By Peter Weill, Stephanie L. Woerner and Nick van der Meulen

Transformation is not easy but the companies who have reached “Future Ready” have significantly higher financial performance. Know about the different pathways companies take in their attempt to achieve breakthrough performance via digitally enabled business transformation.

Digital changes everything – even in the cement business. In an effort to help their customers succeed in a complex and uncertain environment, the global cement company CEMEX became the first in the building materials industry to develop a multi-device customer integration platform. CEMEX Go provides services to streamline customer interactions including ordering, tracking shipments, and payment providing information and transparency to improve operational control, decision making, and productivity. Launched just over a year ago, CEMEX Go adoption raced to 20,000 active customers across 18 countries – a testimony to CEMEX’s ability to innovate and the need for change on building sites.

Like CEMEX, many companies plan to achieve breakthrough performance via digitally enabled business transformation. We call this journey becoming “Future Ready”. Future Ready companies are ambidextrous: on the one hand, they significantly improve their customers’ experience relative to competitors and on the other hand relentlessly reduce cost and simplify their operations. These Future Ready companies are much more agile reusing modular capabilities, make their data a strategic asset, and more easily partner to participate in digital ecosystems.

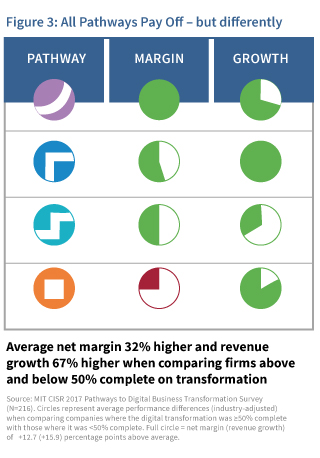

In this paper, we share insights from the journeys of 216 companies.1 We grouped these companies by whether they had completed more or less than 50% of their proposed digital business transformation journey finding large differences in performance. Companies whose transformation was at least 50% complete against target had 32% higher net margins and 67% higher revenue growth than competitor companies whose transformations were less than 50% complete.

[ms-protect-content id=”9932″]

Becoming Future Ready

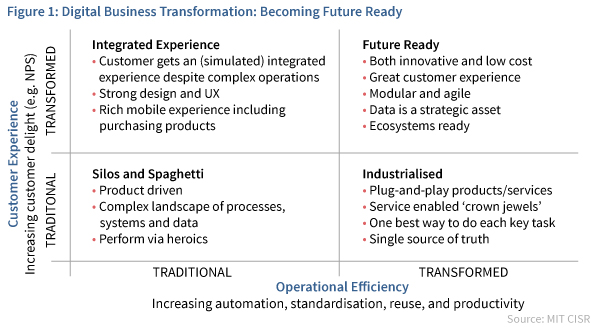

Becoming Future Ready requires a company to transform on two dimensions: customer experience and operational efficiency. Most companies we studied began their journey in the “Silos and Spaghetti” quadrant of Figure 1.2 They had typically prospered over many years by adding new products, adding new geographies, creating new partnerships and adding more complexity to their operations. A complex landscape of business processes, fragmented data and systems spaghetti resulted. These Silo and Spaghetti companies achieved good performance mainly through the heroics of their people who –despite overwhelming complexity – worked hard to deliver a good customer experience.

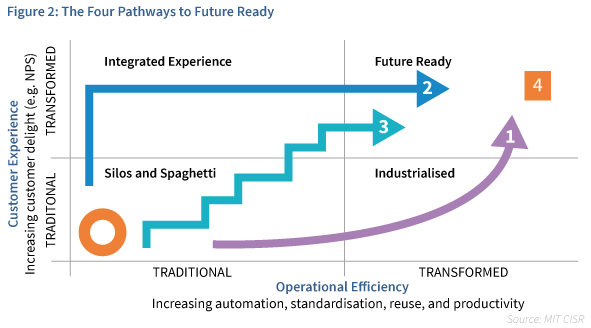

To become Future Ready we found companies adopt one of four pathways – see Figure 2.3 CEMEX followed Pathway 2 with the goal of radically improving the customer experience in the construction industry. In contrast, Tetra Pak is on a Pathway 1 journey. Comprising three businesses: food packaging, processing, and services, Tetra Pak spent over a decade developing global operational standards, data and solutions. Tetra Pak is now working on a connected customer equipment platform that leverages advanced analytics and IoT technologies for a combined packaging, processing, and services solution to its customers. To focus on delighting customers the company radically changed its performance metrics and incentives away from operational efficiency to focus on customer journeys.

Other firms take an iterative approach along Pathway 3. KPN is the leading provider of telecom services in The Netherlands. KPN began its transformation to Future Ready in 2013 while under significant financial strain. Strong competition had reduced prices in saturated markets, regulations capped termination and roaming fees, and over the top (OTT) companies such as Skype, WhatsApp, and Netflix had eroded legacy revenue streams while heavily burdening network capacity. To remain competitive, KPN needed to radically improve its operational efficiency and customer experience nearly simultaneously, making Pathway 3 an attractive option.

At the start of the transformation, KPN identified key customer experience initiatives– such as creating a single customer identity for digital services, and improving the multi-product order capture process in their stores (which was taking about 30 minutes). Before they could pursue these initiatives, the company had to make several improvements to its operational foundation: it had to first move right on Pathway 3 before moving up. For example, KPN re-insourced development and design capabilities. In addition, KPN created a “Simplification and Innovation” unit centralising all business process redesign, IT architecture and development capabilities. Agile teams developed a “digital engine” enabling API access to over 300 legacy services from their back-end systems, allowing developers to quickly execute on customer-facing initiatives. This stair step pattern continued – iteratively improving the customer experience and efficiency, resulting in a 20-point increase in net promoter score (NPS) and cost savings of more than €500 million.

Other companies decide that it will take too long to transform to Future Ready. Instead, they create a new Future Ready enterprise – via Pathway 4 – either as a standalone company or as a separate business unit. Pathway 4 is, on average, the fastest way to get to 50% complete or more but takes longest to achieve profitability. Domain is an Australian company that followed a Pathway 4 journey developing a “dreaming to owning” app-based service for finding and buying a home. As one of Fairfax Media’s fastest growing assets, it had autonomous decision rights to develop its own leadership, technology stack, and culture. Domain adopted a sales-first (rather than Fairfax’s editorial-first) way of working, developing an innovative, mobile-centric platform that acts as the go-to destination for both prospective home buyers and real-estate agents.

Lighter (purpose-built) plug-and-play technologies offered agility as well as a lower cost base, and data on how users interact with the platform became a strategic asset and was used every day to implement the company’s value proposition. Using its digital ecosystem of partners, Domain has achieved 500% year-over-year revenue growth in new transactional revenues, such as facilitating home loans and insurance, utilities connections, and home maintenance. Domain’s rapid growth and market success led to a successful IPO in December 2017 generating a $0.75 billion of new value.

Some companies with multiple business units pursued different digital transformation pathways in different business units. For example, one bank followed Pathway 2 for their B2B institutional business and Pathway 1 for their B2C retail business. Another common approach was coordinating multiple paths in a single business. For example, another large bank is adopting Pathway 1 for 80% of its investment and Pathway 2 for the remaining 20% making “spot bets” to improve the customer experience (like a new mobile app) to keep competitive on customer experience while focusing on improving operational efficiency. The bank’s executive committee decided that spot bets would not exceed 20% of investment and they had to be designed to plug-and-play into the platforms created on Pathway 1.

All pathways payoff – but differently

The good news is that all four pathways lead to success; the more of the journey a company reports it has completed, the better the benefits. But each pathway yields different results on net margin and revenue growth relative to competitors (see Figure 3). For example, Pathway 1 on average yields the best performance on net margin relative to competitors – as illustrated by the full circle – and second best (after Pathway 2) on growth. Partial circles show the relative results of the other three pathways. Similarly, Pathway 2 yields the best relative performance on revenue growth and second best on margin. Pathway 3, despite high expectations, has the worst relative performance on growth and second worst on margin. Pathway 4 company transformations have a very interesting combination of benefits – with the second-highest growth after Pathway 2 – but are not profitable (on average) as yet. And the benefits are large for those more than 50% complete on their journey. For margin, the full circle represents 12.7 percentage points above average while for growth the full circle represents 15.9 percentage points above average.

Pros and cons of the four pathways

All the pathways have pros and cons. For example, as you get past about halfway on Pathway 1, customer experience increases at the same time as you improve operational efficiency – often with a great sense of progress and agility. That’s because you create reusable digitised components that can plug-and-play to quickly create new customer experiences. But that long flat section at the beginning of Pathway 1 we call the “digitisation desert”: that’s when a lot of effort occurs by the operations and IT people with little improvement in customer experience, often frustrating the executives responsible for engaging customers. Fortunately, companies are now shortening the time in the digitisation desert by using recent developments in technology and through practices including cloud computing, APIs, agile teams, DevOps and others.

Pathway 2 is very addictive. Customer experience investments typically show quick results, resulting in strong momentum to spend more. However, in many companies the improvement in the customer experience doesn’t address the underlying operational complexity and typically makes it worse. When following Pathway 2, it’s very important to turn right as soon as possible and focus on improving operational performance because for most companies as you increase the customer experience you also increase the cost to serve, thereby reducing margins.

We often hear from senior executives and consultants that Pathway 3 seems like the best option as it gives the company flexibility to move in small steps in each direction. That’s not what we found, as Pathway 3 has some of the worst performance characteristics. The words “organisational whiplash” summarise why. It’s very difficult to set direction, empower your people, govern the investment and performance and connect the steps often changing direction every 6 to 12 months. We see significant organisational fatigue and confusion about which step to focus on at which time. It’s not to say the Pathway 3 doesn’t work and we have seen many companies like KPN successfully transform that way. But on average it’s harder and takes strong leadership, governance, and a clear road map.

Pathway 4 allows you to create a born Future Ready company, which grows fast, and adds new capability every month. But companies that have successfully followed Pathway 4 then face a dilemma. What do you do with the two separate businesses – one mired in Silos and Spaghetti and the other Future Ready? It’s very hard to merge them as they have different operating models and cultures, so do you run two separate companies or slowly wind down the original company and transfer customers to the new company? This is a dilemma facing ING and their very successful Pathway 4 company ING Direct as they ponder bringing those two together.4

Leadership

Only 30% of the companies in our analysis have so far stayed on course to reach at least 50% transformed – which is when the benefits really start to hit the bottom line. To successfully transform, senior management must choose pathways based on the company’s competitive positioning – in particular, the quality of the company’s current customer experience, and its efficiency relative to competitors. Companies trailing on customer experience need first to move up on the 2×2, while those operating less efficiently need first to move right.

As you ponder your company’s transformation, we suggest two lessons. First, it’s critical to agree on which pathway(s) the company will follow and create a common language around how you will transform. Without agreement there will be many loosely coordinated attempts at transform that will likely fizzle out or clash. In a recent workshop with a CEO and senior executive team of a financial services company, we asked the participants independently to draw their journey over the last three years on the framework. To their surprise and then horror, none of the 8 executives drew the same pathway and a big “aha!” moment occurred as to why they hadn’t made much progress.

Second, significant culture change is needed to transform – both in ways of working and taking responsibility for leadership. For example, the development of the CEMEX Go platform and the needed “digital mindset” involved educating all employees and focusing on continuous innovation to improve the customer experience. Along the journey CEMEX became less hierarchical, operating in a more agile, collaborative and iterative way, and focused on continuous testing and learning. When CEMEX began its journey, three executives heading up three different digital areas led the transformation. About six months into the transformation, the CEO raised the stakes asking the Executive Committee to take ownership of leading the company’s digital future.

Transformation is not easy but the companies who have reached Future Ready have significantly higher financial performance. How will you lead your company to be Future Ready?

[/ms-protect-content]

About the Authors

Peter Weill, PhD, is an MIT senior research scientist and chair of the Center for Information Systems Research (CISR) at the MIT Sloan School of Management, which studies and works with companies on how to transform for success in the digital era. MIT CISR has approximately 100 company members globally who use, debate, support and participate in the research. Peter’s work centers on the role, value, and governance of digitization in enterprises and their ecosystems. Ziff Davis recognised Peter as #24 of “The Top 100 Most Influential People in IT” and the highest ranked academic.

Peter Weill, PhD, is an MIT senior research scientist and chair of the Center for Information Systems Research (CISR) at the MIT Sloan School of Management, which studies and works with companies on how to transform for success in the digital era. MIT CISR has approximately 100 company members globally who use, debate, support and participate in the research. Peter’s work centers on the role, value, and governance of digitization in enterprises and their ecosystems. Ziff Davis recognised Peter as #24 of “The Top 100 Most Influential People in IT” and the highest ranked academic.

Stephanie L. Woerner, PhD, is a research scientist at MIT CISR. Stephanie is an expert on how companies use technology and data to create more effective business models and manage the associated organisational change. She has a passion for measuring hard-to-assess digital factors such as connectivity and customer experience, and linking them to firm performance. Stephanie is the coauthor, withPeter, of What’s Your Digital Business Model? Six questions to help you build the next generation enterprise (Harvard Business Review Press, 2018).

Stephanie L. Woerner, PhD, is a research scientist at MIT CISR. Stephanie is an expert on how companies use technology and data to create more effective business models and manage the associated organisational change. She has a passion for measuring hard-to-assess digital factors such as connectivity and customer experience, and linking them to firm performance. Stephanie is the coauthor, withPeter, of What’s Your Digital Business Model? Six questions to help you build the next generation enterprise (Harvard Business Review Press, 2018).

Nick van der Meulen, PhD, is a research scientist at MIT CISR. He investigates digital business transformations, particularly concerning how leading organizations change decision rights and manage technology to enable new ways of working that drive performance.

Nick van der Meulen, PhD, is a research scientist at MIT CISR. He investigates digital business transformations, particularly concerning how leading organizations change decision rights and manage technology to enable new ways of working that drive performance.

References

1. MIT CISR 2017 Pathways to Digital Business Transformation Survey.

2. For more information on the development of this framework see Weill, Peter and Stephanie L. Woerner. “Is Your Company Ready for a Digital Future?” MIT Sloan Management Review, Winter 2018, 59(2): 20-25

3. The framework and pathway lines are based on series of informal interviews in 2015-7 on digital transformation with senior executives globally and financial performance identified via the MIT CISR 2017 Pathways to Digital Business Transformation survey (N=216).

4. “ING to spend EUR800 million on digital integration; shed 7000 jobs,” Finextra, October 3, 2016, https://www.finextra.com/newsarticle/29533/ing-to-spend-eur800-million-on-digital-integration-shed-7000-jobs.