There is no doubt that the world is heading full-speed towards a digital society. This is true in virtually every corner of every country. The result is an intimately interconnected world that links close to 8 billion people to each other almost instantly.

With this amazing opportunity for collaboration and cooperation come certain inevitable risks. One of the foremost concerns within the digital sphere is identity verification. How do you tell that someone thousands of miles away is who they say they are if you have never met them before?

These challenges go beyond interpersonal relationships. Nefarious characters exploit this nexus of physical distance and digital proximity to further their own agendas. It has become the basis of fraud, money laundering and terror financing around the world at such a scale that national governments have been forced to enact rigorous laws to counter it.

While governments may have almost infinite resources to combat these issues, most businesses do not. This leaves them vulnerable to a variety of underhanded attacks that can not only cause them financial harm but also enmesh them in legal issues that have far more serious consequences for their proprietors and/or shareholders.

Several solutions to this problem have been developed by forward-thinking analysts. One of the simplest is a digital kyc service.

What is a KYC Service?

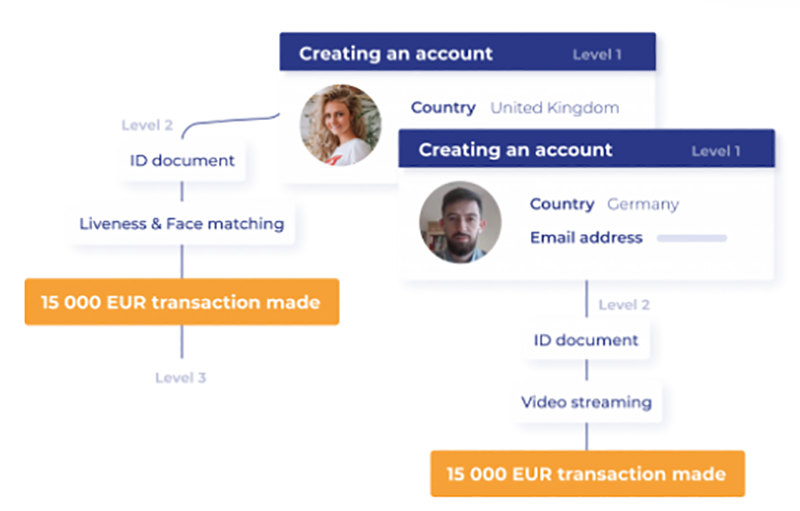

KYC stands for Know Your Customer. It is essentially an identity verification service that allows a business or organization to confirm that the person with who they are interacting is, in fact, the person they claim to be. This is done using a combination of personal data and document verification.

Today, KYC technology is increasingly popular in both the government and private sectors. In fact, almost every KYC request made by a private institution includes a requirement for government-issued ID or related documents. One of the most important factors within the series of checks that follow is biometric verification.

In the not very distant past, it would have been impossible for a system to effectively verify a person’s ID through 2-dimensional images on a screen. That is no longer the case. Modern face recognition software uses precision measurements between predefined points of the features on an individual’s face and head to identify them personally.

This process is completed with such a high degree of precision that a check that takes just a few seconds can distinguish between billions of faces. It is so reliable that it can even tell apart twins when the people who know them personally cannot.

The KYC process goes beyond just identifying individuals against a set of government-issued IDs. As scammers and terrorists use ever more sophisticated methods to bypass checks, they are being countered by databases that include blacklists.

By not just verifying personal ID but also cross-checking it against third-party databases of potentially suspicious and/or criminal characters, organizations place an additional hurdle between themselves and individuals with negative intentions.

The Case for Digital KYC

Non-digital KYC has existed for a long time. We have all had to display our documents at banks and other offices for a face-to-face verification with government and private sector officials. Among the prime drivers of this shift towards digital KYC is the automation factor.

Leading KYC technology providers hit an automation rate as high as 95%. This means that only 1 in 20 applicants who undergo the KYC process have to have their KYC verified by an actual person. The savings in time, labor and management costs are massive. For institutions that deal with thousands of applicants, digital KYC is not an expense but an investment that pays for itself in a very short period of time.

Another factor that has helped to accelerate the adoption rate of digital KYC is the prevalence of mobile devices. Virtually all adults use at least one mobile device, be it an iOS or Android gadget or a laptop. This mobility brings with it the convenience of instantaneous verification, wherever they may be.

The benefits are manyfold for every business:

- The added security comes at a lower cost than required to maintain legacy systems

- It removes the possibility of corruption on the individual level affecting the KYC process

- Digital KYC insulates them against possible legal and financial penalties

- It expands your international potential client base instantaneously

- Data analytics allow you to identify patterns which indicate the likelihood of fraud

- Blacklists reject potentially troublesome clients without expending time and effort

- Whitelists accelerate onboarding for reliable clients

With such comprehensive and far-reaching advantages, it simply makes sense to shift your operations towards digital KYC.