Malta is a small country made up of a group of islands in the Mediterranean Sea. It is known for having a good business climate and a good tax system. The government of Malta has set up many incentives for foreign investors who want to set up businesses in Malta.

The Maltese government has been working hard to encourage entrepreneurship and innovation by giving startups a variety of support programs and ways to get money. Malta is a unique and attractive place for entrepreneurs who want to set up their businesses in Europe because of its strong economic growth, stable political climate, and appealing way of life.

In this article, we’ll give entrepreneurs some tips who want to register a company in Malta some advice.

1. Malta Company Registration

The founders must prepare the necessary documents when registering a company in Malta, such as the memorandum and articles of association, and send them to the registry. They must also choose a company secretary and a local director. The local director must live in Malta.

The founders of the company must also get a Tax Identification Number and, if necessary, sign up for Value Added Tax. They must also get any licenses or permits that their industry requires.

Once all the necessary documents have been submitted and approved, the company’s founders must pay the required registration fees and get a certificate of registration. With this certificate, they will be able to register a company in Malta and enjoy the benefits of doing business in this country.

2. Opening A Maltese Bank Account

Every company registered in Malta must have a bank account in the country. This can be done at any of Malta’s big banks, like the Bank of Valletta, HSBC, and APS Bank.

When opening a bank account, it is important to bring all the required paperwork, such as the company’s registration certificate, identification documents for the company’s directors and shareholders, and proof of address.

Usually, you’ll need the following documents to open a bank account in Malta:

- Bank reference letter (optional)

- Pay stubs or tax returns as proof of income

- Proof of your address, like a utility bill or a lease

- Documents that can be used to prove who you are, like a passport or national ID card

Before giving you an account, the bank will look over your application and may do a background check on you. Depending on how the bank handles things, this process could take anywhere from a few days to a few weeks.

Once your account has been approved, the bank will give you your account information and any access codes you need. Then you can turn on your account and start using it for banking.

3. Pick the Appropriate Legal Form for Your Business

It is important to choose the right legal form when starting a business in Malta. Private limited companies and partnerships are the most common types of businesses in Malta.

Private limited companies are the most common type of business in Malta, and their shareholders have limited liability. On the other hand, partnerships are less common, but they offer more flexibility in terms of how they are run.

4. Choose a Quality Company Name

When picking a business name, it’s important to keep in mind the rules for registering a company in Malta. The name can’t be the same as or too similar to that of an existing company in Malta, and it can’t be rude or offensive.

The name must also end with the correct legal suffix, such as “Limited” or “Ltd.” Your company’s name should show who you are and what you stand for. It should be easy to remember and say, and if possible, catchy and easy to remember.

Before deciding on a name, you should check to see if it can be registered. You can check the online database of the Malta Business Registry to see if the name you want to use is already taken.

5. Tax Regulations and Compliance

One of the best things about starting a business in Malta is that the country has a good tax system. But it is important to follow all of the tax rules in the country. This includes signing up for VAT if your company’s sales are more than €35,000, filing tax returns every year, and paying any taxes on time.

After the company is set up, it must also be set up to pay taxes. This can be done by giving the Inland Revenue Department the right forms.

A registration for value-added tax is required if the company is going to do business in the European Union (VAT). To do this, you can send the right forms to the VAT Department.

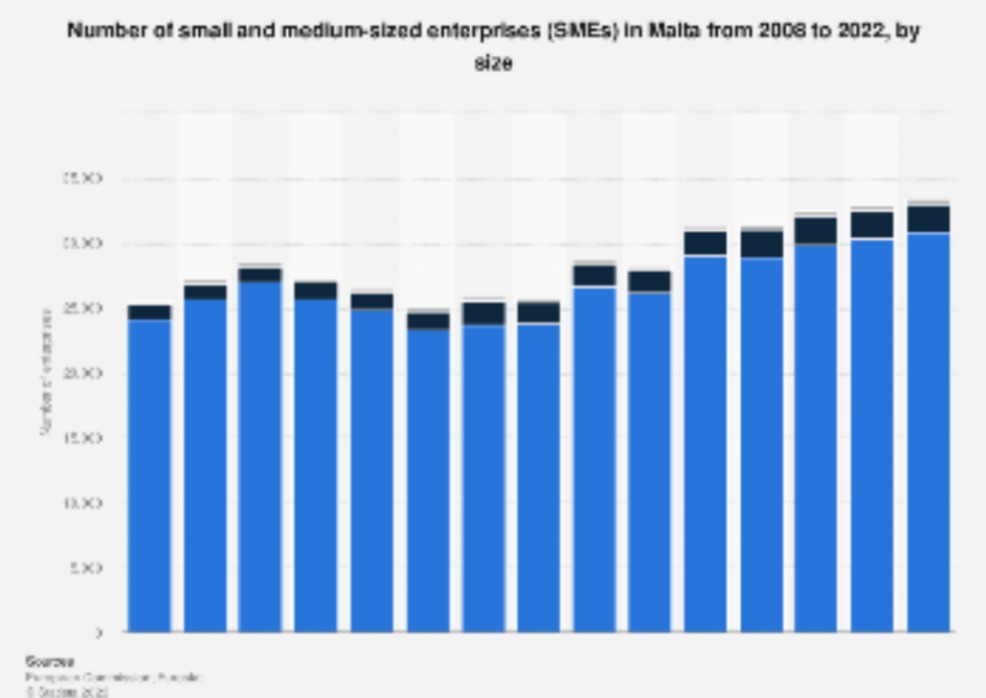

SME Chart In Malta To Latest: Source

6. Licenses and Permit

Depending on what kind of business you want to start in Malta, you might need to get different licenses and permits. For example, if you want to open a restaurant or bar, you will need to get a catering license from the Malta Tourism Authority.

The Malta Financial Services Authority will give you a license if you want to start a company that will offer financial services.

The Malta Business Registry gives out Trade Licenses, which most businesses in Malta need. This license shows that you are allowed to run your business in the country.

7. Working with Local Professional

When setting up a company in Malta, it might be helpful to work with a local expert. This could be a lawyer, an accountant, or a person who helps businesses. A professional in the country can help you understand the legal and regulatory system and make sure your business is set up right.

Once you’ve found a professional in your area, you should set up a meeting to talk about your business plan. This will help the professional understand your goals and objectives and tell you how to set up your business in the best way.

Conclusion

Setting up a business in Malta can be a great way for entrepreneurs to take advantage of the country’s good business environment and tax system. By using these tips and working with a professional in your area, you can make sure that your business is set up right and ready to succeed.

FAQs

Q1. How much is the business tax in Malta?

In Malta, the business tax rate is 35%. But there are several tax breaks and incentives for certain kinds of businesses, like those that do research and development, make things, or make digital games.

Q2. What do you need to do to set up a business in Malta?

To register a business in Malta, you will need a proposed company name, the names and addresses of the directors and shareholders, an address for the registered office, and other information about how the business will run. You’ll also have to fill out the forms and pay the registration fees.

Q3. What kinds of business organizations can I register in Malta?

Malta has several types of business entities, such as limited liability companies, sole proprietorships, partnerships, and branches of foreign companies.