By Thorsten Makowski, Heidi Gardner, and Hannes Beer

Digitalisation is changing procurement and supply chain management. It comes in three stages: cost reduction, value creation and business model transformation. Companies understand that digitalisation is important, but they perform poor and don’t exactly know what to do. Due to perceived risks, implementation comes slower than possible. When a first mover advantage is not existent, this is not a huge problem. When it exists, it can risk the whole company.

Digitalisation is changing the way businesses and their procurement, supply chain and operations operate. Sometimes it has a dramatic and disruptive impact. But oftentimes its impact is not as fast and dramatic as many people fear it could be.

Change driven by technology is nothing new. It all started with fires, beacons, smoke signals, drums and horns. For people, society and business, communication was always important. Around 3.500 B.C. writing was discovered; the Phoenician established the Alphabet around 800 B.C.; in 105 A.D. Tsai Lun invented paper; in 1440 Gutenberg developed the printing press; in 1830 the electronic telegraph was invented and started to rule the business world. In 1876 Bell patented the telephone. The next age of communication started in 1951 when computers were first sold commercially. In 1969 the first form of the Internet was created. 1973 the first Cellular Phone, 1974 brought the first Fax to market, 1981 saw the first Laptop, 1982 the (SMTP) email, 1990 the World Wide Web. Email has for a long time been the most important way of electronic communication, especially for business use. And now digitalisation is expected to transform businesses again.

It is the aim of this new edition of our global procurement and supply chain management study to find out the impact of the digitalisation on businesses today, For this, we have surveyed for the fifth time since 2009 Chief Procurement Officers, CEOs and other Top executives from 1,174 companies in 75 countries from all continents. Besides large corporations like IBM, Dow Chemical, Siemens and PepsiCo, numerous small and medium size enterprises were also represented.

The survey was made between March and August 2017. Our cooperation partner was the Harvard University. After analysing the data, multiple additional interviews were done to deeply understand what good performers do today and why.

[ms-protect-content id=”9932″]3 Stages of Digitalisation

Digitalisation does not mean the same for everyone. Factors like branch, company size, location, and business model have an influence on what digitalisation means for a particular company and how much it is implemented. Company size has a positive impact: large companies develop a strategy 15 percent more often, which defines how to cope with digitalisation in the future. They want to achieve 18 percent more objectives (especially on quality and speed), they measure 26 percent more KPIs, they utilise more than double the amount of e-Business tools and purchase 19 percent more online.

Digitalisation means multiple things of which massive advances in data generation, computing power, and connectivity are the most important. Artificial intelligence and the Internet of Things are examples of digitalisation that create new opportunities, but also new threats, if viewed from a cyber security perspective.

When companies are asked what they want to achieve with digitalisation, there is an interesting pattern that connects their current procurement, SCM and operations maturity to the value levers they want to improve.

The maturity of procurement develops over five stages. In the earliest phase, procurement has to work only – no real value is generated. Once procurement reaches a critical scale, the new goal is cost reduction. In the next stage, operational aspects like reliability, speed and especially quality get optimised too. Procurement becomes an operations enabler. The average procurement in the world is in this stage.2 Companies which already optimised operational aspects begin to add financial value creation levers like capital, tax and especially risk. Top value champions in the final stage of the development focus more on innovation and sustainability.

It is not surprising that most companies focus on the easiest and most obvious value creation levers: Cutting cost, optimising processes and reducing time. A KPMG study came to a similar observation that digitalisation focusses mostly on operational efficiencies, business processes, and cost savings.3 Our study shows more than half of the companies we surveyed focus on cost reduction and faster speed, thus, process efficiency. This is the foundation. Here, the automation of transactional processes of a software solution provider is one example to increase quality by automatised processes, reduce costs by reducing human work, and shorten the processing time. For a third of the companies, who are relatively small or whose strategic focus are on costs, this level is sufficient.

More developed companies want more; they look for more complex value levers such as innovation, sustainability and tax advantages. This does not imply that cost and speed do not matter. Rather, these companies have already established cost-and-time-efficient processes and tools.

In Stage 3 – for only a few companies – the newly available data can be the foundation for a complete new business model. Hereby, data is not an element for better and cheaper processes, but the data itself is the core of a product or service of the business model. Having access to information has always been the key for business partners. SAP Ariba, the largest business network in the world, runs a network of a gigantic 3.8 million suppliers and more than 1.7 trillion USD on commerce. Access to a rich database is the prerequisite for using, and potentially productising data for the benefit of the company.

Table 1: Five Stages of Procurement Maturity

(Developed with data from 3ʳᵈ Global Procurement and SCM Study, 2013 by Thorsten Makowski)

Many companies have a poor digitalisation performance

Digitalisation is seen as a lever to be more successful in the future. Still, many companies perceive their performance to be only average when it comes to digitalisation. This implies the need for action. Many companies did realise their weakness and want to invest more in digitalisation in the future. Only four percent do not want to invest in digitalisation – and those are the weak performers. Nevertheless, not all companies have a clear goal and strategy in terms of digitalisation. Around 40 percent of the companies know what they want and they have to invest, but don’t know how and why. A clear digitalisation strategy is missing. Interestingly, start-ups seem to be better prepared than traditional companies, which increases the probabilities for old, large product and manufacturing focussed companies to be threatened by disruptors.

A digitalisation strategy is necessary

Digitalisation is only an instrument, which can be used to achieve different ends; it is not an objective itself. Prior to every investment, it is important to develop a strategy to ensure the attainment of the aspired goal. It is crucial to include, besides procurement and supply chain management, the top management, IT, and other relevant company functions, as well as external stakeholders such as potential software providers. Moreoever, as the future is hard to predict and digital innovations are happening at numerous places, companies need to be agile to react.

Take Körber, a German enterprise with 2 billion EUR revenue, as an example. The Executive Board initiated a digitalisation initiative, which is structured in three phases: Exploration, Learning and Strategy Development. As part of the second phase, Purchasing conducted a strategy roadshow and several inspirations summits to explore the opportunities from digitalisation for this function. Körber uses the term, “exploration” to show that executives should become explorers, which has an impact on mindsets and organisational structure. It also indicates that strategy is not a one-time, but an iterative process, and that not all decisions can be based on hard ROI analysis, but some have to be done by gut feeling.

Struggle to optimise and speed up internal processes, but digitalisation makes it particularly important to optimise and digitalise internal with external processes. Also, companies need to build new technology capabilities, although customers do not value technology itself but the value it can generate for them.

Platforms become a more and more important lever. Process innovation, improvement, and efficiency have not become less important; but the new strategic reality is that platform innovation increasingly defines and drives process capability rather than the other way around. The potential huge amount of data generated by new platforms can be used for predictive analytic insights to make supply chains more anticipatory and effective.

From a procurement and supply chain perspective, defining a digital transformation strategy, tightly integrated in the overall ERP landscape, is key to get the highest benefits from processes and systems.

Most companies struggle with the basics

Even though digitalisation offers economies of scale, large and globally active companies have an additional problem regarding digitalisation. Due to permanent M&As, it can hardly be avoided that there are multiple (ERP) systems, which are hard to consolidate. Whereas large companies act as first movers in other infrastructure measures, they move relatively slow in terms of digitalisation. Sixty percent of companies have problems with the consolidation of different IT tools. One of Germany’s huge DAX-30 companies, with operations in around 100 countries has more than 30 different ERP-systems. When the Chief Procurement Officer wanted to find out a simple KPI like his total spend volume, dozens of external consultants spending over almost a year were necessary to find the answer.

But the challenge of multiple ERP systems for decentralised large companies is not hopeless. Take ThyssenKrupp as another example, where within a couple of years, it was possible to successfully aggregate the current and historic spends, existing sourcing platforms and catalogues in one aggregated spend data warehouse. The newly created transparency is the basis to collaborate with strategic innovative suppliers to improve the company’s own products and services.

Risks reduce the speed of change

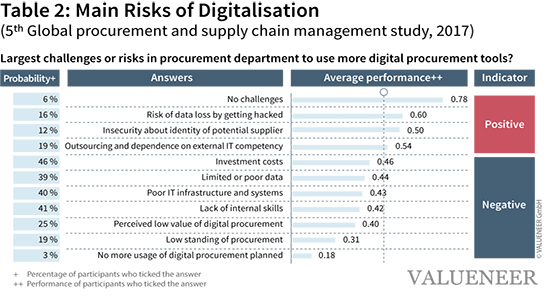

Digitalisation does not come without risk. Whereas more than half of all companies struggle with high investment cost, bad internal (IT) skills and bad IT systems, high performers worry about more strategic aspects. They fear digitalisation could create a new company risk due to a loss of control. Main worries are getting hacked, identity insecurity of suppliers, and increasing dependency on external through outsourcing. These main worries of top performers strategically indicate that there is no first mover advantage, but instead, it seems wise to wait until others have shown that the risk is manageable. Therefore, many concepts and technical opportunities for digitalisation are available on the supplier side, but the implementation is rather slow. Thus, digitalisation process moves as slow as possible until the tipping point gets reached. For companies with a huge threat of disruption, the situation is different; here, the first mover advantage can be significant.

Asian companies perform better

Digitalisation has a different meaning in Asia. Asian companies have more often a digitalisation strategy than western companies and have introduced digital products and services at a much faster rate than their counterparts.6 Western companies use e-Business tools 50 percent more often than Asian companies.

Meanwhile, Asian companies utilise tablets and mobiles more than double as often as western companies. This leads to an improvement in terms of communication and efficiency, even though it is related to lower cost and a lower complexity – a pragmatic approach.

Table 2: Main Risks of Digitalisation

(5ᵗʰ Global procurement and supply chain management study, 2017)

Largest challenges or risks in procurement department to use more digital procurement tools?

Job loss and job changes

From employees’ perspective, digitalisation is connected with bad news. Digitalisation will lead to increased demand for highly qualified strategic employees. Every one in four companies needs such highly qualified employees. They are already hard to find, representing only 15 percent of current procurement employees. Additionally, lower qualified employees are less in demand. Every one in six companies wants to reduce employees in this area. Under this new circumstances, the number of people losing their jobs are 4 times more than those who get hired. This is a net job reduction. The number of employees made redundant is above average in large companies and in Europe.

The job profiles in the procurement function will change. The strategic jobs will get even more complex, not only requiring procurement, interpersonal, business, and technical skills, but also IT skills – digital, analytical and softwares. It can be expected that companies will compete hard in finding them. Regarding their job profiles and processes, companies will have to analyse which processes create additional value if improved and which don’t. That will be the key in the design of future procurement and SCM jobs.

Outlook

Having analysed 4,120 companies from 113 countries in our total global procurement and SCM study series, we found that companies had a median procurement with a company revenue of 330 million EUR, a procurement volume of 180 million EUR, 20 procurement employees of which only three worked in strategical procurement, and 1,120 existing suppliers plus around 14,000 potential suppliers. One can anticipate that procurement, whose job is to create value for its company in managing suppliers as external assets, has significant problems if every strategic employee is on average responsible for 60 million EUR, almost 400 existing suppliers and 5,000 potential suppliers. Imagine the improvement potentials if digitalisation can tackle this highly unutilised potential.

Or as Marcell Vollmer, the Chief Digital Officer of SAP Ariba, put it: “Over the next ten years, companies will see more opportunity than in the past two decades. In embracing digital technologies and strategies, procurement can take the lead in maximising these opportunities and beyond delivering cost savings and process efficiencies, fuel innovation and market advantage.”

[/ms-protect-content]About the Authors

Dr. Thorsten Makowski is managing director of VALUNEER, a managing consulting company. He has over 17 years of consulting experience with a focus on procurement and SCM. He teaches procurement and SCM since 2009 at 24 Business Schools in 13 countries. These schools include Mannheim Business School, Cass London, Bath, Rutgers (US), HHL Leipzig, ESCP Europe and Indian Institute of Management Ahmedabad.

Dr. Thorsten Makowski is managing director of VALUNEER, a managing consulting company. He has over 17 years of consulting experience with a focus on procurement and SCM. He teaches procurement and SCM since 2009 at 24 Business Schools in 13 countries. These schools include Mannheim Business School, Cass London, Bath, Rutgers (US), HHL Leipzig, ESCP Europe and Indian Institute of Management Ahmedabad.

Dr. Heidi Gardner is the Distinguished Fellow in the Center of Legal Profession of Harvard Law School in Boston. Furthermore, she teaches for the Accelerated Leadership Program.

Dr. Heidi Gardner is the Distinguished Fellow in the Center of Legal Profession of Harvard Law School in Boston. Furthermore, she teaches for the Accelerated Leadership Program.

Hannes Beer is Senior Consultant with experience in the fields of strategy consulting and procurement.