By Paul Nunes and Timothy Breene

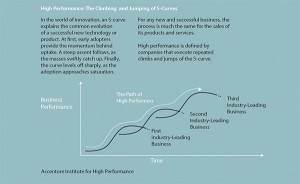

One obvious trait of high-performance companies is that they are all adept at launching new businesses — a process that we call climbing an “S-curve.”

The Sumitomo Group traces its humble origins to the 17th century, when Masatomo Sumitomo opened a book and medicine shop in Kyoto. Since then, over the course of almost four centuries, not only has that family business outlived numerous shoguns and emperors as well as two major world wars, it has continually grown and thrived, entering one new market after another, including copper smelting, trading in textiles and sugar, mining, electric cable manufacturing, forestry, banking, and warehousing. But Sumitomo is the rare exception that proves the rule: Many companies might be fortunate enough to launch one successful venture, but the vast majority will stumble badly when that business begins to mature. In fact, one of the main reasons why so many companies — even large corporations — are here today and gone tomorrow is because they couldn’t make the jump to a new, growing business from an existing, slowing one before revenues from that core market have stalled.

Indeed, past research has repeatedly shown that, once a company’s revenues have flattened, the chances for recovery are anything but promising. In one study, two-thirds of stalled companies ended up being acquired, taken private, or forced into bankruptcy. Moreover, once a business has stumbled badly (annual sales growth slowing to less than 2%), it has less than a 10% chance of ever fully recovering.1 Such sobering statistics raise the crucial question of how companies can avoid such growth stalls in the first place.

That question has become all the more urgent in today’s hypercompetitive environment. When Sumitomo was founded in pre-industrial Japan, the company could enjoy decades of prosperity from its core business before having to branch out. Not so today, when any success invites quick imitation – and replacement. Blockbuster had barely established itself as a force in movie rentals before Netflix was already knocking at the door. It’s no wonder why the average lifespan of companies on the S&P 500 has shrunk drastically, from 75 years in the 1930s to just 15 years in the 2000s.2

[ms-protect-content id=”9932″]Given such daunting numbers, managers might rightfully ask themselves, how then do we create lasting value? That question was at the heart of our research aimed at unlocking the secrets of business high performance. In our study, we analyzed more than 800 companies using more than a dozen financial metrics to assess their performance in terms of growth, profitability, consistency, longevity, and positioning for the future. From that analysis, only about 10% of the companies were found to significantly outperform their peers over the long run. We then studied these high performers to uncover what they did that others didn’t.

Climbing an S-Curve

One obvious trait of high-performance companies is that they are all adept at launching new businesses — a process that we call climbing an “S-curve,” in reference to the S-shaped way in which revenues for a successful new product typically build slowly, then ascend rapidly as the offering catches on, and finally tapers off. But what’s not so obvious is what high performers do before and during that climb.

BEMIs

First, high performers don’t waste undue time or resources on small or uncertain opportunities. Instead, they focus on identifying a “big enough market insight.” Novo Nordisk, for example, was able to create a huge portfolio of opportunities by rightly recognizing that the growing affluence in China and other developing regions would result in a dramatic long-term increase in the global incidence of diabetes.

A key here is that the insight must be “big enough” for a particular organization. Consider how two companies — Samsung and Ovideon Inc. — acted on the same BEMI that advancements in plasma and liquid crystal display (LCD) technologies would enable the development of flat-panel TVs with crystal-clear pictures that would entice viewers to replace their conventional sets. Samsung, the Korean consumer electronics giant, had to win big, so it bet big. It does its own TV manufacturing in order to control both quality and costs for its high-volume operations and, so far, the huge investment has paid off. In 2009, the company controlled about 17 percent of the total market, shipping more than 27 million LCD models and more than three million plasma sets. In comparison, Ovideon’s share of the market is minuscule, but that’s just fine with the start-up from Aurora, Illinois. Ovideon doesn’t need to move huge volumes because it outsources its manufacturing and concentrates on small market niches, such as applications in offices and public spaces like airports. So, for both Samsung and Ovideon, flat-panel TVs have been a BEMI but in strikingly different ways.

BEMIs do not necessarily have to depend on huge demographic changes (like a rising incidence of diabetes in developing countries) or major advances in technology (like the transition from cathode-ray tubes to liquid-crystal and plasma displays). Sometimes a BEMI arises simply from a company’s redefining a mature market. In developing Wii, the popular videogame console, for example, Nintendo wisely foresaw that the potential market could be far larger than just adolescent boys and young men who were buying Microsoft’s Xbox and Sony’s PlayStation. Instead, Nintendo re-imagined the market to include almost everyone, including senior citizens. So, instead of concentrating on flashy graphics and snazzy features to compete against Microsoft and Sony, it focused on ease of use and good, old-fashioned fun. One of the company’s hits is a tennis simulator in which the user hits a virtual ball on the screen by swinging the Wii controller (which contains a motion sensor) as the racket. Thanks to such products, the videogame market has exploded across demographic lines: 40% of users are now adult women, and a quarter of U.S. consumers over the age of 50 plays.

Threshold competence before scaling

After identifying a particular BEMI, high performers adroitly manage the pace and timing of climbing that S-curve. Instead of rushing to market to be first, they spend the necessary time to build essential capabilities before scaling their operations, and they plan for success from the start, often focusing on details such as production and channel strategy early on. The key here is that they understand exactly how they must be distinctive in order to create the value that the market demands. They know the minimum, non-negotiable level of improvement (or threshold competence) that the market requires in order to get customers to purchase the new product or service, and they meet or surpass that level before scaling up their operations. Average- and low-performance companies, on the other hand, completely underestimate that point.

Consider People Express, which built a powerful business model by doing almost everything differently – all seats on a flight were the same price; pilots helped load baggage; and flight attendants checked in passengers. But as People Express grew rapidly, it started to lose that distinctiveness when it began competing directly on routes with established carriers (leading to destructive fare wars) and hiring faster than it could train (resulting in such bad customer service that disgruntled consumers tagged it with the derisive nickname “People Distress”). Eventually, worker morale took a hit, and the airline could no longer manage the huge debt that it had assumed in order to expand so quickly. Sadly, People Express was sold just six years after its promising launch.

In contrast, high performers remain committed to maintaining their distinctive capabilities. They steadfastly refuse to scale too quickly; they replicate their business in a repeatable way; and from the start they remain focused on mastering access to customer and market channels. Like People Express, Southwest Airlines was also founded as a discount airline, but Southwest has grown its business in a decidedly different manner. It has, for example, maintained its point-to-point route system (eschewing the traditional hub-and-spoke model of the legacy airlines), relying more on secondary airports like Fort Lauderdale-Hollywood International Airport rather than primary hubs like Miami International Airport. And Southwest has never wavered from its high standards of hiring only those employees with certain qualities, such as a commitment to customer service and a fundamental belief that everyone should be treated with dignity and respect.

Serious talent

Of course, the right employees are at the core of any winning organization, and high performers focus on attracting and retaining a certain type of individual, what we call “serious talent.” By “serious,” we are referring not only to people who are at the top of their professions (the best programmers in the software industry, for example), but also to those who are just very good at what they do (such as salespeople who consistently land big new accounts). We are also talking about employees who take their careers very seriously, those for whom work is not just a job but also a source of personal pride. Through such serious talent, managers can instill a mindset of relentless improvement throughout the workforce that enables the creation of successful new businesses.

Hiring and retaining serious talent requires three things: seeking and then ensuring that a high degree of competence exists at every level of the organization, providing transparency and instilling mutual accountability in all directions, and creating trust in which people do the right thing not because the rulebook requires it but because the company’s “culture of honor” demands it. There is no one-size-fits-all approach for ensuring that all three criteria are met and, in fact, our research has found that high performers have used a wide variety of methods.

Take, for example, cultures of honor. Best Buy instills one at its headquarters by making staff members highly accountable to one another: the company gives them the freedom to set their own schedules and decide how and where to get their work done just so long as it gets done on time. UPS has also built a culture of honor but uses storytelling to create organizational lore, such as the classic tale of the driver who figured out how to deliver an unclearly labeled package to a military base on Christmas Eve. The contents of that package: plane tickets that enabled one very happy solider to spend Christmas with his family. At Genentech, important decisions about which projects to fund are made only after open, vigorous debate that focuses on the technical merits of the different initiatives. Such transparency helps set the stage for an organizational environment that discourages politics and backroom deals in favor of people making decisions based on what’s best for the overall company.

Jumping an S-Curve

Reaching the top of an S-curve is just the start. Even as a company is enjoying its greatest success, it must find its next S-curve and begin the jump there. Three important elements enable that process: an edge-centric strategy, top teams that change ahead of the curve, and hothouses of talent.

Strategy at the edge

High performers do not develop strategy in traditional ways. For them, strategy making cannot be so predictable that the forces of the status quo are able to game the system. Thus the process cannot be about routine five-year planning (though that remains necessary). Instead it must paradoxically be episodic but continual, and it can’t be a permanent process although it needs to be driven by a permanent commitment to strategy development and execution. Accomplishing all that requires an “edge-centric” strategy. Here we are referring to strategies with three crucial characteristics.

First, they work at the edge of the market to identify insights that are gleaned at the periphery of customer needs and desires. When 3M was investigating how to decrease the infection rate for surgical patients, it didn’t interview doctors and nurses at a typical hospital but at mobile army surgical hospital (MASH) units. Second, they occur at the edge of the organization, led by peripheral groups and employees outside corporate headquarters and the core business. The idea for the highly successful Air Wick Freshmatic, a new product from Reckitt Benckiser that automatically sprays freshener into the air on a set schedule, originated with a brand manager in Korea. And third, they operate at the edge of control in that they are neither centrally planned nor centrally managed. At Cisco, important decision-making has been decentralized into dozens of internal committees, numerous boards, and various working groups. Although that structure might appear to be unwieldy, it has enabled the company to move much more quickly, taking only about a week to develop a business plan for a new venture, compared with six months in the past.

Edge-centric strategies do not, however, displace traditional strategy planning, which is still necessary for allocating resources in an organized manner. Rather, they are complementary to traditional planning. To be sure, keeping both running simultaneously is tricky, requiring a corporate center that recognizes the need for formal planning yet is capable of backing intrapreneurs, protecting fledgling businesses, providing seed funding for important new ideas, and otherwise helping the organization to operate more on the edge.

The right people at the top

Edge-centric strategies might be a crucial ingredient for high performance but they do not obviate the need for having the right senior executives. Quite the contrary. In fact, high performers have an uncanny ability to evolve their top teams early and often to ensure that their corner offices are always filled with those executives who are most qualified for the challenges ahead. After only seven years at the helm of Adobe Systems, CEO Bruce Chizen, who was just 52 years old at the time, handed the reins to his long-time deputy to navigate the challenges of becoming a major force in digital media, a transformation that Chizen had guided. The important thing here is that high performers do not change up their top teams when their core business has slowed but way before that, when the distinctiveness of the company’s capabilities has begun to wane.

Consider Intel. Throughout its history, the semiconductor manufacturer has seen its CEO mantle pass through five executives – Robert Noyce (1968 to 1975), Gordon Moore (1975 to 1987), Andy Grove (1987 to 1998), Craig Barrett (1998 to 2005), and Paul Otellini (2005 to present). None of those transitions was needed because the company was in dire straits. In fact, when Grove stepped down from the top spot, the company’s stock was soaring and he was arguably at the top of his game. But he made way for Barrett, who then implemented a strategy for growing Intel’s business through product extensions. That strategy ultimately had mixed results, but the point is that Barrett was trying to evolve Intel’s business in ways that Grove hadn’t. Grove, himself, had successfully orchestrated Intel’s move away from memory chips to focus on microprocessors, a shift that established the company as a global high-tech leader.

Like Intel, numerous other high performers have also focused on succession planning, and they have made the necessary investments to groom new managerial talent so that they always have the right balance of managerial and entrepreneurial skill needed to jump S-curves. At Colgate Palmolive, the executive succession process begins at the business unit level, with board directors regularly tracking 200 employees to ensure a deep bench for top positions.

Surplus talent

But high performers don’t just focus on managerial talent. In fact they concentrate on continuously having an excess of all kinds of talent, something that goes against the grain of other companies that try to keep headcount lean to spruce up their bottom lines. Even in market downturns and economic recessions, high performers continue planting and nurturing the seeds of talent that will allow them to successfully jump S-curves.

Take, for example, Schlumberger, which invests heavily to obtain a steady flow of young engineering talent. It provides scholarships and internships at top universities to cultivate relationships. Those college graduates who are hired then undergo a multi-year training program to gain field experience. In addition, managers are expected to cultivate their successors, and the company demands a rigorous post-mortem after any high-potential employee leaves. In fact, Schlumberger has been so successful at turning itself into a veritable “hothouse” of talent that its employees are regularly poached by competitors.

That type of surplus talent is necessary to jump S-curves. Consider the amount of talent that is necessary just to adequately supply the needs of an existing business that is rapidly scaling its operations, with additional managers, salespeople, marketers, and so on needed in new offices, regions, stores, and factories. Then add to that the talent necessary to start and grow a new business or initiative. And that’s why high performers know they must always have an excess of talent, because they recognize that engaging in both scaling an existing business and starting a new one requires massive and uncommon quantities of good employees. Low- and average-performance companies, on the other hand, typically underestimate the needs of conducting both activities simultaneously, and they leave themselves vulnerable to having to shortchange one for the other.

Past success does not guarantee future glory, and today’s high performers like Intel, Reckitt Benckiser, Samsung and UPS could easily stumble and become tomorrow’s also-rans. Even venerable Sumitomo, the centuries-old Japanese conglomerate, is vulnerable as it now deals with not only the aftermath of a global financial crisis but also the consequences of the recent disastrous earthquake and tsunami in its home country. How these companies will fare in the future remains to be seen, but what is known is that the fundamentals of business – the climbing and jumping of S-curves — will continue separating those businesses that lead their industries from those that lag.

About the authors

Paul Nunes and Tim Breene are the authors of Jumping the S-Curve: How to Beat the Growth Cycle, Get on Top, and Stay There (Harvard Business Review Press, 2011). They are the founders and co-architects of Accenture’s High Performance Business research program, begun in 2003 and recognized as one of the ten most influential in advancing management thinking on business performance by Harvard Business Review. They have coauthored over a dozen articles on the program’s research findings, and the results of their research have been featured in leading publications.

Paul Nunes is the executive director of research at the Accenture Institute for High Performance. His research has been published in the Wall Street Journal, MIT Sloan Management Review, Conference Board Review, Strategy and Leadership, Optimize, ComputerWorld, Wired and others.

Tim Breene is CEO of Accenture Interactive, Accenture’s pioneering initiative to help companies navigate the transformation of marketing in the digital age. From 1999 through 2009, he served as a member of Accenture’s Executive Leadership Team in a variety of roles, including group chief executive of Management Consulting and chief strategy and corporate development officer.

References

1. Matthew S. Olson and Derek van Bever, “Stall Points” (Yale University Press, 2008).

2. Richard Foster and Sarah Kaplan, “Creative Destruction” (Crown Business, 2001).

[/ms-protect-content]