By Christoph Burger, Andreas Kuhlmann, Philipp Richard & Jens Weinmann

How do energy executives see the potential of the Blockchain? Is it just hype, or does it have real potential to disrupt the functioning of the industry? The German Energy Agency dena and ESMT Berlin have compiled findings on German energy executives’ current opinions, actions and visions of the Blockchain.

Innovation in the 21st century business world is driven by peer-to-peer platforms such as Ebay, Uber, Airbnb, Zipcar, or Kickstarter. These businesses follow the idea of a “sharing economy” by dismantling established hierarchies, diverting societal influence from organisations to individuals, often using democratic instead of autocratic decision processes, and empowering consumers, based on the claim of high ethical standards of a new, decentralised world order.

In the financial sector, cryptocurrencies have emerged as an alternative to the traditional banking system. This is potentially disruptive, as trusted intermediaries could become obsolete. Banks were the first ones to become aware of the threat, epitomised in the cryptocurrency Bitcoin. All of Bitcoin’s transactions are based on the Blockchain, a distributed, digital transaction technology that allows for securely storing data and executing smart contracts in peer-to-peer networks,1 offering both transparency and anonymity in all transactions.

Using cryptocurrencies for monetary transfers is Blockchain’s most obvious use case. Fintech startups such as Abra allow customers to repatriate expats’ remittance money to their home countries via the Bitcoin Blockchain. The founders of Abra state that their model “is 100% peer to peer, with no middle man ever holding, managing or touching your funds at any point in any transaction”.2 They claim that their service has reduced transfer times from one week to one hour, and transfer costs from a 7 percent transaction fee to 2 percent.

Using cryptocurrencies for monetary transfers is Blockchain’s most obvious use case. Fintech startups such as Abra allow customers to repatriate expats’ remittance money to their home countries via the Bitcoin Blockchain. The founders of Abra state that their model “is 100% peer to peer, with no middle man ever holding, managing or touching your funds at any point in any transaction”.2 They claim that their service has reduced transfer times from one week to one hour, and transfer costs from a 7 percent transaction fee to 2 percent.

The technology gains popularity in other applications, too. For example, ride-sharing startup Arcade City directly competes with Uber for individual mobility services. Arcade City has established an open marketplace where riders connect directly with drivers by leveraging Blockchain technology. Conferences on Blockchain-based cryptocurrency Bitcoin are flourishing, startup competitions are held to spot the Blockchain equivalent of Amazon and Uber, and venture capital so far has raised $1.1 billion to scale business models of the future.3

[ms-protect-content id=”9932″]The energy sector – and in particular the electricity supply side – experiences first attempts to use Blockchain, in particular since recent extensions allow for conducting smart contracts via a Blockchain-based platform called Ethereum. Most prominent examples of energy exchanges between decentralised producers and consumers are the US-based startup TransActive Grid and Power Ledger in Perth, Australia.4 TransActive Grid enables its members to trade energy using smart contracts via Blockchain. Its first transaction was successfully launched in early 2016, connecting five homes that produce energy through solar power on one side of a street in Brooklyn with five consumers on the other side of the street, who are interested in buying excess energy from their neighbours.5 One application, developed by a South African startup called Bankymoon, consists of smart prepaid meters that only release power to residential customers once they have topped up their accounts and transferred money to the electricity provider – a kind of mini smart contract. This system brings benefits for the supplier by increasing the payment discipline of its customers, but it may also have advantages for residential consumers: In countries with high inflation rates, payments result in lower expenses for them if they have paid in advance, precluding any accumulation of debts.

TransActive Grid launched a peer-to-peer (P2P) transaction platform that enables Brooklyn Microgrid members to buy and sell electricity produced from residential PV solar installations. Photo courtesy: microgridmedia.com

The value proposition that these new ventures present to potential customers and investors is similar to initiatives in the banking sector: Any necessity for an intermediary between two parties is removed.

Meanwhile, a major change is occurring in global energy supply. Renewable energies, in particular solar power and wind, become major primary energy sources in the generation portfolio of countries such as Australia, Denmark, or Germany. Several states in the US experience a steep rise of photovoltaic power – often delivered from micro-producers with rooftop panels via the conventional distribution grid. In 2015, approximately a third of Germany’s electricity consumption was generated from renewables, with more than 1.5 million photovoltaic micro-generation units,6 26,000 wind turbines,7 and 9,000 biomass power plants.8 These power units alone amount to an installed capacity of 97 GW,9 almost half of Germany’s total capacity.

The combination of Blockchain as emerging peer-to-peer transaction technology with the rapid growth of decentralised energy supply bears a considerable disruptive potential for the energy supply industry, detaching financial transactions and the execution of contractual commitments from a central control unit – a next step toward full decentralisation and a threat for the business of traditional utilities.

How do energy executives see the potential of the Blockchain? Is it just hype, or does it have real potential to disrupt the functioning of the industry? How big do they estimate the potential of Blockchain to be, and in which areas? Will it remain a niche application, or become a game changer?

The German Energy Agency dena and the European School of Management and Technology (ESMT Berlin) have compiled findings on German energy executives’ current opinions, actions and visions of the Blockchain. In July/August 2016, the link to an online questionnaire was sent to members belonging to the dena network as well as ESMT alumni who work in the energy sector or energy-related industries. In total, 70 responses were received.

Responses came from executives all along the value chain in the electricity industry, starting from manufacturers to utilities, grid operators and service providers to employees at the electricity exchange. The three largest groups of respondents were employed at electric utilities, service companies, and grid operators, respectively.

Almost 70 percent of the respondents have already heard about applications of Blockchain in the energy sector. When asked whether their respective companies or organisations have already taken steps in that direction, 13 percent responded that they are already in the process of experimenting with Blockchain and 39 percent are planning to do so, including pilot tests, studies, analyses, and research projects.

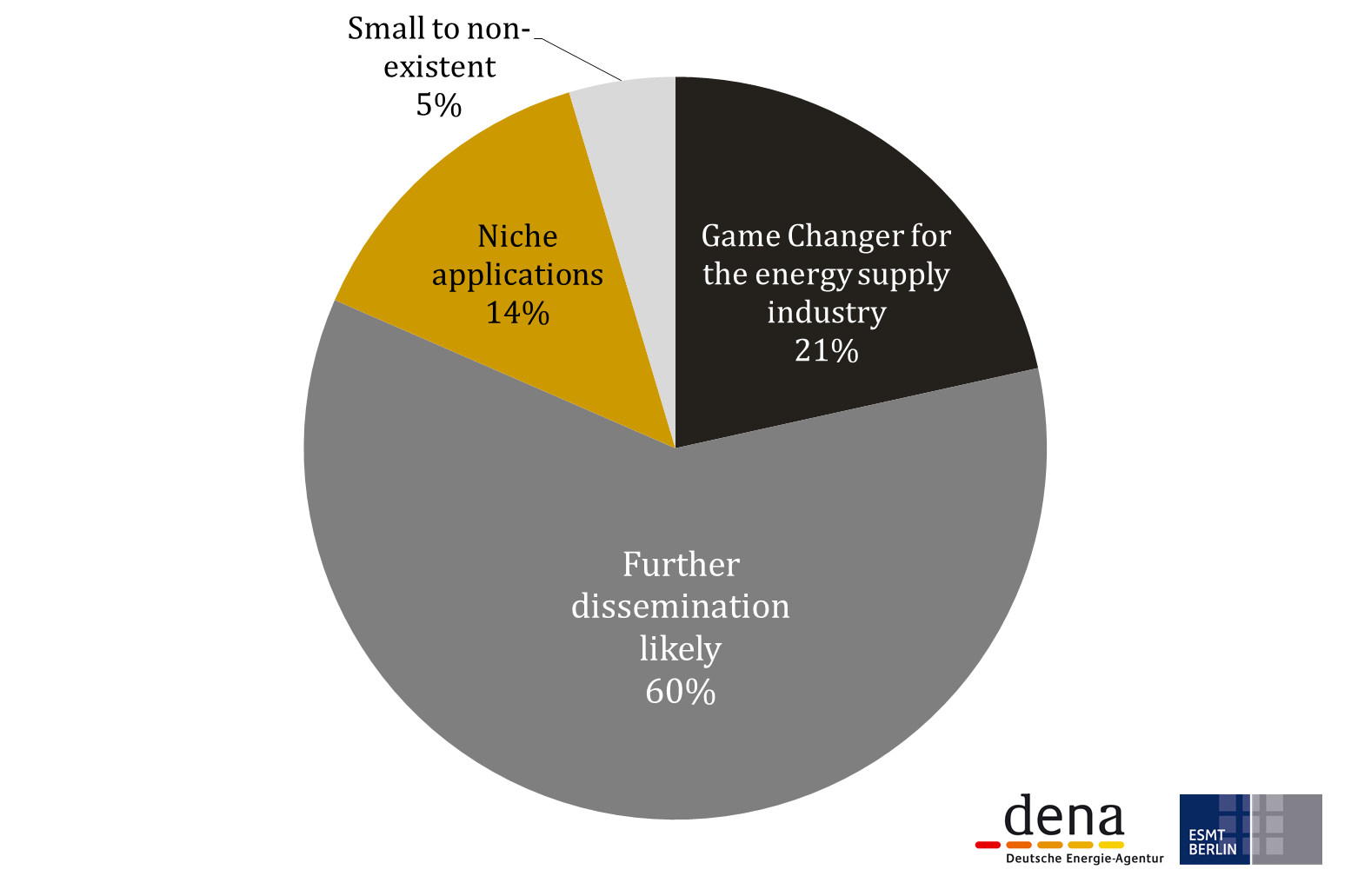

Sixty percent of the respondents believe that a further dissemination of the Blockchain is likely. 21 percent consider Blockchain a game changer for the energy supply industry, and 14 percent expect niche applications. Only 5 percent either do not see any potential or an almost inexistent potential of Blockchain in the energy sector. (see figure 1 below)

More specifically, respondents were asked to qualitatively identify potential use cases and applications of Blockchain in the energy sector and provide a judgment according to the classification used in the previous question, that means, ranging from small to non-existent potential to game changer. In total, respondents identified more than 110 potential use cases and their respective potentials.

The responses can be differentiated into two main clusters: platforms and processes.

As expected, most of the responses in the platforms cluster relate to public platforms, such as peer-to-peer networks composed of residential prosumers who benefit from Blockchain’s decentralised structure and engage in decentralised energy management, neighbourhood solutions, and the coordination of renewable installations. Some respondents also mentioned the potential of privately owned B-2-B platforms, for example in intraday trading, virtual power plants, interruptible loads, and storage capacity.

However, energy executives mention an equally high amount of potential applications in the cluster processes. Most responses were related to billing, including applications in the field of Smart Meters and micro-payments, followed by use cases in sales and marketing that range from package solutions for household devices and the electricity they consume, improvements in customer services and new products, to a change in existing sales practices. Respondents also saw a future role of the Blockchain in automation, metering and data transfer, electric mobility, communication, grid management, and security, including transactions such as authentication and identification of data, and the protection of the private sphere.

The following figure (see figure 2 below) shows an overview of the answers according to applications and use cases. The size of each circle corresponds to the number of individual responses. The colour scheme ranges from black (“Game changer”) to White (“small to non-existent potential”).

The survey suggests that Blockchain bears a potential for cost-cutting in the internal processes of firms and in the interaction with clients and customers. In the energy sector, the availability of increasing amounts of data on the overall state of the system, on customers, and on internal processes coincides with an existential need of many companies to cut costs. Hence, energy companies may have an intrinsic motivation to exploit the efficiency of the Blockchain protocol to increase their internal performance and efficiency. According to respondents’ statements, it has the potential to reduce costs and to enable new business models and marketplaces; it will be instrumental to manage complexity, data security, and ownership.

The results of the survey show that German energy executives see a broad range of possible applications of Blockchain in the energy system, both in terms of processes as well as platforms. However, it is competing with existing solutions and has to prove its attractiveness to users. From a market perspective, establishing Blockchain as the dominant transaction technology might be more difficult in existing markets than in new markets where new applications do not yet exist. Taking a practical case from the energy sector, the rollout of Smart Meters has just begun in countries such as the United Kingdom, in Germany a sequential rollout will start at the beginning of 2017. Many countries plan the official start of the rollout in the next one or two years. It is not clear which software solution will become dominant in multi-directional Smart Meter transactions. Similarly, establishing a homogeneous payment system for public charging stations of electric vehicles is still a work in progress. Startups such as BlockCharge are trying to push a standard based on Blockchain. Wherever a peer-to-peer trading network that does not rely on an intermediary – a trusted institution – has not yet been established on a large scale, Blockchain has the chance to become the dominant design.

Blockchain might have a more contestable position in applications where technologically sophisticated platforms and processes already exist and are accepted among market participants. Electricity exchanges such as the European Electricity Exchange in Leipzig (EEX) serve as platforms that were established under the paradigm of liberalisation to allow parties to trade energy, emissions, and their derivatives. Even though Blockchain alters the configuration of trading by establishing a peer-to-peer network, it has to compete with the existing solution. Only if its applications have tangible, monetary, or timely advantages, Blockchain-based solutions will be able to convince a critical number of market participants to switch from the current status quo to the new platform, generating sufficient liquidity and establishing itself as an attractive alternative.

[/ms-protect-content]

About the Authors

Christoph Burger is senior lecturer and senior associate dean executive education at the European School of Management and Technology. He is a speaker in conferences of World Alliance of Decentralized Energy, Cornwall Energy, Oxford Energy, a member of the jury of the GreenTec Awards and a mentor at accelerators such as the Startupbootcamp or GTEC.

Christoph Burger is senior lecturer and senior associate dean executive education at the European School of Management and Technology. He is a speaker in conferences of World Alliance of Decentralized Energy, Cornwall Energy, Oxford Energy, a member of the jury of the GreenTec Awards and a mentor at accelerators such as the Startupbootcamp or GTEC.

Andreas Kuhlmann is Chief Executive of the German Energy-Agency (dena). Among others, the graduate physicist has held positions at the German Association of Energy and Water Industries (BDEW), the German Embassy in Stockholm and the European Parliament, the German Parliament and the Federal Ministry of Labour and Social Affairs.

Andreas Kuhlmann is Chief Executive of the German Energy-Agency (dena). Among others, the graduate physicist has held positions at the German Association of Energy and Water Industries (BDEW), the German Embassy in Stockholm and the European Parliament, the German Parliament and the Federal Ministry of Labour and Social Affairs.

Philipp Richard is Project Director at the German Energy-Agency (dena). Since 2011 he has been involved in various projects in the fields of digitisation, smart grids, smart metering and market integration of renewable energies. He was responsible for the dena Smart Meter Study (2014) and is head of team for a digitisation project supported by the Federal Ministry for Economic Affairs and Energy.

Philipp Richard is Project Director at the German Energy-Agency (dena). Since 2011 he has been involved in various projects in the fields of digitisation, smart grids, smart metering and market integration of renewable energies. He was responsible for the dena Smart Meter Study (2014) and is head of team for a digitisation project supported by the Federal Ministry for Economic Affairs and Energy.

Dr. Jens Weinmann is Program Director at the European School of Management and Technology (ESMT), Berlin. He is Chairman of the Judging Committee at the Product Innovation Awards of European Utility Week and mentor at the Startupbootcamp Berlin, an accelerator focusing on innovations in energy and transport.

Dr. Jens Weinmann is Program Director at the European School of Management and Technology (ESMT), Berlin. He is Chairman of the Judging Committee at the Product Innovation Awards of European Utility Week and mentor at the Startupbootcamp Berlin, an accelerator focusing on innovations in energy and transport.

References

1. Swan, M., Blockchain: Blueprint for a New Economy. 2015: O’Reilly Media.

2. Abra. How it Works. 2016 [cited 2016 2 Sep]; Available from: https://www.goabra.com/technology/.

3. Weusecoins.com. Venture Capital Investments in Bitcoin and Blockchain Companies. 2016 [cited 2016 22 Sep]; Available from: https://www.weusecoins.com/en/venture-capital-investments-in-bitcoin-and-blockchain-companies/.

4. Potter, B., Blockchain power trading platform to rival batteries, in AFRWeekend. 2016, The Australian Financial Review Magazine.

5. Rutkin, A., Blockchain-based microgrid gives power to consumers in New York, in New Scientist. 2016.

6. BSW, Statistische Zahlen der deutschen Solarstrombranche (Photovoltaik). 2016, Bundesverband Solarwirtschaft.

7. BWE, Anzahl der Windenergieanlagen in Deutschland. 2015, Bundesverband WindEnergie.

8. Fachverband Biogas, Branchenzahlen 2015 und Prognose der Branchenentwicklung 2016. 2016, Fachverband Biogas.

9. BMWi. Entwicklung der erneuerbaren Energien in Deutschland im Jahr 2015. 2016 [cited 2016 20 Sep]; Available from: http://www.erneuerbare-energien.de/EE/Navigation/DE/Service/Erneuerbare_Energien_in_Zahlen/Entwicklung_der_erneuerbaren_Energien_in_Deutschland/entwicklung_der_erneuerbaren_energien_in_deutschland_im_jahr_2015.html.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.