and supply them with the sustainable tools needed to reduce their carbon footprint.

Also commenting on the project, the Managing Director of fintech lender, Swishfund, Andrew Jackson, believes that the correlation between carbon commitment and credit worthiness has encouraged small business funders to jump on board.

“We believe that companies that act sustainably are more likely to be financially responsible, but changing business culture around becoming greener is not just about providing information; it has to make commercial sense to business owners,” He states. “This is why we seek a correlation between environmental responsibility and credit worthiness across the board so that every finance provider will be encouraged to provide cheaper finance solutions to more responsible businesses.”

Addressing SME Funding Challenges

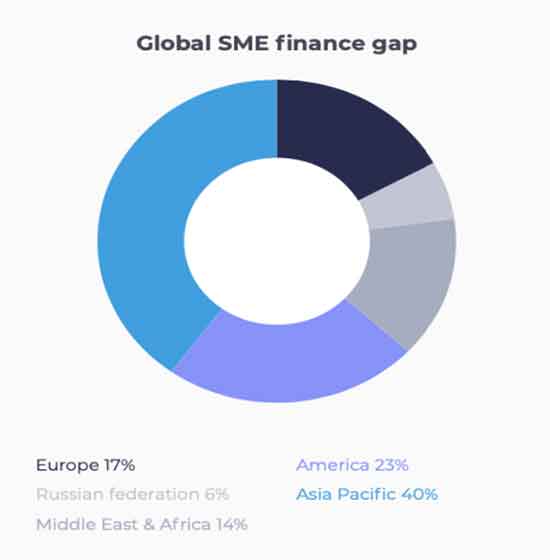

Introducing a green credit scoring system could also reduce the SME financing gap, which continues to challenge several small business leaders in the UK.

In a booming startup landscape dominated by fintech adoption, AR/VR working aids and artificial intelligence, SMEs are constantly competing with each other to boost growth and enjoy the most popular digital aids. However, a lack of funding is sending many ventures into administration in just their first year of business.

To take a deeper look, the SME market currently represents 99.8% of Europe’s business sector. However, while it is considered a corporate backbone, 77% of small business leaders can still not secure bank-based financing in 2022.

Lack of business funding remains the top SME constraint post-pandemic, with a credit gap surpassing $1.5 trillion across Europe.

As a result, 64% of business leaders have faced at least one financial challenge in the last 12 months and more than half have used personal funds to get themselves out of a cash hole. SMEs now must rely on alternative funding sources to stay afloat in the wake of inflation and the impacts of Covid-19, as securing traditional funding remains harder and harder in a competitive corporate arena.

“Alternative finance is arguably the key to helping the economy get back on its feet and grow following the challenges businesses, particularly SMEs, faced during Covid-19,” claims James Crellin, finance director at Walker Morris. “It’s undeniable that there are many hurdles SMEs face when it comes to securing funding – and it’s clear that the perceived risks around insecure finance and regulatory loopholes with alternative finance providers are a huge barrier.”

As we step into a new era of green funding, experts believe these SME hurdles could be squashed as more traditional lenders step forward.

Targeting Conscious Consumerism

It’s no secret that conscious consumerism is on the rise. As 4Most’s green credit scoring system encourages SMEs to take steps towards an eco-friendly future, it seems as if funding won’t be the only positive impact small businesses will see in response to going green.

A recent YouGov study revealed that 55% of European consumers would opt for a carbon-neutral company over one offering a cheaper deal.

Company leaders that opt for a sustainable future could see their profits rising and demographic reputation improving in return. The question is, just how many SMEs will take the crucial steps towards a greener tomorrow? Only time will tell.