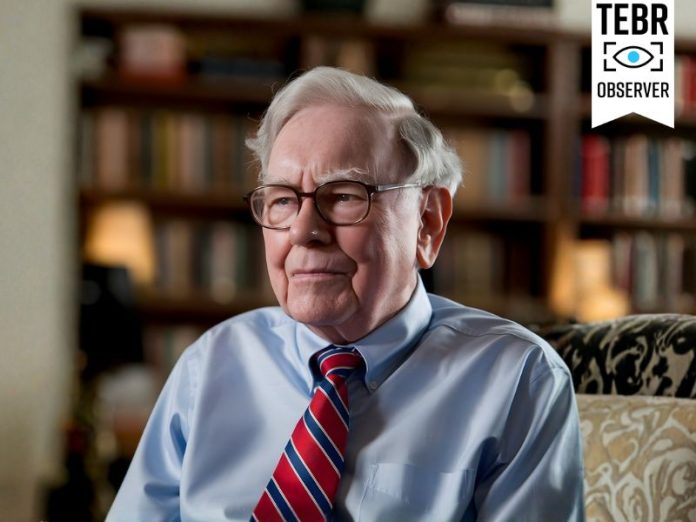

Few business leaders have shaped modern thinking as profoundly as Warren Buffett.

For more than six decades, the Berkshire Hathaway chairman has delivered not only market-beating returns but also a body of wisdom that continues to guide investors, CEOs, and students worldwide. His philosophy blends discipline, humility, rationality, and long-term thinking feel especially relevant today as markets confront volatility and technology accelerates at unprecedented speed.

Buffett on Investing: Patience, Discipline, and Understanding

Warren Buffett’s investment philosophy centers on long-term discipline over speculation. He explained that “successful investing takes time, discipline and patience,” adding that “no matter how great the talent or effort, some things just take time”. His commitment to long-term fundamentals appears again in his well-known remark: “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes”.

Buffett also reframes risk, noting that “risk comes from not knowing what you’re doing”. Even during downturns, he urges decisive action when opportunities emerge: “When it rains gold, put out the bucket, not the thimble”. Across all these insights, he reinforces that patience, conviction, and understanding outperform speculation.

Buffett on Leadership: Integrity, Character, and Reputation

Buffett’s leadership philosophy is anchored in integrity. His well-known warning — “It takes 20 years to build a reputation and five minutes to ruin it” — has been cited across business journals and leadership analyses. He also emphasizes the importance of surrounding oneself with high-quality people: “You will move in the direction of the people you associate with. So it’s important to associate with people better than you”.

Buffett’s stark comment on honesty — “Honesty is a very expensive gift. Don’t expect it from cheap people” — appears consistently across verified business ethics compilations even today. These principles have shaped Berkshire Hathaway’s enduring culture and offer a framework for ethical leadership in today’s increasingly complex business environment.

Buffett on Education and Personal Growth: The Ultimate Investment

Buffett repeatedly emphasizes that education is the highest-return investment. His statement, “The most important investment you can make is in yourself” encourages students to embrace rigorous reading habits, famously advising that knowledge “builds up like compound interest” and recommending that young people “read 500 pages a day”. Buffett also speaks openly about the value of slow decision-making and reflection and highlights that he spends a large part of each day reading and thinking rather than reacting.

When evaluating talent, he rejects pedigree bias entirely: “I never look at where a candidate has gone to school. Never!”. His philosophy champions intellectual curiosity, humility, and continuous improvement as the true differentiators of success.

Buffett on Success: Simplicity, Focus, and Avoiding Big Mistakes

Buffett’s view of success emphasizes clarity and restraint. His statement, “You only have to do a very few things right in your life so long as you don’t do too many things wrong” shows his commitment to constantly showing up for yourself and your work. His most iconic investing principle — “Be fearful when others are greedy and be greedy when others are fearful” — still appears across nearly every established source on Buffett’s teachings.

These reflections reinforce a broader theme: sustained success comes not from doing everything, but from consistently doing the right things.

Buffett on AI and Technology: Cautious Respect for a Transforming World

Buffett does not claim to be an AI expert, but his reflections on the technology reveal a cautious yet grounded stance. He remarked that while AI will meaningfully transform industries, old-fashioned intelligence works pretty well. Buffett’s belief that while technology changes rapidly, foundational values like judgment, honesty, and clear reasoning remain constant. His approach offers a balanced message for modern leaders: embrace technological transformation, but do not abandon the principles that underpin thoughtful decision-making.

In an era defined by rapid AI advancements, geopolitical uncertainty, and shifting economic cycles, Warren Buffett’s philosophy offers a rare form of clarity. His lessons emphasize patience, integrity, deep learning, emotional discipline, and long-term thinking that withstand market cycles and technological shifts.