By Michael Gravier, Christopher Roethlein, and John Visich

In today’s rapidly changing business landscape, supply chain leaders are being challenged by the profound effects of digital economy on the relationship between consumers and the supply chain. In this article, the authors elaborate on three crucial things, particularly connectedness, responsiveness and process, toward value creation as employed by successful businesses such as Norsk Titanium, a digital supply chain pioneer.

Too many supply chains are stuck in the 1990’s when it comes to the technology they use leaving them decades behind the foundations required for the digital economy. The scale and magnitude of the problem are hard to over-state. For example, evidence indicates that half of supply chain managers have yet to embrace Internet technology.1 Organisation for Economic Co-operation and Development (OECD) research into economic malaise in developed economies indicates that a few “frontier” firms are dominating in each industry – meaning top five percent in terms of labour productivity – their key distinguishing feature being their investment in IT.2 The difference between how frontier companies and laggards compensate employees may explain most of the wage gap that has appeared in many developed economies.

This is no longer a “digital economy that’s coming” – it has already begun and the leaders are delivering exponentially more value to their customers. Most modern companies have yet to comprehend how the digital economy will profoundly change the relationship between consumers and the supply chain. Technology is powerful, yet the principal challenge is for supply chain managers to change their strategic conviction. Too much current thinking focusses on efficiencies achieved by direct managerial control that leads to a sub-optimum supply chain. Future supply chain strategies will need to concentrate on shared control of decision making enabled by the application of advanced technologies to create lasting end-to-end supply chain competitive advantage.

[ms-protect-content id=”9932″]

What’s Different?

This reveals a fundamental truth about the digital supply chain – our production technologies are increasing flexibility to the point that production and upstream functions will cease to become a reliable means of achieving sustainable competitive advantage. Both companies and consumers find themselves overwhelmed by the possibilities. Market leaders are the companies that define what performance means in their markets, such as Volvo’s focus on safety. These companies find success by NOT being responsive to customers’ stated preferences, and instead they assertively shape customer criteria of purchase based upon actual customer behaviour and respond with highly-efficient processes – such as how Zara puts out a few units of various products to see what sells. It’s a self-reinforcing cycle between changing market wants, flexible production technology, and the management processes that make everything happen.

Successful business has always done three things to create value: connected with the customer to understand their needs both in relation to the company and to fellow customers; responded to the need by developing a solution; and processed inputs as efficiently as possible to deliver the solution repeatedly and consistently. Connectedness, responsiveness, and process are related through a conceptual Value Equation where:

Value = Connectedness x Responsiveness x Process

Digital Precursor: Leagile Supply Chains

Supply chains use two basic strategies, lean and agile. Leanness means developing a value stream to eliminate all waste, including time, and to ensure a level schedule. Agility means using market knowledge and a virtual corporation to exploit profitable opportunities in a volatile market place4. Traditionally, a decoupling point separates the supply chain into an upstream planning part (lean) and a customer facing part (agile). The decoupling point occurs at the point in the supply chain where the customer places their order for a product. Using information enrichment at the decoupling point integrates the lean and agile paradigms into a leagile supply chain5, the precursor to digital supply chains.

Future digital supply chains that maximise the Value Equation will evolve the leagile strategy to the extreme, where the decoupling point will be a production machine with a batch size of one arranged in a dispersed network deployed near customer markets. A set-up time of virtually zero and batch size of one maximises throughput, allowing a single finished part to be shipped directly to the customer rather than waiting for a batch to be completed, reducing lead times.

The reduction in supply chain entities – and concomitant complexity – exponentially shortens information lead time and increases responsiveness. Reduction in process steps and increased computer controls will reduce the probability of defects, increasing quality. Cost savings will accrue in raw materials purchasing, labour, energy, transportation, inventory holding and waste disposal. Most importantly, customer service will predominate because changes in demand will be easier to accommodate, parts can be delivered faster due to the batch size of one, and new product development time will be reduced.

Leagility powers responsiveness and process. Leveraging the leagile supply chain to enable the digital supply chain requires developing connectedness with the customer and the customer’s socio-economic context in order to both anticipate and sense-and-respond in real time to market demands.

Digital Supply Chain Pioneer: The Case of Norsk Titanium

Norway-based Norsk Titanium (NTi) – widely known as an innovator – represents the challenges and opportunities many digital supply chain pioneers are navigating as they discover how to jointly consider connectedness, responsiveness and process. NTi has developed industrial scale 3D printing, a.k.a., additive manufacturing, that makes titanium parts for aerospace applications with a fraction of the lead time and material waste of conventional competitors, all while reducing the cost of titanium parts to the traditional price point for aluminum parts. Dr. David Jarvis, former Head of New Material and Energy at the European Space Agency, said, “Norsk’s technology is a good candidate for a manufacturing technology that will change the world.”

Titanium makes up 14-percent of the weight of a Boeing 787, a typical application. Military aircraft use much more titanium, with the F-22 fighter containing 39-percent titanium by weight6. Global air fleets are projected to grow 58-percent over the next two decades, and currently, Boeing and Airbus have a record backlog of over 12,000 aircraft; 61-percent of the backlog consists of high titanium content aircraft platforms, in addition to substantial military needs7.

With many steps and players to coordinate, newly designed aerospace titanium parts typically exhibit lead times of 55 to 75 weeks. In order to address the significant future demand for titanium aircraft parts, NTi recognised that the fundamental paradigm shift from “lean” to “ultra-lean” required going beyond the production floor. In order to attain a competitive advantage with the additive method, NTi simultaneously leveraged the value chain factors of connectedness, responsiveness and process.

Connectedness

A proprietary process called Rapid Plasma Deposition™ (RPD™) delivers significant reductions in material costs, lead time, and manufacturing steps. To support RPD™, NTi also had to develop control systems and processes that were capable of producing products for aerospace applications, all of which are tied together by a network of face-to-face and electronic networks that inform NTi which parts will most benefit the customer in terms of performance, cost reductions, and improvements to lead times. One of the challenges with connectedness is convincing customers to change their mindset about part design and delivery. Additive manufacturing encourages interactivity in design, demanding imagination and engagement by customers in order to net the full benefits of connectedness. Most supply contracts and relationships lack the incentive structure to encourage genuine solutions adapted to real-time needs and value generation, instead relying on a priori specifications and cost savings. Smart companies are moving past experimental prototype generation and into design thinking toward limitless whole system opportunities. Front-runners have already initiated a paradigm shift in contract and reward structures8.

Responsiveness

Using additive manufacturing processes and heightened connectedness, the work for a single part can be done with unprecedented responsiveness. In the words of industry expert Ervest Arvai who witnessed Norsk’s technology at the Farnborough air show9: “Using titanium wire the firm can build up any part overnight. Yes, overnight. …This takes JIT to a new level.”

High responsiveness requires restructuring the supply chain and information needs in order to serve customers value that they could never otherwise afford. Many aircraft parts have sporadic, unpredictable demand patterns, leading to high holding costs for parts that may not be required for years. A 4-6 week lead time (or less) provides the option of replacing costly safety stocks of slow moving and hard-to-predict parts with supply chain responsiveness; customers receive unprecedented customer service levels at the same time they save tremendously on supply chain costs. This level of responsiveness also facilitates new product innovation, particularly important in the critical design review stage of aircraft development.

Process

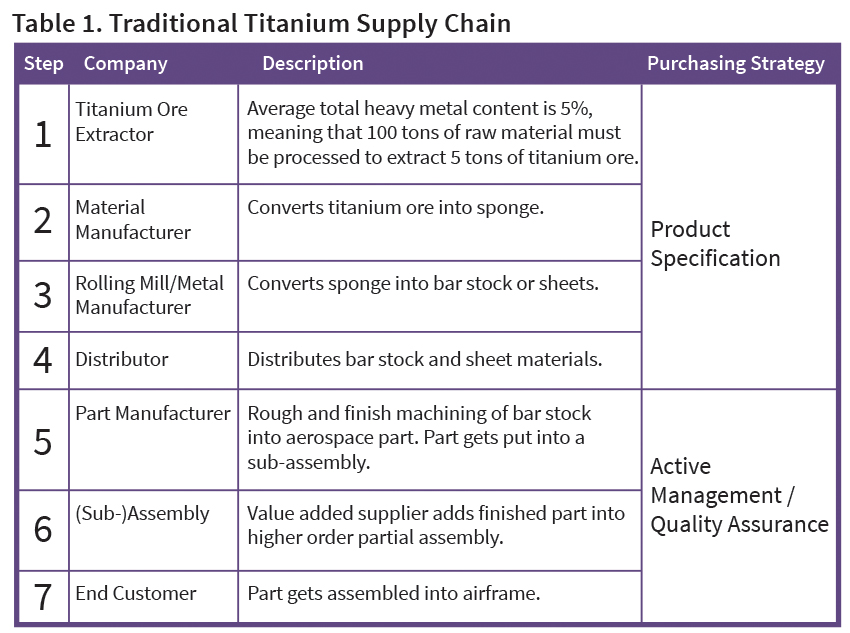

NTi opened the world’s first industrial-scale additive manufacturing plant in Plattsburgh, New York in the fall of 2017. Aerospace grade titanium costs up to $20 per pound compared to aluminum at $13 per pound and steel at $70 per ton. In the aerospace industry, the supply chains for the main engines and titanium components have the longest lead times. The traditional titanium supply chain consists of seven stages, each potentially carried out by a different entity (see Table 1).

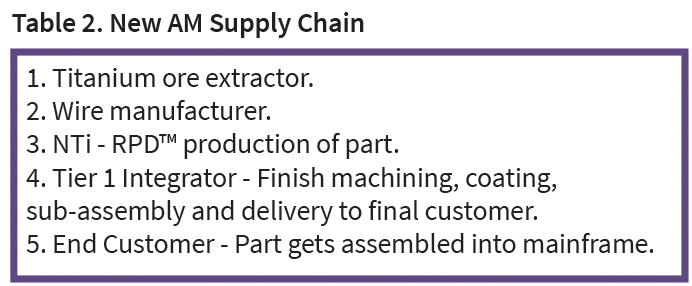

Additive manufacturing requires a supply chain (Table 2) with fewer stages and less complexity. Using wire as the only feedstock material, raw material inventory is greatly reduced, eliminating the need for various sized bar stock and sheet material, all of which have long lead times and complex inventories. Norsk reduced the 55 to 75 week average titanium lead time to 4 to 6 weeks.

The additive manufacturing process produces a near-net-shape part, greatly reducing machining required to finish the product. The buy-to-fly ratio for additive manufacturing ranges from 1.5 to 3.1 times as much raw material purchased than ends up in the final finished product, compared to a ratio of 6 for the traditional subtractive process. Since less material needs to be removed, downstream machining operation times and machining costs are reduced. A further benefit is a reduction in the use of milling fluids and electricity – positive impacts on sustainability.

Conclusion

The digital trifecta of connectedness, responsiveness and process results in exponential efficiency improvements that exemplify the pioneers of digital supply chains. Norsk’s success results from simultaneously developing several technology, process and relationship innovations. The greatest impact of digital supply chain advances like additive manufacturing will coincide with a variety of other technologies, such as artificial intelligence, robots and the Internet of Things. Adopting digital technologies like additive manufacturing lowers costs while providing increased levels of customer service and design flexibility. Competitive strategy shifts from defining value before the market knows what it needs to co-create value in response to actual market needs. These technologies further the blurring of the physical and virtual worlds, requiring companies to re-invent the traditional roles of suppliers and customers.

[/ms-protect-content]

About the Authors

Michael Gravier is Associate Professor of Marketing and Supply Chain Management at Bryant University with a focus on logistics, supply chain management and strategy and international trade.

Michael Gravier is Associate Professor of Marketing and Supply Chain Management at Bryant University with a focus on logistics, supply chain management and strategy and international trade.

Christopher Roethlein, Ph.D. is Professor of Operations Management at Bryant University with a focus on supply chain management, quality and strategy.

Christopher Roethlein, Ph.D. is Professor of Operations Management at Bryant University with a focus on supply chain management, quality and strategy.

John K. Visich is Professor in the Management Department at Bryant University where he teaches courses in operations management, supply chain management and corporate social responsibility.

John K. Visich is Professor in the Management Department at Bryant University where he teaches courses in operations management, supply chain management and corporate social responsibility.

References

1. CapGemini, (2016). “The current and future state of digital supply chain transformation”, GT Nexus, pp.1-12.

2. Andrews, D., C. Criscuolo, and P. N. Gal, (2017), “The best vs the rest: The global productivity slowdown hides an increasing performance gap across firms”, VoxEU, European Union’s Center for Economic and Policy Research, available at http://voxeu.org/article/productivity-slowdown-s-dirty-secret-growing-performance-gap; Andrews, D, C Criscuolo, and P. N. Gal, (2016) “The Best versus the Rest: The Global Productivity Slowdown, Divergence across Firms and the Role of Public Policy”, OECD Productivity Working Papers No. 5, OECD Publishing, Paris.

3. Dawar, Niraj (2013), “When marketing is strategy”, Harvard Business Review, Vol. 91 No. 12, pp.100-108.

4. Naylor, J. B., Naim, M.M., and Berry, D. (1999), “Leagility: integrating the lean and agile manufacturing paradigms in the total supply chain,” International Journal of Production Economics, Vol. 62 No. 1/2, pp. 107-118.

5. Mason-Jones, R., Naylor, B., & Towill, D.R. (2000), “Engineering the leagile supply chain”, International Journal of Agile Management Systems, Vol. 2 No. 1, pp. 54-61.

6. Kopp, C. (2007), Assessing the F-22A Raptor. Technical Report APA-TR-2007-0105, Air Power, Australia.

7. Airbus (2017), Global market forecast: Growing horizons.Retrieved November 24, 2017, from http://www.airbus.com/content/dam/corporate-topics/publications/backgrounders/Airbus_Global_Market_Forecast_2017-2036_Growing_Horizons_full_book.pdf ; Boeing (2017), Current market outlook, 2015-2034. Retrieved November 24, 2017, from http://www.boeing.com/resources/boeingdotcom/commercial/market/current-market-outlook-2017/assets/downloads/2017-cmo-6-19.pdf

8. For example, Vitasek, Kate, and Karl Manrodt (2012), “Vested outsourcing: a flexible framework for collaborative outsourcing”, Strategic Outsourcing: An International Journal, Vol. 5 No. 1, pp. 4-14.

9. Arvai, Ernest (2016). “Farnborough 2016 Was Far From Boring – If You Knew Where To Look”, Air Insight,July 19. Retrieved November 30, 2017, from https://www.airinsight.com/premium-farnborough-2016-far-boring-knew-look/