By Jacques Bughin

AI unicorn valuations have sparked debate over whether they reflect unsustainable speculation or credible growth opportunities. Jacques Bughin examines this phenomenon using real option theory, highlighting uncertainty, strategic positioning, and ecosystem orchestration as key drivers shaping how these companies can unlock enduring value in the fast-evolving artificial intelligence sector.

1. Introduction

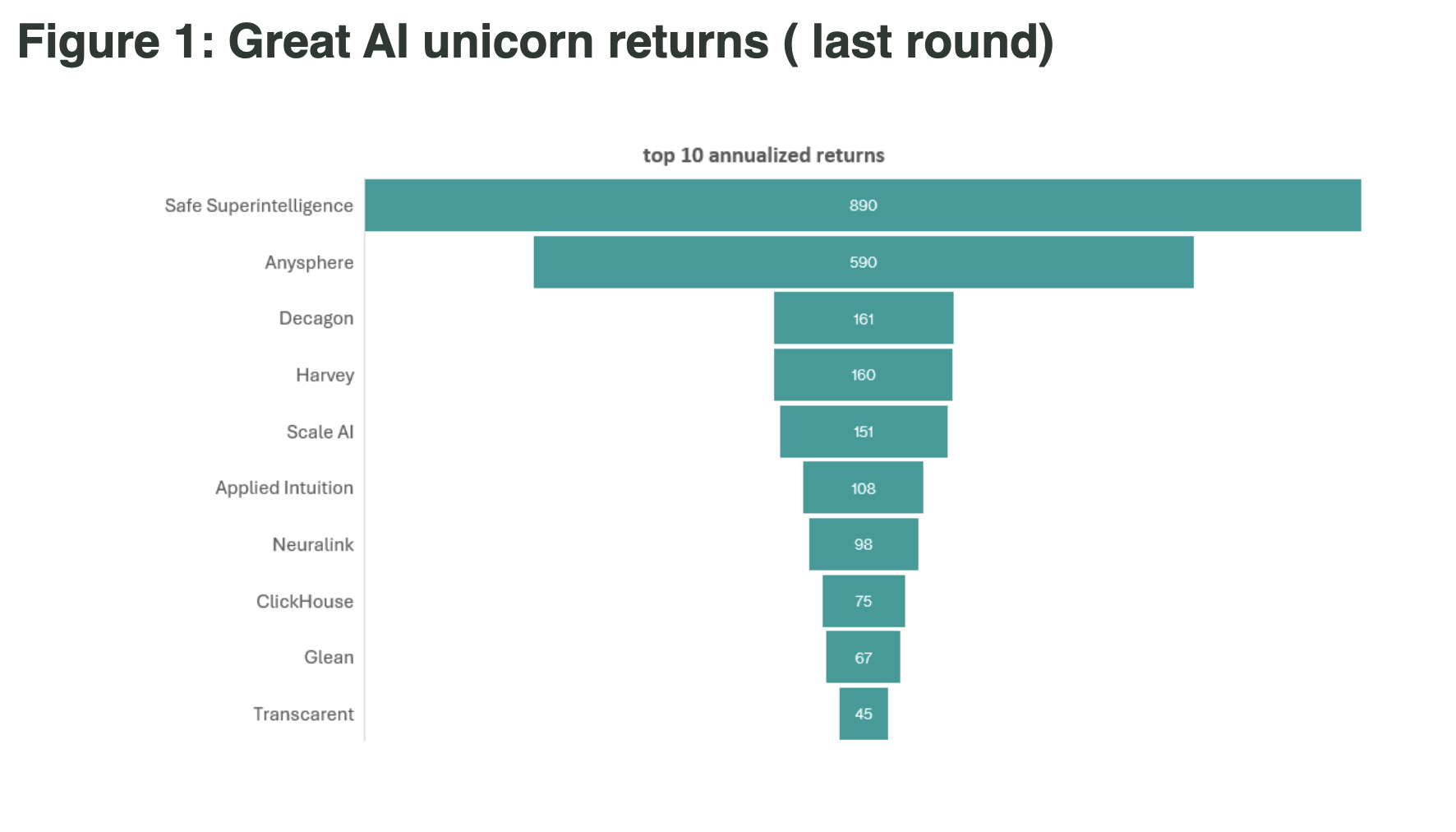

The surge in the valuation of AI unicorns (private companies valued at over US$1 billion) in 2024–2025 has been unprecedented (see Figure 1), mirroring the stock price increases of major publicly quoted AI firms such as Nvidia, or Palantir. But it also has sparked a fundamental question in boardrooms: are these valuations speculative bubbles?

Top AI unicorn companies such as Safe Superintelligence, Anysphere, Cyberhaven, Supabase and Harvey have recently experienced valuation surges in under 18 months. Safe Superintelligence, a foundation model developer that emphasises safe AGI development and has an advanced, research-first methodology, crossed a $30 billion valuation in under a year after launching in 2024. Anysphere, a developer toolkit, is valued at $1.8 billion. Supabase, a Postgres-native open-source software (OSS) backend platform, has surpassed $2 billion. Glean, a knowledge orchestration engine for enterprises, was valued at $3.5 billion in its latest funding round, and ClickHouse, a high-performance OLAP database, is now valued at over $6 billion. Scale AI was recently acquired by Meta Platforms which has taken a 49% stake the company.

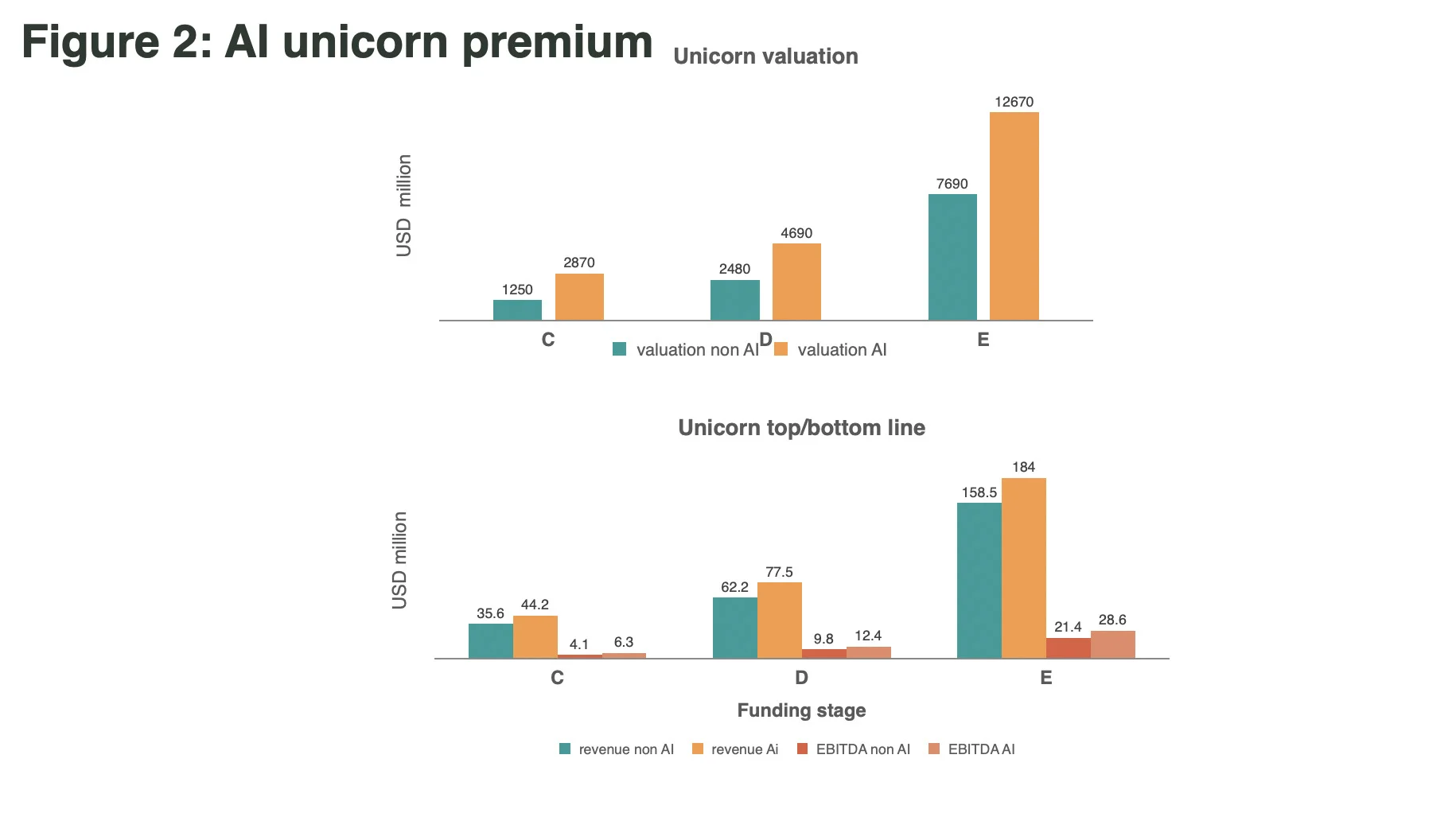

Compared to other non-AI unicorns at the same level of funding development (from series C to F), AI unicorns have slightly better economics (in terms of both top and bottom lines), but the valuation multiple is nevertheless twice as high in the late funding stage compared to non-AI unicorns (see Figure 2)[1].

This raises legitimate scepticism among experienced managers and investors. Are these startups really worth that much? Or is this another bubble ready to burst? From a distance, the temptation may be to shrug it off. Some executives say that these AI companies aren’t generating significant revenue, and older ones say, ‘We saw this in 1999.’

But that may be exactly the danger. Because buried in those valuations is something else: the answer may lie not in discounting, but in real option theory— a probabilistic bet on market-shaping technology where optionality matters more than current margins.

2. Pricing real options

While it is true that many of these companies do not justify their valuations through current cash flows, as with many technology projects involving significant uncertainty and a long timeframe, they can generate substantial returns if a few key strategic assumptions prove correct. This is the principle of real options: the idea that but like in many technology projects with large uncertainty and long period to unfold, the price paid today reflects not only the present value of expected profits, but also the value embedded in growth opportunities, capability scaling and first-mover positioning.

The price paid today reflects not only the present value of expected profits, but also the value embedded in growth opportunities, capability scaling and first-mover positioning.

For example, recent academic research shows that the options embedded in Tesla price can be as large as 65% of its value. Amazon’s valuation in the early 2000s was also criticised for being bubble-like. However, a decade later, these growth options materialised in the form of AWS, logistics leadership and platform dominance, turning what initially seemed like overvaluation into significant value creation for shareholders. Amazon went from a valuation of less than $500 million at IPO to over $2 trillion, with investors tolerating 15 years of losses. That wasn’t a bubble. That was strategic optionality priced correctly. By the way, super firms are those continuing to build new growth options eg, the embedded option in Amazon stock price remains high, from 35% to 60% of the current market price, -and depending on the hypothesis taken on the uncertainty linked to those options, such as the significantly larger data load of AI than typical online activités and impact of AWS profitability, or still the effect of agentic AI on the performance of logistics and e commerce for Amazon.

So, how should today’s AI unicorn valuations be interpreted through this lens? There are five reasons to believe that this is not just a bubble, but rather a reflection of the deep uncertainty surrounding major disruptions that have been priced via strategic options.

3. AI unicorn real options are real.

Firstly, the velocity of value creation has increased dramatically. It’s not just the valuation jumps; it’s also the speed at which companies reach maturity. Companies reach Series D in less than 24 months. Safe Superintelligence was non-existent in mid-2024, but became a global benchmark within 12 months. The cycle of infrastructure deployment, developer tool maturity and API integration has shortened from years to quarters. Funding rounds that used to take 12–18 months are now compressed into six-month periods, with follow-on rounds being preempted by global investors.

Secondly, these start-ups are not just thinly spread SaaS clones. They often achieve growth rates of over 150% year on year, have strong gross margins and operate in capital-light, API-first infrastructures. More importantly, they target large market segments with weak competition. Tools such as Anysphere and Decagon are redefining the capabilities of agents, making significant inroads into areas of knowledge work that were previously dominated by humans, such as legal case management, dev sprints and compliance reporting. The appeal lies in margin expansion and customer lock-in: these tools reduce costs and fundamentally change workflow architecture.

Thirdly, these companies are concentrated in the infrastructure and orchestration layers — places where control over data, models and system logic can produce ecosystem-level lock-in. Consider Supabase and ClickHouse as the new Firebase and Snowflake, but built natively for the AI era. These companies are not just developing apps; they are developing the operating systems of a post-human productivity stack. Much as Android or AWS once did, these AI infrastructure firms are enabling the next generation of software companies.So how do we interpret today’s AI unicorn valuations through that lens? There are five reasons to believe this is not (just) a bubble, but a reflection of deep uncertainty of major disruptions, priced via strategic options.

Fourthly, what is emerging is not just another wave of products—it is a new platform logic. These AI-native models introduce orchestrators, agentic design, transparency layers (such as sandboxing and explainability) and human-AI hybrid architectures. These are not mere extensions of GenAI — they are the beginning of a new digital operating system. We know from past cycles (iOS, Android, AWS) that platform positioning can generate significant growth. The agentic shift also introduces new consumption patterns, such as vibe coding, auto-completing work and multi-agent collaboration, that transform not just efficiency, but also the very structure of work.

Fifth, the market remains concentrated. Despite the existence of thousands of AI start-ups globally, only a few dozen AI unicorns have emerged with elite backing, deep verticalization, and scalable models. This asymmetry reflects what Schumpeter, Christensen, and recent research on firm power suggest: that disruption is rarely democratized. Winners emerge early, create flywheel dynamics, and absorb most of the optionality value.

This was true for Amazon and Google, and it is likely to be true for companies such as Safe Superintelligence (SSI)—SSI is not just another large language model (LLM) builder; it is designed to be AGI-safe from the outset. Its clear goal is to pre-empt future AI alignment concerns. If successful, SSI could define the norms and safety standards for AGI deployment, becoming a central node in the governance of intelligence. ClickHouse is a high-performance OLAP infrastructure offering blazing-fast analytics performance optimised for AI inference and real-time telemetry. It serves as a data execution engine for AI apps across sectors. Just as AWS powers cloud apps, ClickHouse could become the backend layer that AI apps depend on to scale insights and decisions. Finally, just as Google leveraged its early leadership in search and ads to expand into email, cloud and mobile operating systems, many AI unicorns today are already expanding into additional verticals — for example, Anysphere is expanding from developer tools to search.

4. How real options guide the top management AI journey

Firstly, resist the temptation to dismiss AI unicorn valuations as unrealistic. Instead, consider them to be pricing in future asymmetric outcomes in a high-uncertainty environment.

Secondly, options only have value if they are realised. If you are a startup CEO, don’t chase the valuation per se; rather, chase the capability set that unlocks optionality. In particular, the above AI unicorns clearly demonstrate that significant potential is linked to fast orchestration, AI-native stack design and customer-side workflow integration.

Thirdly, AI is not just a technology sector — it is a horizontal meta-capability. This means your firm must invest, adopt and re-architect. Invest in core AI infrastructure (internal or via ecosystem partnerships). Adopt AI in the workflows that matter, such as legal, sales, development, compliance and research. Finally, rethink how you approach software, shifting from deterministic apps to probabilistic, learning and adaptive systems that blend agentic AI and co-pilots with back-end automation.

Value creation will not only come from technology, but also from the ability to orchestrate trust, transparency, and speed.

Fourthly, value creation will not only come from technology, but also from the ability to orchestrate trust, transparency, and speed. This involves building in feedback loops, interpretability and workflow anchoring, as well as minimising the latency between insight and execution. It also means training your people to not only use AI, but also to supervise, shape, and evolve with it.

Fifthly, recognise that much of what appears to be excess is actually the cost of not missing out on the next dominant platform. Back in 1999, investing $1 million in Amazon was considered risky. However, by 2020, it was worth more than $500 million. That was real optionality, and it played out over time. Today, the equivalent might be Harvey, Supabase or Safe Superintelligence. The outcome may not be guaranteed, but the logic remains: small probabilities of significant outcomes can transform the value curve.

Finally, whether you are a tech founder, a senior executive at a large enterprise, or a leader in private equity, don’t confuse valuation multiples with intrinsic value. What we are seeing is the market pricing in scenarios, not certainties. In such environments, the smartest move is not to bet on precision, but to buy access to trajectories and structure your firm to move quickly when the opportunity arises.

The AI pyramid is being built quickly. Its top may look rather speculative. However, history tells us that underlying markets beyond that speculation will clearly define the next economic landscape. So the question is not whether you believe the valuations are rational, but whether you are prepared to recognise that AI is a new platform for your enterprise’s future.

Jacques Bughin

Jacques Bughin