Financial trading, encompassing markets such as Forex, commodities, and stocks, is intrinsically fraught with risk. Yet, the key to sustained success in this volatile landscape lies in the effective implementation of robust risk management strategies. At the heart of these strategies is MetaTrader 4 (MT4), a universally recognized platform favored by traders globally for its comprehensive suite of risk management tools and features.

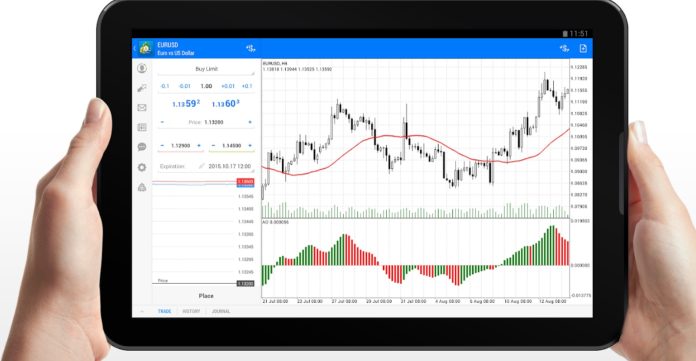

A myriad of reliable brokerages champion this platform, providing it in multiple versions tailored to suit varying trading needs. Take, for instance, the AvaTrade MT4 platform, which offers an adaptable solution to traders, with versions available for mobile, desktop, tablet, and web. These options ensure a seamless trading experience, enabling users to manage risk efficiently, no matter their preferred device or platform.

Via this article, we will explore some of these tools and how they can be deployed to manage trading risks.

Understanding Risk Management

First, let’s understand risk management. Risk management in trading refers to the systematic approach to quantify and mitigate the potential losses that a trader might face. It includes predefined rules for position size, stop-loss levels, take-profit levels, and maximum drawdown, among other factors. The goal is not to eliminate risk completely but to manage it to a level that a trader can comfortably handle and survive the inevitable losses to continue trading.

Leverage Management

MT4 allows traders to set the leverage for their accounts. Leverage can amplify profits but also losses. Therefore, understanding and managing leverage is a critical part of risk management. By carefully selecting the leverage based on their risk appetite, traders can control potential losses. A common rule of thumb is not to use excessive leverage; a conservative approach may involve ratios like 1:10 or 1:20.

Lot Size Selection

In MT4, traders can select their trading volume or lot size. This feature is an integral part of risk management as larger lot sizes increase both potential profit and potential loss. It’s advisable to determine the lot size based on your account balance, risk tolerance, and the specifics of the traded instrument.

Stop-Loss and Take-Profit Orders

Stop-loss (SL) and take-profit (TP) orders are among the most fundamental risk management tools in MT4. These orders automatically close a position when it reaches a predetermined loss or profit level, respectively. Setting SL and TP levels allows traders to manage their risks and rewards without having to monitor their trades continuously.

Trailing Stops

A trailing stop is an advanced type of stop-loss order that moves with the market. If the market moves favorably, the stop level adjusts itself, potentially locking in more profit. If the market turns against the position, the stop level remains unchanged, limiting the loss. Trailing stops in MT4 allow for flexible risk management that can adapt to changing market conditions.

Alerts and Notifications

MT4 allows traders to set alerts and notifications on specific market events or price levels. This feature enables traders to react swiftly to market changes, managing trades and potential risks promptly.

Market Analysis Tools

Successful risk management is also based on a sound understanding of the market. MT4 offers various charting tools, technical indicators, and fundamental analysis features to assist traders in making informed decisions. These tools can help identify potential market reversals, high volatility periods, and key support and resistance levels, all crucial for risk management.

Automated Trading and MQL4

MT4 supports automated trading through Expert Advisors (EAs), scripts programmed in the MetaQuotes Language 4 (MQL4). Traders can develop EAs for implementing their risk management strategies automatically. This feature can remove emotion from trading and ensure consistent application of the risk management rules.

Plug-Ins and Add-Ons

Numerous plug-ins and add-ons are available to extend MT4’s capabilities. For example, tools like a risk calculator can help traders quickly assess the risk associated with a potential trade.

Risk management is an essential discipline in trading. A well-planned risk management strategy can help traders withstand periods of losses and ensure their survival in the long term. It’s important to remember that while MT4 provides a range of tools for risk management, their effective use depends on the trader’s understanding of the markets and their personal risk tolerance. Whether it’s setting appropriate stop levels, choosing correct lot sizes, or implementing automated risk management through EAs, every trader should tailor their risk management approach to their trading style, strategy, and financial goals.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.