By Olaf Plötner

The after-sales-based business models of industrial enterprises are endangered. Simultaneously, modern data-based technologies enable the development of complex service solutions – so called business models 4.0. Olaf Plötner, Dean of Executive Education at ESMT Berlin, describes the potential success of these models as well as the nine major cost traps that are impeding their success.

In 2001 Siemens AG launched Soarian, a data-driven platform designed to revolutionise the inner workings of hospitals and other healthcare organisations. By constantly collecting and evaluating performance data, Soarian sought to improve healthcare workflow – better orchestrating patients, treatments, departments, and products while identifying systemic weaknesses and inefficiencies for optimisation.

Despite a promising launch in the North American market and the acquisition of high-profile customers, Soarian fell short of profitability targets for years. As a result, in 2014 Siemens sold the business for US$1.3 billion to Cerner, a renowned healthcare sector IT and consulting firm.

Siemens was not new to the healthcare sector. For more than a century, the company had profited from diverse industries, including healthcare, where it focused on the development, production, and sale of medical imaging equipment via subsidiary Siemens Healthcare (now Siemens Healthineers).

How then could such a well-established medical equipment manufacturer, with such a strong and diverse customer base, nevertheless fail to profit from a revolutionary medical solutions platform?

Old Revenue Sources, New Revenue Streams

Traditionally, many industrial enterprises gain their profits in “after-sales services” – i.e., repair and maintenance services as well as the sale of spare parts. Today, however, three threats make this business revenue model increasingly endangered:

Low Purchasing Power: New customers in emerging and developing markets lack the spending power needed to purchase either high-quality products or after-sales services.

Copycat Products: Third-party companies are copying the more expensive spare parts of established brands, undercutting after-sales profitability.

The “China” Phenomenon: State interventions, like those that China imposed on German premium car manufacturers in 2014, can force manufacturers to lower the prices of spare parts.

Despite these threats, innovative developments in the IT sector create possibilities for tapping great sales potentials. Two factors are especially important:

Data Mining: There are a surging number of options for generating and analysing real-world data – information that can be captured autonomously and transmitted anonymously back into production and service processes. For example, a modern aircraft engine features over 3,000 sensors, allowing its manufacturer to monitor performance and to act before anything goes wrong.

Connectivity: Global networking – between humans, between machines, and between machines and products – is the new standard. According to a 2011 white paper by Cisco Internet Business Solutions Group, by 2020 the number of connected devices will outnumber people by a factor of six.

There are gradual signs of these changes in industrial markets, and each region has its name for this transformation. The US calls it the “Internet of Things”. South East Asia coined “Made in China 2025”. With a nod to changes in industrial manufacturing specifically, Germany is calling it “Industry 4.0”.

[ms-protect-content id=”9932″]Business Models 4.0

Companies generally have three ways to approach strategic change and achieve revenue growth: they can find new customers, they can offer new products, or they can adopt a new business model.

The reality for the world’s major market players places two of these choices in question. While international markets represent huge untapped potential for small and medium-sized enterprises, the established major players already market their products internationally. Moreover, established companies have difficulties repeating their successes. One reason for this may be what Clayton Christensen describes as “The Innovator’s Dilemma”: i.e., the very brand-customer bond that bolsters a successful product stands in the way of new product development and innovation.

Unsurprisingly, many established industrial companies, when seeking to generate growth, focus on the third strategic growth option: the introduction of a new business model.

Rolls-Royce is a case in point. The company is still producing aircraft engines for which military and civil aviation organisations remain the most important target customers. Instead of selling engines and expensive spare parts, however, they now market sensor-driven products on a “power by the hour” basis. This restructures value-creating processes:

- Services that used to be the customer’s responsibility (e.g., reporting engine malfunctions) are now the supplier’s. This is known as “forward integration” or “going downstream”.

- Ownership of the industrial good (here, the engine) remains with the supplier and does not pass to the customer; i.e., Rolls-Royce sells use instead of ownership.

- Service pricing depends on the degree of utilisation by the customer; this approach is known as “performance-based pricing”.

What Rolls-Royce offers is what I call a “complex service solution”. The hallmarks of this model are that:

- services (intangible, unlike industrial goods) are in focus,

- services are combined with goods to generate customised solutions in the value chain, and

- these solutions have a high degree of complexity and value for customers.

When industrial enterprises introduce new business models using modern information and communication technologies as part of complex service solutions, we speak of “business models 4.0”.

Cost Traps: Where Great Expectations Meet Mixed Results

Industrial enterprises hope that the introduction of business models 4.0 will set them apart from competitors, thus resulting in higher profits. They hope, too, that the implementation of new technologies will strengthen their knowledge of customer needs and quickly reveal new business opportunities.

New business models are not a guarantee of success, however. Rolls-Royce’s 2014 annual report showed that the company did not make a great profit that year. Instead, dividends were cut and jobs were axed. Having repeatedly failed to meet its profit targets, Soarian also cannot be considered an example of the successful introduction of business models 4.0. Numerous studies have shown that these experiences are consistent where similar innovative business models or complex service solutions have been introduced.

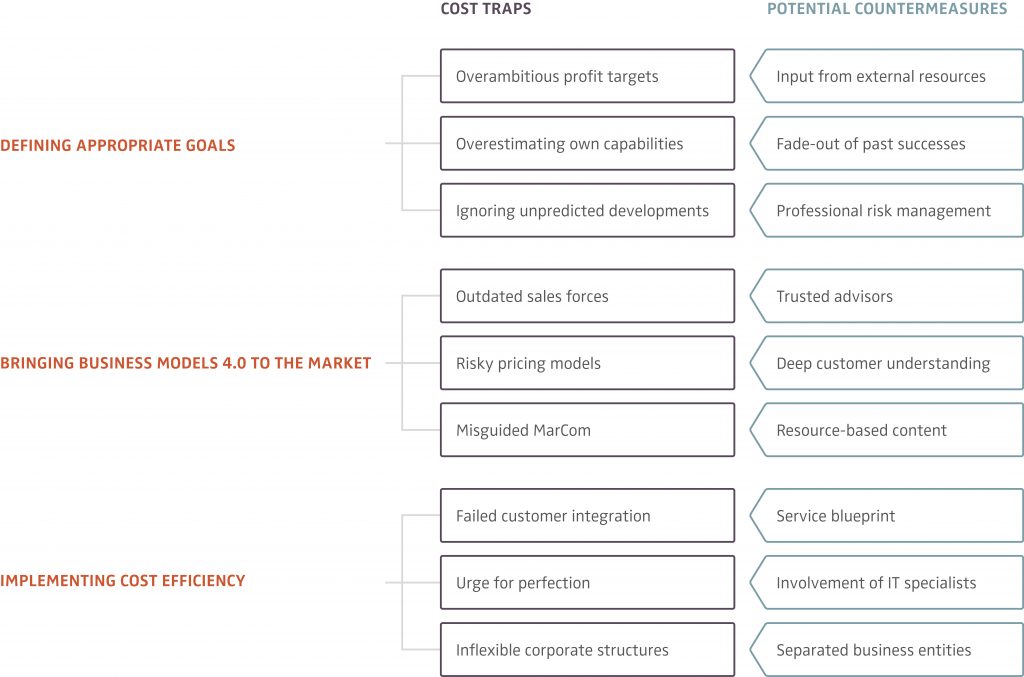

I have identified nine cost traps as impeding business models 4.0 success.

Cost Trap 1: Overambitious Profit Targets

Companies normally combine strategic changes with economic performance targets. However, when traditional industrial enterprises set profit targets for the introduction of complex service solutions, many use the high profitability of their traditional services – e.g., after-sales services – as a benchmark.

Moreover, overambitious planners set too early a date for when they believe the new approach will pay off. Tom Miller, who was then the president of Soarian and a board member of Siemens Healthcare, was convinced of Soarian’s success but realised that it would take longer to become profitable, especially where pricing was coupled to hospital performance. He was unable to convince the management of this before Soarian’s sale.

Cost Trap 2: Overestimating Own Capabilities

Under pressure from key shareholders, some managers agree to high profit targets even if they doubt their attainability. However, most accept the goals because they are convinced that they are achievable – despite knowing what it entails: e.g., changed processes, adapted or newly developed products, revised training, and redefined corporate structures.

Why do managers believe this? According to researchers Kahneman/Lovallo, they are either unaware of the risk or have an “illusion of control”. This arises where problems are primarily seen from an inside view and where past successes are conferred to future challenges.

Cost Trap 3: Ignoring Unpredicted Developments

Unexpectedly high costs are not necessarily caused by the supplier or customer. Under Rolls-Royce’s “power by the hour” concept, for example, the company would earn no money in cases where an aircraft is grounded due to force majeure, snowstorms, or bomb threats that bring an airport to a halt.

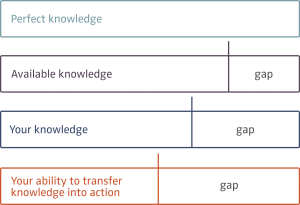

There is a gap, therefore, between “perfect knowledge” and available knowledge. However, just because future events are unpredictable, it does not mean that their costs are incalculable. (The insurance industry is predicated entirely on rating unforeseeable risks.)

Cost Trap 4: Outdated Sales Force

If the supplier intends to sell complex service solutions directly, choosing the right sales team is vital. However, the criteria for sales staff are particularly demanding for business models 4.0.

For Rolls-Royce, a whole array of sales activities becomes obsolete. The sale of spare parts becomes a thing of the past; the sale of services becomes more complex – e.g., requiring knowledge of aircraft engines, an understanding of modern information and communication technologies, and a new language for describing its commercial impacts to customers.

Cost Trap 5: Risky Pricing Models

It seems obvious to combine performance-based pricing with marketing of complex service solutions. Its supporters see it as the ultimate way to overcome the zero-sum game between buyer and supplier. Instead of one party only being able to win something if the other one loses, they both now have a common interest.

However, the focus on customer benefits obscures that this model entails higher risks than the traditional pricing model. In the case of Rolls-Royce, aircraft that is grounded for reasons other than engine problems, e.g., labour strikes, can lead to financial losses.

Cost Trap 6: Misguided MarCom

Unlike the product specifications of tool machines, trucks, or gas turbines, intangible services generally have no visible products to showcase. Moreover, due to the individually tailored nature of complex service solutions, customer testimonials are less effective than for industrial goods; i.e., no customer presumes that the success of another customer’s solution will apply to them.

When it comes to MarCom activities, business models 4.0 industrial enterprises waste money when thinking in traditional content categories. They also fail to value staff-as-customer-partner models, either because they are unaware of the advantages or because they want to deemphasise the resulting importance of individual staff.

Cost Trap 7: Failed Customer Integration

Implementation requires that suppliers and customers collaborate to produce the services. This integrated development process requires that customers also perform efficiently.

However, even if the customer has the required know-how, this is no guarantee of participation. This may be due to institutional role differences. For example, the management of a hospital’s administration may find it desirable to use a platform like Soarian to improve process efficiencies, but a senior doctor may be less interested if it means having fewer staff. The resulting inaccurate, incomplete, or delayed information has expensive consequences, e.g., costly implementation delays.

Cost Trap 8: Urge for Perfection

Industrial enterprises and customers traditionally have little experience with software development and implementation. Previously high product quality contributes to overambitious supplier commitments – a risk exacerbated by customers who, from either competitive pressures or ignorance, then expect too much too soon from new solutions.

Computer specialists have named the resulting phenomenon “technical debt”. The rush to implementation later reveals itself as errors in software programming, because software tests were foregone, coding standards were ignored, and individual processes for data security and documentation were omitted.

Cost Trap 9: Inflexible Corporate Structures

Agility – a buzzword term in the software sector – has not had the same resonance in the traditional industrial goods sector. For many established industrial players, inflexibility is due as much to specific market dynamics as it is to past successes that have made them grow to an unwieldy size.

However, demands for flexibility and timeliness under business models 4.0 go beyond modifying a company’s architecture. This is also about changing a culture of thinking that has deferred more to departmental silos than to collaboration for project goals.

Conclusion

This intensive exploration of cost traps and the challenges of overcoming them should not deter industrial enterprises from using modern technologies for innovative business models. Current market developments make it indispensable to introduce such models in order to remain competitive.

There are now countless examples of industrial enterprises that are successful on the market with business models 4.0. One of them is Siemens AG, which has used the lessons learnt from Soarian to successfully implement new complex service solutions in other markets. For example, the company now cooperates with the Spanish rail operator RENFE, for which Siemens optimised train operations with the help of sensor technology, remote monitoring, and data analytics. The efficiency gains of the optimised value-generation processes are shared with its customers. As another example, Siemens provided energy management services for over a thousand properties of Credit Suisse using data-driven technologies, which led to a ten percent reduction of energy costs.

Excerpted and adapted from “Cost Traps in Business Models 4.0”, a case study of Siemens Soarian. For the full paper, which includes remedies for avoiding cost traps in industrial enterprises, visit https://www.esmt.org/cost-traps-business-models-40.

[/ms-protect-content]

About the Author

Prof. Olaf Plötner is Dean of Executive Education at ESMT Berlin. Dr. Plötner’s current research and teaching focus is on strategic management in global B2B markets. His research has been portrayed in journals such as Industrial Marketing Management and Journal of Business and Industrial Marketing as well as in leading international media such as CNN, Wall Street Journal Europe, Times of India, Frankfurter Allgemeine Zeitung, China Daily Europe, and Financial Times.

Prof. Olaf Plötner is Dean of Executive Education at ESMT Berlin. Dr. Plötner’s current research and teaching focus is on strategic management in global B2B markets. His research has been portrayed in journals such as Industrial Marketing Management and Journal of Business and Industrial Marketing as well as in leading international media such as CNN, Wall Street Journal Europe, Times of India, Frankfurter Allgemeine Zeitung, China Daily Europe, and Financial Times.

![iStock-492910744 [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2017/01/iStock-492910744-Converted.jpg)