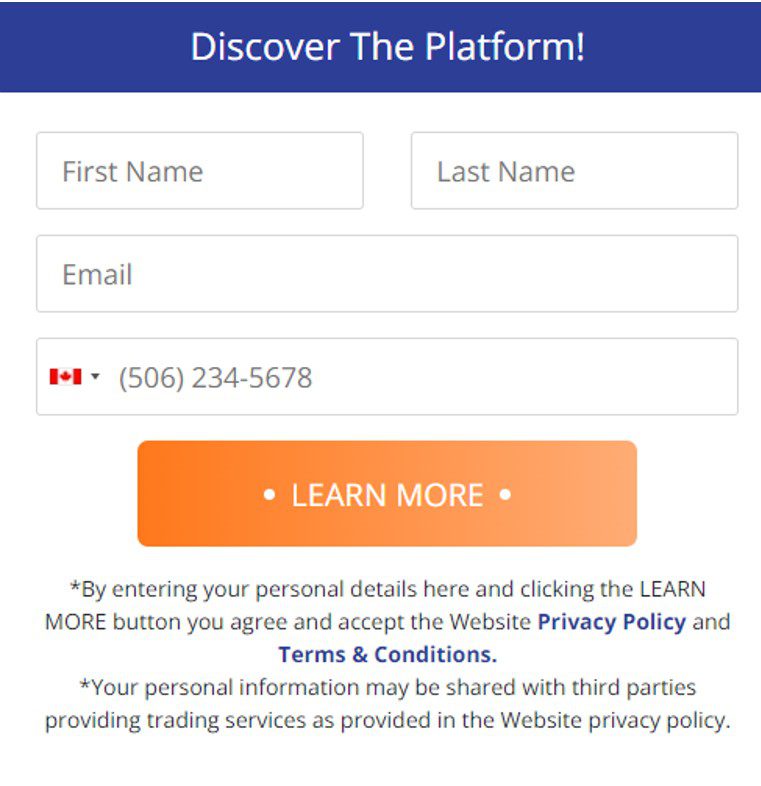

Litecoin and Bitcoin both share similarly limited supply, proof-of-work mining structures. The primary distinction between the two lies in their halving processes. Litecoin’s block reward is cut every 840,000 blocks or approximately every four years while Bitcoin has its reward halved after 210,000 blocks mined which equates to roughly every four years as well. With that said, each halving event brings different outcomes for both coins depending on the market prices at the time. As a result, although Litecoin resembles Bitcoin in many ways it still maintains distinct characteristics for investors to consider when making decisions about investing in either asset class. To know more about bitcoin and Ethereum Code App, you can click on the below image:

Understanding Halving Events

Halving events shield coins from inflation within the realm of cryptocurrencies. Although fiat currencies may be subjected to inflation because of the amount of money circulated, cryptos such as Litecoin and Bitcoin have routine halving events to avoid their devaluation. Conventional currencies depend on a central bank to force substantial interest rates along with other steps to control inflation. Because of the decentralized nature of cryptos, such problems won’t be avoided by any regulatory body. This is the reason halving events is an excellent way to safeguard a crypto’s scarcity.

Comparing Bitcoin and Litecoin Halving Event

The halving event in Litecoin lacks the equivalent market impact

Even though occurring in conjunction with Litecoin, Bitcoin’s halving events enjoy a distinctive industry effect as a result of its dominance in the crypto arena. CoinMarketCap’s historic information indicates that Bitcoin’s industry dominance continues to be primarily unchallenged, leading to a significant effect from its halvings when compared with Litecoin.

Not surprising that Bitcoin’s 2016 halving resulted in a rise in 2017 and early 2018 prices, even though the 2020 halving led to some whole market rally in 2021. In comparison, Litecoin’s halving events were unable to bring about significant market moves in 2015 as well as 2019. Investors might thus think it is much more difficult to find purchasing opportunities for LTC since there’s an absence of apparent correlations between Litecoin’s halving functions as well as its overall performance.

Litecoin lags behind Bitcoin by a span of three years

Despite Litecoin’s upcoming halving event in 2023, it remains behind its successor, Bitcoin, by an outstanding three-year gap. Therefore, the LTC halving occurrence is going to reflect the Bitcoin halving function in 2020. This particular equivalence is the result of the reality that the LTC mining incentive is going to decrease to 6.25 this season, following the present price of Bitcoin. Additionally, the miner incentive is going to drop to 3.125 once Bitcoin experiences its subsequent halving within 2024.

Litecoin and Bitcoin exhibit varying degrees of scarcity within their respective frameworks

The complete source of Litecoin, with 84,000,000 coins, would be in direct opposition to Bitcoin’s shortage, which happens to be restricted to 21,000,000 coins. In comparison with LTC, miners encounter the difficulty of getting access to a substantially smaller-sized pool of Bitcoin. This has caused specialists in the crypto world to consider Litecoin as a silver equivalent of Bitcoin’s gold. Consequently, a lot of extra miners are prone to prioritize the fairly limited Bitcoin instead of tapping into the more plentiful source of LTC.

Miners may be enticed by the larger volumes of LTC as a means to gain access

Conversely, it implies that miners are provided with a considerably greater quantity of LTC when compared with BTC. At the moment there exists under 1.7 million BTC being mined, per CoinGecko, and with additional halving functions further limiting the accessible source, it might take more than 100 years to mine the final Bitcoin.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)