By Suman Sarkar

Suman Sarkar has advised leaders at dozens of disrupting Fortune 500 companies. Executives, he says, focus too much on technology and short-term stock performance and not enough on the customer needs that are actually driving the disruption. Here he gives strategies for keeping ahead of the customer curve. As Jeff Bezos said: “If your customer base is aging with you, then eventually you are going to become obsolete or irrelevant. You need to be constantly figuring out who are your new customers, and what are you doing to stay forever young.” Sarkar shows readers how to do this.

Disruption – the brutal roiling of markets, caused by customers’ ever-changing needs – drives business failure and success. Most people think technology drives disruption, but technology merely enables disruption; changing customer needs cause it.

Take a look at the packaged food industry. Food giants – Kraft, Kellogg, and Campbell Soup – are facing declining sales and responding with mergers, acquisitions, and changes to their leadership teams. But none of these address the real cause of the disruption: Customers – especially Millennials – want organic, sustainable, and locally grown food. Some companies delivered: Think of how WhiteWave took over the market with Silk nut and soy milks as well as Horizon’s organic milk from local cows. Across the food industry, old giants are floundering, and upstarts catering to the new tastes are flourishing.

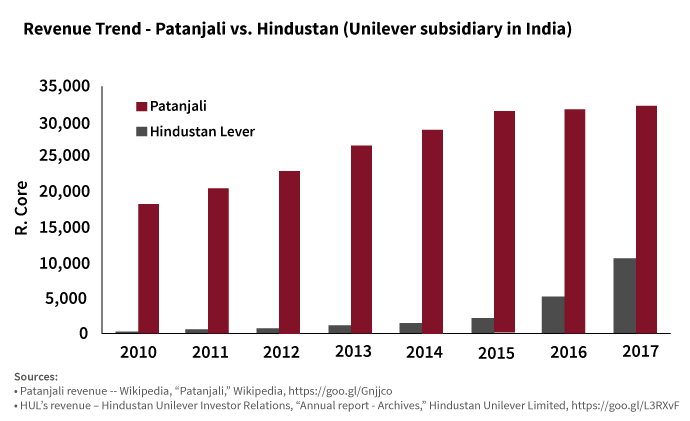

This is true across industries. Consider the growth of Patanjali, an upstart consumer goods company in India. Once, this market was dominated by Hindustan Unilever. But when Indian consumers began saying that the multinational’s products felt harsh and unhealthy for them and the environment, Unilever merely added ingredients to mask the effects of their chemicals. Patanjali offered products based on Ayurveda, a traditional Indian medicinal practice. They used herbs and natural ingredients sourced from local farmers; customers loved them. After only eight years, Patanjali’s revenue is 25% of Hindustan Unilever.

Now multinationals are copying Patanjali’s strategy by introducing natural products, but customers are not coming back.

[ms-protect-content id=”9932″]

Why are businesses getting disrupted?

There are four primary reasons behind disruptions.

Customer profiles are changing: Millennials (born between 1981 to 1996, Pew Research) are becoming the dominant buying group as baby boomers age. Millennials have very different needs than baby boomers. This is true not only in the U.S. but across the world. For example, many Japanese millennials don’t drink, don’t drive and don’t spend the crazy number of hours in the office that their parents did1. They prefer a simple lifestyle, and whether they’re buying cosmetics or hotel rooms, they’re thrifty, Japanese millennials, in short, are like U.S. millennials and millennials the world over: they want value for their yen, like their peers all over the world.

Unfortunately, corporate leaders often don’t know how to interact or sell to them. Consider Procter & Gamble whose sales and profit have declined since 2014. A WSJ article mentioned that Procter & Gamble leaders don’t understand the reason behind their weak U.S. sales2. As Nelson Petz, the activist investor, says, customer preferences are changing worldwide, Millennials don’t trust big brands and prefer natural, organic wellness products; Procter & Gamble is out of tune with that change3. Companies are using old strategies to target newer generations, and that doesn’t work.

Also, customers in international markets are no longer happy with products made for the developed world customers. They want products made for their needs and taste. In every industry, whether telecom, banking, consumer goods, or fast food, local brands are winning over global brands.

Customer awareness and lack of brand loyalty: In my parent’s generation, information about product performance was not readily available. So, people tended to avoid risk by sticking with their favourite brands. Most large corporate brands don’t perform better than their competition in a blind test, and that fact hasn’t changed in decades. However, now, information is readily available with peer reviews, so customers are more willing to take the risk of trying new things. Companies can’t count on brand loyalty if their products don’t perform.

Leadership teams focus on investors instead of customers: Corporate leaders are often incentivised through stock and options to focus on short-term stock price improvements. An MIT study found that CEO and leadership compensation began tilting towards stock grants and options starting in the early 1970s4. No doubt the C-Suite has become very isolated from customers. A 2017 HBR survey of 1,000 CEOs found that on average CEOs spend 10% of their time with clients, 7% with suppliers, and the rest with internal organisations. Only really large customers get attention from the leadership team.

Using old operational methods to cater to new customer needs: Most corporations still run their operations on industrial age goals such as big is better, standardisation, and keeping costs down by lowering quality. When these companies try to address newer generations’ needs, their operations often can’t deliver on them. For example, when Blue Apron introduced meal kits to cook at home, customers loved the idea (new at the time) and the healthy food choices. But Blue Apron’s inefficient supply chain and other operational problems made it hard to keep prices affordable5. It tried automating warehouses, but mix-ups and missed ingredients problems increased, and customers complained. Blue Apron has been struggling ever since.

New operations include fast supply chains, flexible operations, and breakthrough quality standards.

What can companies do to avoid disruption?

Step 1 – Develop customer focused strategies:

Create strategies that will deliver on customer needs and discard old business strategies like incremental innovation, merger & acquisitions, advertising, and others designed to drive short term share prices. Below is an overview of strategies to satisfy evolving customer needs.

Customer Focus Strategy 1: Service

Current customers are a more reliable source of revenue than new customers. But when sales drop, most companies focus on acquiring new customers and neglect existing customers. Internet service providers, for example, offer better rates to new customers than to existing customers, which of course encourages those existing customers to leave.

Even when companies focus on current customers, they go about it the wrong way. Research shows that loyalty and customer retention programmes no longer work — improving service is the way to go. Customers love services like warranties, faster returns, and easy credit. Many also love free shipping, help during shopping, and easy checkout. Customers will spend more money when a company provides the services they value. But many companies don’t do this well. To beat the competition, they offer services to all segments and realise too late that only some are profitable. They ought to be targeting services to specific segments, which can do wonders in developing customer loyalty and increasing customer spending.

Customer Focus Strategy 2: Personalisation

Millennials’ desire to express their individuality is already driving demand for personalisation — products and services that are tailored to each individual. However, millennials are not willing to pay a premium price. So making personalisation affordable requires thinking out of the box about how to design, create or manufacture, and deliver products and services.

This includes focusing on flexibility throughout operations, which is a complete change from the industrial revolution era thinking of “big is better.” Companies can do this by rethinking customer offerings, creating flexible operations, and reducing waste. Companies that make personalisation affordable will gain significant competitive advantage.

Customer Focus Strategy 3: Speed

Customers are becoming impatient and want everything now. They will abandon a shopping cart if the browser takes a few more seconds to load. Millennials and Gen Z (born between 1997 to 2012, Pew Research) have little brand loyalty6 and will embrace other products or services if their old favorites don’t show up on time. Either companies adapt to this mindset or lose to companies that do.

And it’s not just millennials: older generations are getting impatient too – they don’t like to wait at checkout counters or on the phone, and they won’t wait for their favorite brands, either. So leaders must figure out how to deliver faster. Otherwise, before they know it, their customers will be buying from their competitors. And for most business leaders, doing things faster means thinking in entirely new ways, ways that match their customers’ new expectations.

Customer Focus Strategy 4: Quality

Now that the public judges products based on reviews and peer recommendations, companies have to develop higher standards. More and more customers are reading peer reviews on Amazon and other sites before buying products or services. They’re looking at product performance, service, and quality issues, and they trust what their peers tell them – not companies’ claims or advertising. So now all products and services are judged according to how well they work for customers. Improving quality is a sure way of getting repeat business and attracting new customers with favorable reviews.

Most leaders don’t try hard enough for quality: As soon as they’ve beaten the competition, they consider their products good enough. But in today’s world, no company – no matter how far ahead of the competition it is – stays good enough for long. You have to continue to improve quality to remain relevant. Aldi and Lidl have shown how a focus on quality made discount grocers popular throughout Europe.

To win with quality, companies must offer a level of performance customers can’t resist, and the competition can’t beat. Then, they must improve on it continuously. What’s stopping your company from delivering that quality standard? Try doing a series of experiments – both in-house and with suppliers – to identify what’s holding quality improvements back. Then optimise operation for quality and not for throughput (volume of output). In many cases, this may mean challenging long-held misperceptions within your company or industry.

Customer Focus Strategy 5: Reinvention

What makes you great today won’t necessarily keep you great tomorrow unless you and your strategies evolve with your customers. The companies once profiled in old business bestsellers like Good to Great (think GE, IBM, Coca-Cola and the like) are now struggling. It’s hard to predict the future in anything, especially when it comes to customers who keep changing what they want. The only way to do it is to become skilled at creating strategies that support your customers’ needs – and then to keep transforming those strategies. Leaders must continuously revisit, revise, and have the courage to start over completely when the market calls for that.

Consider the transformation of Haier, a Chinese manufacturer of home appliances and consumer electronics. It has reinvented itself four times as customer requirements changed in China and globally. In the 1980s Haier improved product quality by partnering with global companies. In the 1990s they focused on innovation driven by customers. The Haier team looked for unique applications of their technologies, such as a vegetable washing machine to clean potatoes. As their competitors in China started achieving service responsiveness, Haier reorganised to keep up with changing customer needs without getting bogged down by growing in-house bureaucracy. They introduced customer-facing teams, each focused on, organised around, and expert at serving a specific market segment or big customer.

Now Haier is becoming an internet company, collaborating not only with customers but with innovators – including competitors. Haier began modestly in rural China and is now a leading global provider of household appliances.

Leaders with the courage to change their organisations to keep delighting customers will succeed. Doing this requires keeping a sharp eye on customers’ changing needs and then figuring out how to meet those needs by thinking outside the box, engaging end-users, and collaborating with experts and suppliers. And it will all be for nothing unless you keep your operations up-to-date; empower your teams, and; encourage attention to detail in all facets of your company.

Step 2 – Change organisation orientation to customers:

Strategies won’t work if the organisation is not behind them. To make the change happen, key organisation elements have to change.

Change incentives: Leaders’ incentives should be broadened to include customer metrics such as customer satisfaction ratings, customer retention rates, and growth of customer base. Though many companies use these metrics in compensating sales-oriented employees, few companies now include them in incentivising leaders.

Organise in customer-facing groups: Most companies are organised functionally, into silos like sales, marketing, manufacturing, and finance. However, customers don’t care whether employees are from marketing or IT or somewhere in the supply chain. All they care about is how well a company meets their needs. Functional silos work against meeting customer needs: employees tend to feel more loyalty to the department or function than to the customers. This is inevitable when employee compensation and promotions are driven by how happy the employees keep their boss.

To achieve customer focus, companies should create teams organised around customer segments, not by geographic location, type of product, or size. Then, empower these teams and build support for them into the organisation. These customer-facing groups could each consist of people in sales, R&D, marketing, finance, and operations. The exact mix will depend upon the kind of customer the group supports. This is more entrepreneurial than most big corporations today are.

Develop a customer-centric culture: It’s fashionable to talk about a company’s culture, and many companies try to create cultures that make them unique. However, most go about it the wrong way, focusing on things like free food, open offices, parties, employee trips, open presentations by high-level executives, and gyms. These are meant to bring organisation cohesion and identity, but none of these focus employees on customers and encourage attention to detail. Companies that have historically done well and continue to do well, companies like Southwest and Disney, have created and continue to support true customer-centric cultures. As the Southwest website says, “We like to think of ourselves as a Customer Service company that happens to fly airplanes (on schedule, with personality and perks along the way).” Disney cast members are taught “The guest isn’t always right, but let them be wrong with dignity.”

Focus on employee development: Employees are assets and companies who succeed invest in them. Happy employees lead to better customer interactions. So recruit them carefully, pay them fairly, reward them appropriately, train them well, allow them to make decisions without fear, and let them fail safely.

Conclusion

Dr. Samuel Johnson said, “When a man knows he is to be hanged in a fortnight, it concentrates his mind wonderfully.” Disruption can be a death sentence to a business – but it doesn’t have to be. Leaders can use the threat to focus on what’s important – customers. If you use disruption to concentrate on meeting customers’ needs effectively, your business can make an almost miraculous recovery.

[/ms-protect-content]

About the Author

Suman Sarkar is a partner with Three S Consulting and an international consultant who has advised more than forty Fortune 500 companies in strategy and operations. His new book, Customer-Driven Disruption (Berrett-Koehler, 2019), is a blueprint for showing how companies must adapt to ever-changing global demographics and markets. It draws on the author’s extensive experience and features case studies from companies around the world that have thrived in volatile, highly competitive marketplaces. He has published numerous articles in business journals and his first book, The Supply Chain Revolution, is an Amazon top-seller in its genre.

Suman Sarkar is a partner with Three S Consulting and an international consultant who has advised more than forty Fortune 500 companies in strategy and operations. His new book, Customer-Driven Disruption (Berrett-Koehler, 2019), is a blueprint for showing how companies must adapt to ever-changing global demographics and markets. It draws on the author’s extensive experience and features case studies from companies around the world that have thrived in volatile, highly competitive marketplaces. He has published numerous articles in business journals and his first book, The Supply Chain Revolution, is an Amazon top-seller in its genre.

Reference

1. Julian Ryall, “Japan’s millennial men don’t drink, don’t drive, don’t worship work – what do they do?”, South China Morning Post, https://goo.gl/zaiDFt

2. Sharon Terlep et. al, “P&G, After Slight Sales Gain, Puzzled by Weak U.S. Consumer Spending”, The Wall Street Journal, https://goo.gl/udEQmk

3. Trian Partners, “Revitaz P&G Together”, Trian Partners White Paper, https://goo.gl/5hRa8J

4. Carola Frydman et. al, “CEO Compensation”, MIT, https://goo.gl/y9KU72

5. Jason Del Rey, “Blue Apron is stuck in a dangerous cycle that has nothing to do with Amazon”, https://tinyurl.com/y62cck5x

6. Retail Customer Experience, “Study: Brand loyalty not such a biggie for millennials”, https://tinyurl.com/y5ztlwhv

![Deconstructing the Myth of Entrepreneurship iStock-2151090098 [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/09/iStock-2151090098-Converted-218x150.png)