Digital innovations have disrupted numerous industries, and banking is no exception. Digitalisation has introduced us to online banking, contactless payments, and many other services.Banks accelerating the use of financial software development services to meet the needs of their customers and stronglyperform in a competitive environment.

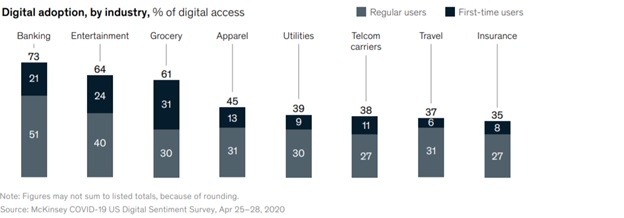

Source: The COVID-19 recovery will be digital: A plan for the first 90 days

In the time of social distancing consumers choose digital channels more than ever. According to the survey conducted by Boston Consulting Group, 24% of respondents are less likely to visit physical bank branches or prefer not to visit them at all. Astechnologies shape customer expectations, financial institutions face the need to undergo digital transformation.

The digital transformation process anticipates that an organisation stays continually updated on the available tools, which can improve the processes to achieve better efficiency, for example, artificial intelligence (AI), machine learning (ML) and others. Thus, it is vital to understand the advantages which digital innovations bring to banking institutions. So let’s take a closer look at 5 ways financial institutions can benefit from digital innovations.

Nowadays, digital presence plays a vital role in the successful conduct of business. Even in the banking field, creating banking applications, social media presence, interactions with users and responding to complaints and queries online can develop and strengthen the sense of consumers’ trust. The Internet offers multiple platforms to engage with users directly and enlarge your customer base.

Digital collaboration helps to streamline the onboarding process of a customer in commercial banking. A customer can register on the online portal or consult a bank employee via a chat-bot or video consultation. All the necessary documentation packages can be uploaded online. Thus, legal, know your customer (KYC) and other teams within the bank can perform their task simultaneously. And meanwhile, the onboarding team approving them, customers are able to view the progress in real–time and be notified once the application is approved.

Frauds, which can result in significant losses, are among the most common pitfalls for both financial institutions and their customers. In 2019, according to the Federal Trade Commission, among 3.2 million identity theft and fraud reports, 1.7 million were related to fraud and 651,000 to identity theft.

The implementation of technology-driven solutions can be used to detect or prevent various financial frauds:

- Fraudulent transactions. AI-based financial fraud detection solutions can identify suspicious transactions, prevent the possible incident, and notify authorities almost instantly.

- False insurance claims. Fake insurance claims are commonfor insurance companies, and if not detected in advancemay lead to fraud claimant receiving insurance money.Using machine learning, insurance companies can spot false claims and save costs.

- Abnormal transactions. Anomalous transactions differ from regular bank operations, and they are not always fraudulent ones. Thus, machine learning solutions can identify them and ask for confirmation that the transaction was client-initiated.

The introduction of cutting-edge technologies can help banks to boost efficiency and minimise human error. Here are some of such digital innovations:

- Electronic signature. Apart from enabling customers to sign documents from anywhere, which is vital in the times of social distancing, implementing E-signatures help the banking sector to reduce spendings and provide a better customer experience. Moreover, the electronic signature isa time-saving solution, which allows saving nearly 1.3 hours per transaction, since all information and signatures are more likely to be captured correctly on the first try.

- Electronic documentation. Managing the growing number of datasets, which usually contain individuals and legal entities’ personal data and sensitive information is a time-consuming and error-prone process. Transferringdocumentation packages to digital environment facilitate the management of the process by reducing the steps required to carry it out. Additionally, all the costs involved in paperwork like printing, scanning, sending various documents and other, can be significantly reduced.

Banking institutions have to deal with the continually increasing amount of sets of data. Infusing everyday financial processes with AI and machine learning solutions allows to accelerate the scanning process of numerous data rows, extract valuable insights from them and make a rational decision.

The advanced analytics powered by tech solutions discover insights which should be interpreted by a specialist. Such collaboration between humans and innovative technologies results in faster and more informed decisions, which lead to a more robust bottom line, considerable commercial success, and more engagement.

Real-time data and innovative technologies allow providingcustomers with more personalised information. According to Forrester, 89% of businesses invest in personalisation. Banking institution can leverage customisation to promote relevant services to the existing or potential customers.

Experience adapted to an individual consumer requiresinnovative tech solutions, which will analyse consumer’s preferences, purchasing behaviour and other information. The implementation of personalisation can tailor financial services to customers’ expectations and increase engagement.

To sum it up

It is challenging to predict how digital innovations will shape the financial sector in the following years; however, it definitely will bring numerous other advantages. So if financial institutions want to survive and thrive in a competitive marketplace, they have to start adopting digital innovations now.