Blockchain research and development has been in full swing since Bitcoin became mainstream. Just last month, blockchain startup Kadena raised $12 million for its research and development. Stories about blockchain companies receiving millions in funding from venture capitalists are now commonplace because companies want to fully integrate the new technology into their operations. However, some blockchain developers have recently revealed that we may not see the technology’s true potential for decades.

American multinational technology conglomerate Cisco was the first one to take a few steps back from blockchain research after 18 months of non-stop work. The company decided to put a halt on multiple blockchain development because they realised it will take years for finance services to get up to speed on blockchain. Instead, Cisco focused its efforts on investigating blockchain only for its use in supply chain management.

However, even if Cisco narrowed down its research, the company confessed that it might take about 10 years before blockchain becomes beneficial to supply chain management in general. For the financial services, the company said it might take about 25 years.

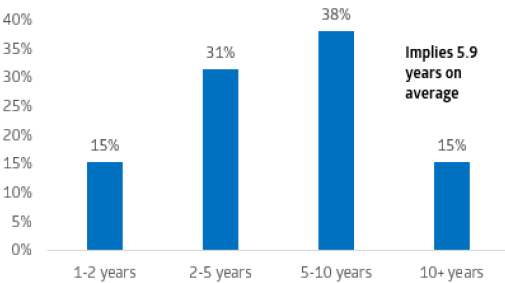

Below is a graph presented by CNBC on the estimated time for the general adoption of blockchain.

“It’s anyone’s guess,” said the Head of Cisco’s Blockchain Research Anoop Nannra. “When you’re trying to drive a mindset shift it’s almost a generational thing.”

Intelligence firm IDC estimates that global investments on blockchain will increase to $2.1 billion in 2018. However, the problem lies in the global adoption of the technology. Cowen’s research shows that 23 experts in blockchain research believe that it will take at the very least 5.9 years for the technology to gain widespread adoption.

Blockchain is a distributed ledger technology that is tamperproof. It is for this very reason that companies all over the world, especially those from the financial sector, are trying to integrate the technology into their systems. Blockchain also cut costs and decreases transaction time because it eliminates the need for a third-party like a bank. Nadex states that while financial institutions view cryptocurrency as bubble markets, they embraced the technology because of its potential to make deposits and withdrawals safer. Bitcoin was the first digital fund to use blockchain with a focus on payments, and it is because of its success, even as a decentralised currency, that financial institutions are drawn to what’s running the transactions.

However, based on Cisco and other developers’ stance on blockchain, it is becoming clear that blockchain isn’t the best solution for now to streamline operations for the supply chain and financial sector. In fact, blockchain can complicate and stand in the way of existing frameworks.

Mark Smith the CEO of blockchain development firm Symbiont, said that after years of research, his company realised that blockchain works best only when there’s a chance to automate workflows, such as data collection.

“I think supply chain is going to be the first, if not near the first, to really show the value of blockchain,” said Smith. “There aren’t any regulatory questions in supply chain management that you have to deal with.”

However, financial institutions will not totally discard their blockchain research. In fact, the Depository Trust & Clearing Corporation (DTCC) is thinking about testing blockchain for managing credit derivatives. Goldman Sachs and Citibank will also be continuing their research and investments into blockchain research.

“The people that are most worried are the banks,” said Drinker Biddle partner William D’Angelo in the same CNBC article. “They’re spending millions and millions of dollars to build private blockchains so they don’t feel like they’re shut out.”

Blockchain is a revolutionary technology that will change how transactions work, which is why financial institutions are always looking for blockchain companies to fund. It’s a race as to which company will be able to utilise it first, and attract new customers.

(Feature image credit: Pixabay)

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.