By Simone Corsi & Max von Zedtwitz

Recognising the growing role that emerging economies play in the global innovation landscape, the article provides a measure for the extent of the phenomenon identifying Asia as the main source of a new threat – and opportunity – for Western companies: reverse innovation.

Introduction

With production and the supply chain increasingly moving to low-cost countries in Asia-Pacific, and local markets in China and India expanding at three to four times faster than in the US and Europe, creativity and innovation were among the few advantages global managers thought that could be retained in the West.

It appears that even this domain is being taken over by competitors from the Far East.

“Reverse Innovations”, i.e. innovations that are “adopted first in a poor country before being adopted in rich countries” (Immelt et al., 2009, and later Govindarajan and Ramamurti, 20111), or also innovations that were explicitly designed and invented in such developing markets and later spilled over into advanced country markets (von Zedtwitz et al., 20152), are more and more capturing our attention… and our fears: Are established companies in Europe and the US finally losing their last remaining edge, their fundamental source of long-term competitiveness, to new upstarts from Asia? Will Chinese and Indian companies start to out-innovate us now? How serious is this threat?

The Threat of Insignificance

Of course, firms from Asia-Pacific have out-innovated us in the West already for decades. Japanese firms have done so since the 1970s, and Korean firms since the 1990s. As significant their contribution to global R&D and innovation was at the time (and still is), it pales to the rise of China and India that is supported by the even more impactful growth in their local markets. This has, for a time, redirected innovation to domestic needs and markets, and misdirected Western companies to believe that they retained an upper hand in their own R&D and innovation effort.

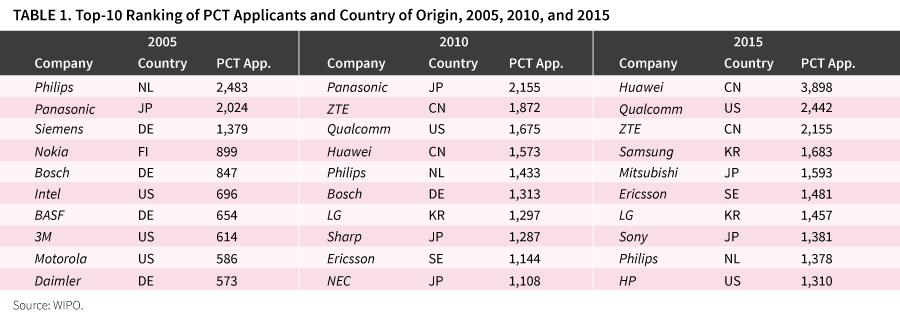

[ms-protect-content id=”9932″]This is no longer the case, as one can easily see from Table 1 (see table 1 below). Western firms held a strong and comfortable position among the top-10 PCT filers in 2005 (PCT are global patents filed under the Patent Cooperation Treaty). Only five years later, three Japanese companies were in the top-10, with the number one spot going to Panasonic. Just last year, in 2015, six companies in the top-10 are from Asia-Pacific, with two of the top three positions being held by companies from an emerging country: China.

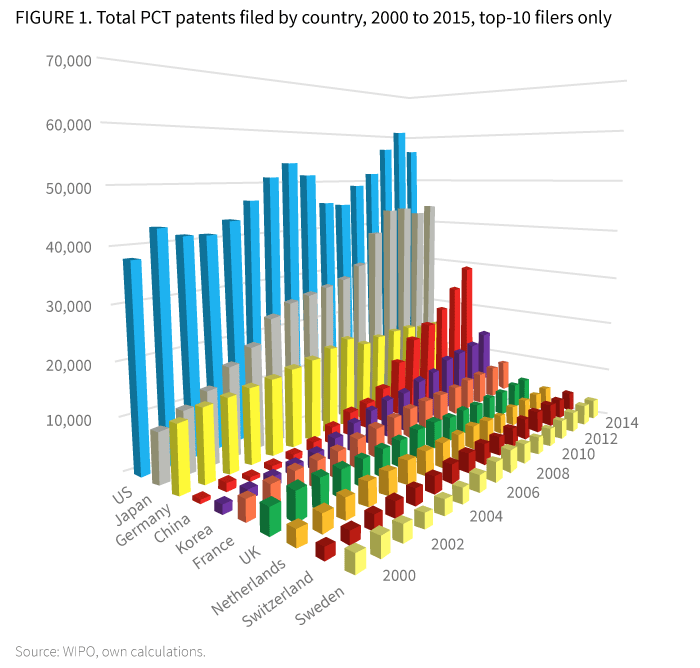

The same picture presents itself in the top-100 PCT rankings. In 2005 Europe led the field with 35 companies, the US had 32, and Japan 27. By 2015 the US dropped to 24 companies, Europe declined to 28, while Japan rose to 36. China jumped from one to 7 firms in just 10 years, with two of these companies – Huawei and ZTE – often topping the ranking. Overall, PCT patents filed by Chinese companies rose an average of 27.5% per year from 2000 to 2015 – the highest growth of any country over this time span. Korea, India, and Japan, even Mexico all had growth rates exceeding 10% over the same period, while countries such as the US, the Netherlands, the UK, and Sweden all rose by no more than 3% (see Figure 1 below).

China especially has increased its R&D spending, starting from as little as 0.54% of GDP in 1996 to 2.0% in 2012, and planning to invest 2.5% by 2020. In comparison, the US spent 2.8% of their GDP in 2012, while the EU average was at 1.7% – yes, Europe now is more similar to a developing country when it comes to R&D investments.

It is therefore no surprise that managers of Western companies look towards Far-East Asia with some apprehension, and a fair amount of uncertainty as to their own long-term innovation prospects. The good news is that – so far – few reverse innovations have truly made a global impact. Much of the talk is perhaps just hype, as many of these reverse innovations appeal more strongly to low and mid-end markets in their own home countries than they do to the sophisticated customers in the West. However, this really is bad news, since it is presently predominantly Western companies that control the flow of innovations from China and India, and thus this is a sign that the West has still not even started to comprehend how to really leverage the creativity and innovation that emerges in the East. All the R&D investment in Asia, especially China, will take decades to ferment before it reaches market maturity in the form of new product innovations, and we expect a tide of reverse innovations to be launched by Asian firms in the next few years. While this sounds like bad news for Western companies, the good news ultimately is that these new technologies and innovations will increase the quality of life for everyone – including us Westerners – whether they are invented and originally owned by companies from China, Europe or the US.

The Challenge Ahead

Reverse innovation will therefore impact us in many different ways. Let us focus on implications for managers in charge of companies that invest in and facilitate the spread of global innovations.

Executives of Western multinational firms with responsibilities for products and markets in Europe and the US will see reverse innovation both as an opportunity and as a threat. On the one hand, there is the potential to pass on reduced costs and improved product-market fit to customers, helping to secure a market premium for themselves. Companies have successfully pursued this strategy for decades, redesigning products to suit emerging market niches and pricing them gainfully. Defeatured and cost-redesigned products sourced from inventors in China and India are just an extension of this long-established approach. One of the inspirations for reverse innovation is exactly one such example: GE’s development of low-cost electrocardiogram devices in India, or its portable ultrasound machines in China. On the other hand, much more so than before, they will not only pass on cost advantages but also product risks and liabilities, further kindled by actual or perceived quality differentials between Chinese and Western products, and requiring substantial attention to retain the premium value label many Western firms have enjoyed for so long. Already now, companies are stretched to demonstrate that their products perform as promised, especially if components are built by third-party providers in countries of very different ethical and operational standards. For instance, Swiss firms are permitted to use the label “Swiss-made” only if at least 50% of the production costs are borne in Switzerland, and the most important part is carried out in Switzerland. This threshold is raised to 60% for electronic watches, and 80% for mechanical watches. Western managers are thus very concerned about the potential of low-cost but good-enough quality competition from reverse innovation, and see even products from their own Asian subsidiaries as undermining their own livelihoods at home.

Directors of Western subsidiaries in China, India and other emerging markets will need to be sensitive to this attitude by their home-based colleagues. At the same time, they see the opportunity of tapping into the local ingenuity and fast-developing expertise in many product and technology sectors that were transferred from the West first by moving production and later by shifting R&D resources. They would be poor managers if they overlooked this potential. In addition, their local teams are itching to prove their worth to the global headquarters, to shed the perception that they only produce low quality results at low labour costs. If they are held back, they will quit and join more open-minded competitors or local startup firms. Such was the case for the Italian mid-sized company Speres, whose Suzhou-based R&D team developed an innovative product well ahead of everybody’s expectation (Corsi et al, 2014).3 Fearing product cannibalisation at home, the HQ initially blocked further development activities until the local general manager used all his personal skill and influence to convince his superiors of the appropriate way forward. Without his ability to champion for his Chinese innovation team, this reverse innovation would have been stifled and resulted in a quick deflagration of talent from the company’s China subsidiary. Local subsidiary directors will need to skilfully orchestrate the powers in charge – HQ-based global business development, global R&D strategy, product category boards, and so on – to allow them the freedom to develop reverse innovations that do not challenge home-turf markets outright, that do not cannibalise revenues and profits at the global scale for a local benefit.

Last but not least, there are more and more executives of those emerging market firms that have an increasingly international, well-informed outlook on business development. Their advantage lies in their superior understanding of local talent and technology, lest not their ability to control local resources better than the foreign Western multinationals. Perhaps they started to internationalise as OEM partners to global firms, such as the Chinese baby stroller maker Goodbaby. Over the course of two decades, this Kunshan-based startup became the largest stroller company in the world, with nearly 40% worldwide share of strollers rolling over the streets in New York City, Amsterdam or Moscow. Their global network of design centres is a constant source of new designs and market input. Their strollers are made to the highest standards, and they have gone for over a decade without a single product recall on a stroller that they designed internally (as opposed to the designs requested by foreign client companies).

Or perhaps they attack global markets on their own, such as telecom giant Huawei did in the 1990s, initially in markets more similar to their own in Russia, Asia-Pacific, and South America, before it had built up sufficient experience and market might to go after high-tech high-demand customers in Europe and the US. Their foray into North America was marred initially by strong opposition of local multinational companies defending their home market such as Cisco and others, but in the meantime Huawei is undisputedly one of the leaders in the telecommunications industry, and its R&D centres in China are a source of new technology and products globally – a new form of reverse innovation that was unheard of until just a few years ago.

What Should We Do Now?

Luckily, all is not lost, even though we are sure that many Western firms will not be able to cope with the new changed world order.

First, Western firms must accept that learning is a two-way street, and that the knowledge and technology transfer that has gone to China and India for so long has resulted in highly talented and skilled innovators in former fringe markets. It is high time that we start learning from them, for instance, how to adopt frugal innovation into our own high-cost systems, or how to accelerate decision-making at home so that we no longer miss out on emerging business opportunities in fast paced markets.

Second, if we want to protect our home turf, we need to be more determined in defending it. Updating our own skill base and technologies, as mentioned just above, is just one element in this game plan. For too long we have been too careless about our technological advantage, believing in the illusion that we could hide behind sophisticated technologies that would take emerging country competitors generations to understand and reverse engineer. We also have been too short-sighted in believing that our closest competitors are those nearest to us: In fact, most of us don’t even have the faintest idea of how ruthless competition is in the cut-throat business environments of China or India. A bit more cooperation rooted in domestic collaboration might prove useful.

Third, we need to recognise and accept that the West is not the sole possessor of modern technology. The Japanese were the first to show us, then the Koreans, and now even the most conservative business owner in Europe knows about the threat coming from China and India. We are sure that this is not yet the end, and we will see even more talented entrepreneurs and innovators come from e.g. South America and Africa. But for our mutual benefit we can and should reach out to capable partners irrespective of their ethnic or cultural origin. Based on a position of strength, as perhaps established by heeding the advice laid out in the previous two paragraphs, such a partnership can have tremendous benefits for both Western and Eastern firms – and consequently the billions of customers and consumers that rely on them.

[/ms-protect-content]About the Authors

Simone Corsi is Programme Manager of the Lancaster China Catalyst Programme and Research Fellow at Lancaster University Management School. His work focuses on helping UK SMEs developing R&D collaborations with Chinese organisations. His research interests include R&D internationalisation and reverse innovation. He has a PhD in Management from Sant’Anna School of Advanced Studies (Italy).

Simone Corsi is Programme Manager of the Lancaster China Catalyst Programme and Research Fellow at Lancaster University Management School. His work focuses on helping UK SMEs developing R&D collaborations with Chinese organisations. His research interests include R&D internationalisation and reverse innovation. He has a PhD in Management from Sant’Anna School of Advanced Studies (Italy).

Max von Zedtwitz is Professor of International Business and Innovation at Kaunas University of Technology, and Director of the GLORAD Center for Global R&D and Innovation. Previously, he was Professor at Tsinghua, Tongji, and Peking Universities in China, as well as Vice President Global Innovation for PRTM Management Consultants based in Shanghai.

Max von Zedtwitz is Professor of International Business and Innovation at Kaunas University of Technology, and Director of the GLORAD Center for Global R&D and Innovation. Previously, he was Professor at Tsinghua, Tongji, and Peking Universities in China, as well as Vice President Global Innovation for PRTM Management Consultants based in Shanghai.

References

1. Immelt, J.R., V. Govindarajan, and C. Trimble 2009. How GE is disrupting itself. Harvard Business Review 87 (10): 56-65. Govindarajan, V., and R. Ramamurti 2011. Reverse innovation, emerging markets, and global strategy. Global Strategy Journal 1(3-4): 191-205.

2. von Zedtwitz, M, S. Corsi, P. Soberg, R. Frega 2015. A Typology of Reverse Innovation. Journal of Product Innovation Management 32(1): 12-28.

3. Corsi, S., A. Di Minin, and A. Piccaluga 2014. Reverse innovation at Speres: a case study in China. Research-Technology Management 57(4): 28-34.

![Deconstructing the Myth of Entrepreneurship iStock-2151090098 [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/09/iStock-2151090098-Converted-218x150.png)