By Ilan Noy

Natural disasters potentially impact severely on economic dynamics — e.g. on production, prices, incomes, and employment — in the post-disaster period.

Over the past 14 months, we have witnessed a spate of very large earthquakes, beginning with the earthquake in Haiti (10/1/2010) — the most destructive natural disaster in modern history (relative to the size of the country’s population: nearly 3% of the national population perished) — and continuing with an exceptionally strong earthquake in Chile (27/2/2010), a very destructive one in New Zealand (22/2/2011), and finally with the devastating tsunami and nuclear crisis generated by the March 11 earthquake which struck the Tohoku region in Northern Japan. Remarkably, the economic impact of this recent spate of catastrophic events is not easy to identify. At the time of writing, even the initial horrific toll of the earthquake/tsunami in Japan has not yet been entirely accounted for, as the nuclear crisis triggered by this event is still unfolding.

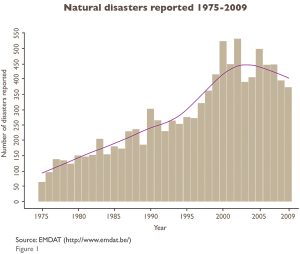

Before discussing these impacts, however, I would like to note that the data have shown an increase in the frequency of disasters over time. The most comprehensive and global data set on disasters reveals an almost three-fold increase in the frequency of disasters between the 1970s and the last decade (see figure 1).

[ms-protect-content id=”9932″]

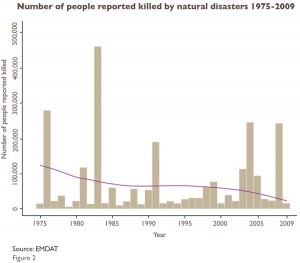

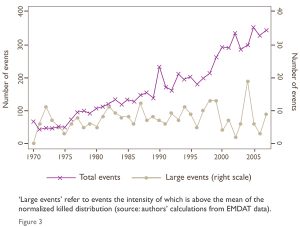

Given the large number of events included in this data set (hundreds a year worldwide), it might be useful to consider additional measures of disaster prevalence. Overall, the number of people dying from natural disasters has been decreasing over time, even though the figures for the years 2004, 2008, and 2010 were very high (figure 2). The specific reasons for these different patterns are not immediately obvious; the evidence suggests that the increase in frequency may be a reflection of the improved reporting of less extreme events. The decrease in mortality is, in all likelihood, a result of improved mitigation policies, especially better building standards to withstand earthquakes, and more accurate storm and flood forecasting and warning systems. There appears to be no clear trend in the frequency of unusually large natural disasters (measured in terms of damage, rather than physical intensity), such as the recent event in Japan, the Indian Ocean tsunami of 2004, the 2008 Sichuan earthquake and cyclone in Burma, or the Haiti earthquake of 2010, which are fortunately quite rare (see figure 3).1

Mortality and Direct Damage from Natural Disasters

The direct damage caused by natural disasters includes the destruction of fixed assets and capital, raw materials and extractable natural resources, and, most importantly, human mortality and morbidity. The number of people killed or hurt, or otherwise affected by disasters, is typically much larger in less developed countries. A comparison of the mortality caused by the 2010 earthquake in Haiti and the geologically more powerful earthquake in Chile a month later easily demonstrates this point. The dramatically different outcome, about 240,000 dead in Haiti as compared with less than 500 in Chile, was at least partially due to vastly different mitigation policies, institutional arrangements, and economic conditions in the two countries.

In light of these differences, the Tohoku earthquake is quite unusual, since the tsunami it generated killed nearly 28,000 people, making it the most deadly natural disaster in a high-income country in a long time —a result of unexpectedly high tsunami waves, not of the earthquake itself. The number of people reportedly killed directly by the earthquake appears to have been very low despite its magnitude; in fact, without the seemingly functional tsunami alerts and the implementation of evacuation plans to nearby shelters, the death toll in the recent Japanese disaster would have been much higher.2

The financial value of damages caused by natural disasters in developed industrial countries is usually considerable, since the initial value of fixed assets, especially real estate, is high. Current estimates of the damages in Japan are close to US$300 billion, but even these sums are not very large proportionate to the size of the economy. Even a dramatic event like the Kobe earthquake of 1995, the most fatal natural disaster to hit a developed country in many years, destroyed physical assets valued at about 2.5% of Japan’s gross domestic product (GDP). The recent events in Japan destroyed maybe 5-6% of the Japanese GDP, a very large sum, though still much lower than the approximately 125% of GDP destroyed in the Haiti earthquake of January 2010.

Understanding the determinants of the direct damages from natural disasters is only the first step in understanding the economic significance of such events. The secondary, but potentially more severe impact of natural disasters is on economic dynamics — e.g. on production, prices, incomes, and employment — in the post-disaster period.

Indirect Damages in the Short- and Long-run

By “indirect” damages from natural disasters we mean the impact on economic activity, in particular the changing production of goods and services, following the disaster, and because of it. These indirect damages may result from direct damages to capital used in production (for example, the damage to the fishing fleet in the Sendai area), from damage to infrastructures that normally facilitate production (for example, the rolling blackouts imposed throughout the region and including Tokyo), or from the fact that reconstruction pulls resources away from more efficient production processes or products. These adverse impacts may be exacerbated whenever the absence of components normally produced in the affected area causes disruptions in supply chains to regions that have not been directly affected (car factories in Korea and the U.S. were widely reported to have been shut down after the earthquake disrupted the manufacture of various key components).

In contrast to such potentially adverse consequences, reconstruction can provide a boost to the domestic economy, however. Government funding for reconstruction provides a fiscal stimulus and an opportunity for employment that can potentially improve economic outcomes. Even privately funded reconstruction from previously accumulated wealth, or from external sources (reinsurance payments, remittances, and foreign aid being the three most likely sources), will provide a boost to the domestic economy by increasing the spending power of residents.

If any of these costs/benefits are economically significant, they can be accounted for in the aggregate. Thus, they may have an impact on the overall performance of the economy, as measured through the most relevant macroeconomic variables, in particular GDP, but also the government accounts, consumption, investment, the balance of trade and the balance of payments. It is quite remarkable that economists have only recently begun to quantify these costs, and to try and explain their magnitude.3

Following several recent research projects, the evidence of the short-run growth effects of disasters is now fairly conclusive. Estimates suggest that over time a developing country would expect to experience about a 9 percentage-points reduction of its pre-disaster GDP growth, while a developed country would most likely experience a mild, cumulative increase of about 1%.4 These stark differences in post-disaster outcomes are similar to the differences between initial vulnerabilities to immediate disaster impact. Not only are developing countries more vulnerable to the initial shock, but their economies are also a lot less resilient in facing its aftermath.

We further conclude that countries with a better-educated population, a better governance, and more direct access to reconstruction resources will fare better in the disaster’s aftermath. As the eighteenth-century economist Adam Smith approvingly noted in his Wealth of Nations (book V, ch. II, p. 359),

The canton of Unterwald in Switzerland is frequently ravaged by storms and inundations, and is thereby exposed to extraordinary expenses. Upon such occasions the people assemble, and every one is said to declare with the greatest frankness what he is worth in order to be taxed accordingly.

In the case of the recent earthquake/tsunami in Sendai, recent data do not suggest that in terms of the initial mortality and destruction it caused even such a catastrophic natural disaster will have any significant adverse impact on the national economy of a rich country like Japan. The absence of any measureable impact on aggregate incomes does not preclude more nuanced effects, however, especially on household welfare and redistribution.

Disasters entail a significant transfer of resources across households. While households with access to credit are able to borrow and maintain their spending levels, households that were already credit constrained before the disaster will experience a dramatic decline in consumption, which is likely to affect their well-being to a considerable extent.5 Similarly, the disaster may not have an impact on the aggregate national economy, though it will most likely generate regional impacts that may persist for long periods of time. Such impacts can take several forms, but will most likely involve movement of economic activity in specific sectors, and maybe even populations, away from the affected region.

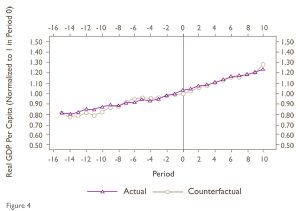

What we know about the long-term effects of natural disasters is scant and inconclusive. The most recent attempts to evaluate the long-running impact of disasters on per capita income suggest that there is no evidence of any such adverse effect. For example, figure 4 constructs a counterfactual synthetic comparison between countries unaffected by disasters and disaster countries.6 The figure clearly demonstrates that even for very large disasters (the top 10 percent in the distribution of disaster impacts), there is no significant long-running effect of disasters on per capita GDP. This possibility has already been noted before. John Stuart Mill, one of the leading political philosophers of the nineteenth century, noted that:

what has so often excited wonder, the great rapidity with which countries recover from a state of devastation; the disappearance, in a short time, of all traces of the mischiefs done by earthquakes, floods, hurricanes, and the ravages of war. An enemy lays waste to a country…and yet in a few years after, everything is much as it was before.

However, as already mentioned, the lack of a significant aggregate effect does not preclude enduring regional impacts. There is almost no research on this question, though some preliminary evidence suggests that large natural shocks can have important regional consequences. One widely mentioned forecast is that the population of New Orleans is unlikely to recover from the dramatic exodus of people from the region after Hurricane Katrina — i.e. that the hurricane accelerated an irreversible decline. We argue that a similar and apparently permanent decrease in population (of about 15%) is observable for the Hawaiian island of Kauai, which was hit by a destructive hurricane in 1992.8

Some argue that disasters provide an impetus for change, which can bring on either positive or negative outcomes. Change can lead to “creative destruction” dynamics that entail replacing old with new technologies and with upgrades of superior equipment, infrastructure, and production processes. The rapid growth of Germany and Japan after the destruction they experienced in World War II is widely used as an example of such beneficial dynamics.

Besides the potential introduction of new technologies to replace the ones that had previously been destroyed, a large natural disaster changes political power dynamics in ways that may facilitate radical change. Rahm Emanuel, Barak Obama’s former chief of staff, is often quoted as saying, “you never want a serious disaster to go to waste . . . it’s an opportunity to do things you could not do before”.9 One can see these dynamics in practice after what many consider the first truly international natural disaster, the Lisbon earthquake of 1755. Sebastião José de Carvalho e Melo, the prime minister of Portugal, appointed to run the relief operations after the earthquake, wrote:

Politics is not always the cause of revolutions of State. Dreadful phenomena frequently change the face of Empires. One could say that these aberrations of nature are sometimes necessary because they can contribute more than anything to eradicating certain systems . . . We could say that it is necessary that across the land provinces are wasted and cities ruined in order to dispel the blindness of certain nations . . .10

Vulnerabilities to Disasters

Besides traditionally conceived geographical characteristics, there is a growing understanding that certain economic conditions also make regions vulnerable to natural disasters. Economic circumstances may lead to increased resilience in the aftermath of a disaster or may, alternatively, exacerbate its negative impacts, especially the indirect economic impacts described above. Vulnerability (or conversely resilience) to hazards can be categorized both ex-ante and ex-post. Ex-ante vulnerability is described by indicators such as frequency and magnitude of disaster events, susceptibility of the economy to be directly impacted, and the implementation of disaster management plans, such as adequate warning systems and shelters. Ex-post vulnerability is characterized by the ability to recover from the aftermath of a natural disaster. Relevant factors include success in the deployment of post-disaster management plans, the flexibility to re-allocate resources for disaster relief and reconstruction, the expected access to foreign funds, and the ability of different economic sectors to rebound.

In general, regions with a large export sector will be less vulnerable to disasters because the demand markets for their products will presumably remain unaffected. At the same time, an economy with a less diversified set of export products is generally more vulnerable to external shocks. Regions with high levels of import needs, in particular with respect to food, are more vulnerable to disasters, especially if they depend on a specific infrastructure to bring in necessities.

Japan, the Nuclear Crisis and Lessons for Business

Given the findings described above, one can confidently conclude that the indirect impact of this horrific earthquake/tsunami disaster on the growth of the Japanese economy would have been quite small had the nuclear crisis been contained more efficiently. The Japanese government and the Japanese people have access to large amounts of human and financial resources that are already being directed toward a rapid and robust (re)construction and (re)building.

However, even if the Japanese macroeconomy is unlikely to experience a long-term setback, this does not mean that households will not be affected negatively, nor does it imply that the region hardest hit (the prefectures of Iwate, Miyagi, and Fukushima – all part of the Tohoku region) will not experience long-term adverse consequences.11 The earthquake will, in all likelihood, lead to a shift in the sectoral composition of production in the region, and some industries may permanently move out of the affected area or disappear altogether.

Even at the risk of drawing premature conclusions, it is nevertheless worthwhile to point out several concerns. Scientific experts repeatedly describe the likelihood of future disasters in terms of one-in-X-year events. We have recently experienced several one-in-500-year events, which suggest that this framing is not very helpful. After all, if there are 500 different possible disaster scenarios worldwide, and each one has a one-in-500-year likelihood associated with it, this means we would have, on average, one such catastrophic event a year. This framing creates the lack of preparedness we have seen most recently in the Fukushima nuclear power plant. With hindsight, it is obvious that the operators of the seaside power plant should have had contingency plans in place for a failure in the electricity supply of both the grid and the emergency generators that were made inoperable by the tsunami. More generally, post-disaster energy supply difficulties and the collapse of communication networks seem to be two aspects of this and other recent disasters that were not planned for adequately.

Economic vulnerability of industrial production, as exposed after this disaster, is a result of an increase in the vertical integration of production networks and the just-in-time supply chain management. These create a vulnerability that can easily spread to unaffected regions, and is compounded by trends toward very specific specializations. The post-tsunami shortage of bismaleimide triazine resin, for instance, is instructive. This product, whose only major worldwide supplier is by Mitsubishi Gas Chemical, is important in smartphones and other similar devices. In this case, the dependence of entire industries on generally one supplier with limited supplies and well-known vulnerabilities seems somewhat puzzling. In many instances, pre-planning by firms to accommodate shocks to specific links in their supply chain does not seem to have been in place.

Finally, the government’s importance in post-disaster recovery should not be discounted. As noted previously, Adam Smith already acknowledged the unique ability of governments to coordinate the mobilization of resources toward post-disaster reconstruction. The recent events in Japan have demonstrated the resilience of local communities and the efficiency with which they dealt with the emergency, as well as the many ways in which the central government’s response was woefully inadequate.12 Though there is much disagreement about the proper role of government in the economy, there is little doubt that effective dealing with large natural disasters requires a coordinating hand, not an invisible one.

About the Author

Ilan Noy is an associate professor of economics, affiliated with the University of Hawaii. His research in international economics focuses on the reasons for financial crises and their costs, on capital flows and their impact, and the economics of natural disasters. He has published more than 30 papers on these topics, and his work has been reported by various media, including the New York Times, the Economist, the New Yorker, the Wall Street Journal, and the Boston Globe. His work is available at http://www2.hawaii.edu/~noy

[/ms-protect-content]