By Varun Yadav

Under the relentless pressure of sustained growth, businesses prioritize incremental improvements over transformative changes. However, rapid technological disruptions, lower entry barriers, fierce competition, shifting consumer preferences, and compressed business cycles make incrementalism insufficient. By continuously assessing seven key dimensions, the Leap and Run Framework helps businesses balance short-term incremental gains with bold transformations.

1. Introduction

In recent years, Intel has lost its dominance to its competitors. The company’s present difficulties may be attributed to delays in adopting advanced manufacturing processes, missed opportunities in the mobile segment, and inertia in capitalizing on the AI market.[1] All these issues were more pronounced as AMD and Nvidia were agile in assessing the trends and adopting new technologies. The scenario presents a classic example of how, in favour of stabilized growth and the illusion of progress, even leaders can miss the changing industry dynamics and critical inflexion points.

In the present scenario, there are several factors which make minor refinements and optimizations inadequate. Rapid technological disruptions, lower entry barriers in the technology space, breakneck competition, changing consumer preferences and expectations, faster churning of trends, reduced information asymmetry, new regulations, and increased automation are some of the factors that make gradual upgrades and refinements insufficient, especially in innovation driven industries. In this context, a Leap and Run framework is envisaged as under for companies and industries navigating rapid shifts in technology and consumer preferences along with compressed business cycles.

2. What is the Leap and Run framework?

The leap-and-run framework consists of the following three factors:

- Leaps: In the context of running, leaps refer to a state where both legs are off the ground. Likewise, any tactical move that brings transformational changes and enhances the efficiency of operations may be termed a leap. Accordingly, bold steps such as innovations, diversification efforts, and transcending to unexplored but related areas that ensure distinct advantages qualify as leaps.

- Runs or Execution Discipline: Run phase of the framework focuses on agile execution with adherence to delivery timelines, reducing overruns, continuous optimization of processes and operations to capitalize on leaps. However, developing culture of accountability and learning, stakeholder alignment, transparent communication, modular planning, having infrastructure, streamlining processes are some of the pre-requisites to execute a run.

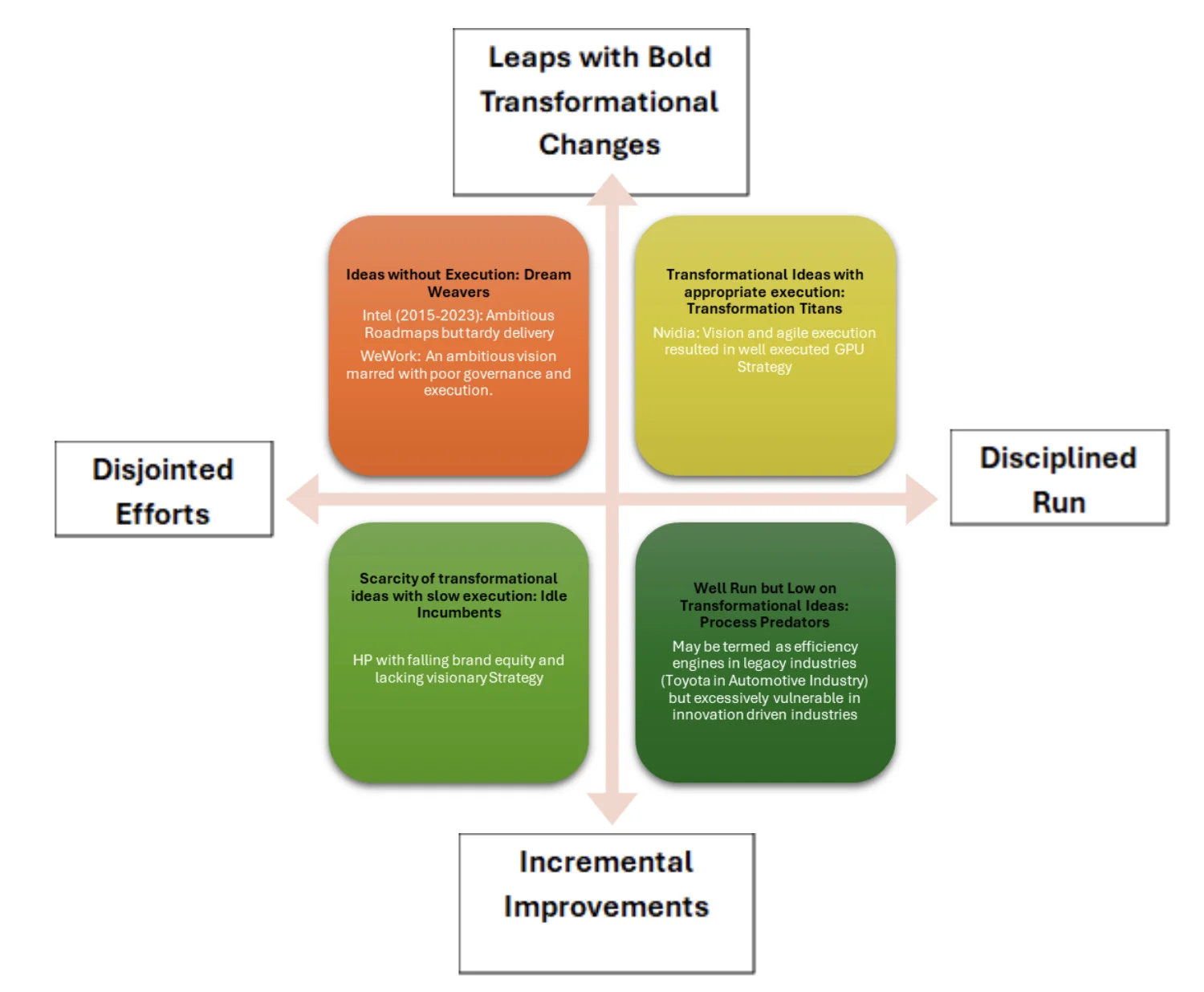

- Balance: Though innovations and transformational changes are critical, it is vital to note that such bold changes require resources. Also, the market has a specific capacity to absorb innovations. On the other hand, the stickiness of incremental improvements risks losing competitive advances and not meeting consumer expectations. Accordingly, the leap and run phases must be balanced and timed perfectly. The 2×2 matrix below (Runs on X-Axis and Leaps on Y-Axis) showcases the probable scenarios in each of the four cases.

3. How to diagnose the right time for leaps and runs?

Another critical balance factor is the timing of these leaps and runs in a sequential order. There are no thumb rules regarding the perfect timing of leaps and runs. However, the following seven dimensions need to be examined regularly through certain key questions to assess the imminent need for either of the two.

Sustainability

- Are there any industry shifts that could disrupt the business in the short term, say, 3–5 years?

- Do short-term profitability concerns drive the decisions, or is the management committed to long-term sustainability?

In the present scenario, the Entertainment Industry needs to examine whether AI-generated content, the penetration of Augmented and Virtual reality devices, compact forms of content, or wider access to 5G/6G networks will affect the entire model of content generation and delivery.

Trends

- Are there any macro or micro shifts in the market?

- Is the business keeping pace with such shifts and consumer preferences?

- Is our value proposition stagnating?

Based on recent developments, it is obvious that cable TV’s value proposition has declined. While Comcast and Disney proactively assessed the trend and devised appropriate strategies, responses from several other players were delayed.

Technology and Innovation

- Are we primarily focused on incremental process improvements rather than disruptive innovation?

- Are there emerging technologies that could potentially disrupt our business model, and we are not fully prepared?

Blackberry was blindsided by the advent of full-screen touch displays as it was overly focused on physical keypads, resulting in a sharp fall from its peak within 5 years.

Industry Landscape and Positioning

- Are competitors adopting strategies or innovations that we have not yet embraced?

- Are we conforming to industry norms rather than challenging them?

Yahoo had an effective search engine. However, while Google and Facebook ventured into data-driven and targeted advertising, Yahoo relied on banner-based ads.

Agility and Culture

- Does our culture discourage risk-taking and breakthrough thinking?

- Is our organizational structure slowing down decision-making and execution?

With e-commerce gaining traction, the lack of agility and the enabling culture in traditional retail chains is becoming evident.

Resource Allocation

- Are we investing enough in high-growth and high-potential areas?

- Are we imposing financial constraints and limiting our ability to take risks?

Intel is a prime example of misallocated R&D budgets, which resulted in several missed opportunities and cost it years of market leadership.

Measurement

- Are we facing stagnating revenue growth, shrinking profit margins, declining returns, or low R&D investment?

- Is our customer acquisition cost rising while customer lifetime value remains stagnant or declines?

- Are we experiencing an increasing churn rate and weakening customer retention?

Businesses need to ask these questions continuously. If the exercise reveals vulnerabilities, it may be wise to execute a leap. However, if answers are primarily negative, businesses may continue with optimizations for now. Leaps are not easy to execute. Businesses always need to be ready with an R&D pipeline and supporting organizational structure so that, if required, leaps may be executed relatively quickly.

4. How do we create leap ready (innovation-driven, agile) organizations?

Leap-and-Run strategy doesn’t consider innovation to be a separate business function. Instead, it considers innovation itself as the core of organizations and businesses. Accordingly, the approach is best suited for industries having shorter innovation cycles. E-commerce, Ed-Tech, FinTech, AI, Entertainment, EV Automotive, and Bio-Tech are such industries. Considering the guiding principle of innovation and agile execution, some of the practical ways to create such organizations are as under:

- Action Oriented Deliberations: Meetings and discussions should focus largely on innovation and execution, not excessive strategizing for the future.

- Incentivising value creation: Rewards and recognition should focus more on conceptualizing and executing projects addressing market inefficiencies and offering new value propositions.

- Automation: The focus should be on activities that add value. Everything routine should be automated so that key resources may be deployed for more critical tasks.

- Consumer-driven prioritization: Projects should be taken based on consumer choices and market trends, not just short-term profitability concerns.

- Rapid project termination: Slow-moving projects and initiatives that do not generate enough traction should be trashed, and the key lessons should be used to devise better opportunities.

- Empowered and accountable Teams: Teams should be empowered enough to take a call on testing and execution rather than going through a hierarchical and cumbersome process. This flexibility should be balanced with outcome-based accountability, financial sustainability, transparency on progress made, and decision-making guardrails.

Here, the broader point is to focus more on execution, agile decision-making, quickly identifying underperforming projects, and deploying resources towards more promising opportunities.

5. How does the Leap and Run framework differ from existing frameworks?

The Leap-and-Run strategy assesses past deliberations and models such as the following –

Ambidextrous Organizations model: This model was theorized by Charles A. O’Reilly II and Micahel L. Tushman in 1991. It emphasizes the need for businesses to balance exploitation (efficiency and incremental improvements) with exploration (innovation and risk-taking) simultaneously to sustain long-term success.

Three Horizons Model: McKinsey introduced the model in 1999. It divided the growth cycle into three distinct timeframes: Horizon 1 (core business), Horizon 2 (emerging opportunities), and Horizon 3 (future breakthroughs). This model helped companies manage growth across these timeframes and ensure continuous innovation without disrupting existing operations.

The S-Curve Innovation Theory: Initially developed in 1962 for the diffusion of innovations and later adapted for business, explains how products and technologies follow a growth, maturity, and decline cycle, requiring companies to proactively jump to the next innovation cycle before stagnation.

The three models were developed with distinct backgrounds and provided deep insights into innovation and industry phases; however, today’s landscape is defined by cross-industry diffusion of innovations and compressed business cycles. Accordingly, the Leap and Run strategy is more agile and market-responsive than traditional models. Like Ambidextrous Organizations, the plan emphasizes maintaining balance. However, while the ambidextrous organization model treats traditional business and innovation distinctly, Leap-and-Run is ideal for sectors driven by rapid technological advancements and shifting consumer preferences, with shorter innovation cycles.

Further, in contrast to the Three Horizons Model, this strategy assumes that the transition through three phases may not be linear, and businesses need to be ready for leaps whenever required. Similarly, while the S-Curve Theory assumes gradual decline, Leap and Run focus on pre-emptive leaps, keeping businesses ahead of industry shifts.

6. Conclusion

Though incrementalism is a recurring theme in management studies and entrepreneurial circles, considering the accelerated decision cycles in the present scenario, the strategy highlights the need to sequence innovation and enactment in a timely manner. By enlisting certain key aspects that need to be examined continuously and highlighting important features of organizations best suited for the strategy, this approach supports businesses in sustaining long-term growth, remaining competitive, and adapting effectively to market dynamics.

Disclaimer: The views expressed in this article are those of the Author and do not represent the views of the Reserve Bank of India.