By Tobias Klatt & Klaus Moeller

Environmental turbulence has be- come a key challenge for companies’ strategic planning. Planning results remain arbitrary and risky, and lack deep knowledge of relevant factors and trends. Traditional instruments such as key performance indicator concepts, strategy maps, and balanced scorecards become increasingly opaque under these conditions, especially owing to their subjective foundations, which are biased because planners are overloaded with information. To overcome these shortcomings, this article integrates predictive analytics throughout the strategic planning process with a special focus on causal reasoning: applications and benefits of knowledge in causal interactions are described for external and internal impact analysis, strategy development, scenario analysis, implementation, and the final checking phase. Our results imply that causality analysis possesses substantial benefits as a new generation of decision support for every company’s strategic planning.

1. Dynamism and Complexity: The Environment Challenges Traditional Strategic Planning Tools

Increasing environmental turbulence challenges established company strategic planning processes and tasks. The dot-com bubble, the recent financial crisis, and the current turbulence in the Eurozone—to name a few—challenge the planner’s understanding of environmental trends. Increasing competition in established markets, with new players from Asia and the growing importance of upcoming markets such as the BRIC countries create further planning uncertainty.

A plethora of demands appear, and these call for new approaches to dealing with environmental uncertainty, especially regarding the possibility of analysing “interactions among variables.”1 These arguments are based mostly on improved data availability and information techniques over the past years. As a result, helping managers to use quantitative models to support their decision-making and planning is a key research topic.2

This article addresses this gap by providing evidence on the diverse contributions of predictive analytics as a new way of analysis that offers new instruments and concepts, a core as- pect of which involves the analysis of causalities, which brings completely new insights to traditional planning approaches. However, the idea behind this is not new: causal reasoning was developed in the 1960s by Clive W. Granger. Christopher Sims, who in the 1980s developed operational transfer, in 2011 received the Nobel Prize with Thomas Sargent for their analyses of causes and effects in macroeconomics.3 Nevertheless, their developments also offer substantial benefits to strategic planning practice and science. This article discloses these benefits in strategic planning’s processes and offers insights on connections with prevalent tools, such as strategy maps or the balanced scorecard (BSC).

2. Causality Analysis Improves Planning Tool Excellence: A Holistic View of Versatilities

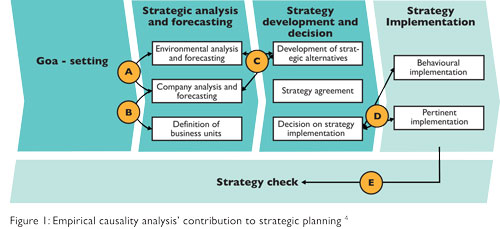

Several instruments support planners during the strategic planning process. While several concepts outline the process itself, this article relies on the detailed structure developed by Mintz-berg as well as Goetze and Mikus, which provides a disaggregated view of the particular tasks within the process steps (see Figure 1).

The instrumental support to the processing of these 9 strategic planning steps gains importance due to the increasingly extensive data and information involved in strategic decision-making in complex and dynamic environments. Traditional instruments offer several contributions to facilitate information processing within strategic planning. However, these tools are mainly based on a subjective instrumental design, such as portfolio concepts or SWOT-type analyses. Even the contribution of numbers-based decision-making models, such as AHP or system dynamics, mainly depend on subjective estimates by users or experts. Although these models have impact because they simplify complex problems and merge excessive information, they do not serve to review the strategic planner’s assessments or enhance his or her thinking by offering an objective view of interactions between strategic impact factors.

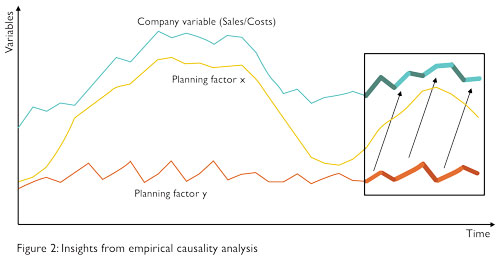

Causality analysis, as a subfield of predictive analytics, closes this gap. The processing is based solely on time series data; no subjective estimates on relationships or interactions are necessary. This approach applies enhanced regression models, which include time-lagged variables. These time-lags allow for the analysis of time-dependent interactions between the variables. Figure 2 lays out the main idea and benefit: the figure includes the development of the company variable, such as sales, and two possible external planning factors. A superficial, subjective view of the time series may trigger the assumption that planning factor X is the relevant one for forecasting the dependent company variable, since both variables show a similar trend.

However, a deeper view of the changes in the variables reveals that planning factor Y has, except the trend, nearly the same growth signs with a two-period preceding offset to the company variable. Depending on the time intervals, planning factor Y may be more accurate. For instance, in the case of quarters, current developments of Y indicate similar changes in the company variable six months ahead.

This article’s integration goal is to enable a comprehensive application of causality analysis to support more accurate strategic planning. Accuracy should lead to a more analytical-rational decision-making style, as an alternative to previous strategic planning processes, which have a purely subjective basis. Empirical causality analysis’ primary integration opportunities are connected to strategic planning tasks (see the circles in Figure 1) and are listed in Figure 2.

2.1 A: Environmental impact analysis

Against the background of increasing environmental turbulence, the analysis of causal dependencies between strategic impact factors in the environment and the company is the most challenging task. The capability to rapidly glean information on environmental developments such as customers and markets helps to attune companies to changes in the environment and can result in a competitive advantage in contrast to slower competitors.

The most suitable and comprehensive contributions of empirical causality analyses result from strategic questions concerning distribution activities. Companies have comprehensive knowledge of their markets, customers, and competitors—both as implicitly experienced by managers as well as explicitly gathered in comprehensive databases. Similarly, large public databases and research institutes provide comprehensive time series data on environmental factors, such as consumer confidence, income development, consumer price index, etc. On this basis, the analysis of causal relationships between environmental impact factors and distribution-oriented target measures such as sales or turnover can contribute to several key aspects in strategic planning. These include:

• an empirical examination of planning assumptions, such as whether sales forecasts are related to GDP developments or, instead, to different factors,

• an early warning system using leading indicators that are empirically tested on their correspondence with company target figures,

• deeper planning processes, which use additional information from empirical analysis rather than subjective estimates of impact factors’ influence,

• proactive timing of marketing activities, owing to empirically identified time-lags between changes in early indicators and sales,

• customer-oriented product strategies, as interaction effects between the instruments of the marketing mix (product, price, place, promotion) and customer-related factors (e.g., satisfaction) become evident.Besides these direct contributions of causality checks in environmental analysis, there is one more important aspect concerning the complete strategic planning process: the first strategic analysis steps also represent the primary input for the planner’s strategic learning as long-term input for developing successful strategies. Mintzberg, Ahlstrand, and Lampel emphasise the importance of learning about the environment for the success of the company’s strategic planning: “Above all, learning, in the form of fits and starts, discoveries based on serendipitous events, and the recognition of unexpected patterns, plays a key role, if not the key role, in the development of strategies…”5

The company’s learning-based ability to gather and use new knowledge from external sources defines the capability to achieve and maintain strategic fit: the contextual environment cannot be influenced directly by individuals or companies, which implies that environmental requirements are given. Changes in these requirements differ from com-pany to company, since the need to acquire resources creates dependencies between organisations and external units. Learning about the environment thereby allows for the clear perception of environmental requirements, depending on managers and planners’ capabilities and perceptions. The deep identification, analysis, and interpretation of environmental effects on company target figures is therefore crucial to the strategic planning success as a whole, since it determines the achievement of strategic fit.

2.2 B: Internal causality analysis

A key company analysis task is the identification of the firm’s strengths and weaknesses. Subsequently derived performance drivers of the company’s target figures should help to achieve strategies that build on these strengths and eliminate or minimise the weaknesses.

The analysis of causal connections between these performance drivers (such as consumer confidence or scrap rates) and the company’s target measures (such as turnover or shareholder value) can contribute substantially to the planner’s understanding of value generation. This also provides an objective basis for discussing and estimating cause-and-effect relationships within the company’s value creation process. Such active management participation in the strategic planning process can amplify the effectiveness of strategic planning.6

Internal causality analysis also prepares much-needed methodological support for strategy implementation (see Section 2.4). Strategy maps are significantly improved through the use of empirically proven cause-and-effect relationships. Strategy maps present “a visual representation of a company’s critical objectives and the crucial relationships among them that drive organizational performance.”7 These maps use cause-and-effect diagrams to describe how a strategy must be carried out to achieve the organisation’s desired outcomes. However, constructing high-quality strategy maps is difficult. Kaplan and Norton recommend that employees visually represent cause-and-effect linkages that integrate the different performance drivers and outcome measures. This approach carries the risk of invalid cause-and-effect-relationships, which can result in dysfunctional organisational behaviour, wrong strategy communication and control, and suboptimal performance. An empirical causality check of these linkages can help to review the theoretical considerations of proposed cause-and-effect-relationships.

2.3 C: Scenario analysis and strategic alternative generation

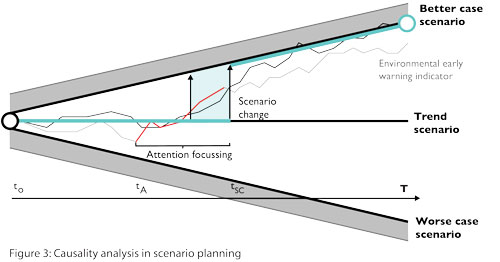

The external and internal analysis results are used during the strategy development and decision phase to generate and evaluate strategic alternatives and measures. Traditional planning approaches in dynamic and complex environments—such as scenario planning—are often criticised for their purely subjective nature, which can lead to biased planning results. Although these qualitative approaches have their specific advantages, empirical causality analysis helps to develop more elaborate scenario planning. On the one hand, the empirical identification of directly and indirectly relevant strategic impact factors is supported. On the other hand, this knowledge enables a more accurate preparation of guidance in the case of scenario changes. Connecting al-ternative scenarios with an early warning system based on causally proven indicators can enable an earlier recognition of environmental changes, as illustrated in the attention-focussing phase (tSC – tA) in Figure 3. This time lead represents a strategic advantage to the company and offers more possibilities to develop adequate strategic responses. Furthermore, this connection counteracts the frequently observed focus on a single baseline or trend scenario in strategic planning, which ignores the scenario planning advantage of building on the consideration of multiple futures.8

The second advantage enabled by empirical causality analysis is the more precise planning of responses to environmental change. Impulse-response analysis provides a view of the course and delay of responses in the company’s target figures to strategic impact factor changes. This knowledge can lead to better resource allocation: if the response function reveals a two-quarter sales response delay to a change in consumer confidence, marketing expenses can be allocated to promote advertising campaigns one to two quarters ahead.

2.4 D: Implementation

Several tools are used during the strategy’s implementation phase to transfer and communicate strategic plans into the organisation. The balanced scorecard has received substantial attention from both managers and researchers; it is the dominant concept in the performance measurement field. The balanced scorecard visualises the company’s strategy using causal relationships among key performance drivers in different units and operationalises them by assigning key performance indicators. Today, a variety of companies use the BSC to link their strategy with their short-term operations.

However, the BSC is under fire, especially regarding the interrelationships between performance drivers. The lack of explicit causal models of the relationships between measures makes it difficult to evaluate performance measures’ relative importance. Furthermore, the linkages between different dimensions of organisatio- nal performance should be clearer. Similarly, survey results show that only half of the companies surveyed in the U.S. that use formal performance measurement systems have implemented and tested causal relationships between their measures.9 Yet these causal relationships help company members to understand how objectives can be achieved and to evaluate performance according to strategically linked measures instead of common and general financial measures.

While some of these measures, especially the financial perspective, are connected by logic, others—such as the consumer or potential perspective—have only a tacit relationship. Empirically testing the causality between these measures could enhance knowledge of the value creation process and help to identify de facto key performance drivers.

2.5 E: Strategic checking

In the aftermath of global distortions in the beginning of this century, regulatory standards that claimed more detailed risk management approaches were enforced: especially the International Financial Reporting Standards (IFRS) 7 and the International Accounting Standards (IAS) 1 require companies to report estimations on their early risk recognition, quantitative statements about the company’s risk exposure, and instruments used in the risk management and foresight process. Such forward-looking risk management should incorporate environmental scanning systems into internal risk analysis.

These regulatory developments were also accompanied by a comprehensive body of literature that developed environmental scanning and early warning systems. However, these concepts and instruments are seldom used by practitioners, primarily owing to insufficient knowledge by managers and planners on the right setup of these systems; some managers and planners may not even know how or where to start, or how to solve problems in design, implementation, or day-to-day operations.10

The state-of-the-art of these environmental warning systems covers four general types: The first generation, developed in the early 1970s, concentrated on risk detection based on projections using past data from internal sources, such as accounting figures. Based on criticism of this system’s purely risk-oriented design and its internal focus, a second generation of early warning systems provided indicator-based surveillance of internal and external developments. These systems, which were faulty owing to their directedness on single aspects, were followed by a third generation of 360° strategic radar analysis. Fourth-generation approaches integrated the operational and the strategic perspectives of the second and third generation’s early warning systems. These cover the identification of risks opportunities, and provide the basis for the development of responses, such as systems based on scenario techniques.

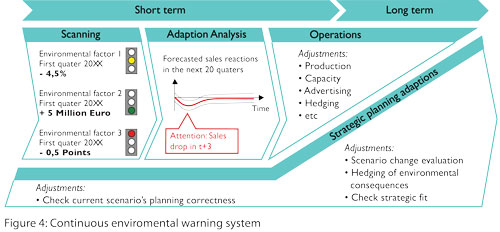

Predictive analytics, with their causality analysis improvements, contribute to the further development of these fourth-generation models. Exploiting the increasing amounts of available data enables one to identify and use empirically proven early warning indicators. Together with knowledge about the effects of alternative developments in these indicators, the claimed “comprehensive system for managing risks in the external business environment”11 is supported. Figure 4 (bottom of page) depicts how the empirical causality analysis results can be incorporated into an environmental warning system. Knowledge about the time-varying relationship between strategic impact factors and company target figures thus enables one to prepare specific response actions, depending on the company’s business model and industry.

3. Lessons Learned: A New Generation of Strategic Planning Support

This article provides an approach to comprehensively apply empirical causality analysis in the strategic planning process. The primary contributions are the analysis of external and internal strategic impact factors, the development of scenario plans and their implementation, and early warning systems. These contributions should enable more analytical-rational decision support, which is considered beneficial to strategic planning effectiveness, and reduces the risk of information overload.

These contributions depend on a company’s specific situation and requirements. These include the existence of databases containing time series data on the company’s target figures. This requirement is a work in progress, since many companies are still in the data storage establishment phase. Furthermore, most of the noted contributions require the presence of traditional management co-ntrol instruments, such as the BSC or strategy maps. Although these tools are widely known, many companies do not apply them. In these cases, companies face extensive organisational and monetary efforts to exploit the full benefits of empirical causality analysis.

Besides these limitations, our results similarly revealed concepts and opportunities for further research. This article focussed on strategic impact factor analysis in the company environment (outside perspective). By doing this we do not tackled causality analyses in operations management (inside perspective). Furthermore, growing data availability increasingly eases application and its opportunities for more extensive applications.

About the Authors

Tobias Klatt is research affiliate at the Center for Performance Research and Analytics (CEPRA) at Augsburg University and controller in corporate management, Axel Springer AG, Berlin. His research concerns the analysis of causal impacts from environmental developments on strategic planning. He earned his PhD at Goettingen University for his thesis on empirical causality analysis in strategic planning and completed his diploma in Political Economics at Goettingen University (Germany) and the Department of Business Studies at Uppsala University (Sweden).

Klaus Moeller is professor for Controlling and Performance Man-agement and director of the Institute of Accounting, Control and Auditing at the University of St. Gallen, Switzerland. He is founder and director of the Center for Performance Research and Analytics (CEPRA) at Augsburg University, and the consulting firm The Performance Management Company (PMC) GmbH, Munich, Germany. He has held chairs at Goettingen University (2007 to 2011) and the Technical University of Munich (2006 to 2007). His research focuses on performance management, predictive analytics, and innovation control.

References

1. Aragon-Correa, J.A. and Sharma, S. (2003). A contingent resource-based-view of proactive corporate environmental strategy. Academy of Management Review, 28(1), p. 75

2. Möller, K., Batzlen, S. und Klatt, T. (2012), Nutzung von Performance Management Analytics zur Prognose- und Risikoberichterstattung, Schweizer Treuhänder, 86(6-7), pp. 446-450.

3. Granger, C.W.J. (1969). Investigating causal relationships by econometric models and cross-spectral methods. Econometrica, 37(3), pp. 424-438; Sims, C.A. (1980). Macroeconomics and Reality. Econometrica, 48(1), pp. 1-48.

4. see also: Mintzberg, H. (1994). The rise and fall of strategic planning. New York: Free Press; Goetze, U., Mikus, B. (2006). Strategische Unternehmensplanung – Phasen, Instrumente und ausgewählte Strategien. Chemnitz: Physica Verlag.

5. Mintzberg, H., Ahlstrand, B., and Lampel, J. (1998). Strategy safari. New York: Free Press, p. 73.

6. Elbanna, S. (2008). Planning and participation as determinants of strategic planning effectiveness. Management Decision, 46(5), pp. 779-796.

7. Kaplan, R.S. and Norton, D.P. (2000). Having trouble with your strategy map? Then map it. Harvard Business Review, 78(5), p. 168.

8. Bishop, P., Hines, A. and Collins, T. (2007). The Current State of Scenario Development: An Overview of Techniques. Foresight, 9(1), pp. 5-25.

9. Marr, B. and Schiuma, G. (2003). Business performance measurement – past, present and future. Management Decision, 41(8), pp. 680-687.

10. Lesca, N. and Caron-Fasan, M.-L (2008). Strategic scanning project failure and abandonment factors: lessons learned. European Journal of Information Systems, 17, pp. 371-386.

11. Global Intelligence Alliance (2007). Market intelligence for the strategy & planning process, GIA White Paper 1/2007, p. 3.