Charles Schwab has developed an AI system that reads client emails and routes complex questions to humans, while automatically responding to simple ones. The AI platform for financial advisors cut response times from hours to minutes for basic inquiries about account balances and transaction history. Advisors now spend their time on portfolio strategy instead of explaining why a dividend payment is late.

Three Ways Cloud AI Works in Financial Advisory

Financial advisors face the same problem every day: clients want answers faster than humans can provide them. Cloud AI tools promise to solve this by handling routine tasks, but most platforms overpromise and underdeliver on their promises. The ones that work focus on three specific problems: communicating with clients, managing finances, and staying compliant.

Client Communication Tools

Financial advisors answer the same questions daily: account balances, meeting times, and where a statement went.

AI chatbots handle these basic requests without human help. The software reads client messages and responds with account information or scheduling links. Tools like Zocks record meeting conversations and write follow-up emails from the transcript.

But the technology hits walls fast. Complex questions about market crashes or retirement strategy still need human expertise. Clients trust chatbots for simple tasks, not major financial decisions.

The math works like this: save 2-3 hours per day on admin work. Free up time for portfolio reviews and client strategy sessions. Reduce response time from hours to minutes for routine questions.

The limits matter more than the benefits. Chatbots can’t explain why markets dropped 15% last week. They can’t calm down a panicked retiree. The software handles information requests, not emotional support or complex advice.

Portfolio Management Platforms

Financial advisors swim in forms. Client meetings need documentation. Investment recommendations require approval chains. Trade records pile up for audits.

Tools like Jump AI turn meeting recordings into compliant documentation. The software flags potentially risky conversations before they escalate into problems. AdvisoryAI cranks out investment proposals while advisors grab coffee.

Pattern recognition works here. Missing client signatures get caught. Mentions of penny stocks trigger warnings. Standard reports flow through compliance without human review.

Regulators shift rules like weather patterns. Systems trained on 2023 regulations often fail to incorporate 2024 updates. Gray areas still need lawyers, not algorithms. One missed compliance rule costs more than the software saves in a decade.

Compliance and Workflow Tools

Advisors spend more time on paperwork than talking to clients. Every meeting generates forms. Every investment recommendation needs three approvals and a compliance stamp.

Tools like Avanade capture client conversations and automatically build compliant documentation. RegTech platforms scan emails for compliance violations before they reach clients. Workflow software automates the routing of investment proposals through approval chains, eliminating the need for human intervention.

These systems excel at repetitive tasks, such as flagging risky language in client emails, generating standardized disclosures, and tracking deadlines for documentation. Pattern matching works well when rules stay consistent.

Compliance changes faster than software updates. New SEC regulations break systems trained on old rules. Human lawyers still handle edge cases because one missed requirement triggers million-dollar fines.

Cut Cloud AI Costs Without Breaking Performance

1. Data Foundation

Well-organized data enables more efficient fine-tuning and yields more accurate results from AI models. Fix data quality first. Insufficient data is more costly to process and yields poorer results. Build automated data validation pipelines before deploying AI tools.

2. Resource Optimization

Companies like OpenAI utilize model compression techniques to reduce costs without compromising performance through knowledge distillation and the development of smaller models. Right-size compute resources based on actual usage patterns. Align resource allocation with the needs of workloads, rather than over-provisioning.

3. Usage Tracking

Implement usage-based cost allocation to ensure your FinOps team attributes costs accurately and can identify which AI projects are driving the most expenses. Track spending by specific use case, not just by department. Set spending alerts before costs spiral.

4. Automation

Advanced cloud cost management solutions incorporate AI into their technology platforms to automate critical steps and workflows, enabling faster time to cost savings. Automate scaling policies. Schedule workloads during off-peak hours. Use spot instances for non-critical processing.

5. Continuous Monitoring

Understanding use cases, becoming familiar with the costs of AI products and features, and cultivating a culture around cloud FinOps can significantly reduce deployment costs. Review spending monthly. Kill unused models. Benchmark costs against business value delivered.

AI Agents in Financial Advisory

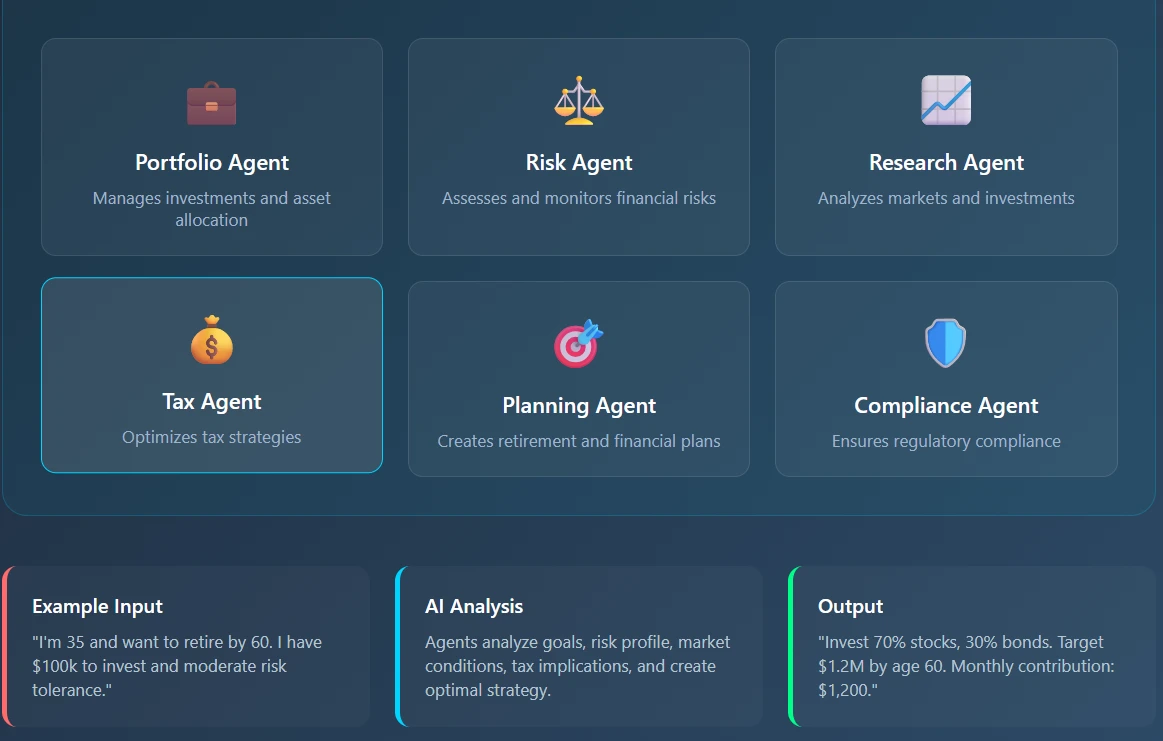

An AI assistant for financial advisors represents a shift from simple chatbots to autonomous software that makes decisions without constant human babysitting. These agents handle messy workflows from start to finish, learning from mistakes along the way.

What Are AI Agents

AI agents are software that handle complete tasks from start to finish without constant human direction. Unlike chatbots that just answer questions, agents make decisions and take actions across multiple systems. They read emails, update databases, schedule meetings, and generate reports while humans focus elsewhere. These programs learn from mistakes and adapt to changing conditions over time. But they still break when encountering scenarios outside their training data.

How Do AI Agents Work Commonly?

AI agents follow a basic loop: sense the environment, decide what to do, then act. They extract information from databases, emails, and APIs to gain a comprehensive understanding of the current situation. The software weighs options against preset goals and selects the most effective action available. Agents execute decisions by sending messages, updating records, or triggering other systems automatically. When something goes wrong, they log the failure and adjust behavior for next time.

How Do AI Agents Work in Financial Advisory?

Financial agents read client portfolios, market data, and regulatory requirements to make investment recommendations. They generate compliant reports, schedule client meetings, and draft follow-up emails based on portfolio performance. These systems connect to CRM platforms and trading systems to execute routine transactions automatically. Agents flag compliance violations before they reach regulators and ensure timely tracking of documentation deadlines. But complex client situations involving emotional decisions still require human advisors because agents lack empathy.

Reduce Cloud AI Costs with AI Agents

AI agents replace human hours, not just computing power. Organizations use AI to automate time-intensive tasks, such as document processing and report generation, which drives significant savings. The math says: agents handle 60% of routine tasks.

Task Automation Strategy

Deploy agents for repetitive work first. AI agents streamline procure-to-pay workflows — automating transactional steps, such as invoice validation and discrepancy checks so that advisors can focus on client relationships instead of paperwork.

Resource Optimization

Agentic AI surpasses GenAI by enabling autonomous decision-making, collaboration, and learning to handle multiple client requests simultaneously. One agent processes hundreds of portfolio reviews while human advisors sleep.

Infrastructure Efficiency

Organizations that implement agentic AI with cloud-native infrastructure report improved performance and reliability because agents scale resources based on demand, not fixed capacity.

Development Cost Reduction

Financial AI agent APIs reduce development costs and time, bypassing months of R&D for immediate ROI, rather than building custom solutions from scratch.

Cutting Advisory Costs with Data Management and Agentic AI

This matrix maps the financial advisory process against two cost-saving levers. Data Management reduces duplication, streamlines reporting, and keeps systems clean. Agentic AI cuts human workload further by automating analysis, drafting, monitoring, and compliance. Together, they lower operating costs without reducing service quality.

|

Financial Advisory Stages |

Cut Costs with Data Management |

Cut Costs with Agentic AI |

|---|---|---|

| Client Onboarding | Centralize KYC data, cut duplication. | Agents verify IDs and spot anomalies. |

| Data Gathering & Profiling | Merge sources, clean data. | Agents auto-collect and update profiles. |

| Risk Assessment & Goal Setting | Use in-house risk models. | Agents run simulations and stress tests. |

| Strategy Development | Reuse past cases, centralize feeds. | Agents draft and optimize portfolios. |

| Proposal Presentation | Standardize templates, single source. | Agents auto-generate tailored proposals. |

| Execution & Transactions | Link trading platforms directly. | Agents monitor and rebalance portfolios. |

| Monitoring & Reporting | Automate reports with live pipelines. | Agents deliver continuous insights. |

| Compliance & Audit | Centralize audit trails. | Agents self-audit and prep compliance files. |

Use Case: Automated Portfolio Rebalancing with Compliance Checks

A mid-size advisory firm runs portfolio rebalancing scenarios for thousands of clients. Each cycle, raw client data is messy and scattered, forcing large LLM calls to clean, interpret, and simulate. Cloud bills spike because AI ends up doing data wrangling and financial reasoning, repeating work.

How Data Management Cuts Cloud AI Costs

- Cleans and normalizes client and market data before it hits the AI layer.

- Deduplicates records to prevent the AI from reprocessing identical data points.

- Keeps historical cases in structured storage, letting the AI query only incremental updates.

This reduces input size for each AI call, cutting token usage and compute costs.

How Agentic AI Cuts Cloud AI Costs

- Agents handle routine tasks (fetching data, comparing allocations, drafting rebalancing notes) without invoking large models every time.

- Agents cache results from previous queries and reuse them in compliance checks.

- They only escalate complex edge cases to the expensive LLMs.

This reduces the number of AI calls and routes work to lighter, more cost-effective compute.

Result

- The advisory team spends less on manual reconciliation.

- Cloud AI costs decrease because both input volume (in terms of tokens) and request frequency are reduced.

- Advisors continue to deliver timely, compliant, and personalized portfolio updates.

The Hard Road to Smarter Financial Advisory

Data management and agentic AI can reduce costs and enhance advisory work, but the path to achieving this is fraught with trade-offs. Each win in efficiency comes with a new demand for governance, oversight, and cultural change inside the firm.

When a financial advisory firm attempts to integrate both data management and agentic AI, the first obstacle typically arises before the AI even begins to work: messy data. Most advisors run on a patchwork of legacy CRMs, trading platforms, and compliance tools. If that data is fragmented or inconsistent, an AI agent will only exacerbate the errors more quickly. The promise of efficiency can quickly collapse into an expensive exercise in debugging.

Even if the data is cleaned, integration remains a grind. Connecting warehouses, client databases, and live market feeds so that AI agents can operate in real time isn’t plug-and-play—it’s heavy engineering work. Once the system is operational, regulators closely monitor it. An AI-generated portfolio rebalance or compliance note still needs a clear audit trail. “The agent decided it won’t pass SEC or MiFID checks.

There’s also the matter of cloud costs. Poorly orchestrated AI agents can flood APIs with unnecessary calls, consuming excessive compute and tokens. The efficiency gain then flips into an unplanned expense line. At the same time, advisors worry about trust—too much automation, and clients may feel the human judgment they pay for has been hollowed out.

Behind all this lies the most significant challenge of all: security. Financial data is among the most sensitive information any business handles, and moving it into cloud-based AI environments raises fears of leaks, breaches, and cross-border data issues. Add the risk of silent failures—agents missing alerts or misinterpreting data—and the firm needs fallback systems just to stay safe.

More Competent Advice, Cheaper AI—The Real ROI of Data and Agents

Financial advisory firms stand at a crossroads. Data Management cuts waste by keeping information clean, structured, and reusable. Agentic AI reduces manual effort by automating the workflows that drain advisor time. Together, they don’t just lower operating costs—they make cloud AI itself cheaper to run by reducing input volumes, eliminating redundant calls, and routing work to more efficient systems. However, none of this comes without cost: the gains require stronger governance, tighter security, and cultural change within advisory teams. The firms that succeed will be those that treat AI as infrastructure—something to be engineered, monitored, and continuously improved.