There are a number of ways a trader can abuse their brokers’ services. One of them is by a process known within the industry as “machine gunning”.

The scheme is used by traders with relatively large sums of money on their trading accounts. The purpose of the manipulation is to pay significantly lower fees on the trades that they make.

In a regular business, if you buy goods in larger quantities, you would usually get a discount, paying a lower price per unit. For example, one can buy a bottle of water in a nearby grocery store for £2, or get a pack of 20 water bottles in a wholesale store for £0.50 each.

In financial markets, there isn’t a universal price valid for all volumes of trades. In fact, the logic of executing trades is entirely different. The rule of thumb here is that relatively small orders are executed at a lower price. The larger the order is, the higher the price a trader has to pay.

To abuse the broker using this manipulation, a trader is effectively splitting a large trade into smaller pieces, to benefit from better fees.

In this article, we take a closer look at order books, liquidity, commissions and spreads to better understand machine gunning liquidity abuse and how it works.

What is an order book?

In trading, an order book is an electronic list of offers from buyers and sellers of a security, organised by price. An order book typically shows how much of a security is being on offer by market participants behind buy and sell orders. It’s an important tool in a trader’s arsenal and can be helpful in evaluating liquidity and market depth. Order books also help improve market transparency.

Understanding liquidity

Liquidity refers to how quickly and easily a security can be bought and sold without significantly affecting the price. For example, assets with high trading volumes tend to be more liquid as they can be easily bought and sold due to a large number of market participants willing to trade.

Commissions vs spreads

Traders typically pay fees in financial markets in two forms: either the fee is already priced into the spread, which is the difference between the bid and the ask price; or there is a commission charged by the broker per trade.

For example, you can trade GBP/USD priced at 1.2050 and pay 2 basis points (bps) commission. This will have the same effect if you trade GBP/USD with 0.2 bps spread and buying at 1.2051 and selling at 1.2049. The difference in the ask and the bid prices is the same 2bps.

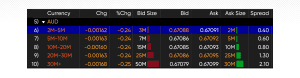

In the order book traders can see different price levels and volumes available for buying or selling a security or a derivative product.

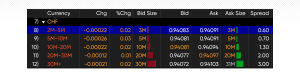

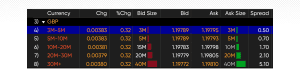

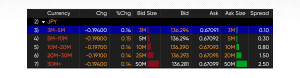

On Bloomberg terminal, for example, at the trade size of $3 million, the fee for GBP/USD can be as low as is 0.50 bps. If the trade size is increased further to $30+ million or higher, the fee can be as high as 5.1 bps or more, which is at least 10 times higher than the fee at the $3 million trade size.

Same pattern works for other markets, as shown on screenshots below.

What is machine gunning broker abuse?

Machine gunning broker abuse is when a trader makes a very large trade, for example, worth $100m, and wants to pay a commission fee set for smaller trades.

To achieve this, an abuser splits a large order into multiple smaller-sized orders and makes them within a small period of time. Usually this is executed by a trading robot. The robot sends small trades so quickly that its work can be compared with a firing of a machine gun. Hence the name “machine gun abuse”.

As a result, the large trade is executed at a much cheaper fee, compared to what traders would be charged otherwise. The difference can be as large as 10-20 or more times, which leads the trader to save a lot on the commission.

The prudent broker then goes to the market to get liquidity for these multiple trades and gets a market price, which is a lot higher than what the abuser had paid. This results in clear losses for the broker.

In other words, a trader’s large order is being executed at prices and sizes that are not available on the underlying markets at that time. The price for a large order would be different. Artificial split of large trade into multiple smaller trades in a very short space of time on the same market does not change the essence of this trade. It is still one large trade and needs to be priced accordingly.

A simple real-life example

Let’s imagine you own a pizza shop, where you sell pizzas at $10 a piece. When ordering online, your regular customer finds a way to trick the system and get the same pizza for 1$ instead. This wasn’t due to a technical bug on your website, but rather because the customer wanted to abuse the system.

Meanwhile, as a pizzeria owner, you are paying 5$ per piece to make it (as it takes resources that cost money).

The customer in this scenario needs to understand that the pizza was not free to produce. So if they bought it at a 90% discount rate by cheating, they have misused the company’s trust, especially being their regular. Therefore, when the pizzeria owner suddenly asks them to pay the missing $9 instead of letting them run away with it, they are correcting the abuse of trust.

Same as pizza, market liquidity has a price. If a broker sells it to a trader at a 90% discount rate, they lose money the same way as the pizzeria owner.

Why do brokers not change the price on the platform for everyone?

Regulated brokers have duties on the best execution price to their clients and have to fill the liquidity for all traders trading on the same market. Brokers cannot widen the spread 10 times for all traders as the result of the actions of one – it would be in breach of the best execution principle. That’s why brokers have to constantly fill liquidity at the best price at every moment of time, and the machine gun abusers have a window of opportunity.

How do brokers protect themselves?

There are multiple ways brokers can protect themselves.

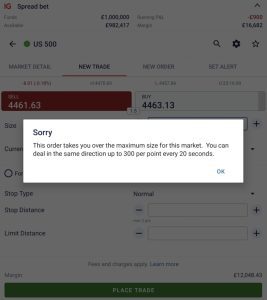

Some brokers may limit the number of transactions clients can make within a certain time period. At IG, for example, spread-betting clients can trade on S&P 500 in the same direction for up to 300 points every 20 seconds, but not more frequently than that.

For less liquid foreign exchange (FX) markets this rule is set at 60 seconds, and is called the repeat dealing rule. Usually most brokers have it enabled for all clients.

However, brokers can switch off or adjust these repeat dealing rules for trusted clients. In this case, the checks are done post-factum based on analysis of traders’ activity.

If the broker sees that the trader has benefitted from the machine gun abuse, they have the right to cancel the abusive transactions and update the prices to the levels that they would have been during regular trading activity.

In other cases, brokers can ban traders who had engaged in liquidity abusive trading from being able to trade on their platform.

Most brokers’ T&C allow for such measures to be taken.

In conclusion

Machine gun broker abuse is widely known across brokers. It’s hard for traders to benefit from it. Brokers protect themselves by having repeat dealing rules, properly drafted T&Cs in place and proper monitoring controls in place.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.