By Adam J Bock and David Johnson

In knowledge-intensive fields, new ventures live or die within entrepreneurial ecosystems. This article shows how policymakers can nurture entrepreneurial ecosystems to fix broken triple helixes at the university-industry (U-I) boundary. The authors investigated university-based venturing activity in the stem cell field to identify missing links in triple helixes.

Technology transfer has become big business. Between 1996 and 2010, technology transfer in the US contributed $388 billion to GDP via thousands of license agreements and more than 4,000 start-ups.1 Research universities have embraced technology commercialisation as part of the “triple helix model” to drive innovation and regional economic development.2 Policy-makers at all levels have focused attention on practices and resources that accelerate technology transfer and tech venture growth.3 These policies, however, often fail to support the development of entrepreneurial ecosystems just beyond the U-I boundary where new tech ventures thrive or die.

Without a robust entrepreneurial ecosystem, the triple helix of government, industry and university, primarily benefits entrenched firms with less motivation to innovate technologies and business models.

University spinouts are a unique and fragile breed. They often combine world-class science with new and inexperienced founders, testing asset-intensive business models in capital-poor environments. These fledgling firms face an extraordinary array of uncertainties, spanning technical, operational, and market unknowns. Some, like Wisconsin-based Nimblegen and Tomotherapy, grow rapidly and exit via IPO or acquisition. These exits return wealth and knowledge to the ecosystem. But many spinouts stall, struggling year-to-year just to raise enough capital to stay alive. From a university and public policy perspective, these are triple helix successes generating employment. These firms, however, absorb critical ecosystem resources, preventing valuable capital, knowledge, and people from being recycled into better opportunities. Neither alive nor dead, “zombie” ventures are a signal for ailing entrepreneurial ecosystems unlikely to generate fast-growth “gazelles” that drive high-value job creation.

Emerging ecosystems in regenerative medicine

To go beyond the triple helix to healthy entrepreneurial ecosystems, it helps to look at an emerging sector rife with uncertainty. The regenerative medicine sector, commercialising stem cell technology, will eventually revolutionise the health care industry.4 Despite research and tool sales exceeding $15 billion,5 commercialising stem cell products requires navigating complex and often conflicting intellectual property (IP) and market regulations. To-date, there are no FDA / EMA approved stem cell therapeutics. The high level of uncertainty has kept big pharma on the sideline, while universities and new ventures drive the majority of innovation and development.6

Regenerative medicine entrepreneurial ecosystems (RMEEs) face unique challenges. Stem cell technologies present complex institutional, ethical and legal issues for university TTOs.7 The academic scientists essential to technology translation must balance potentially conflicting scientific and commercial identities.8 Entrepreneurs in nascent ecosystems struggle to identify and emulate institutional norms that will facilitate venture growth.9 In the regenmed sector, ecosystems at the U-I boundary are the leading edge; stem cell entrepreneurs are at the sharp end facing the unknown.

We studied the nascent entrepreneurial ecosystems that have formed around three stem cell research institutions. The University of Edinburgh (UK), where Dolly the Sheep was cloned, is one of the leading regenerative medicine programs in Europe. The University of Wisconsin-Madison (United States), where James Thomson first isolated primate and human stem cells, is a global leader in regenerative medicine research and technology transfer. Skolkovo Institute of Science and Technology is a new research university in Moscow, formed in partnership with MIT. All three universities have active programs to develop and commercialise stem cell innovations.

Policymakers must go beyond triple helix connections to build robust entrepreneurial ecosystems in knowledge-intensive fields like regenerative medicine. Doing so requires rewriting the standard playbook for tech venturing at the U-I boundary. Research-driven entrepreneurs need specific coping strategies and knowledge collaboration practices to address uncertain markets. Institutions and government must embrace failure as a necessary component of health entrepreneurial ecosystems.

The triple helix model requires three “patches” to function properly under conditions of high uncertainty and knowledge-intensive innovation. We discuss these and also note the “placebo” most commonly used in entrepreneurial ecosystems.

Patch #1: Inspire independence

Uncertainty is ubiquitous in RMEEs. It affects everyone, but everyone responds differently. Entrepreneurs, financiers, institutional leaders and government policymakers cope with uncertainty by making decisions without complete information. RMEE participants rely on two coping strategies. A problem-based coping response attempts to resolve the underlying cause of uncertainty via information-seeking, lean experiments, or risk-sharing partnerships. An emotion-based coping response assumes the uncertainty cannot be resolved. Participants focus on leveraging available resources and mitigating the perceived downside of missing information.10

Entrepreneurial culture at the central institution appears to play a critical role in the dominant coping strategy used in the ecosystem. When the university encourages independence and entrepreneurial thinking, the ecosystem utilises problem-based coping. When the university attempts to protect resources, the ecosystem tends towards emotion-based coping.

From a psychological perspective, different coping strategies bring value to different situations. But in RMEEs, like many high-technology sectors, knowledge is disproportionately valuable and rapidly-changing. Emotion-based coping may help ventures through short-term crises, but hold little promise for adaptation in industries with accelerating rates of technological change.11

The policies designed to protect technology and new ventures, are, in effect, hindering the development of the entrepreneurial ecosystem. Overly restrictive IP licensing terms and programs that shield new ventures from market forces limit opportunity-seeking behavior and entrepreneurial learning. These policies might maximise the university’s licensing revenue on any one deal, or stave off near-term failure for any one deal. But over time, these policies slow rates of learning, innovation, and growth in the ecosystem.

Tomotherapy provides an excellent example from another knowledge-intensive field. GE sponsored and then abandoned innovative radiotherapy research at UW-Madison. Founder and CEO Paul Reckwerdt took the venture out of the university and tackled every unknown as a problem to be solved. Without the protection of the University or GE, Reckwerdt and his team were forced to become industry and market savvy. The uncertainties of funding, product launch, market entry, and scale-up could be mitigated with prioritisation. He explains the process with an engineer’s methodical analysis: “Business is not rocket science…. There’s a thousand things happening here, and you have to balance them off each other and do triage and balance their impact… you have to make the shortest path to the minimum viable product, so you can get it out there to bring money in so you can pay for future research.” As just one example, the company’s revolutionary Hi-Art helical radiotherapy device received FDA clearance in less than 6 months. Tomotherapy went public in 2007 at an $800 million valuation. Since then, the founders and executives have started, run, and funded more than half a dozen other technology ventures.

Patch #2: Promote knowledge collaboration

Coping strategy is only half the story. In knowledge-intensive sectors, knowledge collaboration is essential because early stage ventures are unlikely to possess sufficient interval knowledge.12 In RMEEs, knowledge collaboration may appear high-risk, because IP is valuable, tightly controlled, but hard to enforce across geographic boundaries. Because regenerative medicine market information is incomplete, new ventures are appropriately wary of sharing information about proprietary technologies and novel business models.

In this case, self-reliance is the problem. Entrepreneurs and ventures that apply the “independence” mantra to knowledge development are more likely to miss emerging market opportunities. They are also at risk of ignoring early market feedback about product capabilities and minimum customer value requirements.

Collaborative knowledge development is difficult. Entrepreneurs in knowledge-intensive sectors walk a fine line between protecting critical IP and partner-based knowledge creation. Cellular Dynamics, James Thomson’s stem cell spinout venture, found the right balance. The company set up collaborative development projects with carefully selected biotech and pharma partners. At the same time, it offered research “grants” to academic scientists working on induced pluripotent stem cells (iPSCs) technologies closely related to its own products. Finally, it created parallel “blue sky” funding for internal projects. Multiple paths ensured that the company stayed at the leading edge of knowledge creation and collaboration in this incredibly uncertain field. The company was first to market with more than a half-dozen iPSC types and was the Wall Street Journal’s most innovative company in the world in 2011. Cellular Dynamics was acquired by FujiFilm in 2015 for $307 million.

It is also useful to note the role of ecosystem recycling: the funders and executive team at Cellular Dynamics had previously led two other university spinouts: Third Wave Technologies and Nimblegen. Third Wave, the first true equity spin-out from UW-Madison, went public in 2001 and was ultimately acquired by Hologic for $580 million. Nimblegen was acquired by Roche in 2007 for $272 million. Healthy entrepreneurial ecosystems recycle successful entrepreneurs and exit-event wealth into new ventures.

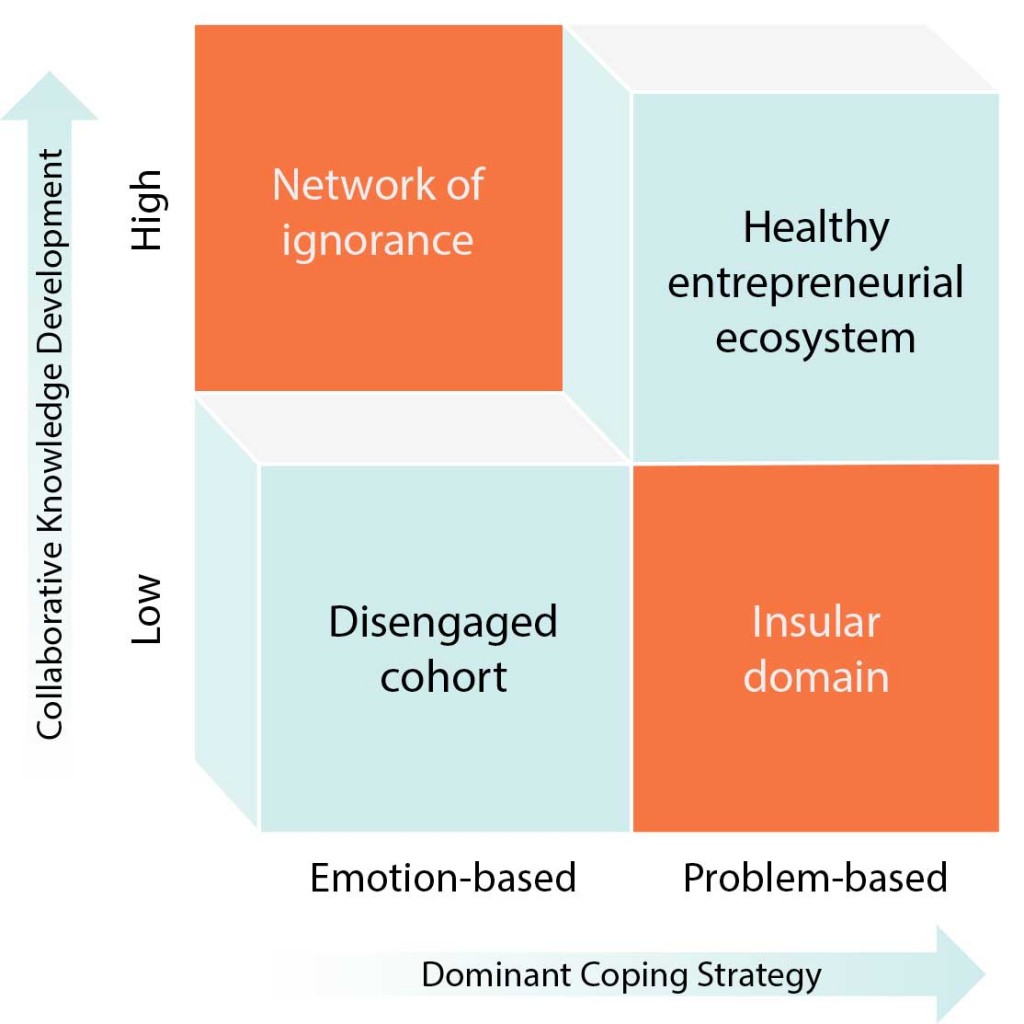

Figure 1 shows the ecosystem types based on the dominant coping strategy and level of collaborative knowledge development. Healthy ecosystems arise when ventures utilise problem-based coping and collaborative knowledge development. This is encouraging because our research found that these two characteristics are correlated – the presence of one tends to encourage the other. On the other hand, emotion-based coping and low collaborative knowledge development are also correlated, generating clusters of disengaged firms focused internally on available resources.13

The mixed outcomes are less likely but important to recognise. Insular domains result when entrepreneurs and ventures are problem-solvers but poor collaborators. Of most concern, however, are networks of ignorance that result from collaboration among ventures utilising emotion-based coping. Here, homophily effects lead ventures with flawed technologies and commercialisation models to seek out firms living with the same misconceptions. Because these firms prefer to deny the effects of uncertainty, they generate networks that serve as echo chambers, failing to adapt to changing technology regimes and market conditions. A significant number of zombie ventures suggests a network of ignorance.

To avoid networks of ignorance, policymakers can create open-access forums where scientists, entrepreneurs, and industry leaders can test assumptions about technologies and markets. Encouraging participation by a wide variety of knowledge leaders brings more knowledge, including marginal ideas to the discussion. When market data is scarce or nonexistent, as is the case with nascent fields like regenerative medicine, the best option is to generate collaborative knowledge bases to explore possibilities, rather than rely on internally-generated assumptions.

The Placebo: “Entrepreneurial” training for scientists

As research universities attempt to meet policy expectations for entrepreneurial activity, many have begun providing “entrepreneurial” training to scientists. This is, at best, a placebo; there is no compelling evidence that entrepreneurial training improves venturing outcomes. At worst, it inflates expectations and increases the potential for cohorts of zombie ventures. General business skills training and entrepreneurial awareness are valuable to nearly any type of student, including career scientists. Supply-driven entrepreneurial activity, however, tends to generate products looking for markets and higher rates of failure.

Patch #3: Embrace (some) failure

Successful ventures are a measure of an ecosystem’s potential. It is the failures, however, that indicate the ecosystem’s overall health and resilience. Unfortunately, universities usually seek to shield academic entrepreneurs and new ventures from market forces to safeguard their survival. The intention is good: nurturing fragile ventures seems obvious. Low failure rates appear to demonstrate effective use of public funds and encourage more venturing activity.

But failure is an unavoidable element of entrepreneurial ecosystems, providing value at the individual and community level.14 Healthy ecosystems and smart entrepreneurs do not avoid or ignore failure, they learn from it.15 Rapid failure and recycling of organizational resources provides critical, sometimes low-cost, resources to emerging and rapidly growing ventures. Artificially supporting ventures traps key people and drains the ecosystem of risk capital. Zombie companies may pad university spin-out statistics and provide lifestyle income to scientist-founders, but they are entrepreneurial ecosystem parasites. High failure rates are a necessary outcome of the experimentation process required when entrepreneurs utilise problem-based coping strategies.

Universities and government policymakers must accept some failure to foster healthy entrepreneurial ecosystems. Industry expects new ventures to de-risk technologies and go-to-market strategies. If governments and universities attempt to mitigate or stigmatize failure, the triple helix can’t function properly. Universities should be less concerned with protecting new ventures from inevitable market forces; TTOs should loosen their selectivity of technologies for possible spin-off. Failed ventures are a necessary by-product of robust ecosystems and active technology commercialisation programs. Reporting and even celebrating failure, however, may be difficult for universities and government policymakers to accept.

Coping strategies, knowledge collaboration, and failure play key roles in healthy entrepreneurial ecosystems. Policymakers should go beyond the placebo effect of general business training to patch up triple helixes, especially in knowledge-intensive technology fields like regenerative medicine.

About the Authors

Adam J. Bock is Associate Professor of Management at Edgewood College and Senior Lecturer in Entrepreneurship at The University of Edinburgh Business School. He studies technology ventures to explain why entrepreneurs commercialise innovations and how they develop new business models. Adam is the co-author of Models Of Opportunity: How entrepreneurs design firms to achieve the unexpected (2012, Cambridge) and Inventing Entrepreneurs (2008, Prentice-Hall). He is the co-founder of three university spin-out companies.

Adam J. Bock is Associate Professor of Management at Edgewood College and Senior Lecturer in Entrepreneurship at The University of Edinburgh Business School. He studies technology ventures to explain why entrepreneurs commercialise innovations and how they develop new business models. Adam is the co-author of Models Of Opportunity: How entrepreneurs design firms to achieve the unexpected (2012, Cambridge) and Inventing Entrepreneurs (2008, Prentice-Hall). He is the co-founder of three university spin-out companies.

David Johnson is a Doctoral Candidate at the University of Edinburgh Business School and former Visiting Scholar at The Wisconsin School of Business at The University of Wisconsin-Madison. His research on regenerative medicine entrepreneurial ecosystems has been accepted for publication in the Journal of Technology Transfer as well as Research in Translation (Elgar, UK).

David Johnson is a Doctoral Candidate at the University of Edinburgh Business School and former Visiting Scholar at The Wisconsin School of Business at The University of Wisconsin-Madison. His research on regenerative medicine entrepreneurial ecosystems has been accepted for publication in the Journal of Technology Transfer as well as Research in Translation (Elgar, UK).

References

1. The Association of University Technology Managers. http://www.autm.net/AM/Template.cfm?Section=

Tech_Transfer&Template=/CM/ContentDisplay.cfm&ContentID=14734

2. Etzkowitz, H. & Leydesdorff, L. (2000) The dynamics of innovation: From national systems and “Mode 2” to a Triple Helix of university-industry-government relations. Research Policy, 29(2), 109-123.

3. Audretsch, D.B. (2014) From the entrepreneurial university to the university for the entrepreneurial society. Journal of Technology Transfer, 39, 313-321.

4. Chien, K.R. (2008) Regenerative medicine and human models of human disease. Nature, 453, 302-305.

5. https://www.alliedmarketresearch.com/regenerative-medicines-market

6. McKernan, R., McNeish, J. & Smith, D. (2010) Pharma’s developing interest in stem cells. Cell Stem Cell, 6(6), 517-520.

7. Hogle, L.F. (2014) Regenerative Medicine Ethics: Governing Research and Knowledge Practices. Springer, New York.

8. George, G. & Bock, A.J. (2009). Inventing Entrepreneurs: Technology Innovators and their Entrepreneurial Journey. Pearson Prentice Hall.

9. Santos, F.M. & Eisenhardt, K.M. (2009) Constructing markets and shaping boundaries: Entrepreneurial power in nascent fields. Academy of Management Journal, 52(4), 643-671.

10. Johnson, D. & Bock, A.J. (forthcoming) Coping with uncertainty: Entrepreneurial sensemaking in regenerative medicine venturing. The Journal of Technology Transfer.

11. Derfus, P.J., Maggitti, P.G., Grimm, C.M. & Smith, K.G. (2008) The Red Queen effect: Competitive actions and firm performance. Academy of Management Journal, 51(1), 61-80.

12. Zahra, S.A. & George, G. (2002) Absorptive capacity: A review, reconceptualization, and extension. Academy of Management, 27, 185-203.

13. Bock, A.J. & Johnson (forthcoming) Translating regenerative medicine: A cross-national study of entrepreneurial ecosystem development under uncertainty. In, Phan, P. (Ed) Research in Translation, Elgar, UK.

14. Cardon, M.S., Stevens, C.E. & Potter, D.R. (2011) Misfortunes or mistakes?: Cultural sense-making of entrepreneurial failure. Journal of Business Venturing, 26(1), 79-92.

15. Miner, A., Kim, J.Y., Holzinger, I.W. & Haunschild, P. (1999) Fruits of failure: Organizational failure and population level learning. Advances in Strategic Management, 16, 187-220.

[/ms-protect-content]