By Jeremy Kasler

As global interest in alternative assets continues to expand, bourbon is emerging as a unique economic narrative. The barrels aging today in rickhouses across Kentucky are not only preparing for the bottles of tomorrow, but they’re redefining the relationship between time, value, and legacy within the modern investment landscape.

The New Age of Bourbon

Once viewed purely as a craft deeply rooted in American heritage, bourbon is now emerging as a distinctive asset class. As distillers continue to perfect the art of maturation, investors are beginning to look beyond traditional financial instruments and recognize bourbon’s potential as a tangible, time-tested asset.

Inside Kentucky’s rickhouses are millions of barrels quietly evolving, each shaped by seasonal cycles that gradually deepen flavor and complexity, unlike other asset classes, which are influenced merely by market perception. As the liquid matures, the characteristics and color develop through the years, gaining potential for long-term value.

This dynamic model combines technology and demand for premium spirits to position bourbon investment as a modern tool for wealth preservation.

Bourbon Meets Wealth Management

At first glance, the idea of bourbon as an investment may not seem conventional. Yet today, its economic logic closely aligns with the very principles embedded in wealth management.

Unlike asset classes driven by market sentiment, bourbon’s appreciation is dependent on its maturation process. As each barrel rests, seasonal temperatures affect the warehouse environment, drawing the spirit’s flavor in and out of the oak staves, gradually deepening the flavor and complexity. The evaporated liquid is known as the “angel’s share,” which introduces natural scarcity, leaving less liquid inside the barrels but with greater aggregate value over time.

For investors, this presents a diversification strategy. Bourbon provides an alternative for portfolios that hedges against volatility, where market shifts do not determine a barrel’s value. According to a study conducted by J.P. Morgan, they reported that a 30% allocation to alternative assets achieved higher annual returns combined with lower volatility.

Fostering the Future of America’s Native Spirit

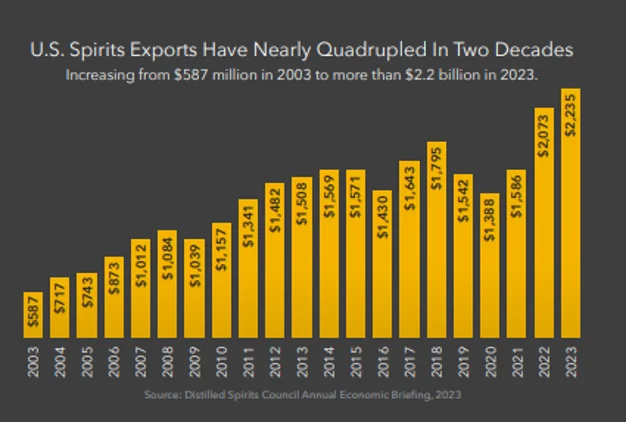

Bourbon’s economic potential has expanded dramatically over the past several decades, but its current narrative is the story of preservation. Within the industry lies a deeper story that delves into tradition and innovation that’s shifting the global marketplace.

The center of bourbon is tied to the regions that shaped it, particularly the state of Kentucky, also referred to as “The Bourbon Capital of the World”. The industry’s evolution has accelerated distilling activity, boosted tourism, and increased international demand, ultimately creating a distinct sector within the broader spirits market.

Across generations, both long-standing distilleries and newly revived facilities have ignited the foundation of bourbon’s future. Continued investment supports production, experimentation with new mashbills, and allows aging to run its full course without the pressure of premature bottling.

Efforts to restore historic distilleries, revive pre-Prohibition brands, and expand multigenerational family legacy operations all highlight a broader commitment within the industry. It’s maintaining bourbon’s authenticity while adapting to a global marketplace that is evolving just as rapidly as the spirit itself. This balance between preservation and innovation is shaping how bourbon will be produced, valued, and experienced for decades to come.

Legacy, Value, and Lasting Growth

What once stood as a symbol of heritage has quietly become a vessel of value. In the 2024 Economic and Fiscal Impacts by the Kentucky Distillers’ Association, data showed that from the years of 2003-2022, there was a dramatic growth of 2,015% in bourbon production to meet accelerating demand. It was also reported that total capital investments were $1.916 billion over the past five years, with two-thirds towards buildings and land.

The famously known Pappy Van Winkle reflects that very notion of intrinsic value. Bottles of these expressions range on the secondary market from $800-$4,000, driven by its limited supply and highly desired demand. This combination of scarcity, craftsmanship, and historical roots showcases how bourbon has evolved into a tangible asset with enduring economic and cultural relevance.

Historically, bourbon’s growth is further supported by its resilience. It has adapted to shifting domestic preferences, expanding global markets, and evolving regulatory landscapes. A notable milestone is the formal recognition of the American Single Malt, a new category for the first time in 52 years. This U.S.-produced whiskey has already opened new international pathways, including increased interest from India’s rapidly growing consumer base.

This balance of heritage and innovation positions bourbon as both culturally enduring and economically adaptable.

A Glimpse Into the Future

The barrels being filled today will continue to shape the market for decades to come. All the decisions made by the distillers, investors, and consumers alike influence the trajectory of bourbon’s future.

As the world continues to explore new forms of alternative assets, bourbon stands out as a case study in how heritage industries can evolve without losing their identity. Its future will depend on the balance between tradition and innovation, supply and demand, and the ever-evolving preferences of an increasingly international audience.

What remains certain is that the bourbon aging in rickhouses today will tell a story years from now, one defined by patience, craftsmanship, and the enduring economic relevance of America’s native spirit.

Jeremy Kasler

Jeremy Kasler