altFINS Signals Summary gives traders an overview of market insights, with quick links to trading strategies and signals. Traders can quickly jump to market scan results to find assets in up/down trend, assets with breakouts, pullbacks in uptrend, or pattern breakouts.

For instance, signals such as “Pullback in Uptrend (1W)” gives traders one-click access to assets that are in an Uptrend but have experienced a pullback, which could be a “buy the dip” trading opportunity.

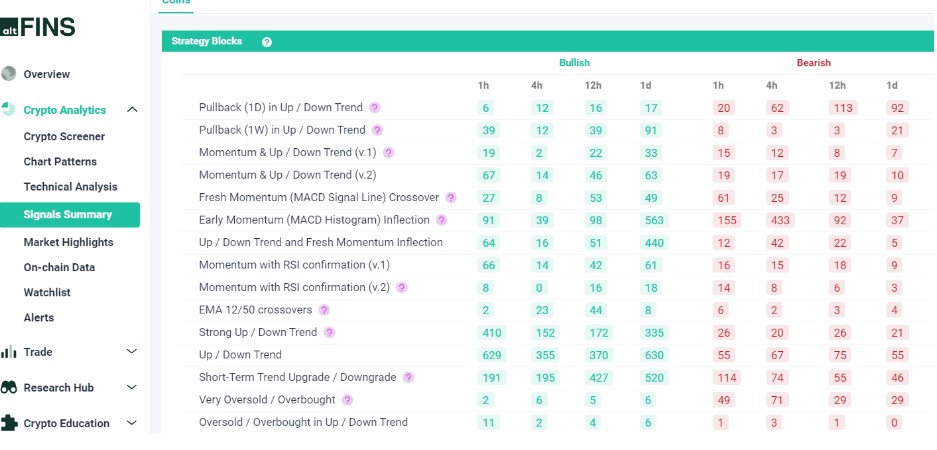

This information is presented across multiple time intervals, including 1-hour, 4-hour, 12-hour, and 1D.

Key Benefits of altFINS Crypto Signals Summary

altFINS Signals Summary serves as a tool for cryptocurrency traders, offering timely insights into market trends and trading opportunities. Here are some key reasons why it’s a valuable resource:

- Efficiency: By aggregating key signals and trends into a single, easy-to-navigate section, altFINS saves traders time and effort with trade idea discovery.

- Customization: Custom market scans / trade signals that users create, also appear on top of the Signals Summary page, giving them quick access to the results.

- Personalization: Signals Summary section can be further filtered for users’ watchlists or portfolio. This way, traders can analyze and monitor trade signals for just their existing holdings or assets on their watchlist.

- Comprehensive Coverage: With signals spanning multiple time intervals, altFINS Signals Summary offers a holistic view of the cryptocurrency market, enabling traders to make well-rounded decisions.

- Bullish and Bearish signals. There are both, Bullish (BUY) and Bearish (SELL) trading signals covered under the Signals Summary section, giving traders a chance to profit during market up- and down-trends.

- Learning tool. Each market scan / trade signal in the Signals Summary section has an explanation and tutorial associated with it, which helps traders learn how to use that signal properly.

altFINS Signals Summary includes 5 categories of signals:

-

- Strategy Blocks: 30 trading strategies, both bullish and bearish signals on 4 time intervals, including Pullback (1D) in Up / Down Trend, Momentum & Up / Down Trend, Fresh Momentum (MACD Signal Line) Crossover, EMA 12/50 crossover and other strategies

- Chart Patterns: Inverse Head And Shoulders, Channel Up / Down, Support/ Resistance and 24 other chart pattern types across four time intervals

- Trend and Momentum: Price / EMA Crossovers, SMA / EMA Crossovers, MA Ribbon, Unusual Volume Gainers / Decliners

- Leading Indicators: RSI, Stochastic RSI Fast, Bull / Bear Power, Williams Percent Range

- Divergence Signals: RSI divergence

Navigating to Actionable Insights

While Signals Summary provides a high-level overview of potential trading opportunities, users can delve deeper by clicking through to the Crypto Screener. This allows traders to explore the results in more detail, refining their search criteria by adding additional indicators or variables such as minimum market capitalization, traded volume, or price change.

Conclusion

altFINS Signals Summary is a powerful tool that empowers cryptocurrency traders with timely, actionable insights into market trends and trading opportunities.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.