With great power of Internet payments comes great vulnerability. New technologies make way for new forms of fraud, and it takes time to recognize them. One of the slipperiest features of e-commerce is a chargeback possibility. Fraudsters were running free until chargeback prevention services appeared, but there is still more to beware for an Internet merchant.

Friendly Fraud and its Prevention

The best fraudsters look and act like law abiding citizens. That’s how they act to make money on chargebacks: first make a purchase, then complain and claim chargeback. Being presumed innocent by their card issuer, they get what they want at the merchant’s expense.

There are many services that offer protection from this chargeback-based fraud. The major one is VMPI by VISA that provides the issuer with details of the transfer, so they can decide whether to satisfy the customer’s claim or decline it. Extra services collect data and provide merchants with it, so they can decide in real time whether to accept the payment from a certain card or to decline it preventively.

All of this makes sense, as the merchant will much less often have to return the money for the successfully shipped items.

Not-So-Friendly Fraud: How Much Is the Phishing?

When you are popular, people want to be you. Sometimes they take it too literally and imitate your website so thoroughly that one needs to check it twice to detect it. There are even more dangerous technologies like cross-site scripting: using the vulnerabilities of your site, the fraudsters make it redirect the user to where they want to, and you unwillingly become their partner in crime, sharing the responsibility but not the income.

To minimize the risks of that, we recommend the following:

- Instruct your customers how to tell the real Slim Shady from all the others just imitating.

- In order to know that, know your enemies. If there is a phishing site reported, examine it, find differences in its interface, in the emails that mislead your customers – everywhere.

- When sending notifications, alerts, news, whatever, follow your standards to make your genuine messages distinguishable.

- Insert personal information with a script to make it clear that the messages are not spam but sent by your store.

- Contact groups like PhishTank that track phishing sites and report them.

- Contact the authorities if you find a phishing site imitating yours. This may not grant any result, as the site may be beyond the jurisdiction of your state. But you still should try.

- Make minor redesigns to your site frequently.

- Protect your website from unauthorized access to avoid cross-site scripting. Check it with the anti-malware programs.

Usability Must Grow

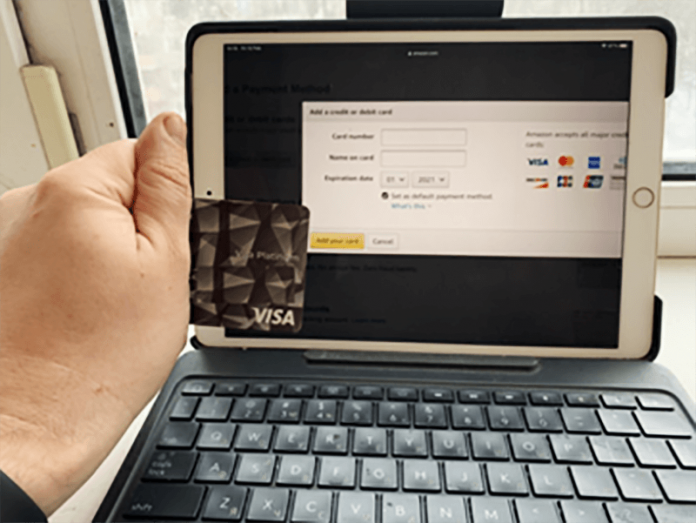

One of the biggest problems with online payments was that people were not ready to do a lot of new things. Entering the number of the card? Expiration date? CVV2? Using gateways? Extra authentication? No, no, I’d rather drive to the store.

Though now people tend to pay online significantly more often than a decade earlier, the problem remains: customers choose the easiest payment methods, even if it costs a bit more. So it’s up to you to make it as easy as can be.

- Embed payment gateways that many customers are already using, so they don’t need to re-enter their card numbers and stuff.

- Make a mobile app that allows uisng with Apple/Google Pay as a payment option. The former is as well usable on Macs.

- There are never too many payment methods. Credit cards? PayPal? Maybe ViaBill, Payoneer, or Skrill? Why not cryptocurrencies? You will have to process everything about them – cash them in, calculate tax returns, whatever. But you better deal with that money on your PayPal than not get it at all.

- Provide an easy instruction that depicts the main stages of making a payment. Embed pictures illustrating it.

- Let your customers save their payment and shipping details in their profiles, so they don’t have to re-enter them. It means that you will be responsible for possible leaks, so take measures to avoid that. In return, you will get more loyal customers who are ready to purchase from you because it’s easier.

To conclude, the customer should be able to make a purchase in one click or tap. It’s you who has to fiddle around with that – both to make the payment easy and to handle it when you receive it.

Internet Is Not for “International”

One of the biggest issues with online payments is about receiving them from abroad. In theory, all the methods available within your state should work worldwide as well. In real life, though, there may be trouble. Here are but a few of these:

- Hidden fees, because of floating rates and intermediary policies.

- Shipping problems. They can appear because of natural disasters, wars, revolutions, or coups. This may cause reasonable disputes or chargebacks.

- Payment tracking is problematic. International payments are hard to identify; it’s just as hard to check whether the transfer is complete.

There are lots of other issues: legal status of certain payment methods in certain countries, different time zones, different days out, which may also contribute to the problem. In order to minimize that, you can set the list of countries you are ready to work with. Or accept international payments only with PayPal and or its alternatives. Whatever you choose, you must acknowledge that these solutions minimize your problems but not eliminate them completely.

If You Build It In, They Will Come

As you see, though paying online is better than carrying a bag of gold through forests and seas, it has its risks regardless. It will be wise to explore the market for the best potential solutions before you enter; if you’re already in, though, it’s not too late. Provide the best methods your potential customers will like; the more, the better.

If you have something to ask or add, make clear or share your experience, feel free to leave your comments down here. Or share it on your social media pages to start a discussion with your friends there.