By Dennis M. Sponer

Breaking into U.S. healthcare demands more than smart algorithms. At CES 2026, European innovators revealed what actually drives scale, trust, and investment in the world’s toughest market. In this analysis, Dennis M. Sponer shows how AI becomes credible only when paired with governance, reimbursement fluency, and institutional readiness built for American realities.

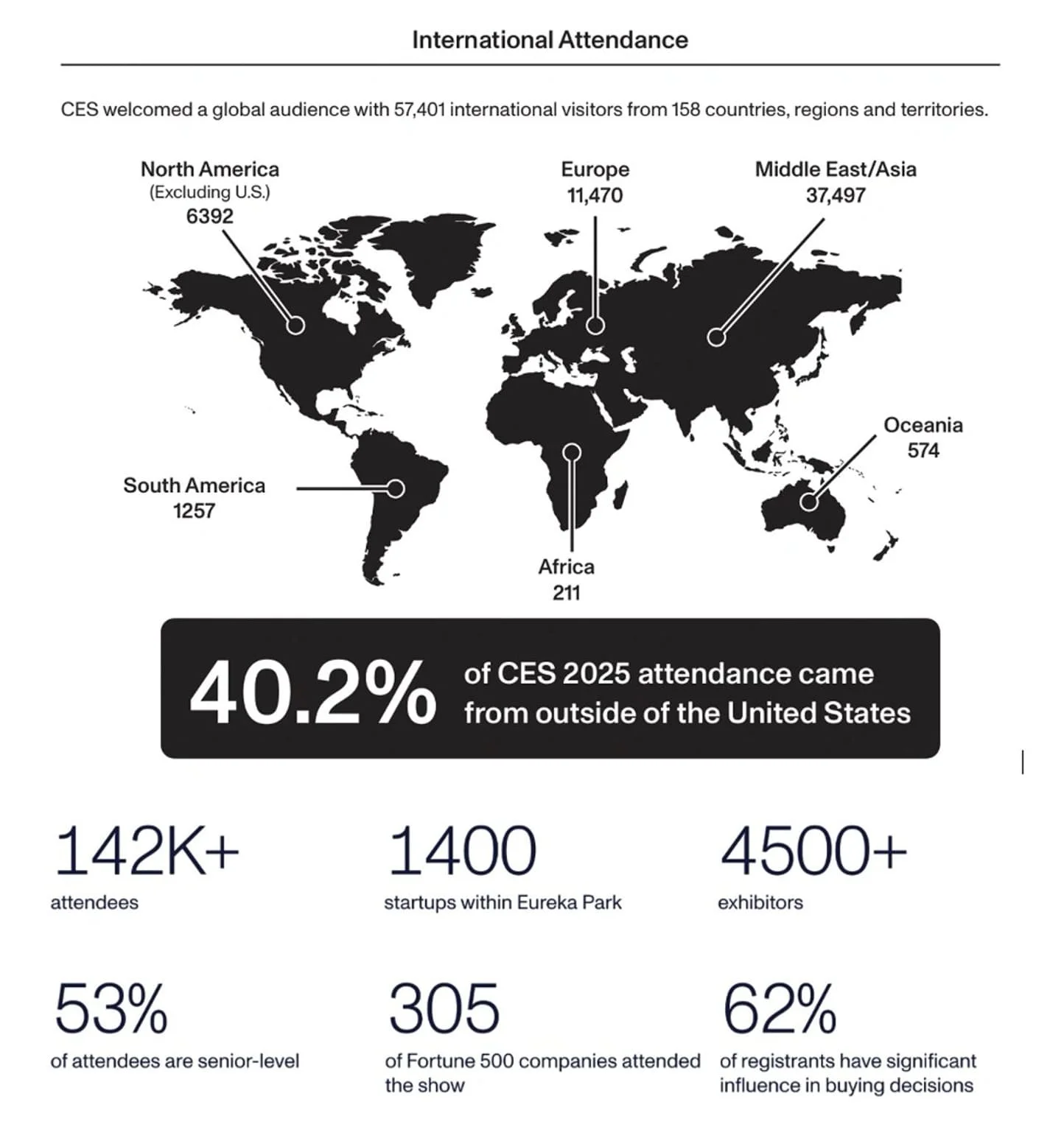

The Consumer Electronics Show (CES) has become one of the world’s most important global showcases for healthcare innovation. What began as a consumer technology exhibition now includes a dedicated healthcare pavilion, alongside multiple national pavilions located just one floor below it, where countries showcase their most advanced technology companies. At CES 2026, there were over 40 global pavilions, including notable European pavilions like the European Innovation Council (EU) Pavilion, France (La French Tech), Germany, Italy, the Netherlands, Switzerland, Poland, and Hungary.

This physical proximity of the healthcare pavilion to the international pavilions highlights CES’s broader role as a distinctly international forum. CES is where healthcare innovation, capital, regulation, and market-entry strategy converge. This year also served as the setting for the third annual TRIUM Global Executive MBA alumni get-together focused on AI and global healthcare leadership.

AI is rapidly transforming how healthcare is delivered, diagnosed, and managed. It now sits at the heart of healthcare innovation, from clinical decision support and medical imaging to care coordination and population health analytics. However, for European healthcare companies, possessing advanced technology alone is not enough to guarantee success—especially when aiming to enter the U.S. healthcare market.

The key question has shifted from whether a company is innovative to whether that innovation can be turned into investability. This involves the ability to operate at scale, attract institutional capital, pass regulatory scrutiny, and navigate one of the most complex healthcare systems in the world. In this regard, the U.S. healthcare market remains the most attractive in the world. It has the highest healthcare spending, the most private equity and venture capital investment, and the most active environment for strategic acquisitions. Artificial intelligence has become a powerful tool for European companies seeking entry into this industry, but only when combined with strict execution, governance, and institutional knowledge.

CES as a Stress Test for Entering a Market

The Consumer Electronics Show (CES) in Las Vegas now serves as a global benchmark for this shift. It used to focus mainly on consumer gadgets and technology. Now, it’s a platform for showcasing applied AI, digital health solutions, and scalable healthcare business models. CES is no longer just about attracting attention for European healthcare companies. It is where the U.S. market’s priorities and expectations—regarding business, government, and institutions—are made clear.

At CES, new ideas and questions come together. Increasingly, investors, business purchasers, and strategic partners are asking the same questions: How does this AI product fit into the U.S. reimbursement system? Who is responsible for both clinical and legal responsibilities? How is patient data protected? Can the company grow in a way that is compliant across all jurisdictions, payers, and provider systems? Companies that directly address these questions tend to gain more business. Conversely, those that don’t often discover that technical excellence alone does not ensure readiness for the U.S. market.

From AI Capability to Alignment with Institutions

These issues repeatedly came up during CES, including the third annual TRIUM Global Executive MBA meeting, where graduates from NYU Stern, the London School of Economics, and HEC Paris discussed how AI is evolving in healthcare. A common theme emerged: AI maturity has shifted. The primary concern is no longer whether AI works but whether it aligns with reimbursement models, clinical procedures, regulatory frameworks, and corporate governance systems.

This shift is especially significant for European companies. In American healthcare, value isn’t only derived from predictive abilities or machine use. It arises when AI integrates with hospitals, insurers, employers, regulators, and capital sources. To be effective leaders, understanding how these organizations operate and influence innovation is crucial.

France: Regulated Innovation and Clinical Accountability

The French Pavilion at CES showcased a strong focus on well-managed, regulation-aware innovation. Companies like Deglace, Avatar Medical, Inside Quest, Iristia, Skwheel, Solver, Y-Brush by Biotech Dental, and Acquire To Decide (A2D) displayed AI solutions for imaging, surgical planning, diagnostics, dental care, and decision intelligence.

All these organizations emphasized the importance of being able to explain, audit, and be held accountable. French founders saw regulation not as a hurdle but as a design element. This approach aligns well with U.S. healthcare expectations, where liability, FDA compliance, and the ability to make clinical decisions are paramount. For both regulators and buyers, healthcare AI that cannot be explained or audited remains a red flag.

By embedding governance into their product design, these companies simplified buying, contracting, and regulatory review processes. This significantly contributed to their faster adoption in the U.S.

The Netherlands: Workflow Integration and Interoperability

Dutch companies demonstrated strength in system integration and workflow improvement. Interoperability has long been a focus of Dutch healthcare innovation, which was clearly on display at this year’s CES. Their solutions aimed to connect doctors, payers, employers, and patients in previously separate contexts.

OrthoFoodie exemplifies this well—it’s an AI-driven platform dedicated to personalized nutrition and metabolic health. Its relevance to the U.S. stems not only from its engagement with patients but also from potential applications in employer-sponsored insurance, value-based care, and prevention programs. In a system where employers bear a significant part of healthcare costs, platforms that leverage data to personalize care and influence behavior are increasingly attractive.

Dutch exhibitors consistently emphasized interoperability as a business need, not just a technological feature. In the U.S., where data silos impact reimbursement, utilization, and outcomes, this perspective makes investments more viable.

Italy: Engagement, Prevention, and Human-Centric AI

Italian healthcare innovators focused on AI applications that promote patient involvement, nutrition, and preventive care. Many highlighted AI’s potential to change behaviors, improve adherence, and support long-term population health—beyond just clinical decision support.

These approaches resonated with U.S. insurers, employers, and self-funded plans – all of which are constantly seeking cost savings through early intervention and prevention. When backed by trustworthy data governance and clinical validation, AI platforms focused on prevention and engagement fit well within new U.S. reimbursement models emphasizing outcomes over volume.

European health tech companies like bitCorp also actively participated in CES meetings and discussions across borders. Their engagement underscored a growing trend: more European founders view CES as an opportunity to forge U.S. alliances, secure funding, and validate markets.

Investability as the True Differentiator

A clear pattern emerged across all pavilions. Typically, U.S. investors and business clients assume that European companies have strong technical skills. What sets successful entrants apart is their level of preparation—covering corporate structure, data governance, reimbursement strategies, compliance, and leadership credibility—all from the start.

Executives emphasized that the first 6 to 12 months after entering the U.S. market are critical. Poor employment choices, weak business contracts, or non-compliant data practices can hinder scaling. Conversely, disciplined early decisions unlock advantages: faster contracting, easier fundraising, and increased strategic options.

In this context, AI plays two roles. On one hand, scalable AI systems demonstrate operational leverage, margin growth, and defensibility—elements valued by venture capital and private equity. On the other hand, AI heightens regulatory, ethical, and governance risks. Companies that proactively mitigate these risks stand out, not only technically but also through strong institutional practices.

CES as a Barometer of U.S. Market Readiness

As healthcare spending and private investment in the U.S. continue to outpace other regions, European companies will have even more motivation to prepare. While AI opens doors, success ultimately depends on disciplined leadership, institutional knowledge, and execution.

CES no longer merely highlights European healthcare innovation. It now acts as a real-time gauge of the U.S. market’s readiness, where new ideas meet the realities of size, regulation, and investment. European healthcare firms can learn valuable lessons from CES 2026: innovation sparks conversation, but market entry and revenue determine success.

Dennis M. Sponer

Dennis M. Sponer